2025 FOREX Price Prediction: Expert Analysis and Market Outlook for Major Currency Pairs

Introduction: Market Position and Investment Value of FOREX

Handle.fi (FOREX) serves as a decentralized multi-currency stable coin protocol that enables users to create and exchange multiple fiat-pegged tokens across various alternative currencies. Since its inception, Handle.fi has established itself as a key player in the DeFi foreign exchange ecosystem. As of January 2026, FOREX has a market capitalization of approximately $53,935 with a circulating supply of 114,172,402 tokens, currently trading at $0.0004724 per token. This innovative protocol, which facilitates the minting of fxTokens (such as fxAUD, fxCNY, and fxKRW) backed by collateral deposits, is playing an increasingly vital role in enabling decentralized cross-currency transactions and multi-currency stability within the DeFi landscape.

This article will provide a comprehensive analysis of FOREX's price movements and market trends as of January 5, 2026, integrating historical performance patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to this decentralized FX protocol.

Handle.fi (FOREX) Market Analysis Report

I. FOREX Price History Review and Current Market Status

FOREX Historical Price Evolution

-

December 2021: FOREX reached its all-time high of $0.985949, marking the peak of the project's initial market cycle.

-

December 2025: FOREX touched its all-time low of $0.0001178, representing a significant downturn from historical peaks.

FOREX Current Market Situation

As of January 5, 2026, FOREX is trading at $0.0004724, with a 24-hour trading volume of 12,048.63 units. The token has experienced a -4.55% decline over the past 24 hours, retreating from the 24-hour high of $0.0004939 to the low of $0.0004537.

Over longer timeframes, FOREX demonstrates positive momentum: the 7-day period shows a +73.69% gain, the 30-day period exhibits +84.65% growth, and the 1-year performance registers +33.16% appreciation. The 1-hour price movement shows a minor -0.21% decline.

The fully diluted valuation stands at $198,408.00, with a circulating market capitalization of $53,935.04 based on the current circulating supply of 114,172,402 FOREX tokens out of a maximum supply of 420,000,000 tokens. The circulating supply represents approximately 27.18% of the maximum supply. FOREX maintains a market dominance of 0.0000059% and ranks #5654 by market capitalization.

The token is currently supported by 1,441 token holders and is traded on a single exchange with active trading activity.

View current FOREX market price

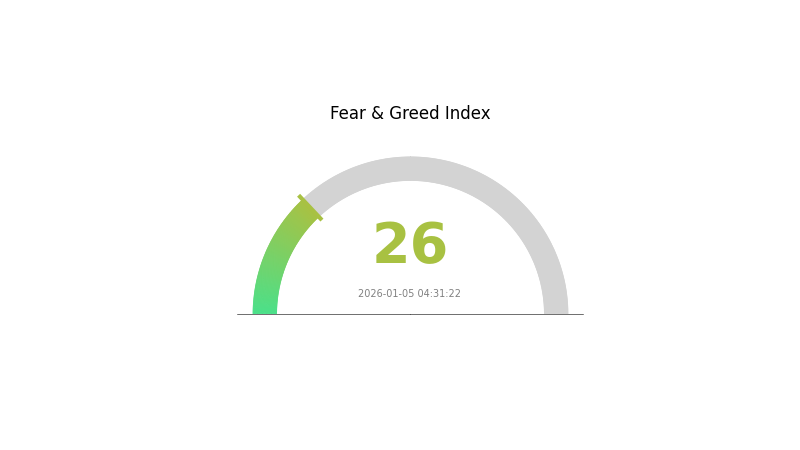

Crypto Market Sentiment Index

2026-01-05 Fear and Greed Index: 26 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing significant fear sentiment with an index reading of 26, indicating heightened market anxiety. This fear-driven environment typically reflects investor concerns about price volatility, potential bearish trends, or broader economic uncertainties. Market participants may be adopting more cautious trading strategies, with many adopting a wait-and-see approach before making new commitments. During such periods, volatility often increases, presenting both risks and opportunities for experienced traders. Investors should remain vigilant and consider their risk tolerance carefully when navigating these fear-dominated market conditions on Gate.com.

