2025 AITECHPrice Prediction: Market Trends, Economic Factors and Investment Opportunities in the Artificial Intelligence Sector

Introduction: AITECH's Market Position and Investment Value

Solidus Ai Tech (AITECH) as the world's first deflationary AI infrastructure utility token, has made significant strides since its inception in 2023. As of 2025, AITECH's market capitalization has reached $44,526,860, with a circulating supply of approximately 1,628,634,269 tokens, and a price hovering around $0.02734. This asset, dubbed the "AI Infrastructure Pioneer," is playing an increasingly crucial role in high-performance computing and AI-focused projects.

This article will provide a comprehensive analysis of AITECH's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. AITECH Price History Review and Current Market Status

AITECH Historical Price Evolution

- 2023: Project launch, price started at $0.00197

- 2024: Reached all-time high of $0.5 on March 13

- 2025: Market correction, price dropped to current level of $0.02734

AITECH Current Market Situation

As of October 1, 2025, AITECH is trading at $0.02734. The token has experienced a significant decline of 13.47% in the past 24 hours, with a trading volume of $750,480.63. The current market capitalization stands at $44,526,860.91, ranking AITECH at 736th position in the overall cryptocurrency market.

AITECH's price has shown negative trends across various timeframes. In the past week, it has decreased by 12.72%, while the 30-day decline is 18.04%. The most substantial drop is observed in the yearly performance, with a 75.09% decrease from its previous year's price.

The token's all-time high of $0.5 was achieved on March 13, 2024, while its all-time low of $0.006 was recorded on August 28, 2023. Currently, AITECH is trading 94.53% below its all-time high and 355.67% above its all-time low.

The circulating supply of AITECH is 1,628,634,269 tokens, which represents 81.43% of its maximum supply of 2,000,000,000 tokens. The fully diluted market capitalization is calculated at $54,680,000.

Click to view the current AITECH market price

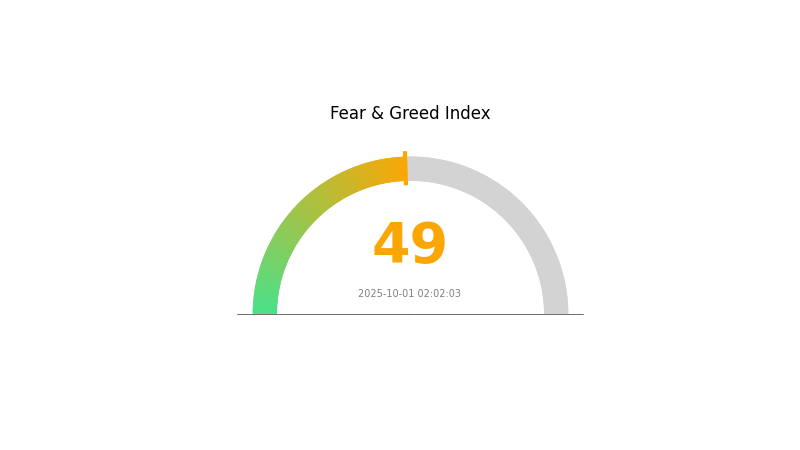

AITECH Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced as the Fear and Greed Index hovers at 49, indicating a neutral outlook. This equilibrium suggests that investors are neither overly fearful nor excessively greedy. While the market shows stability, it's crucial for traders to stay vigilant and conduct thorough research before making investment decisions. Gate.com offers a range of tools and resources to help you navigate the crypto landscape effectively. Remember, market conditions can change rapidly, so always stay informed and trade responsibly.

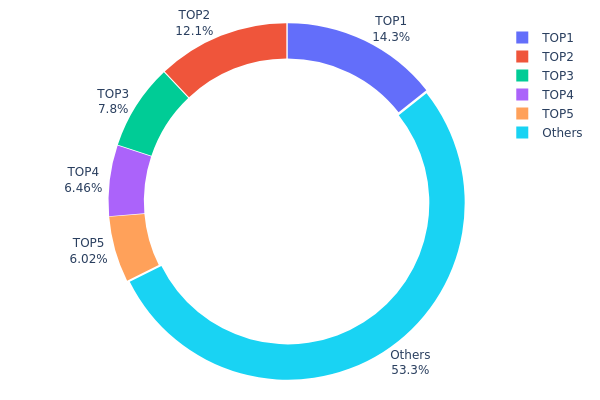

AITECH Holdings Distribution

The address holdings distribution data for AITECH reveals a relatively concentrated ownership structure. The top 5 addresses collectively hold 46.68% of the total supply, with the largest holder possessing 14.34%. This concentration level indicates a significant influence of major stakeholders on the token's market dynamics.

While not excessively centralized, this distribution pattern suggests potential volatility risks. The presence of large holders could impact price movements if they decide to liquidate substantial portions of their holdings. However, the fact that over 53% of tokens are distributed among other addresses provides some level of decentralization, potentially mitigating extreme market manipulations.

This ownership structure reflects a market with a balance between major players and wider distribution. It suggests a developing ecosystem, but also highlights the need for vigilance regarding potential whale movements that could affect AITECH's price stability and overall market sentiment.

Click to view the current AITECH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0529...c553b7 | 284970.67K | 14.34% |

| 2 | 0xbb6d...22f720 | 240000.00K | 12.07% |

| 3 | 0x3e93...2b995b | 155010.40K | 7.80% |

| 4 | 0x2e8f...725e64 | 128454.59K | 6.46% |

| 5 | 0x2c4d...c31184 | 119566.60K | 6.01% |

| - | Others | 1059209.17K | 53.32% |

II. Key Factors Influencing AITECH's Future Price

Supply Mechanism

- Deflationary Model: AITECH employs a deflationary model where a portion of tokens used on the platform is systematically burned, affecting token scarcity and price.

