2025 CEUR Price Prediction: Expert Analysis and Market Forecast for the European Central Bank Digital Currency

Introduction: Market Position and Investment Value of CEUR

CEUR (Celo Euro) is a stablecoin designed to track the Euro currency, operating within the Celo ecosystem as an open platform that enables people with mobile phones to access financial instruments. Since its launch in June 2021, CEUR has established itself as a critical infrastructure asset in the decentralized finance space. As of December 23, 2025, CEUR maintains a market capitalization of approximately $12.88 million with a circulating supply of about 6.04 million tokens, trading at $1.1704. The Celo network utilizes reserve mechanisms to ensure that CEUR's price accurately tracks the base Euro currency, making it an essential tool for price-stable value transfers and cross-border transactions.

This article will provide a comprehensive analysis of CEUR's price trajectory and market dynamics through 2030, integrating historical price patterns, market supply and demand fundamentals, ecosystem development, and macroeconomic factors. By examining these elements systematically, we aim to deliver professional price forecasting and practical investment strategies for market participants seeking to understand CEUR's positioning within the broader digital asset landscape.

CEUR Market Analysis Report

I. CEUR Price History Review and Current Market Status

CEUR Historical Price Movement Trajectory

- 2022: CEUR reached its all-time high of $19.98 on November 1st, 2022, reflecting significant market enthusiasm during that period.

- 2024: CEUR experienced a substantial decline, reaching its all-time low of $0.236339 on January 9th, 2024, marking a critical low point in the asset's trading history.

- 2025: CEUR has demonstrated recovery momentum, appreciating by 12.98% over the past year and currently trading near its stabilized price levels.