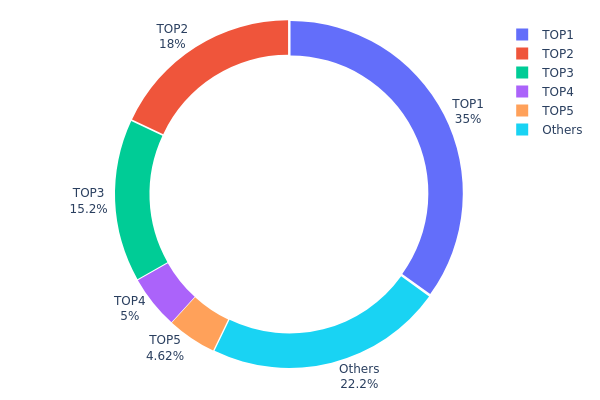

FOREX Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, revealing the degree of wealth centralization within the FOREX ecosystem. By analyzing the top holders and their respective percentages of total supply, this metric provides critical insights into potential market vulnerabilities, price manipulation risks, and the overall decentralization characteristics of the asset.

FOREX currently exhibits a pronounced concentration pattern that warrants careful examination. The top three addresses collectively control 68.16% of the circulating supply, with the largest holder alone accounting for 34.95%. This level of concentration presents notable centralization risks. The distribution deteriorates further when considering that the top five addresses command 77.78% of all tokens, leaving only 22.22% dispersed among remaining holders. Such extreme concentration in the hands of a limited number of addresses significantly constrains the decentralized nature of the protocol and creates substantial tail risks dependent on the actions of these major stakeholders.

This holding structure carries material implications for market dynamics and ecosystem stability. The dominant position of the top holders suggests heightened vulnerability to coordinated selling pressure, whale-driven volatility, and potential price manipulation. The substantial gap between the top holder and subsequent addresses, combined with the limited retail distribution, indicates that FOREX's market structure remains heavily influenced by a small cohort of early investors or institutional participants. From a governance and security perspective, such concentration raises questions about decision-making independence and the protocol's resilience to adverse actions by major token holders. Monitoring shifts in these top addresses remains essential for understanding potential liquidity events and directional biases in future price movements.

Click to view current FOREX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3e45...7208ec | 146800.00K | 34.95% |

| 2 | 0x8c21...9173e9 | 75754.00K | 18.03% |

| 3 | 0xa112...3aad8b | 63778.16K | 15.18% |

| 4 | 0xadcf...6c5680 | 21000.00K | 5.00% |

| 5 | 0x0d07...b492fe | 19411.05K | 4.62% |

| - | Others | 93256.79K | 22.22% |

II. Core Factors Affecting FOREX Future Price Movement

Macroeconomic Environment

-

Monetary Policy Impact: Central bank interest rate decisions directly influence currency valuations. Higher interest rates increase asset yields and attract global capital inflows, strengthening the currency, while rate cuts weaken currency appeal. Quantitative easing (QE) typically leads to currency depreciation by increasing money supply, whereas quantitative tightening (QT) supports currency appreciation.

-

Inflation Hedge Properties: High inflation rates erode a currency's purchasing power and cause rapid depreciation. For example, when inflation exceeds central bank targets (such as the ECB's 2% goal), authorities typically raise interest rates to combat price pressures, which can subsequently strengthen the currency as traders anticipate these policy adjustments. Conversely, lower inflation may trigger rate cuts and currency weakness.

-

Geopolitical Factors: International conflicts, trade disputes, and geopolitical tensions increase market volatility and risk aversion, driving capital flows toward safe-haven currencies like the Swiss franc and Japanese yen. Positive developments such as trade agreements can support currency strength. For instance, the 2020 USMCA agreement signing enhanced market confidence and supported the US dollar temporarily.

Economic Data Drivers

-

Employment Metrics: Lower unemployment rates indicate robust economic health and strong consumer spending capacity, supporting currency strength. Higher unemployment signals economic slowdown and typically pressures currency values downward.

