2025 BBLAST Price Prediction: Expert Analysis and Future Market Outlook

Introduction: Market Position and Investment Value of BBLAST

Burger Blast Token (BBLAST), a BEP-20 token powering a rapidly expanding multi-platform Web3 gaming ecosystem built on BNB Chain, has emerged as a notable player in blockchain gaming. As of January 2, 2026, BBLAST maintains a market capitalization of approximately $150,422.59, with a circulating supply of 147,850,000 tokens and a current price of $0.0010174. Designed for mass adoption across standalone Web applications and Telegram mini-apps, this asset is increasingly playing a pivotal role in decentralized gaming and token utility innovation.

This article will conduct a comprehensive analysis of BBLAST's price trajectory through 2026-2031, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

I. BBLAST Price History Review and Current Market Status

BBLAST Historical Price Evolution Trajectory

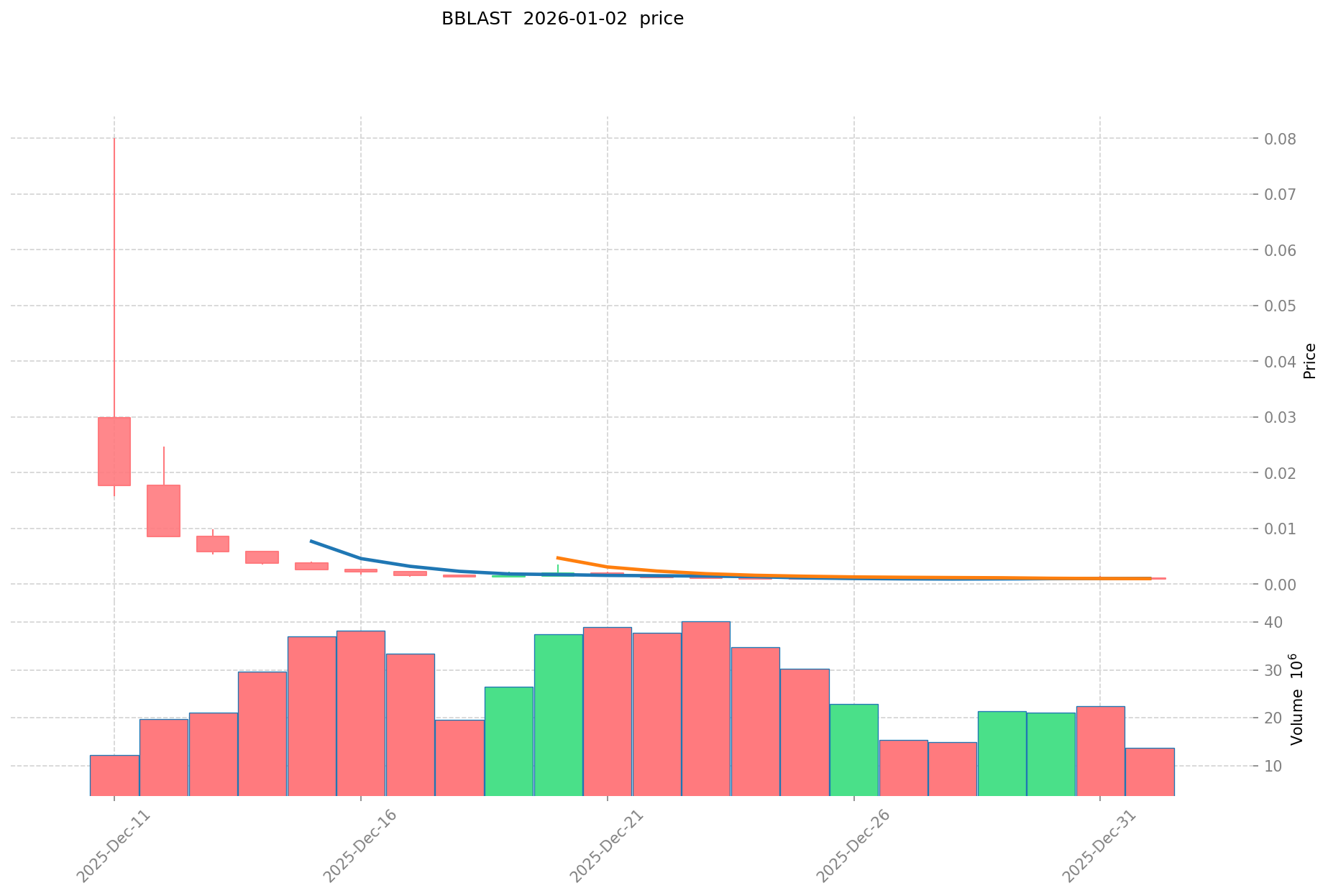

- December 2025: Project launch period, token reached its all-time high of $0.08 on December 11, 2025