CEUR Current Market Status

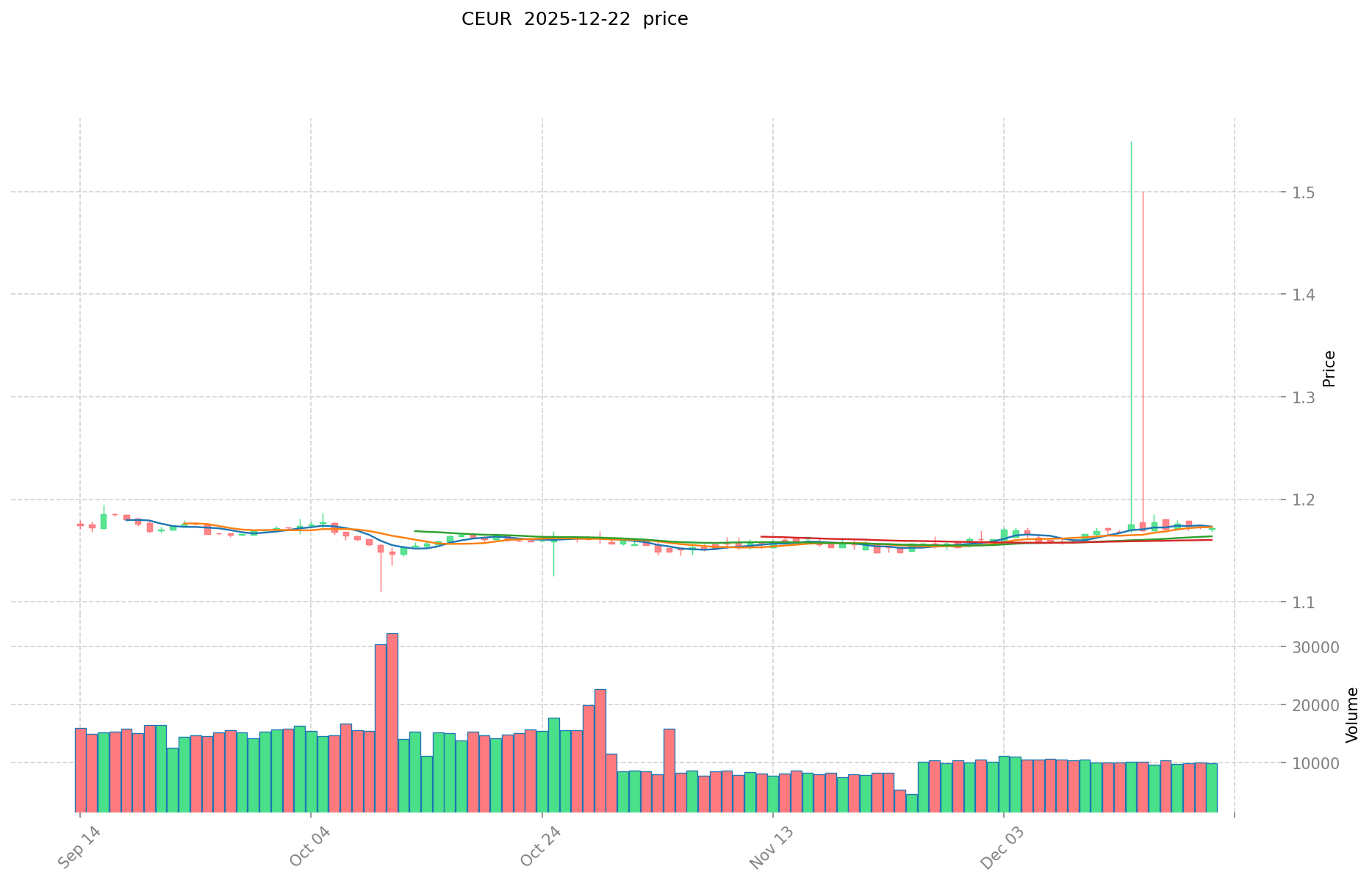

As of December 23, 2025, CEUR is trading at $1.1704, with a 24-hour trading volume of $11,831.44. The token exhibits minor price volatility in the short term, with a marginal decline of 0.11% over the past 24 hours. Over a one-week period, CEUR has declined by 0.61%, while monthly performance shows a modest gain of 1.91%.

The circulating supply stands at 6,040,806.93 CEUR tokens out of a total supply of 11,005,846 tokens, with a circulating ratio of 53.57%. The current market capitalization is $7,070,160.43, and the fully diluted valuation reaches $12,881,242.16. CEUR maintains a market dominance of 0.00039%, ranking 1,348 globally by market capitalization.

The asset is actively trading with 23,843 token holders and maintains a one-hour price change of +0.04%, indicating relative price stability in intraday trading. The 52-week performance demonstrates a year-to-date appreciation of 12.98%.

View the current CEUR market price on Gate.com

CEUR Market Sentiment Indicator

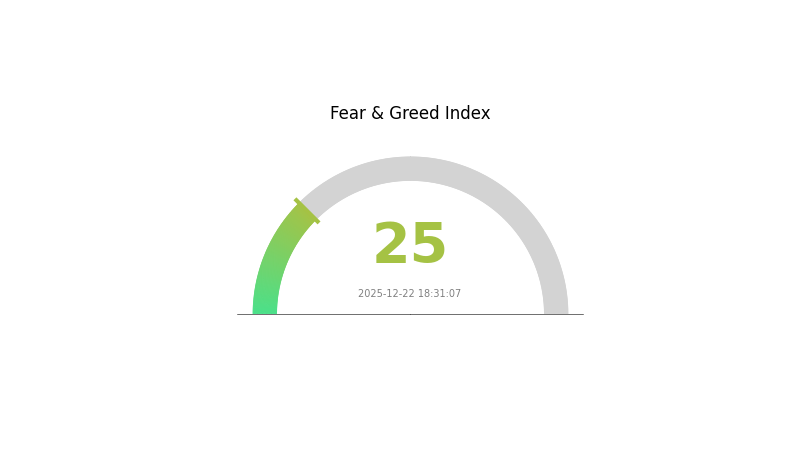

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently in a state of extreme fear, with the Fear and Greed Index reading 25. This indicates significant market pessimism and investor anxiety. During periods of extreme fear, markets often experience sharp declines as sellers dominate. However, historically, such extreme readings have presented opportunities for contrarian investors. It is crucial to maintain a balanced perspective, conduct thorough research, and avoid making emotional trading decisions. Consider your risk tolerance and investment strategy carefully before taking any market action during such volatile periods.

