# GlobalTechSell-OffHitsRiskAssets

4.72K

BeautifulDay

#GlobalTechSell-OffHitsRiskAssets

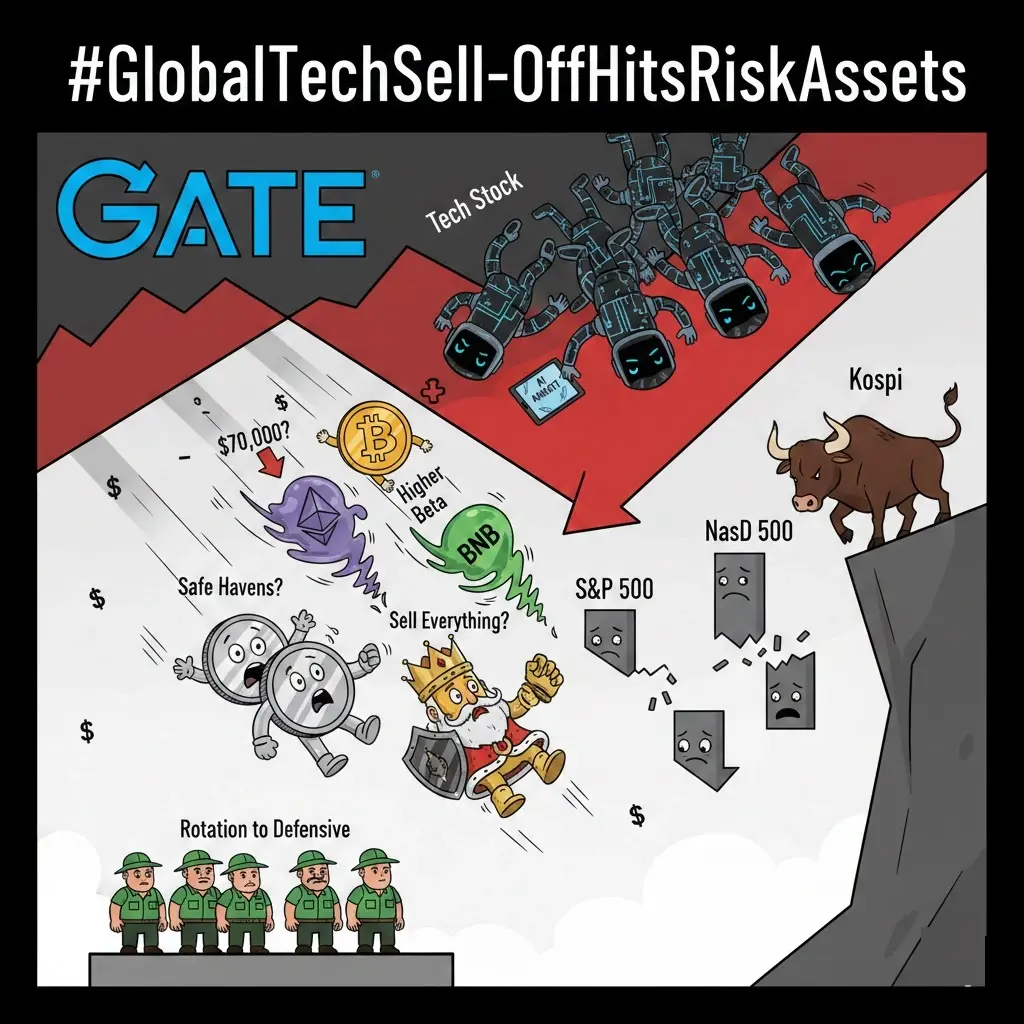

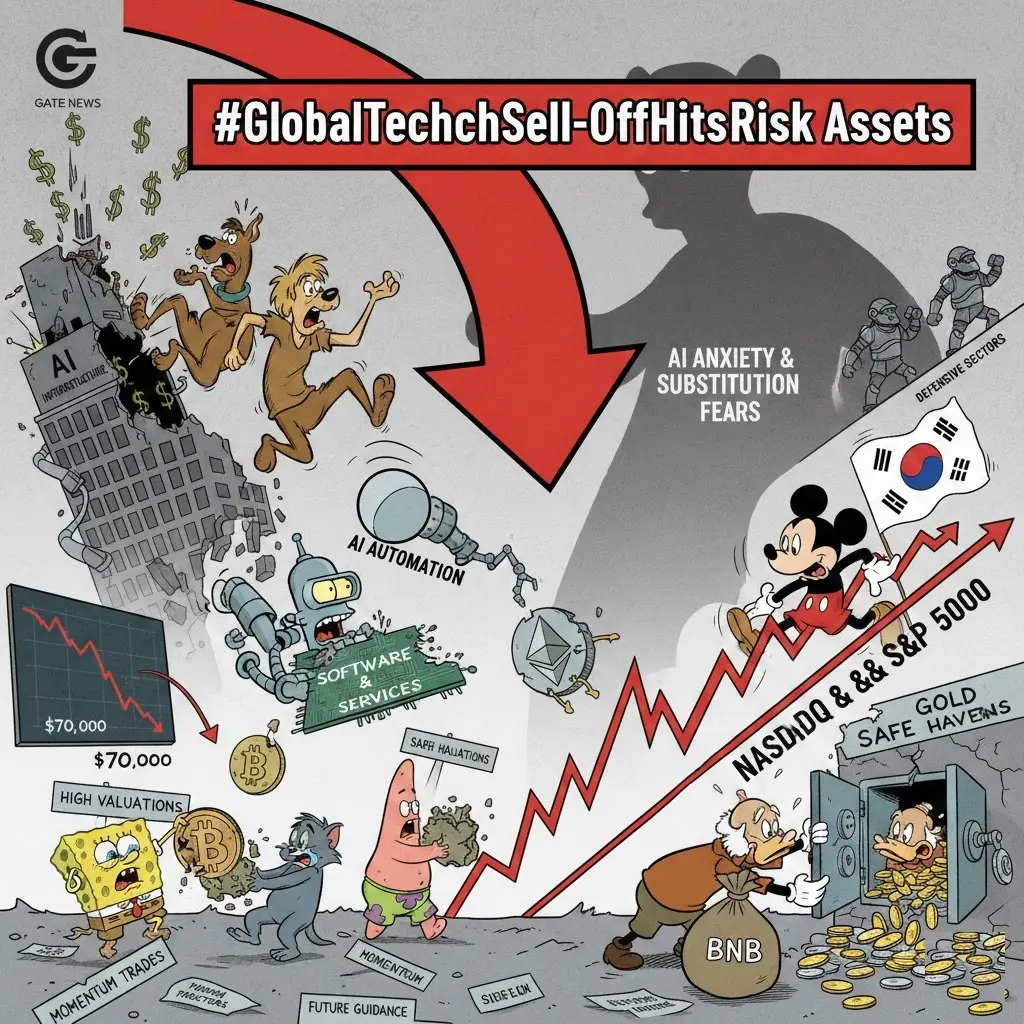

The recent global tech sell-off is more than just Nasdaq pain — it’s sending shockwaves through all risk assets, including crypto. Understanding the mechanics is critical for positioning.

📉 What’s Driving the Sell-Off?

Rising Interest Rate Pressure

Tech stocks, heavily leveraged and growth-oriented, are highly sensitive to rates.

Bond yields rising → future cash flows discounted → tech valuations drop.