- December 2025: Sharp market correction, price declined significantly from peak levels to $0.00082 on December 24, 2025, representing a 98.75% decrease from the all-time high

BBLAST Current Market Dynamics

As of January 2, 2026, BBLAST is trading at $0.0010174, with a market capitalization of $150,422.59 and a fully diluted valuation of $1,017,400.00. The token has a circulating supply of 147,850,000 BBLAST out of a total supply of 1,000,000,000, representing 14.79% circulation ratio. The 24-hour trading volume stands at $13,732.30, with the token currently ranked 4,448 in the overall market capitalization rankings.

In short-term price action, BBLAST has shown modest gains of 2.62% over the past hour and 2.83% over the past seven days. However, the token has experienced significant downward pressure over the medium to long term, declining 5.12% in the last 24 hours and falling 94.75% over the past 30 days and one year. The token's 24-hour price range has fluctuated between $0.00089 and $0.001073, indicating continued market volatility. With 86,410 token holders, BBLAST maintains an active community presence on the BNB Chain network.

Check current BBLAST market price

BBLAST Market Sentiment Index

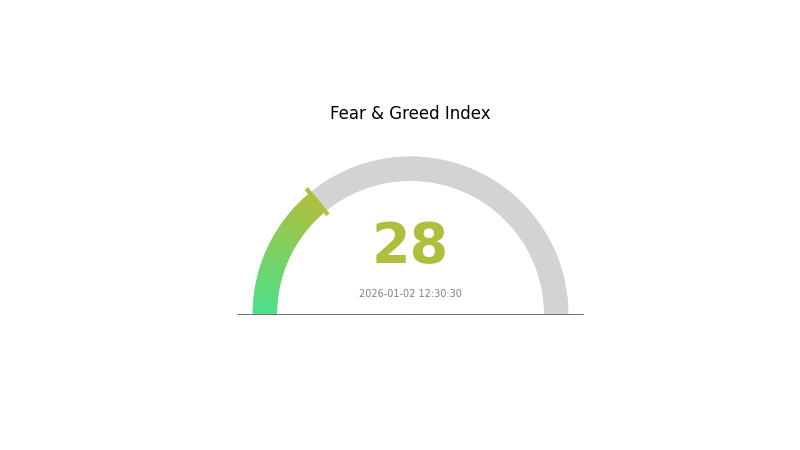

2026-01-02 Fear and Greed Index: 28 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment, with the index at 28. This reading indicates heightened market anxiety and risk aversion among investors. During periods of fear, asset prices often face downward pressure as participants become more cautious. However, contrarian investors sometimes view extreme fear as potential buying opportunities, as markets can reverse when sentiment reaches extreme levels. Monitor market developments closely and consider your risk tolerance when making trading decisions on Gate.com.

BBLAST Token Distribution

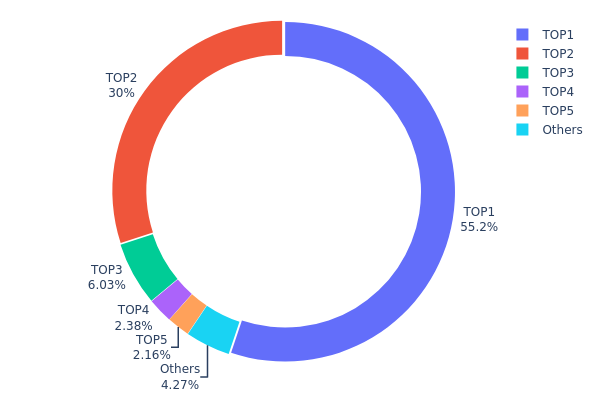

The address holding distribution data provides a critical lens into the concentration dynamics of BBLAST token ownership across the blockchain. This metric maps how token supply is allocated across wallet addresses, serving as a fundamental indicator of decentralization levels, market structure health, and potential vulnerability to coordinated selling pressure or market manipulation.