- Historical Pattern: The deflationary nature has historically contributed to increased token scarcity, potentially supporting price stability.

- Current Impact: The ongoing token burn mechanism is expected to continue influencing AITECH's price by gradually reducing the circulating supply.

Institutional and Whale Dynamics

- Enterprise Adoption: AITECH is being adopted by enterprises in various sectors, including healthcare, finance, and government, for AI and high-performance computing solutions.

Macroeconomic Environment

- Inflation Hedging Properties: As a digital asset, AITECH may be viewed as a potential hedge against inflation, similar to other cryptocurrencies.

Technological Development and Ecosystem Building

- AI Marketplace: AITECH is developing an AI marketplace categorizing tools into foundational AI models, AI agents, and standalone AI solutions, potentially driving adoption and value.

- High-Performance Computing (HPC): The platform's focus on providing scalable HPC resources for AI and blockchain applications may enhance its utility and market position.

- Ecosystem Applications: AITECH supports various DApps and ecosystem projects, particularly in AI and blockchain integration, which could drive demand for the token.

III. AITECH Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0199 - $0.02726

- Neutral prediction: $0.02726 - $0.02944

- Optimistic prediction: $0.02944 - $0.03 (requires strong market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.02532 - $0.03815

- 2028: $0.02167 - $0.03729

- Key catalysts: Technological advancements, wider industry adoption, and favorable regulatory developments

2029-2030 Long-term Outlook

- Base scenario: $0.03014 - $0.03768 (assuming steady market growth and adoption)

- Optimistic scenario: $0.03768 - $0.04672 (assuming accelerated adoption and positive market conditions)

- Transformative scenario: $0.04672 - $0.05000 (assuming breakthrough innovations and widespread integration)

- 2030-12-31: AITECH $0.04672 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02944 | 0.02726 | 0.0199 | 0 |

| 2026 | 0.03742 | 0.02835 | 0.02438 | 3 |

| 2027 | 0.03815 | 0.03289 | 0.02532 | 20 |

| 2028 | 0.03729 | 0.03552 | 0.02167 | 29 |

| 2029 | 0.03895 | 0.03641 | 0.02621 | 33 |

| 2030 | 0.04672 | 0.03768 | 0.03014 | 37 |

IV. AITECH Professional Investment Strategies and Risk Management

AITECH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate AITECH tokens during market dips

- Hold for at least 1-2 years to potentially benefit from ecosystem growth

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor AI industry news and AITECH ecosystem developments

- Set stop-loss orders to manage downside risk

AITECH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Plans

- Diversification: Spread investments across different AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update security settings

V. AITECH Potential Risks and Challenges

AITECH Market Risks

- High volatility: Cryptocurrency markets are known for extreme price fluctuations

- Competition: Increasing number of AI-focused blockchain projects may impact AITECH's market share

- Market sentiment: Overall crypto market trends can significantly influence AITECH's price

AITECH Regulatory Risks

- Uncertain regulations: Evolving cryptocurrency regulations may impact AITECH's operations

- Cross-border compliance: Differing regulatory approaches across jurisdictions could pose challenges

- Tax implications: Unclear or changing tax laws related to crypto assets may affect investors

AITECH Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the token's underlying code

- Scalability challenges: Possible limitations in handling increased network activity

- Technological obsolescence: Rapid advancements in AI and blockchain may outpace AITECH's development

VI. Conclusion and Action Recommendations

AITECH Investment Value Assessment

AITECH presents a unique value proposition in the AI infrastructure space, with potential for long-term growth. However, short-term volatility and market risks remain significant factors to consider.

AITECH Investment Recommendations

✅ Beginners: Consider small, regular investments to build a position over time

✅ Experienced investors: Implement a balanced approach with both long-term holding and active trading strategies

✅ Institutional investors: Conduct thorough due diligence and consider AITECH as part of a diversified AI and blockchain portfolio

AITECH Trading Participation Methods

- Spot trading: Buy and sell AITECH tokens on Gate.com

- Staking: Participate in staking programs if available to earn additional rewards

- DeFi integration: Explore decentralized finance options within the AITECH ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Solidus AI Tech legit?

Yes, Solidus AI Tech is a legitimate project with active development and strong community support. It shows potential for growth in the AI and blockchain space.

Does API3 have a future?

API3 shows potential for growth, with long-term forecasts suggesting possible price increases. However, current sentiment is mixed, with bearish signals slightly outweighing bullish indicators.

How much is Aitech coin worth?

As of October 1, 2025, Aitech (AITECH) coin is worth $0.0025. This price reflects its role in the Solidus Ai Tech ecosystem as a deflationary token used for service procurement.

What is the most promising AI crypto?

NEAR Protocol is currently the most promising AI crypto. It combines blockchain with AI for enhanced efficiency and has the largest market cap in the AI crypto sector.

2025 FET Price Prediction: Analyzing Market Trends and Future Potential for Fetch.ai's Native Token

2025 TRACAIPrice Prediction: Future Valuation Analysis and Market Potential for Emerging Blockchain Technology

2025 CAMP Price Prediction: Analyzing Market Trends and Growth Potential for Blockchain Gaming Assets

2025 NC Price Prediction: Analyzing Market Trends and Future Growth Potential

2025 REX Price Prediction: Bullish Outlook as Adoption and Utility Drive Growth

2025 MIRA Price Prediction: Analyzing Future Trends and Potential Growth Factors

What is Stop Loss Hunting? How to Avoid Whale Liquidity Traps

Snoop Dogg and Bored Ape Yacht Club Launch Animated Avatars on Telegram via TON

Bill Gates on Digital Currency

Hamster Kombat Cipher Code Guide: How to Enter Codes and Earn Rewards

Why Is China Banning Cryptocurrencies?