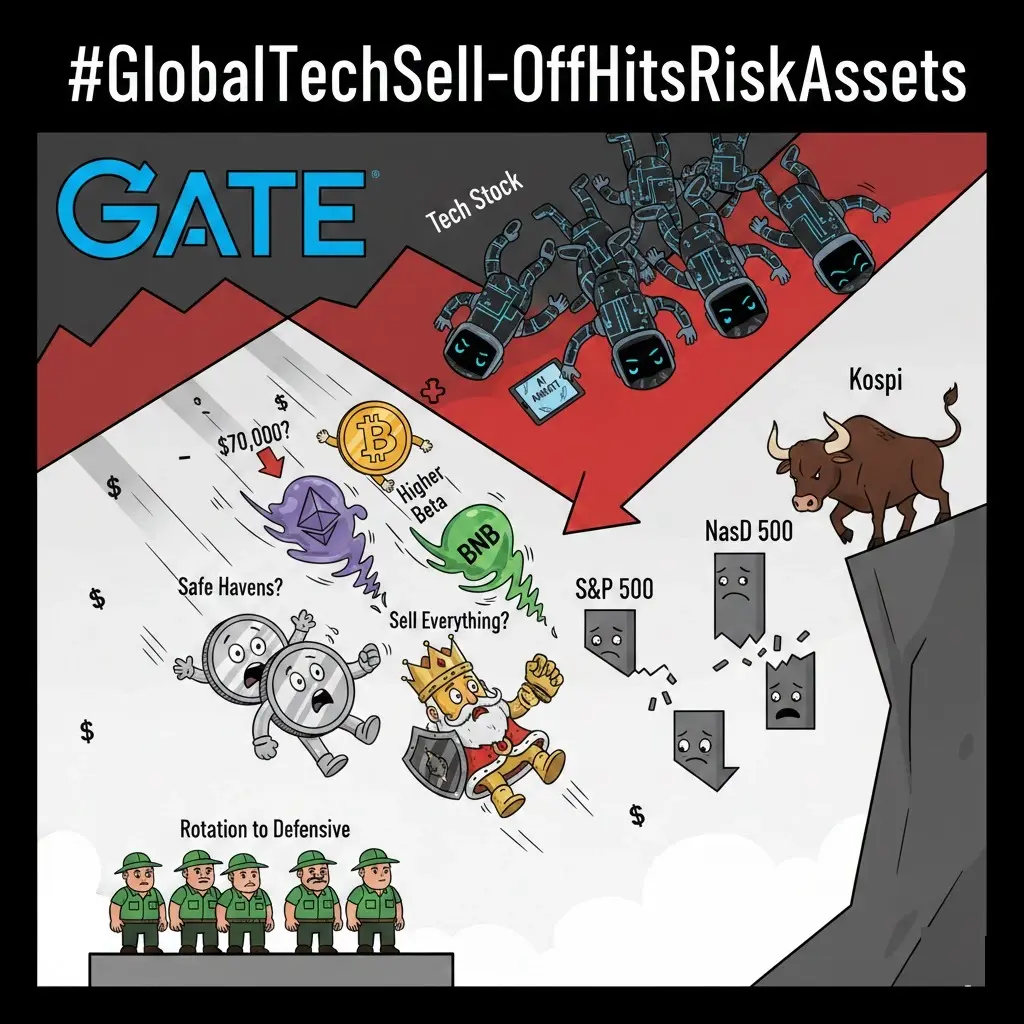

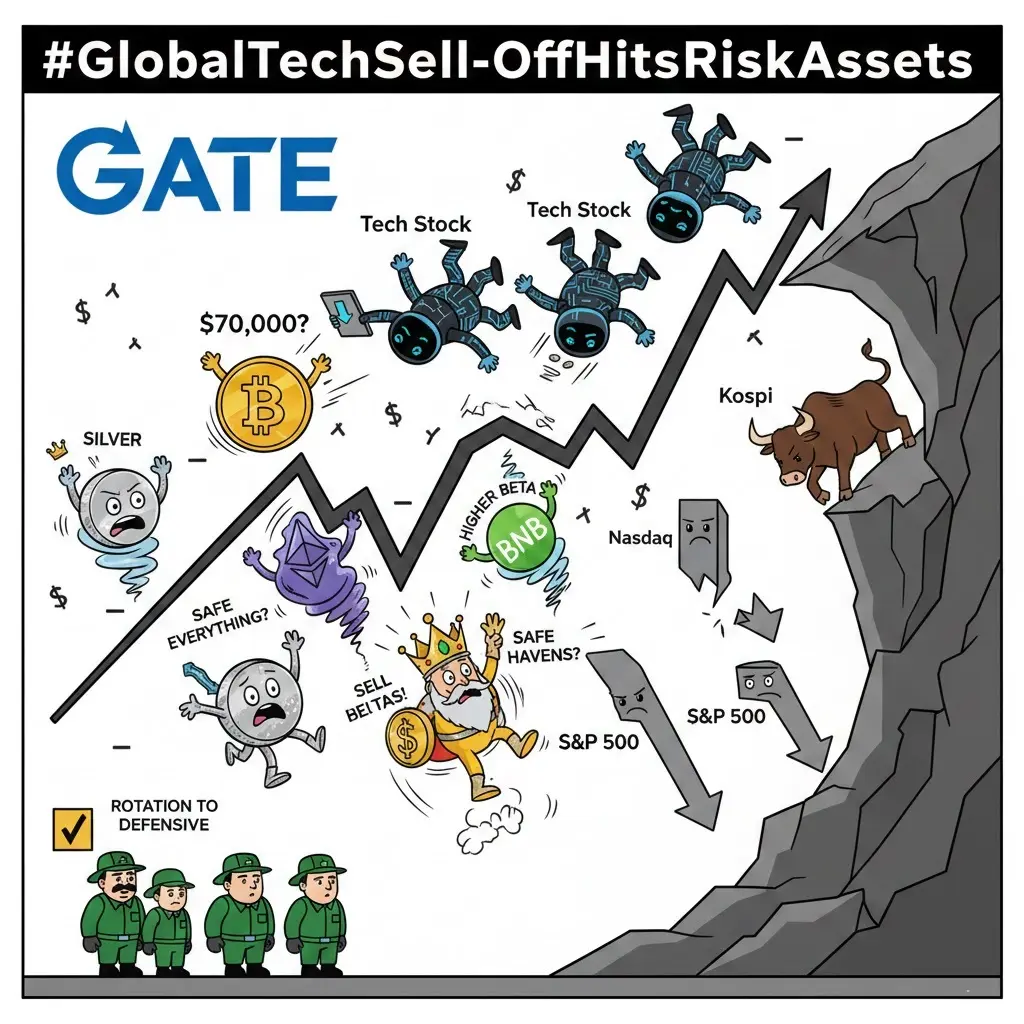

Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens (USD, bonds, gold).

Crypto, as a high-beta risk asset, is impacted immediately.

Macro

The recent global tech sell-off is more than just Nasdaq pain — it’s sending shockwaves through all risk assets, including crypto. Understanding the mechanics is critical for positioning.

📉 What’s Driving the Sell-Off?

Rising Interest Rate Pressure

Tech stocks, heavily leveraged and growth-oriented, are highly sensitive to rates.

Bond yields rising → future cash flows discounted → tech valuations drop.

Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens (USD, bonds, gold).

Crypto, as a high-beta risk asset, is impacted immediately.

Macro

- Reward

- like

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets

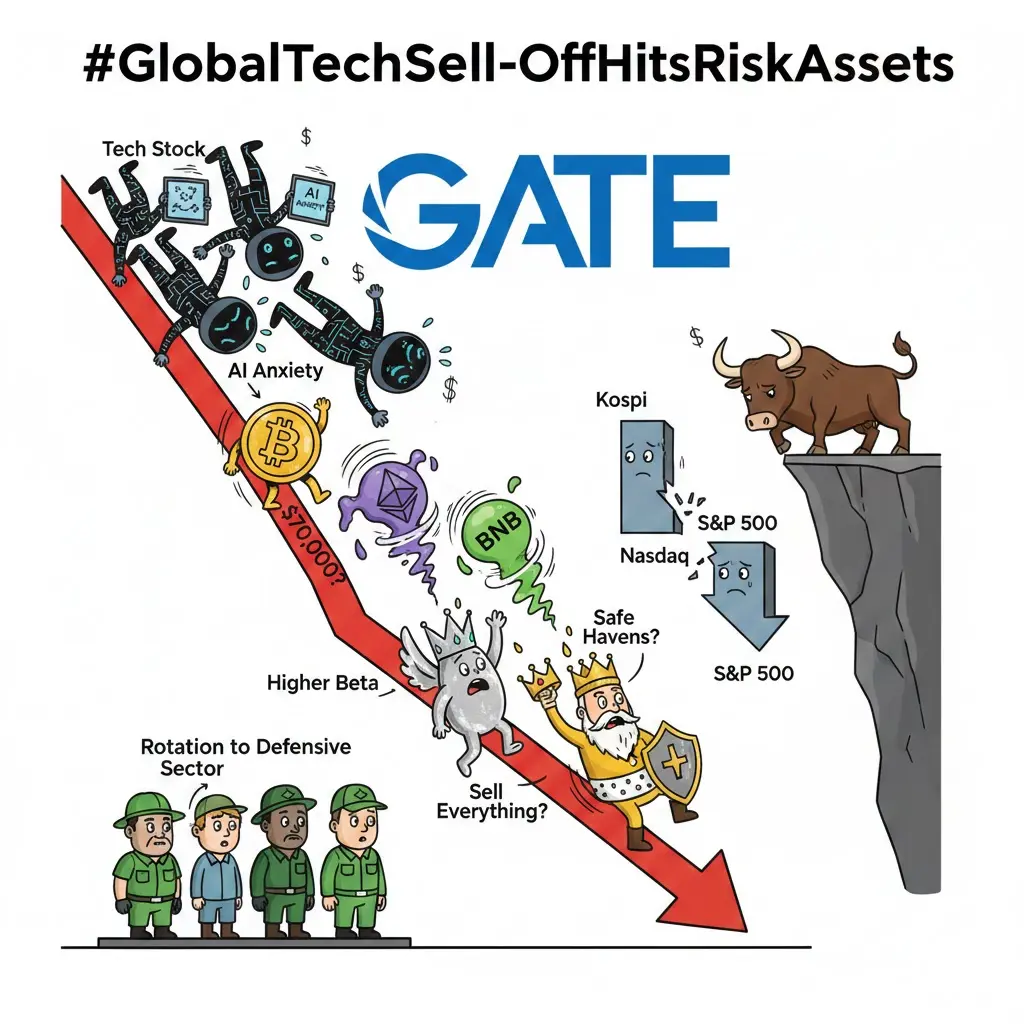

Global markets are experiencing a broad risk-off event, driven by a sell-off in major technology sectors. When tech stocks correct sharply, it often triggers capital flight from risk assets, including crypto. This macro pressure has led to increased volatility, rapid price swings, and stress tests across markets.