-

GDP Growth: Strong GDP expansion exceeding expectations encourages market expectations of potential rate increases to prevent economic overheating, attracting international capital flows into currency assets.

-

Supply and Demand Dynamics: Currency price movements are fundamentally driven by supply and demand relationships. Increased demand for a currency (more people wanting to convert their holdings into that currency) drives appreciation unless supply increases proportionally.

Investor Sentiment and Market Dynamics

-

Market Sentiment: Currency movements are not always based on fundamental analysis. Investor psychology and collective expectations about price direction can become primary drivers. When most traders believe a currency will appreciate, herd behavior can amplify price movements.

-

Credit Ratings: Beyond interest rates and economic data, investors consider credit ratings when allocating capital. Higher credit ratings reduce perceived risk and attract investment flows, supporting currency appreciation.

-

Global News Flow: Major international news events directly impact currency valuations through their effects on supply and demand relationships. Traders continuously assess how global developments will influence capital flows and currency pairs.

III. Price Forecast for FOREX (2026-2031)

2026 Outlook

- Conservative Forecast: $0.00037 - $0.00047

- Neutral Forecast: $0.00047

- Optimistic Forecast: $0.0005 (requires sustained market sentiment and trading volume stability)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental growth momentum, characterized by modest volatility and consolidation patterns as market participants reassess asset fundamentals.

- Price Range Predictions:

- 2027: $0.00033 - $0.00066

- 2028: $0.00037 - $0.00071

- 2029: $0.00059 - $0.00081

- Key Catalysts: Increased institutional adoption, improved market liquidity, technical analysis breakout signals, and macroeconomic conditions favoring risk assets.

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00057 - $0.00102 (assuming steady regulatory clarity and mainstream integration)

- Optimistic Scenario: $0.00081 - $0.00113 (contingent on significant protocol upgrades and expanded use cases)

- Transformational Scenario: $0.00113+ (under conditions of exceptional technological breakthroughs and widespread enterprise adoption)

- 2031-12-31: FOREX targets $0.00113 (representing 126% cumulative growth from current levels, reflecting substantial market maturation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.0005 | 0.00047 | 0.00037 | 0 |

| 2027 | 0.00066 | 0.00049 | 0.00033 | 3 |

| 2028 | 0.00071 | 0.00057 | 0.00037 | 21 |

| 2029 | 0.00081 | 0.00064 | 0.00059 | 36 |

| 2030 | 0.00102 | 0.00073 | 0.00057 | 53 |

| 2031 | 0.00113 | 0.00087 | 0.00081 | 84 |

Handle.fi (FOREX) Professional Investment Strategy and Risk Management Report

IV. FOREX Professional Investment Strategy and Risk Management

FOREX Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: DeFi protocol believers, forex stablecoin ecosystem participants, and patient capital investors

- Operational Recommendations:

- Accumulate FOREX tokens during market downturns when volatility is elevated, particularly during periods when 24-hour price changes exceed -5%

- Hold positions through multiple market cycles to capture protocol governance rewards and ecosystem growth potential

- Maintain a diversified portfolio approach, limiting FOREX allocation to 2-5% of total crypto holdings

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price volatility: FOREX exhibits significant volatility, with a 73.69% 7-day gain indicating momentum-driven trading opportunities

- Volume analysis: Monitor 24-hour trading volume ($12,048.63) relative to market cap ($53,935.04) to identify liquidity conditions

- Trading Operation Insights:

- Current market position: Trading significantly below all-time high ($0.985949 from December 2021), indicating potential recovery opportunity or continued downward pressure

- Recent momentum: 7-day and 30-day gains of 73.69% and 84.65% respectively suggest potential rebound after extended bearish period

FOREX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total cryptocurrency portfolio

- Aggressive Investors: 3-5% of total cryptocurrency portfolio

- Professional/Institutional Investors: 2-4% of diversified DeFi protocol allocation

