2025 BRETTPrice Prediction: Analyzing Future Market Trends, Challenges, and Growth Potential

Introduction: BRETT's Market Position and Investment Value

BRETT (BRETT), as a legendary character inspired by Matt Furie's Boy's club comic, has become the blue mascot of the BASE blockchain since its inception. As of 2025, BRETT's market capitalization has reached $535,032,320, with a circulating supply of approximately 9,909,841,090 tokens, and a price hovering around $0.05399. This asset, known as "the blue mascot of the blue chain," is playing an increasingly crucial role in the BASE ecosystem.

This article will comprehensively analyze BRETT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

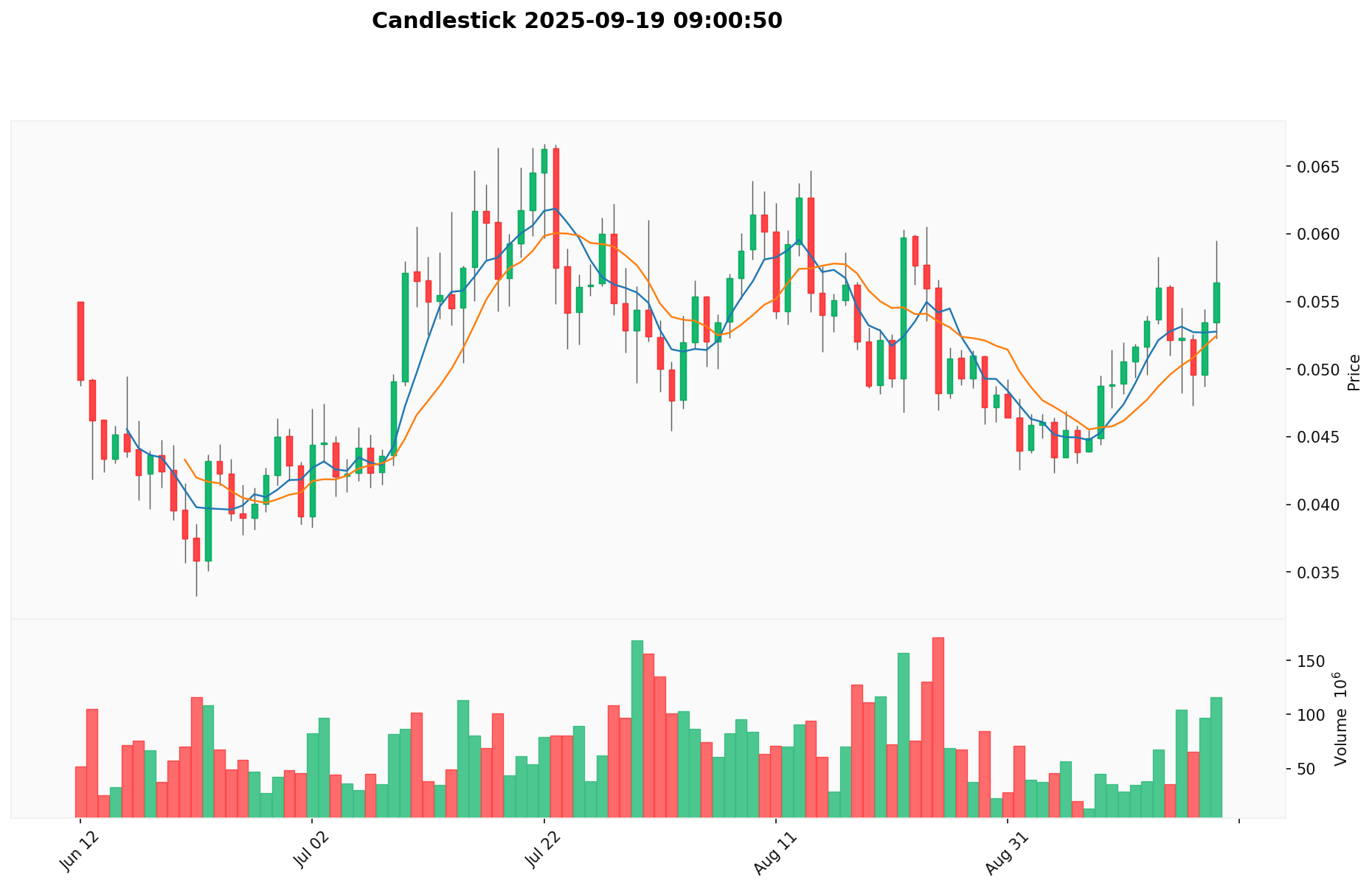

I. BRETT Price History Review and Current Market Status

BRETT Historical Price Evolution

- 2024: BRETT reached its all-time high of $0.23603 on December 1, marking a significant milestone in its price history.

- 2024: The token experienced its all-time low of $0.0185 on March 25, demonstrating high volatility in the market.

- 2025: BRETT has shown recovery, with the current price at $0.05399, representing a 191.84% increase from its all-time low.

BRETT Current Market Situation

As of September 19, 2025, BRETT is trading at $0.05399, with a market capitalization of $535,032,320. The token has experienced a 4.57% decrease in the last 24 hours, indicating short-term bearish sentiment. However, BRETT has shown positive growth over longer periods, with a 5.16% increase in the past week and an 8.7% rise over the last 30 days. The trading volume in the past 24 hours stands at $4,701,678, reflecting moderate market activity. With a circulating supply of 9,909,841,090 BRETT tokens, representing 99.09% of the total supply, the token maintains a high level of liquidity in the market.

Click to view the current BRETT market price

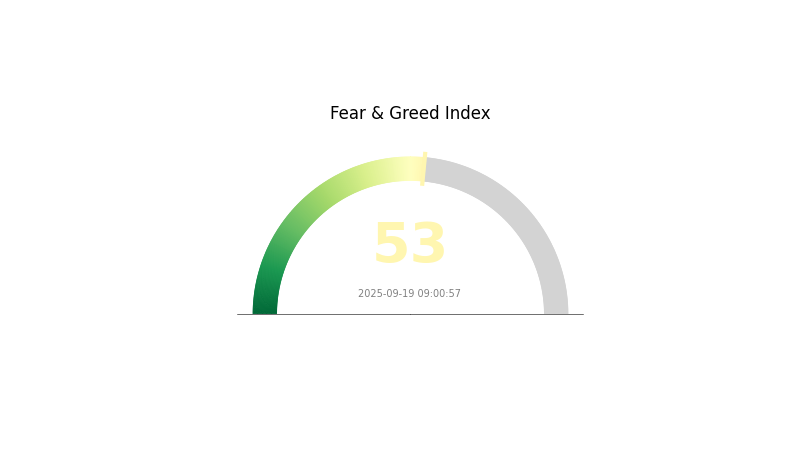

BRETT Market Sentiment Indicator

2025-09-19 Fear and Greed Index: 53 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 53, indicating a neutral stance. This suggests investors are neither overly fearful nor excessively greedy. Such equilibrium often presents opportunities for strategic trading. However, it's crucial to remain vigilant, as market sentiment can shift rapidly. Traders should continue to monitor key indicators and market trends while maintaining a disciplined approach to risk management. As always, diversification and thorough research are essential in navigating the dynamic crypto landscape.

BRETT Holdings Distribution

The address holdings distribution data for BRETT reveals an interesting pattern in its token concentration. Currently, there are no addresses holding significant percentages of the total supply, indicating a highly dispersed token distribution. This suggests that BRETT has achieved a relatively decentralized state, with no single entity or small group of addresses controlling a large portion of the tokens.

The absence of dominant holders is generally considered a positive sign for market stability. It reduces the risk of large-scale market manipulation and sudden price fluctuations caused by the actions of a few major token holders. This distribution pattern also implies that BRETT may have a more diverse and engaged community of users and investors, potentially contributing to a more robust and resilient ecosystem.

However, it's important to note that while a dispersed distribution can indicate a healthy market structure, it may also result in slower decision-making processes for any on-chain governance mechanisms. Overall, the current address distribution of BRETT reflects a market with a high degree of decentralization and potentially lower volatility risks associated with large holder movements.

Click to view the current BRETT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing BRETT's Future Price

Supply Mechanism

- Token Distribution: BRETT tokens were launched with a fair distribution model, without any pre-allocation to team members or insiders.

- Current Impact: The transparent and immutable smart contract ensures no changes can be made after deployment, potentially creating a sense of trust among investors.

Institutional and Whale Dynamics

- Enterprise Adoption: Some companies have started adopting BRETT, which could influence its price trajectory.

- Government Policies: Regulatory changes may impact BRETT's future performance.