The current distribution pattern reveals a highly concentrated token structure, with the top two addresses commanding 85.15% of total supply. The largest holder (0xfa40...60fe2f) maintains a dominant 55.15% stake, while the second-largest (0x344e...9bdfe8) controls an additional 30.00%. This degree of concentration substantially exceeds healthy decentralization benchmarks and suggests significant structural risk. The remaining top three addresses hold relatively modest positions at 6.02%, 2.37%, and 2.16% respectively, while other addresses collectively account for only 4.30% of circulating supply.

This extreme concentration presents notable implications for market dynamics and stability. The disproportionate holdings among the top addresses create elevated liquidity risks and amplify the potential for pronounced price volatility in response to large position movements. Concentrated ownership structures of this magnitude typically correlate with reduced market resilience and increased susceptibility to adverse price action, particularly during periods of reduced trading volume. The minimal distribution among retail participants and smaller holders further underscores the token's current reliance on a narrow investor base, suggesting that BBLAST's market structure exhibits characteristics more aligned with early-stage or restricted distribution protocols rather than mature, organically distributed tokens.

Access current BBLAST Token Holdings on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfa40...60fe2f | 551599.12K | 55.15% |

| 2 | 0x344e...9bdfe8 | 300000.00K | 30.00% |

| 3 | 0x53f7...f3fa23 | 60283.38K | 6.02% |

| 4 | 0x0d07...b492fe | 23786.42K | 2.37% |

| 5 | 0xfa2b...8a6675 | 21625.00K | 2.16% |

| - | Others | 42706.08K | 4.3% |

II. Core Factors Influencing BLAST's Future Price

Supply Mechanism

-

Token Distribution Structure: BLAST has a total supply of 100 billion tokens with the following allocation: Community (50%), Core Contributors (25.5%), Investors (16.5%), and Blast Foundation (8%). Community tokens are linearly unlocked over 3 years from TGE, while core contributors and investors experience a 4-year lockup period with 25% unlocking after year one, followed by monthly linear vesting over the subsequent 3 years.

-

Historical Airdrop Impact: The first airdrop distributed 17% of total supply (17 billion BLAST tokens) comprising Blast Points (7%), Gold Points (7%), and Blur Foundation allocation (3%). Following the airdrop on June 26, the token demonstrated strong market performance, with fully diluted valuation breaking through $2.6 billion within one hour and reaching a peak of $2.9 billion, representing over 20% daily gains.

-

Current Supply Dynamics: As of the airdrop event, over 250 million users completed token claims within 12 hours, with 124 billion tokens claimed, representing 88.63% of the initial airdrop allocation. The phased unlocking schedule will continue to influence price dynamics through 2027 and beyond.

Institutional and Major Holder Dynamics

-

Institutional Investment: Paradigm invested in the Blast team due to developer Pacman's Layer 2 vision aimed at extending Blur project success. Paradigm acknowledged concerns about project decisions while expressing support for the team's previous work and willingness to engage in dialogue on technical matters.

-

Exchange Recognition: Major centralized exchanges including Gate.com, Upbit, and Coinbase listed BLAST trading pairs, validating market acceptance and providing essential liquidity infrastructure for secondary market trading.

Macroeconomic Environment

-

Monetary Policy Influence: CPI data stabilization and market expectations of potential Federal Reserve rate cuts in 2024 created favorable conditions for risk asset recovery, providing tailwind support for BLAST trading activity during the airdrop period.

-

Layer 2 Ecosystem Growth: Layer 2 solutions are increasingly important for blockchain scalability, enhancing Ethereum's transaction throughput while reducing costs. This expanding ecosystem benefits BLAST's market positioning alongside peer Layer 2 protocols.

Technology Development and Ecosystem Building

-

Native Yield Mechanism: BLAST introduced a novel approach where user deposits are converted to stETH and DAI, generating native yields from Ethereum staking rewards and RWA (Real World Assets) through lending protocols. Revenue sources derive from Lido's Ethereum staking yields and MakerDAO's on-chain Treasury Bills, providing sustainable yield sustainability claims.

-

Ecosystem DApps: The BLAST ecosystem includes multiple mining opportunities through projects such as Ambient, Juice, Synfutures, NFTperp, and Munchables, demonstrating active developer participation and ecosystem diversification.

-

Optimism Superchain Compatibility: BLAST's future development will maintain compatibility with Optimism Superchain ecosystem while providing foundational token grants to support ApeCoin DAO's participation in Superchain governance, enhancing inter-protocol cooperation.