Here’s a thorough breakdown of what’s happening, why it matters, and how I’m approaching it as a Gate user — Repanzal.

Recent Market Reality Check

In recent sessions:

Equities, especially tech stocks, have pulled back significantly, leading to wider

Global markets are experiencing a broad risk-off event, driven by a sell-off in major technology sectors. When tech stocks correct sharply, it often triggers capital flight from risk assets, including crypto. This macro pressure has led to increased volatility, rapid price swings, and stress tests across markets.

Here’s a thorough breakdown of what’s happening, why it matters, and how I’m approaching it as a Gate user — Repanzal.

Recent Market Reality Check

In recent sessions:

Equities, especially tech stocks, have pulled back significantly, leading to wider

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#GlobalTechSell-OffHitsRiskAssets

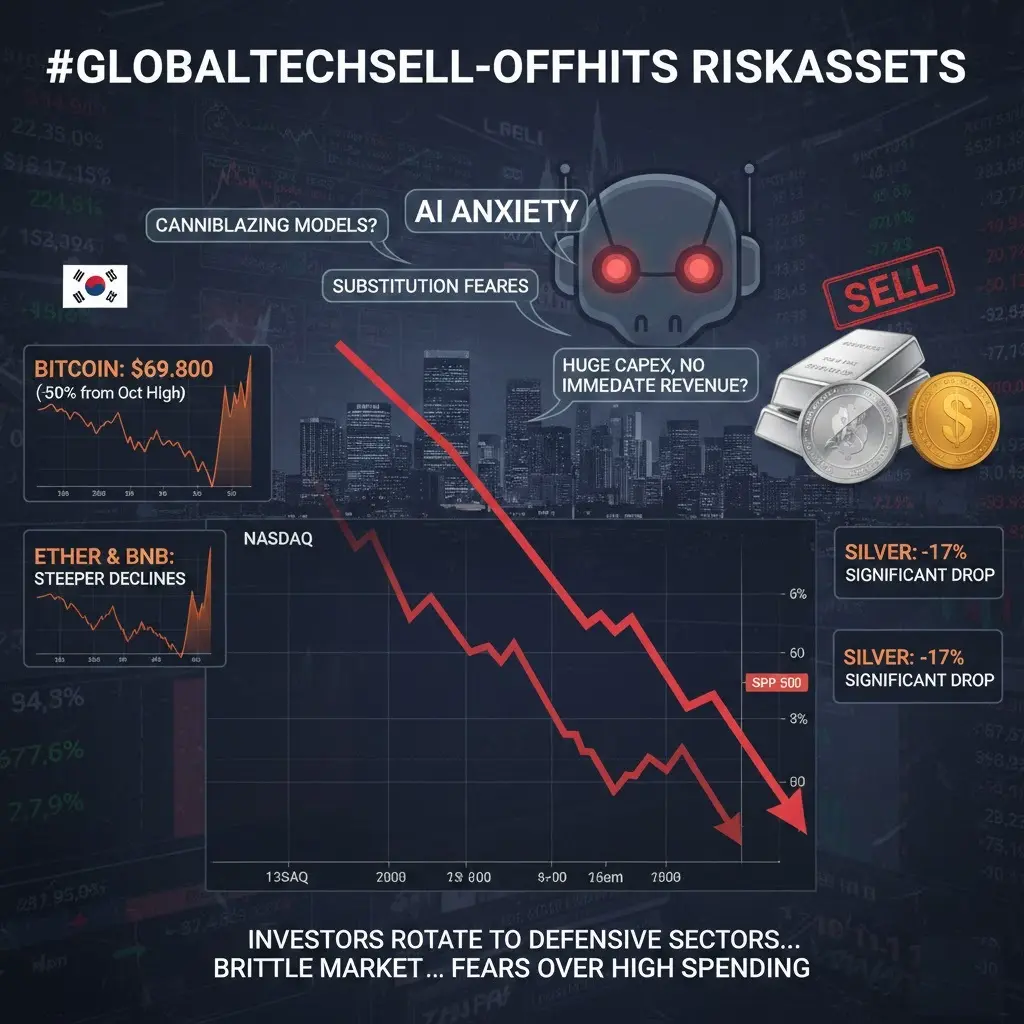

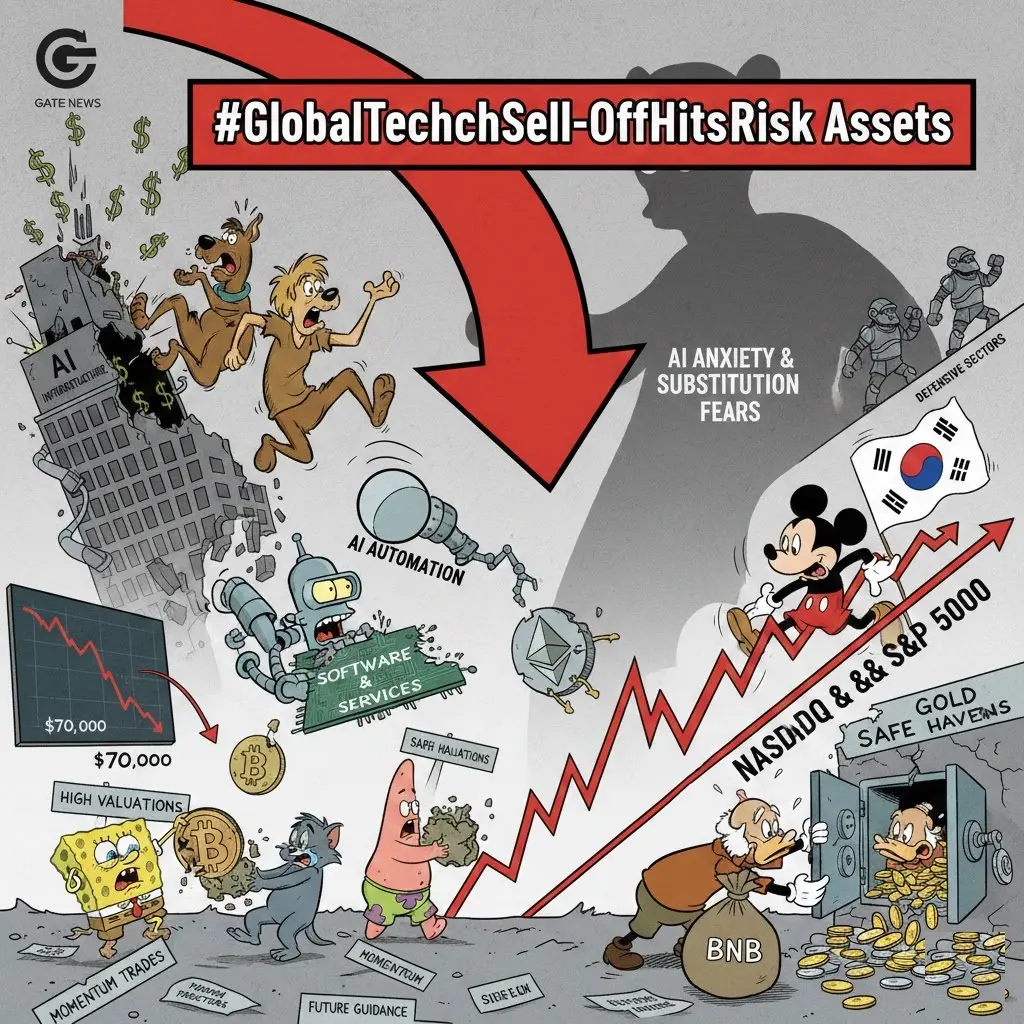

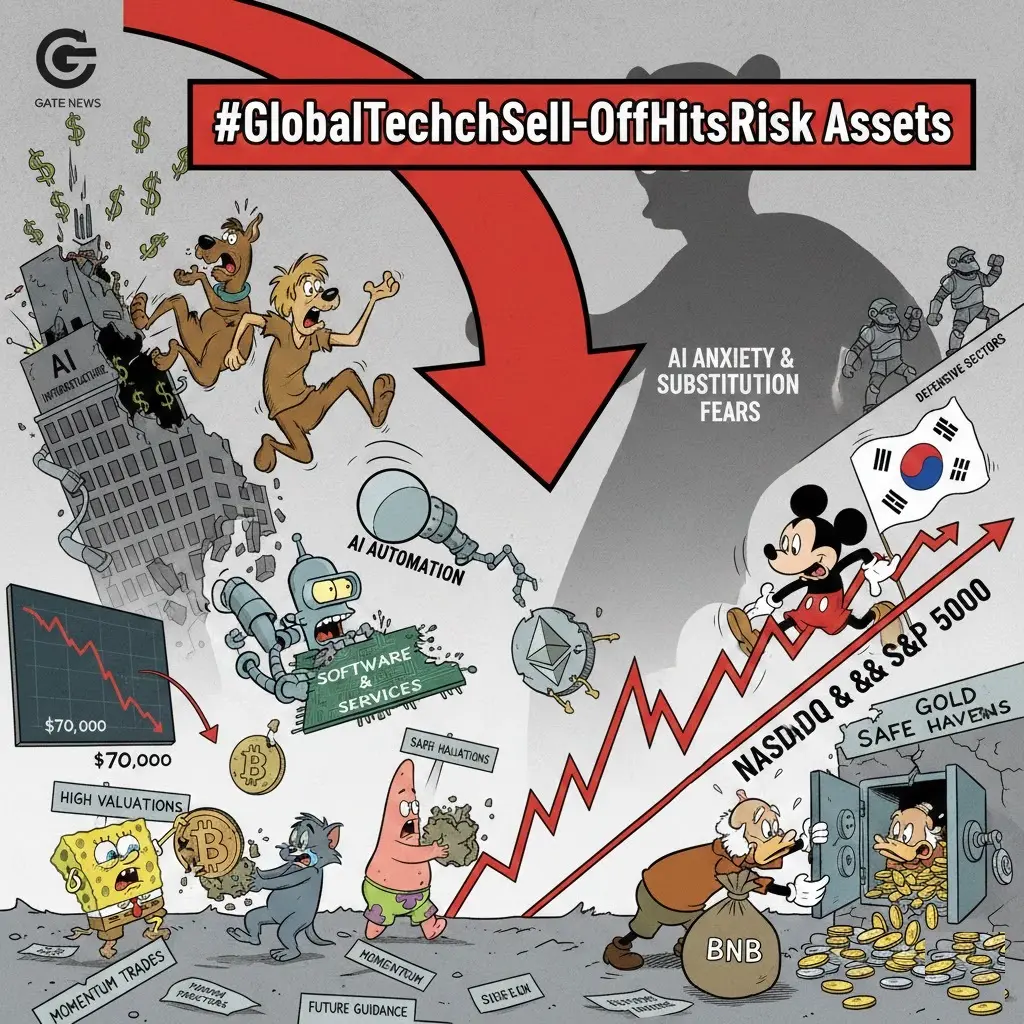

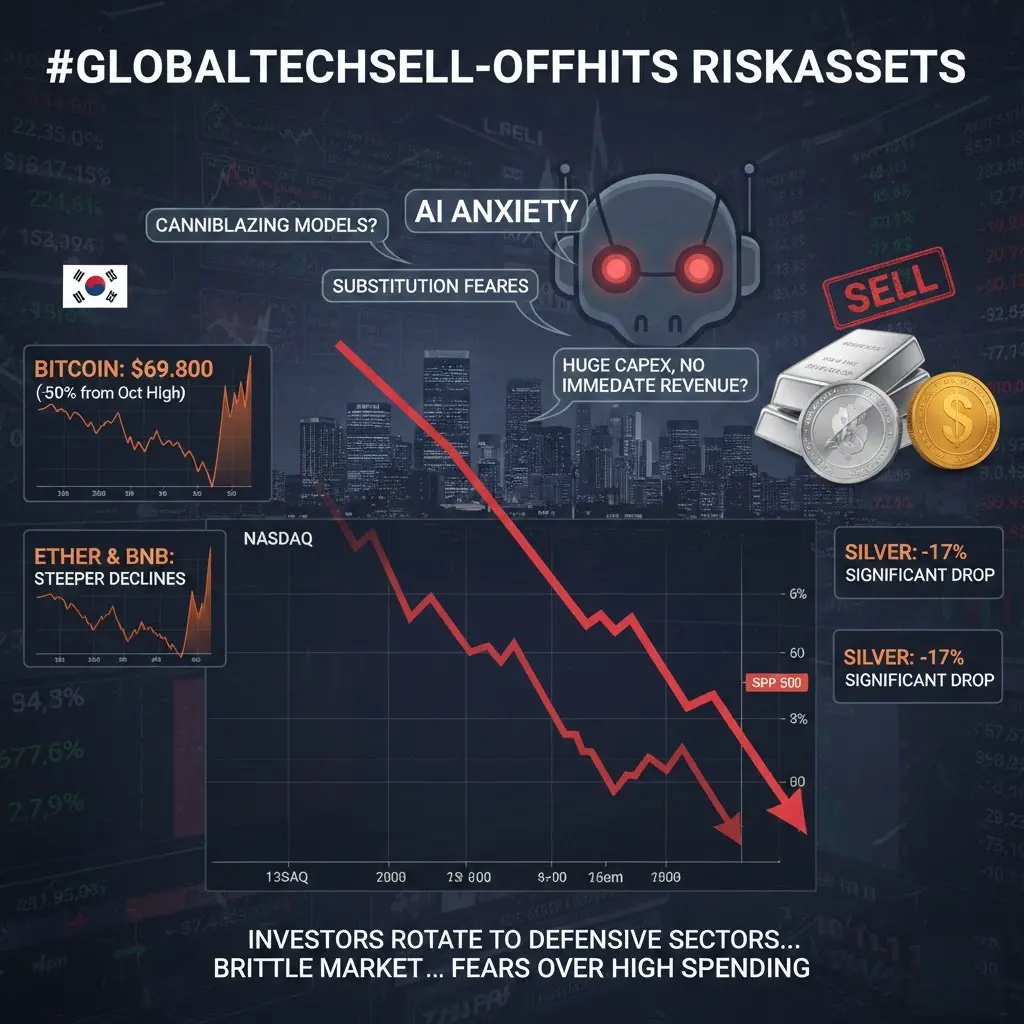

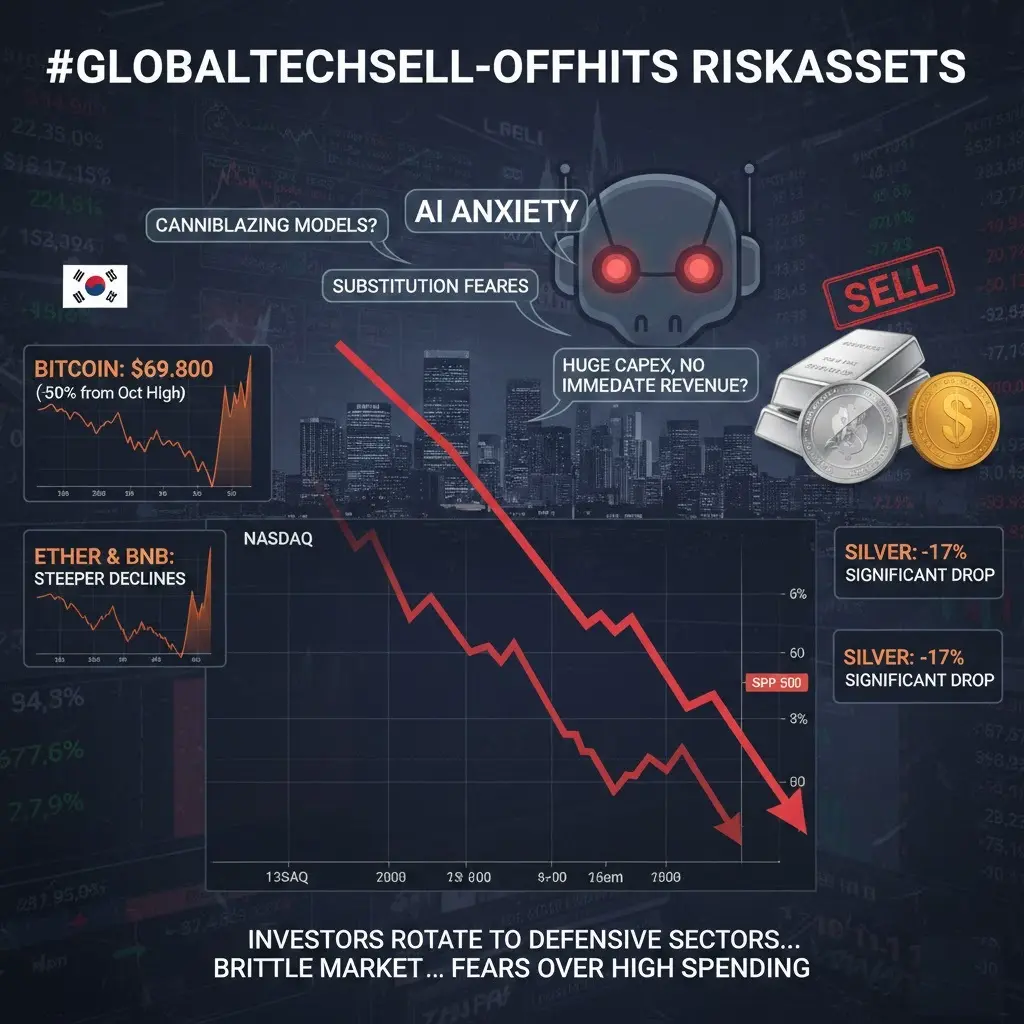