CEUR Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, revealing the degree of capital centralization and the potential influence of major stakeholders on token liquidity and price dynamics. By analyzing the top holders and their proportional ownership, we can assess the decentralization level and market structure stability of CEUR.

The current holdings distribution of CEUR demonstrates moderate concentration characteristics. The top five addresses collectively control approximately 60.7% of total supply, with the largest holder commanding 20.75% of all tokens. Notably, the top three addresses account for 49.64% of circulating supply, indicating a significant concentration among these major stakeholders. However, the dispersed holdings among other addresses, which represent 39.3% of the total supply, suggest a relatively healthy distribution pattern that mitigates extreme centralization risks.

From a market structure perspective, this distribution pattern presents both opportunities and considerations. The concentration among top holders could potentially facilitate organized decision-making and market coordination; however, the substantial portion held by dispersed addresses provides a counterbalancing force. The moderate concentration level suggests that CEUR maintains reasonable decentralization compared to more top-heavy token distributions, reducing the risk of sudden price manipulation through coordinated large-scale liquidations. This distribution reflects a market structure where institutional or strategic holders maintain meaningful influence, while retail participation remains sufficiently distributed to support organic price discovery and market resilience.

Click to view current CEUR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0708...E36e21 | 652.48K | 20.75% |

| 2 | 0xDE55...7aDa64 | 500.50K | 15.92% |

| 3 | 0xD876...D6cA73 | 407.93K | 12.97% |

| 4 | 0xE273...C07568 | 186.37K | 5.92% |

| 5 | 0x0b65...07D3b3 | 161.57K | 5.14% |

| - | Others | 1234.37K | 39.3% |

II. Core Factors Influencing CEUR's Future Price

Macroeconomic Environment

-

Commodity Price Volatility: Gold and silver prices are subject to significant fluctuations influenced by multiple factors. Supply-side factors remain relatively stable, with demand-side dynamics serving as the primary price driver. Key demand factors include risk-aversion sentiment driving gold purchases and central banks' continued accumulation of gold reserves globally.

-

Currency Fluctuation Risk: Exchange rate movements represent a critical factor affecting precious metals pricing, as these commodities are typically denominated in U.S. dollars in international markets.

-

Geopolitical Risk: International tensions and geopolitical instability can drive increased demand for precious metals as safe-haven assets, thereby supporting prices during periods of uncertainty.

Operational Factors

-

Operational Risk: Mining operations face inherent technical, safety, and environmental risks that can impact production levels and operational costs.

-

Rising Operating Costs Risk: Increased operational expenses present a downside risk to profitability and may compress margins in the mining sector.

-

Environmental Regulation Risk: Stricter environmental monitoring and regulatory requirements may impact mining operations and increase compliance costs.

III. 2025-2030 CEUR Price Forecast

2025 Outlook

- Conservative Forecast: $0.80 - $1.17

- Neutral Forecast: $1.17 - $1.63

- Optimistic Forecast: $1.63+ (requires sustained adoption and positive regulatory developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual appreciation as institutional interest increases and market infrastructure matures

- Price Range Predictions:

- 2026: $1.01 - $1.90 (19% potential upside)

- 2027: $0.84 - $1.73 (40% potential upside)

- 2028: $1.11 - $1.79 (44% potential upside)

- Key Catalysts: Enhanced regulatory clarity, expanded integration with traditional finance, increased adoption across payment platforms, and strategic partnerships

