🇺🇸 US Spot ETF Flows , August 21

🔻 $BTC : -1,700 BTC ($194M)

🔺 $ETH : +66,350 ETH ($288M)

After 4 straight days of outflows, Ethereum ETFs are back in the green, a strong rebound for $ETH !

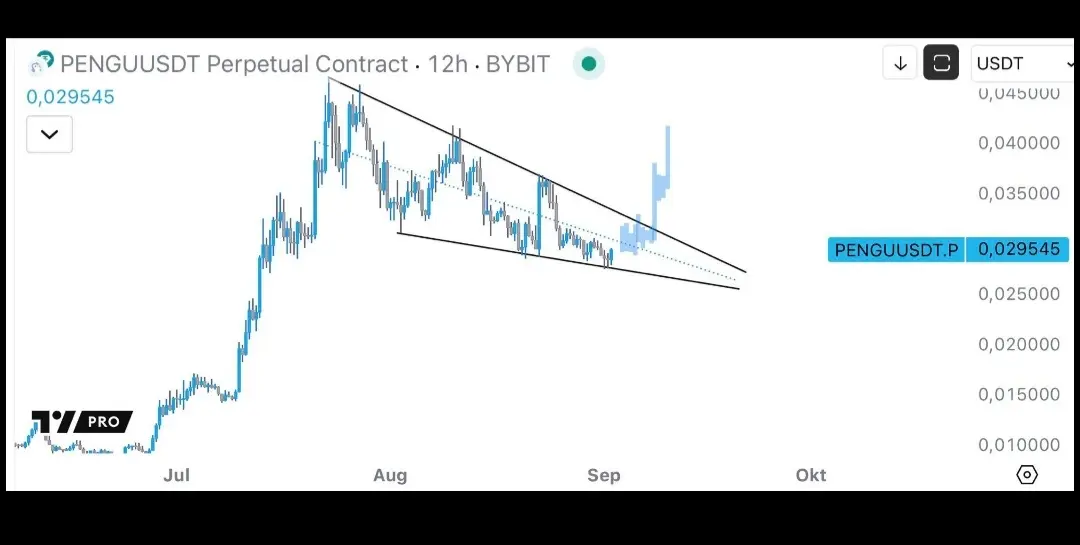

$BCH $ARB $METIS $FLOKI $KAITO $SOLV

#Crypto Market Rebound#

🔻 $BTC : -1,700 BTC ($194M)

🔺 $ETH : +66,350 ETH ($288M)

After 4 straight days of outflows, Ethereum ETFs are back in the green, a strong rebound for $ETH !

$BCH $ARB $METIS $FLOKI $KAITO $SOLV

#Crypto Market Rebound#