Market Valuation Context

According to market analysis, BLAST's estimated value range positions it between $3 billion and $10 billion based on pre-market trading data at approximately $0.03 USD per token. This valuation reflects modest discount positioning relative to more established Layer 2 projects: Arbitrum trades at $2.7 billion, Optimism at $2.0 billion, while BLAST demonstrates TVL comparable to or exceeding certain competing Layer 2 solutions despite lower market capitalization recognition.

III. BBLAST Price Forecast for 2026-2031

2026 Outlook

- Conservative Forecast: $0.00088 - $0.00102

- Base Case Forecast: $0.00102

- Optimistic Forecast: $0.0015 (requires sustained ecosystem development and increased adoption)

2027-2029 Mid-term Outlook

- Market Phase Expectation: Gradual accumulation phase with moderate recovery trajectory as project fundamentals strengthen and market sentiment improves

- Price Range Predictions:

- 2027: $0.00082 - $0.00151 (23% upside potential)

- 2028: $0.00111 - $0.00171 (35% upside potential)

- 2029: $0.00141 - $0.00206 (52% upside potential)

- Key Catalysts: Enhanced protocol functionality, expanded partnerships, growing user base, improved market liquidity, and positive sentiment cycles in the broader cryptocurrency market

2030-2031 Long-term Outlook

- Base Scenario: $0.0013 - $0.00227 (assumes steady ecosystem expansion and mainstream adoption progress)

- Optimistic Scenario: $0.00180 - $0.00245 (assumes accelerated platform utility growth and significant institutional interest)

- Transformative Scenario: $0.00227+ (requires breakthrough developments including major mainstream integration, exceptional technological advancement, or significant macroeconomic tailwinds favoring risk assets)

- January 2, 2026: BBLAST trading within consolidation range at $0.00088-$0.0015 (stabilization phase following market volatility)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.0015 | 0.00102 | 0.00088 | 0 |

| 2027 | 0.00151 | 0.00126 | 0.00082 | 23 |

| 2028 | 0.00171 | 0.00138 | 0.00111 | 35 |

| 2029 | 0.00206 | 0.00155 | 0.00141 | 52 |

| 2030 | 0.00227 | 0.0018 | 0.0013 | 77 |

| 2031 | 0.00245 | 0.00204 | 0.00173 | 100 |

Burger Blast Token (BBLAST) Investment Analysis Report

I. Executive Summary

Burger Blast Token (BBLAST) is a BEP-20 token built on the BNB Chain, serving as the native utility token for the Burger Blast Web3 gaming ecosystem. As of January 2, 2026, BBLAST is trading at $0.0010174, with a market capitalization of $150,422.59 and a fully diluted valuation of $1,017,400.

Key Metrics:

- Current Price: $0.0010174

- 24h Change: -5.12%

- Market Cap Rank: #4448

- Circulating Supply: 147,850,000 BBLAST (14.79% of total supply)

- Total Supply: 1,000,000,000 BBLAST

- 24h Trading Volume: $13,732.30

- All-Time High: $0.08 (December 11, 2025)

- All-Time Low: $0.00082 (December 24, 2025)

- Holders: 86,410

II. Project Overview and Fundamentals

Project Description

Burger Blast is a rapidly expanding multi-platform Web3 gaming ecosystem built on BNB Chain. Designed for mass adoption, the project operates seamlessly across its standalone Web App and Telegram Mini App, enabling users to access blockchain gaming anytime, anywhere. Supported by reputable global partners, Burger Blast focuses on scalable distribution, polished gameplay loops, and sustainable token utility.

Technical Foundation

Blockchain Network: BNB Chain (BSC)

Token Standard: BEP-20

Contract Address: 0x6e6d6e98621dc1e757d6c4538c0ebc4e0d370612

Network Explorer: https://bscscan.com/token/0x6e6d6e98621dc1e757d6c4538c0ebc4e0d370612

Platform Infrastructure

The project's multi-platform approach includes:

- Standalone Web Application: Full-featured gaming interface accessible through desktop browsers

- Telegram Mini App Integration: Seamless gaming experience within Telegram, enabling convenient access for a broader user base

III. Market Performance and Technical Analysis

Price Performance Metrics

| Time Period | Price Change | Change Amount |

|---|---|---|

| 1 Hour | +2.62% | +$0.000026 |

| 24 Hours | -5.12% | -$0.000055 |

| 7 Days | +2.83% | +$0.000028 |

| 30 Days | -94.75% | -$0.018362 |

| 1 Year | -94.75% | -$0.018362 |

Current Market Position

- Market Cap Dominance: 0.000031% of total cryptocurrency market

- Price Range (24h): $0.00089 - $0.001073

- Circulating/Total Supply Ratio: 14.79%

- Active Holders: 86,410

- Trading Venues: Listed on Gate.com

Recent Price Volatility

BBLAST has experienced significant volatility since launch. The token peaked at $0.08 on December 11, 2025, representing an 8,085% surge from the current price level. However, it subsequently declined 94.75% over the 30-day period, settling near its all-time low of $0.00082 reached on December 24, 2025. This extreme volatility indicates the speculative nature of early-stage gaming tokens and the market's ongoing price discovery phase.