Macroeconomic Environment

- Monetary Policy Impact: Global liquidity increases as central banks inject cheap capital into their economies, which historically correlates with significant price increases in cryptocurrencies.

- Geopolitical Factors: Real-world events, such as regulations and government adoption, can affect BRETT's price.

Technical Development and Ecosystem Building

- Blockchain Platform: BRETT operates on the Base platform, which may influence its technical capabilities and market positioning.

- Ecosystem Applications: The project focuses heavily on community involvement, which could drive ecosystem growth and adoption.

III. BRETT Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.05196 - $0.05412

- Neutral forecast: $0.05412 - $0.0671

- Optimistic forecast: $0.0671 - $0.0801 (requires positive market sentiment and increased adoption)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range predictions:

- 2026: $0.04899 - $0.07986

- 2027: $0.06246 - $0.07716

- Key catalysts: Expanding use cases, technological advancements, and broader market recovery

2030 Long-term Outlook

- Base scenario: $0.08701 - $0.09458 (assuming steady market growth and adoption)

- Optimistic scenario: $0.09458 - $0.10214 (assuming strong market performance and increased utility)

- Transformative scenario: $0.10214 - $0.11000 (assuming breakthrough developments and mainstream acceptance)

- 2030-12-31: BRETT $0.10214 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0801 | 0.05412 | 0.05196 | 0 |

| 2026 | 0.07986 | 0.06711 | 0.04899 | 24 |

| 2027 | 0.07716 | 0.07348 | 0.06246 | 36 |

| 2028 | 0.10922 | 0.07532 | 0.05047 | 39 |

| 2029 | 0.09688 | 0.09227 | 0.04982 | 70 |

| 2030 | 0.10214 | 0.09458 | 0.08701 | 75 |

IV. Professional Investment Strategies and Risk Management for BRETT

BRETT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate BRETT tokens during market dips

- Set a target holding period of 3-5 years

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend confirmation

- Relative Strength Index (RSI): Use for overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

BRETT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Dollar-Cost Averaging: Regularly invest small amounts to reduce timing risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BRETT

BRETT Market Risks

- High volatility: BRETT price may experience significant fluctuations

- Market sentiment: Meme coin status may lead to unpredictable price movements

- Competition: Other meme coins may impact BRETT's market share

BRETT Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of meme coins

- Compliance challenges: Possible restrictions on trading or holding BRETT

- Taxation issues: Evolving tax regulations for crypto assets

BRETT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Network congestion: High traffic on the Base network could impact transactions

- Wallet compatibility: Ensuring broad support across various wallet platforms

VI. Conclusion and Action Recommendations

BRETT Investment Value Assessment

BRETT presents a high-risk, high-reward opportunity within the meme coin sector. While it has shown significant growth potential, investors should be aware of its speculative nature and the inherent volatility in the market.

BRETT Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio, focus on education ✅ Experienced investors: Consider BRETT as part of a diversified crypto strategy ✅ Institutional investors: Approach with caution, conduct thorough due diligence

BRETT Trading Participation Methods

- Spot trading: Purchase BRETT tokens on Gate.com

- Limit orders: Set specific buy and sell prices to manage entry and exit points

- Staking: Explore potential staking opportunities if offered by the project

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will Brett coin go?

Based on market analysis, Brett coin could reach a high of $0.0722 in 2025, representing a potential 110% increase from current levels.

What is the price prediction for Brett in 2040?

By 2040, Brett is predicted to reach a maximum of $1.43 and a minimum of $0.04513, based on current market trends.

Which Brett coin is best?

Layer Brett is currently considered the best Brett coin, showing strong potential for significant returns based on technical analysis.

What are the risks of investing in Brett coin?

Investing in Brett coin involves high volatility, speculative price swings, and potential market manipulation. Risks include significant financial losses due to its lack of substantial backing.

why is crypto crashing and will it recover ?

2025 DADDYPrice Prediction: Bullish Forecast and Key Growth Factors for this Emerging Token

2025 PAIN Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 HOUSE Price Prediction: Navigating the Real Estate Landscape in a Post-Pandemic World

2025 PATRIOT Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

How Does MOG Token's Liquidity and Holding Concentration Affect Its Price Volatility?

Bearish candlestick patterns

Bitcoin Lifestyle

Is Trading with Leverage Haram?

Crypto Ice Mining

ETF vs Index Fund: Key Differences and How to Choose in 2026