The markets are currently experiencing a significant "risk-off" environment. What started as a focused correction in high-flying technology stocks has snowballed into a broader retreat from risk assets—including cryptocurrencies and commodities—as we move through the first week of February 2026.

AI Anxiety & "Substitution" Fears

The primary trigger for this week’s rout was a sharp repricing of the AI narrative.

Market sentiment shifted following the release of new AI automation tools. Investors are no longer viewing AI solely as a "productivity booster" but a

The markets are currently experiencing a significant "risk-off" environment. What started as a focused correction in high-flying technology stocks has snowballed into a broader retreat from risk assets—including cryptocurrencies and commodities—as we move through the first week of February 2026.

AI Anxiety & "Substitution" Fears

The primary trigger for this week’s rout was a sharp repricing of the AI narrative.

Market sentiment shifted following the release of new AI automation tools. Investors are no longer viewing AI solely as a "productivity booster" but a

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊📉🌍 #GlobalTechSell-OffHitsRiskAssets – Market Volatility Alert ⚡

Global tech sector mein massive sell-off ne risk assets ko bhi impact kiya hai, including crypto markets. Traders aur investors ke liye heightened caution zaruri hai. 🛡️

✨ Key Insights:

Tech stocks aur related risk assets par pressure 📊

Increased market volatility – BTC, ETH aur altcoins affected 🪙

Macro trends aur investor sentiment closely monitor karein 🌐

💡 Gate.io Tip:

Use real-time analytics, charts, and risk management tools on Gate.io to navigate volatile markets and protect your portfolio. ⚡

Stay informed. Trade wi

Global tech sector mein massive sell-off ne risk assets ko bhi impact kiya hai, including crypto markets. Traders aur investors ke liye heightened caution zaruri hai. 🛡️

✨ Key Insights:

Tech stocks aur related risk assets par pressure 📊

Increased market volatility – BTC, ETH aur altcoins affected 🪙

Macro trends aur investor sentiment closely monitor karein 🌐

💡 Gate.io Tip:

Use real-time analytics, charts, and risk management tools on Gate.io to navigate volatile markets and protect your portfolio. ⚡