IV. BBLAST Professional Investment Strategy and Risk Management

BBLAST Investment Methodology

(1) Long-Term Holding Strategy

Suitable Investors:

- Patient capital allocators with 2-3 year+ investment horizons

- Believers in Web3 gaming ecosystem expansion and token utility development

- Risk-tolerant investors who can withstand significant volatility

Operational Guidelines:

- Position Sizing: Allocate only capital you can afford to lose completely; consider this allocation separate from core portfolio holdings

- Entry Strategy: Consider dollar-cost averaging over multiple entry points during periods of extended consolidation rather than attempting to time the market bottom

- Holding Discipline: Maintain positions through volatility cycles while monitoring token utility development, gaming ecosystem growth, and adoption metrics

(2) Active Trading Strategy

Technical Analysis Considerations:

- Volatility Assessment: Given the extreme price swings observed (94.75% decline over 30 days), utilize wider stop-loss parameters and position sizing adjustments

- Support and Resistance Levels: Monitor historically significant price points ($0.00082 as recent support, $0.001073 as near-term resistance)

Wave Trading Key Points:

- Identify accumulation phases during market weakness

- Take profit targets during recovery rallies to manage risk exposure

- Maintain flexibility given the emerging nature of the gaming ecosystem

BBLAST Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of overall portfolio allocation

- Aggressive Investors: 1-3% of speculative capital allocation

- Professional Investors: 0.5-2% of diversified alternative asset holdings

These allocations should represent capital that investors can afford to lose entirely without materially impacting their financial objectives.

(2) Risk Mitigation Approaches

- Diversification Strategy: Balance BBLAST exposure with established cryptocurrencies and traditional assets to reduce idiosyncratic risk

- Position Management: Implement strict position sizing and systematic rebalancing to prevent overexposure during price surges

(3) Secure Storage Solutions

- Self-Custody Options: Store BBLAST in personal wallets where you control private keys; ensure secure backup of recovery phrases

- Exchange Custody: Maintain only actively traded portions on Gate.com, with the majority in personal custody

- Security Critical Considerations:

- Never share private keys or recovery phrases

- Verify contract addresses before transactions to avoid phishing scams

- Enable withdrawal whitelisting on exchange accounts

- Consider hardware cold storage for substantial holdings

- Regularly update security credentials

V. BBLAST Potential Risks and Challenges

Market Risks

- Extreme Volatility: BBLAST has demonstrated 94.75% depreciation over 30 days, indicating severe price instability and high liquidation risk for leveraged positions

- Low Trading Liquidity: With 24-hour volume of only $13,732.30, large trades may face significant slippage and execution challenges

- Market Cap Concentration: At $150,422.59 circulating market cap with only 86,410 holders, the token remains highly vulnerable to concentrated selling pressure and potential whale manipulation

Regulatory Risks

- Emerging Regulatory Landscape: Web3 gaming tokens face evolving regulatory scrutiny across different jurisdictions regarding gaming mechanics, token classification, and consumer protections

- Jurisdictional Uncertainty: Changes in gaming and cryptocurrency regulations could materially impact token utility and platform operations

Technical Risks

- Early-Stage Technology: The Web3 gaming ecosystem remains nascent, with unproven scalability and sustainability models for long-term operations

- Smart Contract Vulnerabilities: While BNB Chain provides established infrastructure, individual smart contract implementations carry potential security risks

- Adoption Execution Risk: Success depends on achieving meaningful user adoption across Web App and Telegram Mini App platforms, which remains uncertain

VI. Conclusion and Action Recommendations

BBLAST Investment Value Assessment

Burger Blast represents a high-risk, speculative opportunity within the emerging Web3 gaming sector. The project's multi-platform distribution strategy and integration with Telegram presents a potentially scalable user acquisition model. However, the token's extreme volatility, limited trading liquidity, and early-stage technical maturity present substantial risks. Current market conditions suggest significant price uncertainty as the project remains in early adoption phases. Investors should view this as a speculative position appropriate only for risk capital with a clear understanding that total loss remains a realistic outcome.