2029-2030 Long-term Outlook

- Base Case Scenario: $1.53 - $2.55 (48% potential upside by 2029), reflecting steady ecosystem growth and moderate market expansion

- Optimistic Scenario: $2.15 - $3.17 (83% potential upside by 2030), contingent on mainstream adoption acceleration and substantial institutional inflows

- Transformational Scenario: $3.17+ (by 2030), dependent on breakthrough regulatory frameworks, widespread CEUR integration in global payment systems, and major financial institution endorsements

- 2030-12-31: CEUR targets $2.14 average valuation (base case scenario achievement)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.62866 | 1.1717 | 0.79676 | 0 |

| 2026 | 1.89025 | 1.40018 | 1.00813 | 19 |

| 2027 | 1.72747 | 1.64521 | 0.83906 | 40 |

| 2028 | 1.78752 | 1.68634 | 1.11299 | 44 |

| 2029 | 2.55329 | 1.73693 | 1.5285 | 48 |

| 2030 | 3.17477 | 2.14511 | 1.32997 | 83 |

CEUR Investment Strategy and Risk Management Report

IV. CEUR Professional Investment Strategy and Risk Management

CEUR Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Conservative investors and stablecoin users seeking Euro exposure through blockchain technology

- Operational Recommendations:

- Maintain consistent positions in CEUR for long-term Euro-denominated asset allocation

- Utilize CEUR for cross-border payments and settlements with minimal volatility concerns

- Monitor reserve backing mechanisms to ensure price stability tracking the Euro

(2) Active Trading Strategy

- Market Context: CEUR trading volume stands at approximately $11,831 USD in the 24-hour period, with limited liquidity depth

- Trading Considerations:

- Execute trades during periods of higher volume to minimize slippage

- Monitor 24-hour price movements (-0.11%) to identify short-term trading opportunities

- Pay attention to reserve ratio maintenance as a fundamental stability indicator

CEUR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 3-5% of stablecoin portfolio allocation

- Active Investors: 5-10% of diversified cryptocurrency holdings

- Professional Investors: Custom allocation based on Euro exposure requirements

(2) Risk Hedging Strategies

- Multi-stablecoin diversification: Balance CEUR holdings with other major stablecoins to reduce single-asset risk

- Reserve monitoring: Track Celo network reserve ratios to ensure adequate backing of CEUR supply

(3) Secure Storage Solutions

- Custody options: Store CEUR on Gate.com for active trading with built-in security protocols

- Self-custody approach: Use blockchain-native wallets on the Celo network for long-term holdings

- Security Precautions: Enable two-factor authentication, maintain secure private key management, and verify smart contract addresses before transfers

V. CEUR Potential Risks and Challenges

CEUR Market Risks

- Limited Liquidity: Daily trading volume of approximately $11,831 USD indicates concentrated liquidity, potentially creating challenges for large transactions

- Price Volatility: Despite stablecoin design, CEUR has experienced historical price fluctuations ranging from $0.236339 to $19.98, indicating potential depegging events

- Low Market Adoption: Market capitalization of $12.88 million and dominance of 0.00039% suggest limited ecosystem integration compared to major stablecoins

CEUR Regulatory Risks

- Stablecoin Regulation: Evolving global regulatory frameworks for stablecoins may impact CEUR's operational framework and reserve requirements

- Reserve Requirements: Changes in regulatory expectations around reserve backing could necessitate structural adjustments to the Celo protocol

- Cross-border Compliance: Operating across multiple jurisdictions introduces compliance complexity, particularly regarding Euro-denominated digital asset regulations

CEUR Technical Risks

- Smart Contract Risk: Smart contract vulnerabilities or exploits affecting the CEUR contract (0xD8763CBa276a3738E6DE85b4b3bF5FDed6D6cA73 on Celo network) could compromise functionality

