2025 CAKE Price Prediction: Bullish Trends and Key Factors Driving PancakeSwap's Token Value

Introduction: CAKE's Market Position and Investment Value

PancakeSwap (CAKE), as a leading decentralized exchange on the BNB Smart Chain, has achieved significant milestones since its inception in 2020. As of 2025, PancakeSwap's market capitalization has reached $1.06 billion, with a circulating supply of approximately 343 million tokens, and a price hovering around $3.10. This asset, often hailed as the "AMM pioneer on BNB Chain," is playing an increasingly crucial role in decentralized finance (DeFi) and yield farming.

This article will comprehensively analyze CAKE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. CAKE Price History Review and Current Market Status

CAKE Historical Price Evolution

- 2020: CAKE launched at $0.4, reaching an all-time low of $0.194441 on November 3rd

- 2021: Bull market peak, CAKE hit all-time high of $43.96 on April 30th

- 2022-2024: Crypto winter and recovery, price fluctuated between $1.5 and $5

CAKE Current Market Situation

As of October 16, 2025, CAKE is trading at $3.1006, down 10.26% in the last 24 hours. The current price represents a 92.95% decrease from its all-time high of $43.96. CAKE's market capitalization stands at $1,063,593,274, ranking 95th in the global cryptocurrency market.

The 24-hour trading volume is $32,917,160, indicating moderate market activity. CAKE's circulating supply is 343,028,212 tokens, with a total supply of 368,728,648 and no maximum supply limit.

Short-term price trends show mixed signals: while CAKE is up 0.3% in the last hour, it has experienced significant losses of 22.47% over the past week. However, the 30-day and 1-year trends are positive, with gains of 26.59% and 65.83% respectively, suggesting potential long-term recovery.

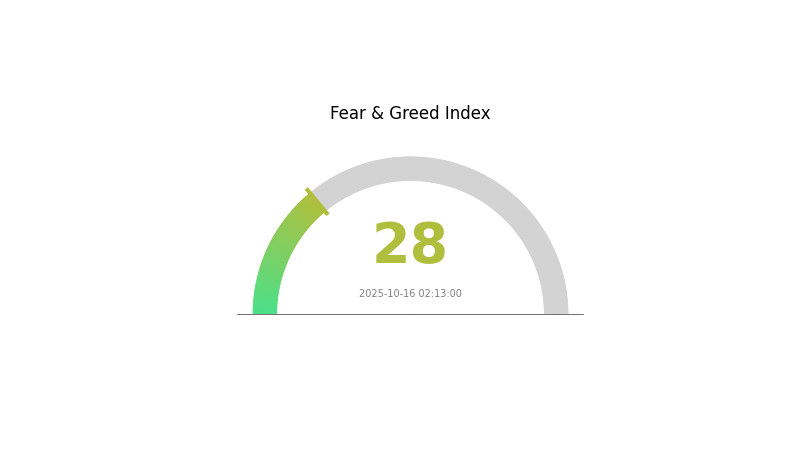

The current market sentiment for cryptocurrencies is cautious, with the Fear and Greed Index at 28, indicating "Fear" in the market.

Click to view the current CAKE market price

CAKE Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a fearful sentiment, with the Fear and Greed Index standing at 28. This indicates a cautious atmosphere among investors. During such periods, some traders may see potential buying opportunities, while others might adopt a wait-and-see approach. It's crucial to conduct thorough research and exercise prudence in your investment decisions. Remember, market sentiments can shift rapidly, so staying informed is key to navigating the volatile crypto landscape.

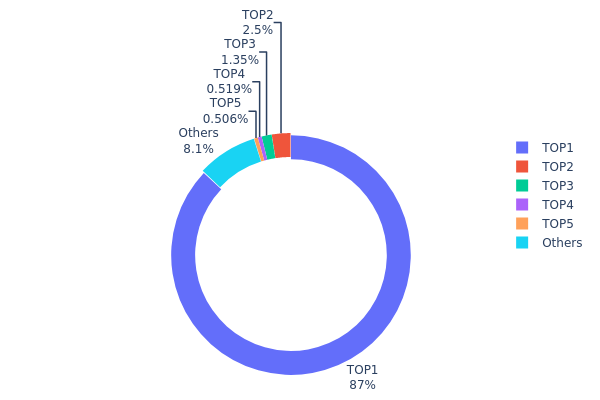

CAKE Holdings Distribution

The address holdings distribution data for CAKE reveals a highly concentrated ownership structure. The top address, likely a burn or dead address, holds an overwhelming 87.03% of the total supply, effectively removing these tokens from circulation. The next four largest holders collectively account for only 4.85% of the supply, with the second-largest holder possessing 2.49%.

This distribution pattern indicates a significant level of centralization in CAKE ownership. While the large burn address suggests a deflationary mechanism, the concentration among the top holders could potentially impact market dynamics. The limited number of major stakeholders may lead to increased volatility and susceptibility to price manipulation, as large movements from these addresses could disproportionately affect the market.

Despite the high concentration at the top, it's noteworthy that 8.12% of the supply is distributed among other addresses. This suggests a degree of wider participation in the CAKE ecosystem, albeit limited. The current distribution reflects a project with strong deflationary characteristics but potential challenges in achieving broad decentralization and market stability.

Click to view the current CAKE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 2441357.37K | 87.03% |

| 2 | 0xf977...41acec | 70000.00K | 2.49% |

| 3 | 0x8894...e2d4e3 | 37879.74K | 1.35% |

| 4 | 0x86ac...09df5c | 14559.35K | 0.51% |

| 5 | 0x45c5...7f859e | 14195.97K | 0.50% |

| - | Others | 227182.81K | 8.12% |

II. Key Factors Influencing CAKE's Future Price

Supply Mechanism

- Token Burning: CAKE implements an aggressive token burning strategy to increase scarcity. In March 2025, a single burning event destroyed 9.59 million CAKE tokens.

