Liquidation Heatmap Analysis: A Key Indicator of Liquidation Risk

In cryptocurrency derivatives trading, liquidation occurs when a leveraged position is forcibly closed because the price moves against you and your margin falls short. For newcomers, the liquidation heat map is an invaluable visualization tool—it instantly shows where risk clusters and where liquidations are likely to concentrate. This article provides a step-by-step overview of the tool.

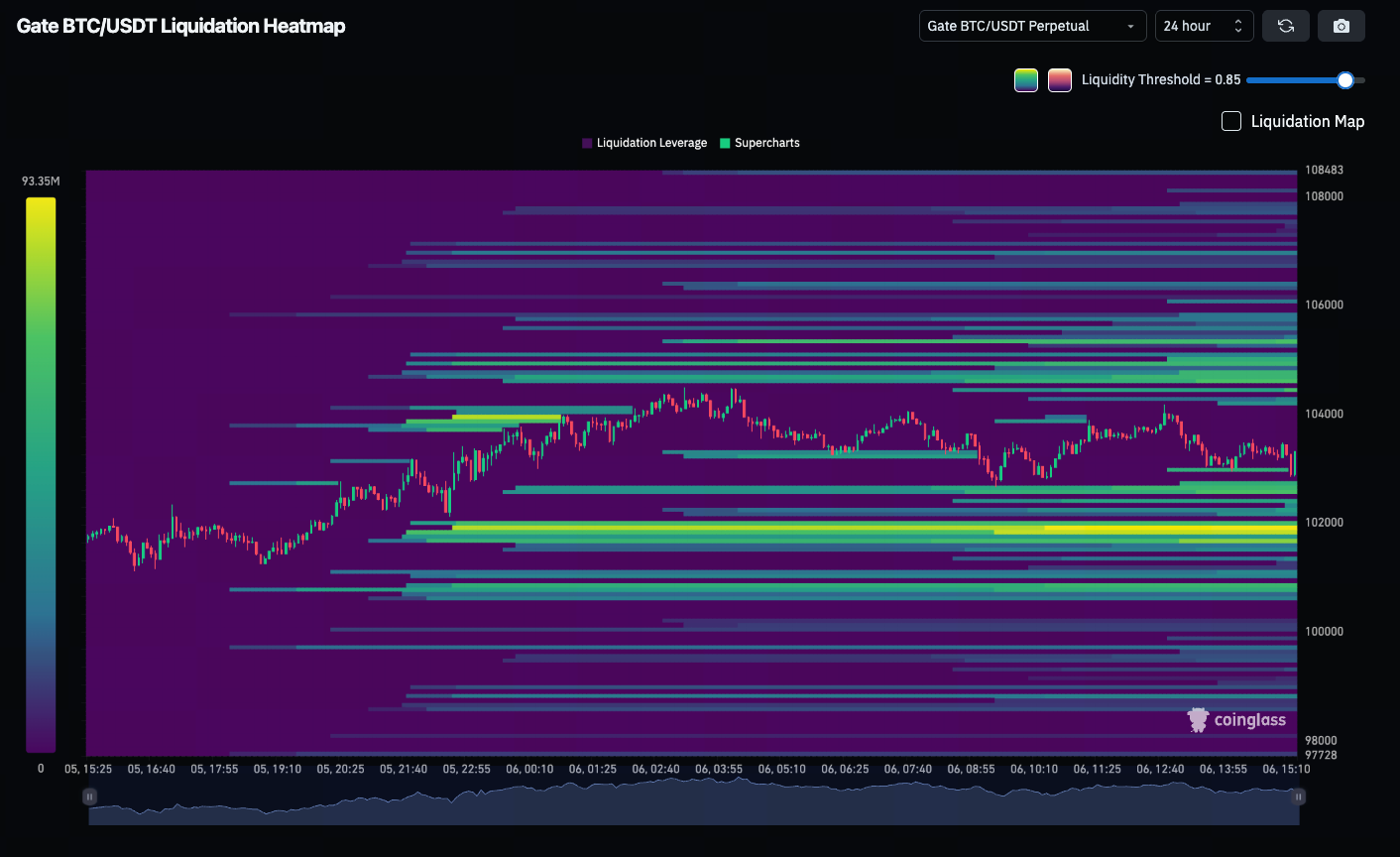

What Is a Liquidation Heat Map?

Source: https://www.coinglass.com/pro/futures/LiquidationHeatMap?coin=BTC

Liquidation heat maps, provided by platforms like Coinglass and CoinAnk, display where long and short positions are most vulnerable to forced closure at specific price levels and over varying timeframes. The map uses color gradients—shifting from light to dark or cool to hot (green → yellow → red)—to indicate position density. The hotter the zone, the greater the concentration of at-risk positions, making those price points more likely to be subject to market-driven liquidations.

Why Does It Matter for Traders?

- Spotting Potential Risk Zones: As prices approach a hot zone, many positions may be liquidated, which can cause sharp market swings. When prices enter these densely packed areas, expect strong liquidation events and intense volatility.

- Supporting Reversal and Breakout Judgments: The heat map reveals where long positions are weak and where shorts are concentrated, helping traders anticipate short squeezes or long sweeps.

- Risk Management: Focusing only on fundamentals or technicals without considering leverage exposure is risky. The heat map flags hidden risks, helping you sidestep major losses.

Latest Market Signals: Where Is Liquidation Risk Clustered Now?

In early November 2025, total market liquidations once again exceeded hundreds of millions of dollars. Bitcoin (BTC) and Ethereum (ETH) led the pack with approximately $400 million in forced liquidations. Meanwhile, Dogecoin (DOGE) saw its long liquidation metric surge to 1564.8% during a specific hourly window. Exceptionally bright spots on the heat map—particularly where positions are rapidly stacking up near price—mark danger zones that traders should closely monitor.

How Can Beginners Use Liquidation Heat Maps to Avoid Getting Swept Out?

- Start with Larger Timeframes: Use 24-hour or 12-hour heat maps rather than 5-minute windows; the data is more stable and less prone to traps—ideal for beginners.

- Watch for Color Shifts Near Price: If the current price is close to a zone with high liquidation risk, the market may soon sweep into that area, triggering forced liquidations.

- Integrate Support/Resistance Analysis: The heat map isn’t a standalone predictor; combine it with chart support and resistance. If a liquidation hot spot sits below the current price, a breakdown could accelerate declines—and vice versa.

- Manage Leverage and Set Stop-Losses: Even the best tool can’t replace sound risk control. The heat map highlights possible liquidation points, but doesn’t guarantee direction. Always set stop-losses.

- Entering a position where long positions are accumulating may expose traders to sweep zones. Traders should wait for confirmed breakouts before entering positions.

Summary: Key Points

- Liquidation heat maps visualize position density by price and color, pinpointing where liquidation risk clusters.

- They’re especially valuable for traders using leverage—crucial for beginners.

- Recent data show multiple nine-figure liquidations have occurred, and heat map signals are growing stronger.

- Beginners should combine heat map insights with price structure and solid risk management, not just chase signals.

- Exercise caution near high-risk zones and consider breakout opportunities.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article