- Network Risk: Dependence on Celo network stability; network disruptions could affect CEUR accessibility and price stability

- Depegging Risk: Failure of reserve mechanisms or rapid market conditions could cause CEUR to deviate significantly from Euro parity

VI. Conclusion and Action Recommendations

CEUR Investment Value Assessment

CEUR represents a niche positioning within the stablecoin ecosystem, providing Euro exposure through a blockchain-based mechanism. The project demonstrates technical viability through the Celo network infrastructure but faces significant challenges in market adoption and liquidity depth. With current market capitalization of $12.88 million and limited daily trading volume, CEUR is primarily suited for specialized use cases rather than mainstream financial applications. The historical price volatility, despite stablecoin design, underscores the importance of reserve monitoring and regulatory compliance as critical success factors.

CEUR Investment Recommendations

✅ Beginners: Start with small allocations (under 2% of portfolio) through Gate.com, focusing on understanding the Celo ecosystem and reserve mechanisms before increasing exposure.

✅ Experienced Investors: Consider CEUR as a specialized Euro-exposure vehicle for international transactions or hedging purposes; implement strict position sizing and reserve monitoring protocols.

✅ Institutional Investors: Evaluate CEUR adoption within broader Euro liquidity management strategies; conduct comprehensive due diligence on Celo network security and regulatory compliance.

CEUR Trading and Participation Methods

- Gate.com Spot Trading: Direct CEUR purchases and sales with integrated wallet functionality for immediate settlement

- Blockchain Transactions: Direct peer-to-peer transfers using the Celo network for cross-border payments and settlements

- Portfolio Integration: Use CEUR within decentralized applications on the Celo network for enhanced financial utility

Cryptocurrency investment carries extreme risk and potential for substantial financial loss. This report does not constitute investment advice. Investors should carefully evaluate their risk tolerance and financial situation before participating. Consult qualified financial advisors for personalized guidance. Never invest more capital than you can afford to lose completely.

FAQ

Which coin price prediction 2025?

Bitcoin and Ethereum are expected to reach new highs in 2025, driven by increased institutional adoption and tokenized real-world assets growth. Altcoins linked to DeFi and Web3 infrastructure may see significant appreciation as the market matures and regulatory clarity improves.

What factors influence CEUR price movements?

CEUR price movements are influenced by supply mechanisms, scarcity levels, institutional investment activity, market demand, and broader cryptocurrency market trends. Trading volume and Celo ecosystem developments also impact price dynamics.

Is CEUR a good investment for 2024-2025?

CEUR demonstrated strong financial performance in 2025 H1 with revenue exceeding $840.8 million and net income margin around 14.7%, indicating solid fundamentals. The project shows promising growth potential for the period, though market conditions remain dynamic.

How does CEUR price compare to other stablecoins?

CEUR maintains a $1.16 peg but has lower adoption and liquidity compared to major stablecoins like USDT and USDC. It targets the Euro market with niche positioning.

RAI vs XLM: Comparing Stablecoin Solutions for Cross-Border Payments

Is World Liberty Financial USD (USD1) a good investment?: Evaluating the Risks and Potential Returns of This Controversial Stablecoin

Dai Price Analysis 2025: Trends and Outlook for the Stablecoin Market

USDe Price Prediction: 2025 Ethena Stablecoin Market Analysis and Investment Strategy

What HBAR Is (and Why It Exists)

USD1 stablecoin on Gate: Analysis and Investment Opportunities for WLFI Token

Is Polkadot Legit? A Look at Whether DOT Is Real or a Scam

HBAR Price Analysis: Hedera's Mainnet Upgrade and Enterprise Partnerships Fuel Market Momentum

What Is Analog (ANLOG) Protocol and How to Claim ANLOG Airdrop?

What is Stop Loss Hunting? How to Avoid Whale Liquidity Traps

Snoop Dogg and Bored Ape Yacht Club Launch Animated Avatars on Telegram via TON