BBLAST Investment Recommendations

✅ Newcomers: Begin with minimal allocations (< 0.5% of portfolio) focusing on long-term ecosystem development potential; prioritize learning about gaming utility before increasing exposure

✅ Experienced Investors: Implement systematic position management with strict risk controls; consider tactical accumulation during periods of extended weakness while maintaining disciplined exit strategies

✅ Institutional Investors: Conduct thorough due diligence on gaming ecosystem adoption metrics, user retention data, and tokenomics sustainability before considering allocation; maintain strict position limits within alternative asset allocations

BBLAST Trading Participation Methods

- Gate.com Trading: Access BBLAST spot trading directly on Gate.com; utilize limit orders to manage entry and exit at predetermined price levels

- Web App Direct Participation: Engage with gaming ecosystem through Burger Blast's standalone Web App to evaluate actual token utility and user experience firsthand

- Telegram Mini App Integration: Access gaming mechanics and in-app token utility through Telegram, evaluating the platform's user engagement and retention potential

Risk Disclaimer: Cryptocurrency investment carries extreme risk of total capital loss. This report does not constitute investment advice. All investors must conduct independent research and consult professional financial advisors based on individual risk tolerance, financial objectives, and circumstances. Never invest capital you cannot afford to lose completely. The crypto market's volatility and emerging regulatory landscape create substantial uncertainties that could dramatically impact investment outcomes.

FAQ

What is BBLAST? What are its main functions and uses?

BBLAST is a cryptocurrency token designed for decentralized applications and blockchain ecosystem participation. It serves as a utility token enabling users to access platform services, governance voting, and transaction rewards. The token facilitates ecosystem growth through incentive mechanisms and decentralized finance integration.

What is the current price of BBLAST token? What are its all-time high and all-time low prices?

BBLAST's all-time high reached $0.5223, while its all-time low was $0.0006666. Current price fluctuates based on market conditions.

What is the BBLAST price prediction for 2024? How do professional analysts view it?

2024 BBLAST price predictions remain uncertain. Professional analysts hold cautious views as Blast's TVL declined significantly, dropping 30% from its June peak of $2.2 billion. Market sentiment has weakened, making future performance difficult to forecast.

What are the main factors affecting BBLAST price?

BBLAST price is influenced by market demand, trading volume, global economic conditions, policy changes, expert predictions, and investor sentiment. Network activity and ecosystem development also play key roles in price movements.

What are the risks of investing in BBLAST? What should I pay attention to?

BBLAST investment risks include unrestricted team fund usage potentially leading to high-risk strategies. Monitor team behavior and fund allocation closely. Ensure you understand all potential risks before investing.

What are the advantages and disadvantages of BBLAST compared to similar tokens?

BBLAST offers long-term incentive mechanisms but features extended lock-up periods with lower initial returns compared to competitors. Its unique reward structure prioritizes sustained participation over immediate gains, appealing to long-term holders while potentially deterring short-term traders.

What is the technical foundation and team background of BBLAST?

BBLAST is built on DeFi and Web3 technology, led by Blur's founder Pacman. The team comprises members from FAANG companies and prestigious universities including Yale, MIT, NTU, and Seoul University, bringing strong expertise in blockchain innovation.

From a long-term perspective, what are the development prospects of BBLAST?

BBLAST has strong long-term prospects as a Layer2 solution enhancing blockchain scalability. Growing market demand, substantial airdrop allocations, and robust community support position it well for continued growth in the blockchain ecosystem.

What is XAI: Understanding Explainable Artificial Intelligence and Its Impact on Modern Decision-Making Systems

What is XAI: Exploring the Evolution and Impact of Explainable Artificial Intelligence

What is SLIMEX ($SLX)? An in-depth exploration of the game-driven L2 network.

What is B3: The Essential Vitamin for Optimal Health and Metabolism

WEMIX vs IMX: A Comparative Analysis of Two Leading Blockchain Gaming Platforms

2025 IMX Price Prediction: Bullish Outlook as Layer 2 Adoption Accelerates

What is spot trading?

BTC Dominance at 59%: The $2 Trillion Rotation That Could Ignite Alt Season

Top Ethereum ETFs to Consider

Bearish candlestick patterns

Bitcoin Lifestyle