- Historical Pattern: Token burning has historically increased CAKE's scarcity, potentially supporting price growth.

- Current Impact: The large-scale token burning in 2025 is expected to significantly increase CAKE's scarcity, which may positively influence its price.

Institutional and Whale Dynamics

- Institutional Holdings: Major exchanges like Gate.com provide liquidity for CAKE, which can stabilize its price.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, CAKE may be viewed as a potential hedge against inflation, which could affect its demand and price.

Technical Development and Ecosystem Building

- Multi-chain Expansion: CAKE's ongoing multi-chain expansion supports gradual price growth.

- Layer-2 Integration: Potential Layer-2 integration by 2030 could contribute to price stability around an average of $7.80, with higher extensions reaching $9.20.

- Ecosystem Applications: Increased staking volume and governance demand may benefit CAKE's price by 2030.

III. CAKE Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $1.65 - $2.50

- Neutral estimate: $2.50 - $3.50

- Optimistic estimate: $3.50 - $4.17 (requires sustained DeFi growth and increased PancakeSwap adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market cycle

- Price range forecast:

- 2027: $3.22 - $5.70

- 2028: $3.76 - $5.11

- Key catalysts: DeFi ecosystem expansion, increased institutional interest in crypto

2030 Long-term Outlook

- Base scenario: $4.00 - $6.00 (assuming steady crypto market growth)

- Optimistic scenario: $6.00 - $7.36 (with widespread DeFi adoption and favorable regulatory environment)

- Transformative scenario: $7.36+ (with groundbreaking technological advancements in PancakeSwap)

- 2030-12-31: CAKE $6.03 (potential year-end average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.17477 | 3.1155 | 1.65122 | 0 |

| 2026 | 4.22836 | 3.64514 | 3.02546 | 17 |

| 2027 | 5.70828 | 3.93675 | 3.22813 | 26 |

| 2028 | 5.11186 | 4.82251 | 3.76156 | 55 |

| 2029 | 7.10308 | 4.96719 | 4.47047 | 59 |

| 2030 | 7.36286 | 6.03513 | 3.98319 | 94 |

IV. CAKE Professional Investment Strategies and Risk Management

CAKE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and DeFi enthusiasts

- Operation suggestions:

- Accumulate CAKE during market dips

- Participate in PancakeSwap's staking and farming programs

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor PancakeSwap's product updates and community growth

CAKE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- web3 wallet recommendation: Gate Web3 Wallet

- Hardware wallet solution: Store long-term holdings offline

- Security precautions: Use strong passwords, enable two-factor authentication, and regularly update software

V. CAKE Potential Risks and Challenges

CAKE Market Risks

- High volatility: CAKE price can experience significant fluctuations

- Competition: Increasing number of DEXs on various blockchains

- Market sentiment: Susceptible to overall crypto market trends

CAKE Regulatory Risks

- DeFi regulations: Potential for increased scrutiny of decentralized exchanges

- Token classification: Risk of CAKE being classified as a security

- Cross-border restrictions: Possible limitations on accessing PancakeSwap in certain jurisdictions

CAKE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Blockchain congestion: High gas fees or network slowdowns on BSC

- Technological obsolescence: Risk of newer, more efficient DEX technologies emerging

VI. Conclusion and Action Recommendations

CAKE Investment Value Assessment

CAKE presents a unique investment opportunity in the DeFi space, with strong potential for long-term growth. However, investors should be aware of short-term volatility and regulatory uncertainties.

CAKE Investment Recommendations

✅ Beginners: Start with small positions and focus on learning PancakeSwap's features ✅ Experienced investors: Consider a balanced approach of holding and active participation in PancakeSwap's ecosystem ✅ Institutional investors: Explore strategic partnerships and larger-scale liquidity provision

CAKE Trading Participation Methods

- Spot trading: Buy and hold CAKE on reputable exchanges like Gate.com

- Yield farming: Participate in PancakeSwap's liquidity pools and farming programs

- Governance: Engage in protocol decision-making by staking CAKE

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does CAKE crypto have a future?

Yes, CAKE crypto has a promising future. It's predicted to reach $5.16 by November 2025, showing significant growth potential in the coming years.

What is the price prediction for CAKE coin in 2040?

Based on long-term projections, CAKE's price could reach $150-$300 by 2040, assuming continued growth in the crypto market and PancakeSwap's ecosystem.

How high can PancakeSwap go?

PancakeSwap's price is projected to reach $9.30 in 2025, with potential to hit $10 in the long term. However, regulatory risks may impact its growth trajectory.

Is CAKE a good coin?

CAKE has shown strong performance and growth potential. As of 2025, it remains a notable investment option in the crypto market.

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

SWELL vs RUNE: Comparing Two Leading DeFi Protocols in the Cross-Chain Liquidity Race

2025 ALCX Price Prediction: Future Outlook and Market Analysis for Alchemix Token

2025 CVX Price Prediction: Bullish Outlook as DeFi Adoption Accelerates

SPO vs SNX: Comparing Two Leading DeFi Protocols for Yield Farming and Staking

How Does AVAX Token Flow Affect Its Market Cap in 2025?

Why Do We Celebrate Bitcoin Pizza Day?

How to Buy Bitcoin ETFs: A Comprehensive Guide for 2026

What is spot trading?

BTC Dominance at 59%: The $2 Trillion Rotation That Could Ignite Alt Season

Top Ethereum ETFs to Consider