Stay informed. Trade wi

- Reward

- 3

- Comment

- Repost

- Share

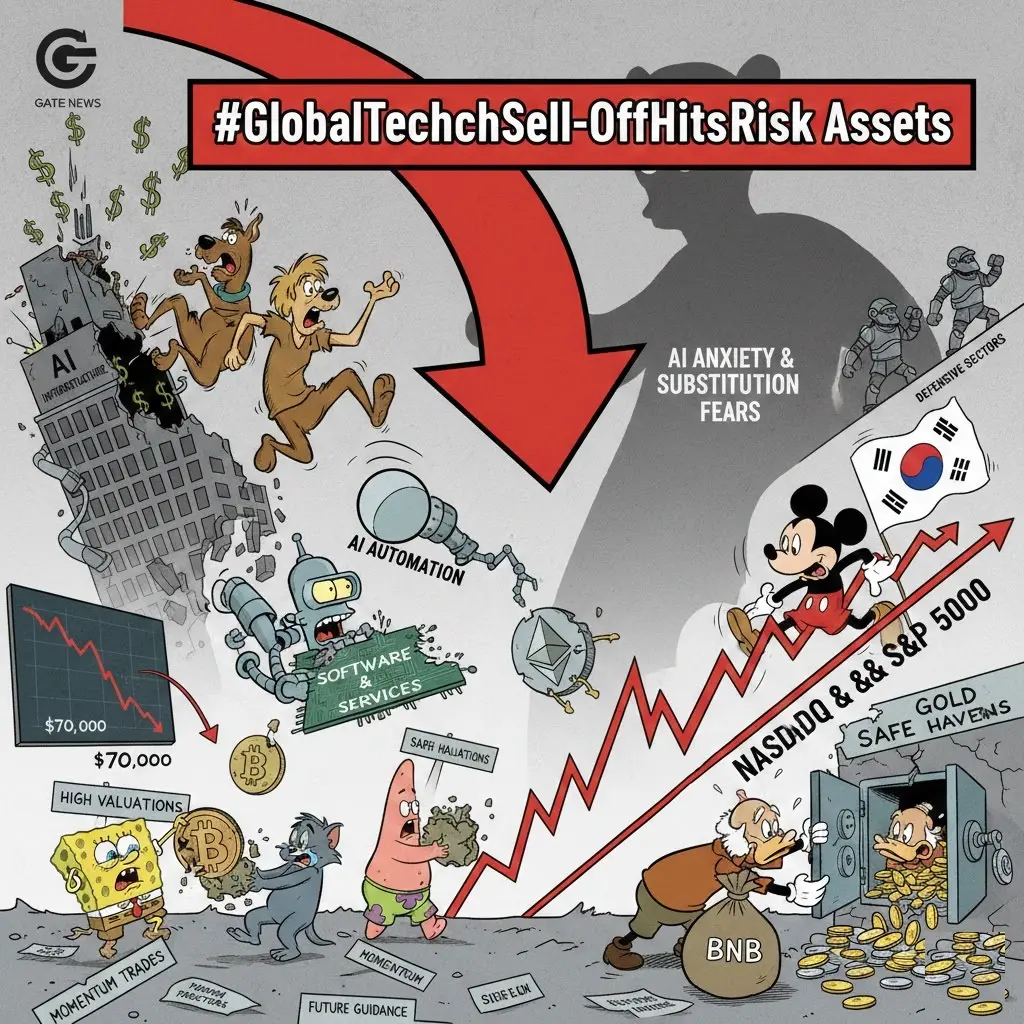

#GlobalTechSell-OffHitsRiskAssets 🌏Global markets have entered a pronounced “risk-off” phase as the first week of February 2026 unfolds. What began as a valuation reset in high-growth technology stocks has now evolved into a broad-based retreat from risk, impacting cryptocurrencies, commodities, and emerging market equities. This is no longer an isolated sector correction — it reflects a systemic repricing of growth, leverage, and future earnings expectations.

At the center of this shift is rising anxiety around artificial intelligence investment cycles. Recent breakthroughs in automation too

At the center of this shift is rising anxiety around artificial intelligence investment cycles. Recent breakthroughs in automation too

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#GlobalTechSell-OffHitsRiskAssets

The markets are currently experiencing a significant "risk-off" environment. What started as a focused correction in high-flying technology stocks has snowballed into a broader retreat from risk assets—including cryptocurrencies and commodities—as we move through the first week of February 2026.

AI Anxiety & "Substitution" Fears

The primary trigger for this week’s rout was a sharp repricing of the AI narrative.

Market sentiment shifted following the release of new AI automation tools. Investors are no longer viewing AI solely as a "productivity booster" but a

The markets are currently experiencing a significant "risk-off" environment. What started as a focused correction in high-flying technology stocks has snowballed into a broader retreat from risk assets—including cryptocurrencies and commodities—as we move through the first week of February 2026.

AI Anxiety & "Substitution" Fears

The primary trigger for this week’s rout was a sharp repricing of the AI narrative.

Market sentiment shifted following the release of new AI automation tools. Investors are no longer viewing AI solely as a "productivity booster" but a

- Reward

- 11

- 13

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback Another wave of selling just hit the market.

BTC struggling below key structure.

ETH under pressure.

Altcoins bleeding harder than majors.

But let’s be clear — this isn’t random.

This is what happens when: 🔹 Liquidity tightens

🔹 Leverage gets flushed

🔹 Weak hands panic

Pullbacks are uncomfortable… but they’re also necessary. Every strong uptrend in crypto history has been built on corrections that scared the crowd first.

Right now the market is testing patience, not just support levels.

Smart money focuses on: • Major demand zones

• Volume behavior

• Liquidation cluste

BTC struggling below key structure.

ETH under pressure.

Altcoins bleeding harder than majors.

But let’s be clear — this isn’t random.

This is what happens when: 🔹 Liquidity tightens

🔹 Leverage gets flushed

🔹 Weak hands panic

Pullbacks are uncomfortable… but they’re also necessary. Every strong uptrend in crypto history has been built on corrections that scared the crowd first.

