Gate Contract Trading Beginner’s Guide: Master Essential Features and Risk Control for a Fast, Confident Start

Image: https://www.gate.com/futures/USDT/BTC_USDT

Futures trading stands out as one of the most dynamic derivatives products in the crypto market. It enables users to maximize capital efficiency through leverage and profit in both bullish and bearish conditions. However, for newcomers, the advanced features and high volatility also bring significant risks. Choosing a platform with an intuitive interface and robust functionality is essential for a smooth start. This article uses Gate as a case study to provide a comprehensive look at futures trading features and offers guidance for beginners on how to start trading safely.

What Is Futures Trading?

Futures trading is a derivative trading method based on the price movements of virtual assets. Users can take long or short positions according to market trends without actually holding the underlying cryptocurrency.

Key features include:

- Two-way trading: Profit from both upward and downward price movements

- Leverage: Amplify capital efficiency

- No need to hold underlying assets: Participate via contracts

- High trading activity and liquidity

Important: The higher the leverage, the greater the risk. Maintain discipline and control in your strategy; this is more important than chasing returns.

Why Choose Gate for Futures Trading?

Among many trading platforms, Gate’s derivatives section is widely recognized for its user-friendly interface and comprehensive features, making it especially suitable for beginners. Its main advantages are:

Stable Matching Engine

Gate’s high-performance engine remains stable during volatile market conditions, minimizing lag, slippage, and other disruptions.

Comprehensive Risk Management Tools

Including:

- Automatic liquidation

- Auto-Deleveraging (ADL)

- Take profit and stop loss settings

These tools help beginners significantly reduce the risk of liquidation.

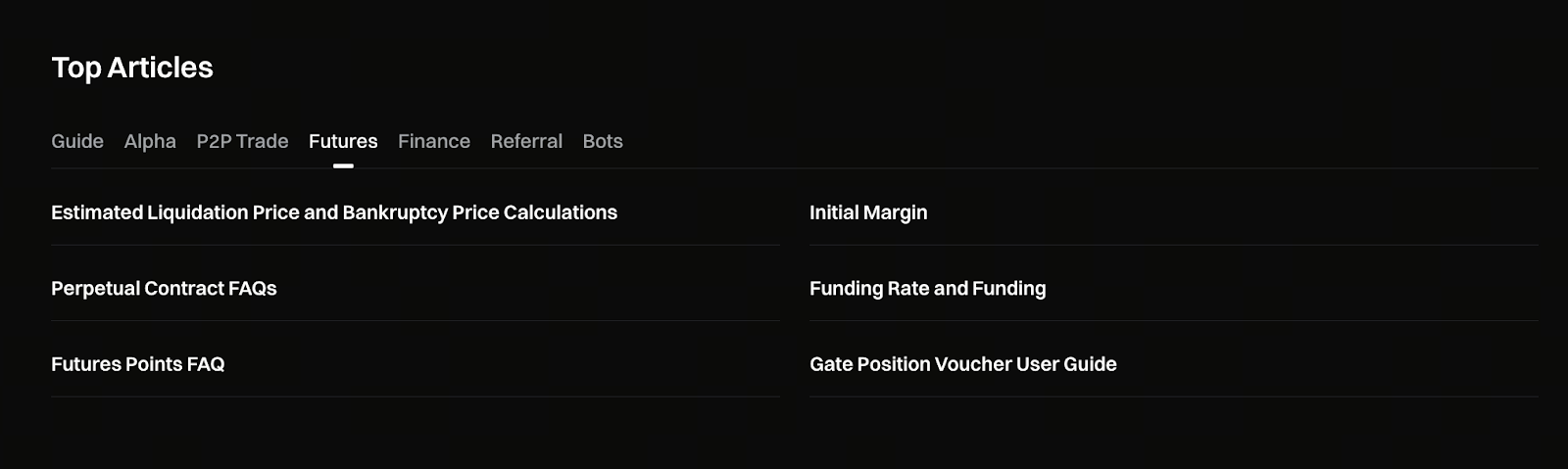

Extensive Educational Resources

Image: https://www.gate.com/help

The platform offers comprehensive futures tutorials and demo trading, providing new users with effective learning tools.

Wide Range of Contract Types

Supports USDT-margined contracts, cryptocurrency-margined contracts, and covers major cryptocurrencies like BTC and ETH.

Gate Futures Trading: Core Features Explained

1. Adjustable Leverage

Gate offers flexible leverage options, from 1x up to 100x. Beginners should start with 1x to 3x leverage to keep risk under control.

2. Long and Short Positions

- Long: Expecting the price to rise

- Short: Expecting the price to fall

Two-way trading enables users to find opportunities in any market condition.

3. Multiple Order Types

Order types include:

- Limit orders

- Market orders

- Conditional orders (including take profit and stop loss)

- Scheduled orders

Conditional orders are essential for beginners, as they allow you to predefine your risk parameters and control potential losses.

4. Auto-Deleveraging (ADL) Mechanism

During periods of extreme market volatility, the system automatically adjusts positions to protect users from excessive losses.

5. Contract Data Dashboard

Gate provides professional data such as open interest, funding rates, and liquidation data, helping you assess whether the market is overheated or oversold.

How to Make Your First Futures Trade on Gate? (Beginner’s Step-by-Step Guide)

The following is a step-by-step guide for beginners:

Step 1: Select a Contract Type

After entering the Gate futures interface, choose a USDT perpetual futures contract, which is ideal for those just starting out.

Step 2: Set Your Leverage

Start with low leverage (1x–3x) to maintain a conservative approach.

Step 3: Choose Your Direction (Long or Short)

Assess the market:

- If you expect prices to rise → Open a long position

- If you expect prices to fall → Open a short position

Avoid impulsive trades and focus on following market trends.

Step 4: Select Order Type

Use a limit order if you want to control your entry price; use a market order for immediate execution.

Step 5: Set Take Profit and Stop Loss

Protect your capital by using these settings, especially in highly volatile futures markets.

Best practices:

- Set your stop loss at 1%–2% of your position size

- Keep your take profit target reasonable—don’t be greedy

Step 6: Close Positions and Manage Risk

When the market hits your target or shows signs of reversal, promptly manually close your position. Cancel unfilled orders to avoid unintended trades.

Common Beginner Mistakes and Risk Alerts

To help you avoid losses, beginners should pay close attention to the following:

Mistake 1: Using Excessive Leverage Blindly

High leverage may look attractive, but it leads to rapid liquidation. Never treat futures trading as gambling.

Mistake 2: Not Setting a Stop Loss

Trading futures without a stop loss is like driving without brakes—it’s extremely dangerous.

Mistake 3: Overtrading

Futures trading involves fees, and frequent trading can quickly drive up your costs.

Mistake 4: Emotional Trading

Panic selling and excessive buying are both highly risky and can result in significant losses.

Summary: Master the Rules, Trade Prudently

Futures trading is fundamentally a high-leverage derivatives tool, offering both significant opportunities and risks. To succeed with Gate futures as a beginner, follow these three key points:

- Always start with low leverage

- Set both stop loss and take profit levels

- Stay disciplined and stick to your trading plan

Understanding the rules and managing risk can help you achieve consistent results in a highly volatile market.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution