2025 AGENT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: AGENT's Market Position and Investment Value

AgentLayer (AGENT) as the first decentralized network for autonomous AI agents, has made significant strides in revolutionizing AI governance and coordination since its inception. As of 2025, AGENT's market capitalization stands at $336,878.95, with a circulating supply of approximately 228,237,770 tokens, maintaining a price around $0.001476. This asset, dubbed the "AI Governance Pioneer," is playing an increasingly crucial role in decentralized artificial intelligence management and development.

This article will comprehensively analyze AGENT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. AGENT Price History Review and Current Market Status

AGENT Historical Price Evolution

- 2024: Project launch, price reached all-time high of $0.098 on November 30

- 2025: Market downturn, price dropped to all-time low of $0.001337 on October 16

- 2025: Volatile market cycle, price fluctuating between $0.001337 and $0.098

AGENT Current Market Situation

As of October 31, 2025, AGENT is trading at $0.001476, with a 24-hour trading volume of $11,504.37. The token has experienced a slight decrease of 0.67% in the past 24 hours. AGENT's market cap currently stands at $336,878.95, ranking it at 3813 in the cryptocurrency market.

The token is showing mixed short-term performance, with a 0.70% increase in the last hour but a 10.16% decrease over the past week. The 30-day trend indicates a significant decline of 27.68%, while the year-to-date performance shows a substantial drop of 94.66%.

AGENT's circulating supply is 228,237,770 tokens, which represents 22.82% of its total supply of 1,000,000,000. The fully diluted market cap is $1,476,000.

Click to view the current AGENT market price

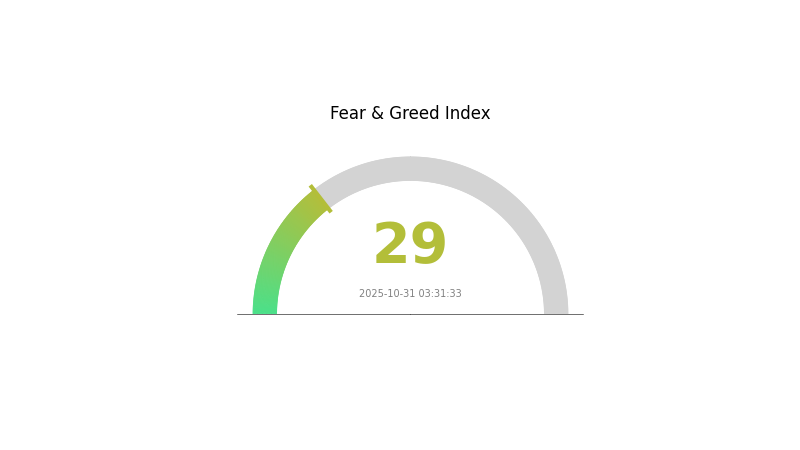

AGENT Market Sentiment Indicator

2025-10-31 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone with a reading of 29. This suggests investors are cautious and potentially bearish. Such periods of fear can present buying opportunities for long-term investors, as assets may be undervalued. However, it's crucial to conduct thorough research and manage risks carefully. Remember, market sentiment can shift quickly, and this indicator is just one tool among many for market analysis.

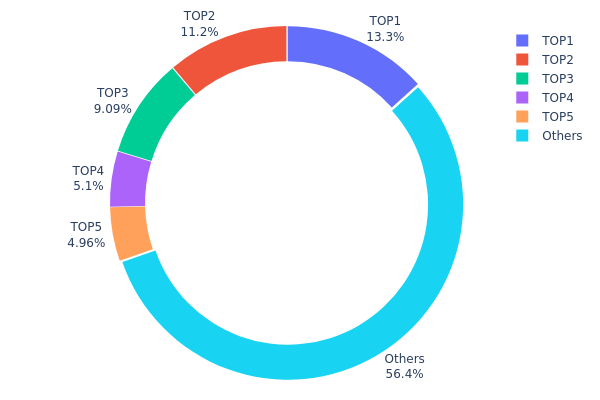

AGENT Holdings Distribution

The address holdings distribution data provides valuable insights into the concentration of AGENT tokens among various wallet addresses. Analysis of this data reveals a relatively high concentration among the top holders. The top 5 addresses collectively control 43.61% of the total AGENT supply, with the largest holder possessing 13.32% of tokens.

This level of concentration suggests a moderate degree of centralization in AGENT token distribution. While not alarmingly high, it does indicate that a small number of addresses have significant influence over the token's supply. Such concentration could potentially impact market dynamics, as large holders have the capacity to influence price movements through substantial buy or sell orders.

However, it's noteworthy that 56.39% of AGENT tokens are distributed among other addresses, indicating a broader base of smaller holders. This distribution pattern suggests a balance between major stakeholders and a more diverse community of token holders, which can contribute to overall market stability and reduce the risk of market manipulation by any single entity.

Click to view the current AGENT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 132971.42K | 13.32% |

| 2 | 0xab4f...719bd3 | 111557.57K | 11.17% |

| 3 | 0xc15d...78a976 | 90717.27K | 9.08% |

| 4 | 0x0529...c553b7 | 50861.42K | 5.09% |

| 5 | 0xf8bb...2a6dee | 49458.00K | 4.95% |

| - | Others | 562438.11K | 56.39% |

II. Key Factors Affecting AGENT's Future Price

Market Sentiment

- Sentiment Analysis: Market sentiment is a crucial factor influencing AGENT's price volatility. Deep Trading Agents can assess changes in market sentiment by analyzing discussions on social media and news reports.

