- Pin

- 🎉 Follow to Win! Gate_Activity account is now live!

💰 Follow Gate_Activity and grab your share of $50 Points rewards!

10 Lucky Followers * $5 Points Each

Join:

1️⃣ Follow Gate_Activity 👉 https://www.gate.io/profile/Gate_Activity

2️⃣ Like this post

📅 Deadline: May 17, 10:00 AM (UTC)

Follow now and don't miss the great activities!

- 🚀 Gate.io #Launchpad# for Puffverse (PFVS) is Live!

💎 Start with Just 1 $USDT — the More You Commit, The More #PFVS# You Receive!

Commit Now 👉 https://www.gate.io/launchpad/2300

⏰ Commitment Time: 03:00 AM, May 13th - 12:00 PM, May 16th (UTC)

💰 Total Allocation: 10,000,000 #PFVS#

⏳ Limited-Time Offer — Don’t Miss Out!

Learn More: https://www.gate.io/article/44878

#GateioLaunchpad# #GameeFi#

- 📢 Gate Post Ambassadors are Now Actively Recruiting!

Not sure how to become a Gate Post Ambassador? 🤔

Check the image below 👇️

🎁 Become an Ambassador to unlock exclusive privileges and enjoy generous benefits!

- Special Benefits Tasks

- Exclusive Merch

- Fan Red Packet Support

- VIP5 & Golden Mark

- Honorary Ambassador

Click the link to join ➡️ https://www.gate.io/questionnaire/4937

More details: https://www.gate.io/announcements/article/38592

- Dear Gate Post users, we’re excited to announce a brand-new upgrade to our user interface! The new version is simpler, smoother, and packed with many thoughtful new features. Update now and explore what's new! What do you think of the new Gate Post experience? Which features do you like most? Have you noticed any surprises or improvements? Share your experience now to split a $50 prize pool!

🎁 We'll select 5 users with outstanding posts, each winning $10!

How to participate:

1. Follow Gate_Post;

2. Create a post with the hashtag #MyGatePostUpgradeExperience# , sharing your feedback and experie

- 🚀 Gate.io #Launchpad# Initial Offering: #PFVS#

🏆 Commit #USDT# to Share 10,000,000 #PFVS# . The More You Commit, the More $PFVS You Receive!

📅 Duration: 03:00 AM, May 13th - 12:00 PM, May 16th (UTC)

💎 Commit USDT Now: https://www.gate.io/launchpad/2300

Learn More: https://www.gate.io/announcements/article/44878

#GateioLaunchpad#

The decline in Bitcoin's hashrate has reached a level similar to December 2022.

The decline in Bitcoin's hashrate, a measure of the relative decrease in computational power of the Bitcoin network, has reached an unprecedented level since December 2022 - immediately after the collapse of FTX during the previous bear market bottom.

According to data from CryptoQuant, True Bitcoin Hashrate Drawdown is currently at -7.6%, indicating the possibility of a price bottom for this leading asset.

In the case of a market bottom supported by other indicators such as Bitcoin Exchange Reserve, MPI (Miner Position Index), and Bitcoin Miner Reserve, all show low selling pressure.

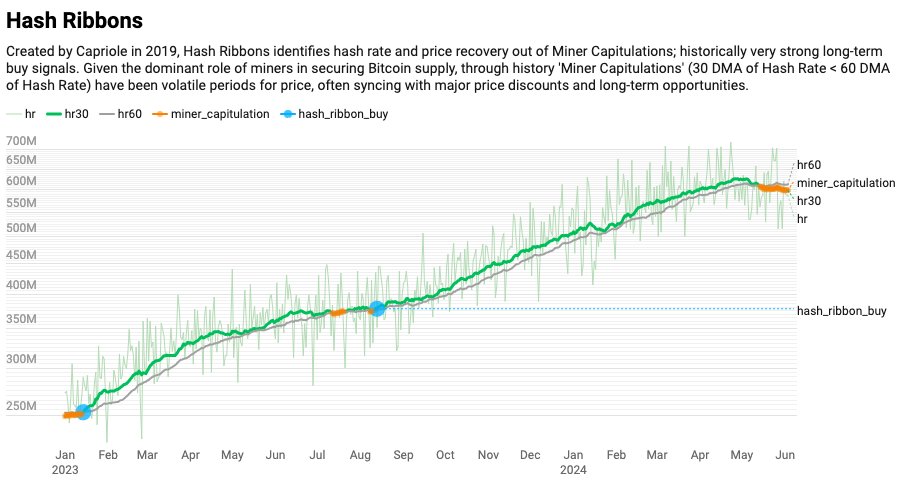

The chart shows the decline in hashrate from December 2022 to now. Source: CryptoQuant## Miner capitulation and the current cycle

In the past few weeks, some indicators have shown that miners are starting to capitulate, creating potential buying opportunities for Bitcoin.

In early June, Charles Edwards, the founder of the Capriole cryptocurrency hedge fund, argued that the Bitcoin Hash Ribbons indicator developed by his company is signaling a buy, reflecting a relative slowdown in the network's computational power.

Hash Ribbons measures the network's hashrate by comparing the 60-day moving average of Bitcoin's hashrate with the 30-day moving average. When the 30-day average drops below the 60-day average, it indicates a relative decrease in hashing power.

Hash Ribbons Indicator | Source: CaprioleMarket analyst Will Woo agrees with Edwards by explaining that the market will not reach new highs until weak miners are forced to stop - a traditional phenomenon that occurs in the weeks following the halving event but appears to be prolonged in the current cycle.

Recently, withdrawals by Bitcoin miners have decreased by up to 90% after halving, indicating that selling pressure from miners has been reduced and the price of Bitcoin will continue to rise.

The reality after halving and Bitcoin mining business

While preparing for the halving event in April 2024, financial services company Cantor Fitzgerald has released a report highlighting the challenges that miners will face after the block reward reduction.

This report has identified 11 mining companies, including Marathon Digital, Hut8, and Argo Blockchain, at risk of becoming unprofitable due to high mining costs and lower rewards.

According to the report, if the market price of Bitcoin drops to $40,000, some of the world's largest mining companies will be forced to surrender, highlighting the difficulties in the mining industry after halving.

*Bitcoin Exchange Reserves are the total amount of Bitcoin on exchanges, increasing when more people are willing to sell and decreasing when more people withdraw for long-term holding. The Miner Position Index (MPI) is the ratio of Bitcoin that miners sell versus hold, with high MPI when miners sell a lot and low MPI when miners hold a lot. Bitcoin Miner Reserves are the total amount of Bitcoin that miners hold, increasing when miners hold and decreasing when miners sell; these indices provide deep insights into the behavior of miners and investors.