Right now the market is testing patience, not just support levels.

Smart money focuses on: • Major demand zones

• Volume behavior

• Liquidation cluste

- Reward

- 2

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#GlobalTechSell-OffHitsRiskAssets Global markets have entered a pronounced “risk-off” phase as the first week of February 2026 unfolds. What began as a valuation reset in high-growth technology stocks has now evolved into a broad-based retreat from risk, impacting cryptocurrencies, commodities, and emerging market equities. This is no longer an isolated sector correction — it reflects a systemic repricing of growth, leverage, and future earnings expectations.

At the center of this shift is rising anxiety around artificial intelligence investment cycles. Recent breakthroughs in automation tools

At the center of this shift is rising anxiety around artificial intelligence investment cycles. Recent breakthroughs in automation tools

- Reward

- 2

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Michael Saylor is currently facing an unrealized loss of $4.4 billion as Bitcoin slips below $70,000.

📉 With MicroStrategy’s average purchase price around $76,000, the company’s massive holdings are now deep in the red.

MicroStrategy controls roughly 713,000 BTC, and the decline is weighing heavily on its balance sheet.

😐 The irony? Saylor has spent years promoting the mantra “never sell.”

But the market may now force a difficult choice:

realize a portion of the losses,

or borrow more to average down and reassure investors.

🧠 While retail traders stress over a $100 dip, whales quietly abs

📉 With MicroStrategy’s average purchase price around $76,000, the company’s massive holdings are now deep in the red.

MicroStrategy controls roughly 713,000 BTC, and the decline is weighing heavily on its balance sheet.

😐 The irony? Saylor has spent years promoting the mantra “never sell.”

But the market may now force a difficult choice:

realize a portion of the losses,

or borrow more to average down and reassure investors.

🧠 While retail traders stress over a $100 dip, whales quietly abs

- Reward

- like

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets In early February 2026, global markets are grappling with a sharp tech-driven sell-off, sending shockwaves across risk assets from equities to cryptocurrencies. Major technology indexes have dropped significantly, driven by disappointing earnings reports, slower growth forecasts, and increasing regulatory scrutiny in the U.S. and Europe. This decline has prompted investors to rotate capital away from high-beta tech stocks into defensive sectors such as utilities, consumer staples, and precious metals, creating a ripple effect in crypto markets, where Bitcoin a

- Reward

- 1

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

110.28K Popularity

20.02K Popularity

388.32K Popularity

7.17K Popularity

4.72K Popularity

4.56K Popularity

3.45K Popularity

4.84K Popularity

2.79K Popularity

3.2K Popularity

12.77K Popularity

8.41K Popularity

20.68K Popularity

28.76K Popularity

23.89K Popularity