- Historical Pattern: Past sentiment shifts have shown significant correlation with price movements.

- Current Impact: Real-time sentiment analysis is expected to provide early signals for potential price trends.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions are increasingly showing interest in AGENT, potentially leading to larger capital inflows.

- Corporate Adoption: Several tech companies are exploring AGENT integration, which could drive demand.

- Government Policies: Regulatory clarity in key markets is gradually emerging, potentially reducing uncertainty.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of major economies, are expected to influence AGENT's valuation.

- Inflation Hedge Properties: AGENT's performance in inflationary environments is being closely watched by investors.

- Geopolitical Factors: Global political tensions and economic partnerships may affect AGENT's adoption and value.

Technological Development and Ecosystem Growth

- Scalability Upgrades: Ongoing developments aim to improve transaction speeds and reduce costs.

- Interoperability Solutions: Cross-chain capabilities are being enhanced to expand AGENT's utility across different blockchain networks.

- Ecosystem Applications: The growth of DApps and projects built on AGENT's blockchain contributes to its overall value proposition.

III. AGENT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00076 - $0.00148

- Neutral prediction: $0.00148 - $0.00167

- Optimistic prediction: $0.00167 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.00090 - $0.00204

- 2028: $0.00137 - $0.00269

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00227 - $0.00237 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00246 - $0.00291 (assuming strong market performance and increased utility)

- Transformative scenario: $0.00291+ (assuming breakthrough innovations and mainstream adoption)

- 2030-12-31: AGENT $0.00291 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00167 | 0.00148 | 0.00076 | 0 |

| 2026 | 0.00177 | 0.00158 | 0.0012 | 6 |

| 2027 | 0.00204 | 0.00167 | 0.0009 | 13 |

| 2028 | 0.00269 | 0.00186 | 0.00137 | 25 |

| 2029 | 0.00246 | 0.00227 | 0.00187 | 54 |

| 2030 | 0.00291 | 0.00237 | 0.00128 | 60 |

IV. AGENT Professional Investment Strategies and Risk Management

AGENT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and AI technology enthusiasts

- Operation suggestions:

- Accumulate AGENT tokens during market dips

- Set price alerts for significant market movements

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Monitor AI industry news and developments

- Set strict stop-loss and take-profit levels

AGENT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and blockchain projects

- Stop-loss orders: Implement automated sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for AGENT

AGENT Market Risks

- High volatility: Significant price fluctuations common in emerging technologies

- Competitive landscape: Rapid development of AI sector may impact AGENT's market position

- Liquidity risk: Limited trading volume may affect ability to enter or exit positions

AGENT Regulatory Risks

- Uncertain regulatory environment: Evolving AI and blockchain regulations may impact operations

- Cross-border compliance: Varying international regulations may limit global adoption

- Data privacy concerns: Potential regulatory scrutiny on AI data usage and management

AGENT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: Possible limitations in handling increased network activity

- Interoperability issues: Compatibility challenges with other blockchain networks or AI systems

VI. Conclusion and Action Recommendations

AGENT Investment Value Assessment

AGENT presents a unique value proposition in the intersection of AI and blockchain technology. Long-term potential is significant, but short-term volatility and regulatory uncertainties pose considerable risks.

AGENT Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Consider AGENT as part of a diversified AI and blockchain portfolio

AGENT Trading Participation Methods

- Spot trading: Direct purchase and sale of AGENT tokens on Gate.com

- Staking: Participate in potential staking programs for passive income

- DeFi integration: Explore decentralized finance opportunities involving AGENT tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

Blast is predicted to 1000x by 2025 due to its $3B+ TVL, strong DeFi integrations, and growing Layer-2 adoption during the expected bull run.

Will Fetch AI reach $100?

Based on current predictions, Fetch AI is unlikely to reach $100. Forecasts suggest it may reach around $0.56 by the end of 2025.

Which coin will reach $1?

Kaspa (KAS) is likely to reach $1. It has shown strong growth potential and market predictions suggest it could hit this milestone soon.

Will Ethereum hit $50,000?

Ethereum reaching $50,000 is possible but highly speculative. It would require massive market growth and capital inflow, surpassing current projections.

2025 AICPrice Prediction: Navigating Market Trends and Technological Innovations in the Evolving Digital Asset Landscape

2025 NETMINDPrice Prediction: Analyzing Market Trends, Technology Adoption, and Growth Potential in the Evolving AI Ecosystem

2025 OGPU Price Prediction: Analyzing Market Trends and Technological Advancements in GPU Technology

2025 FAI Price Prediction: Analyzing Market Trends and Potential Growth Factors for FAI Token

2025 ARC Price Prediction: Bullish Trends and Key Factors Shaping the Future of Algorand's Governance Token

2025 FET Price Prediction: Analyzing Market Trends and Future Potential for Fetch.ai's Native Token

What is spot trading?

BTC Dominance at 59%: The $2 Trillion Rotation That Could Ignite Alt Season

Top Ethereum ETFs to Consider

Bearish candlestick patterns

Bitcoin Lifestyle