(2) Risk Hedging Strategies

- Protocol Risk Mitigation: Diversify across multiple stablecoin protocols to reduce concentration risk in single DeFi FX solutions

- Market Exposure Management: Use stablecoin positions (such as fxTokens) as partial hedge against FOREX token price volatility

(3) Secure Storage Solutions

- Hot Wallet Management: For frequent trading, maintain FOREX holdings in Gate.com Web3 Wallet with multi-signature security protocols enabled

- Cold Storage Approach: Long-term holdings should utilize offline storage solutions with regular security audits

- Security Precautions: Enable two-factor authentication, use hardware-based key management, and never share private keys or recovery phrases

V. FOREX Potential Risks and Challenges

FOREX Market Risks

- Extreme Price Volatility: FOREX has declined 95.21% from all-time high ($0.985949) to current price ($0.0004724), reflecting severe market corrections and potential loss of investor confidence

- Low Trading Liquidity: Daily trading volume of approximately $12,048 relative to fully diluted valuation of $198,408 indicates limited market depth and high slippage risk for large transactions

- Limited Market Capitalization: Current market cap of only $53,935 (27.18% of fully diluted valuation) suggests significant dilution concerns and weak market support levels

FOREX Regulatory Risks

- DeFi Regulatory Uncertainty: Multi-currency stablecoin protocols face evolving regulatory frameworks across jurisdictions, particularly regarding currency issuance and forex-linked products

- Compliance Requirements: Regulatory changes in major markets could restrict FOREX token trading or limit fxToken creation capabilities

- Jurisdiction-Specific Challenges: Different regulatory approaches to synthetic forex instruments across regions may impact protocol functionality and adoption

FOREX Technical Risks

- Protocol Implementation Risk: Smart contract vulnerabilities in the Handle.fi protocol could result in asset loss or unexpected market disruptions

- Collateral Management Risk: The stablecoin protocol relies on collateral mechanisms; inadequate collateralization could trigger liquidations or system instability

- Adoption and Network Effects: As a relatively small protocol (5,654 market cap ranking), FOREX faces challenges in achieving critical mass for network effects and sustained growth

VI. Conclusions and Action Recommendations

FOREX Investment Value Assessment

FOREX represents a high-risk, experimental investment in the decentralized foreign exchange protocol space. The token has experienced severe depreciation (-95.21% from ATH), indicating either fundamental protocol challenges or significant market cycle pressures. Recent positive momentum (73.69% over 7 days, 84.65% over 30 days) may represent either genuine recovery signals or dead-cat bounces in an illiquid market. The Handle.fi protocol offers innovative multi-currency stablecoin functionality, but remains unproven at scale with extremely limited market capitalization and trading volume. Investment should be approached with extreme caution and only by participants with high risk tolerance and understanding of DeFi protocol mechanics.

FOREX Investment Recommendations

✅ Beginners: Avoid direct FOREX token investment until gaining deeper understanding of DeFi protocols. Consider first learning Handle.fi's fxToken mechanics through small-scale transactions.

✅ Experienced Investors: Limit FOREX exposure to 1-3% of portfolio as speculative position. Implement strict stop-loss orders given volatility. Monitor protocol governance updates and adoption metrics.

✅ Institutional Investors: Conduct thorough technical audits of Handle.fi smart contracts and collateral mechanisms before participation. Structure positions with clear hedging strategies against protocol failure scenarios.

FOREX Trading Participation Methods

- Gate.com Spot Trading: Direct FOREX/USDT or FOREX/ETH trading pairs for active price discovery and portfolio rebalancing

- Protocol Native Interaction: Participate in Handle.fi stablecoin creation by minting fxTokens, which provides protocol exposure beyond token speculation

- Governance Participation: Hold FOREX tokens to participate in protocol governance decisions regarding collateral types, stability mechanisms, and fee structures

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must evaluate risks according to personal risk tolerance and circumstances. Seek professional financial advice before investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

What is forex (FOREX) price prediction? How does it work?

Forex price prediction is forecasting future currency pair movements based on market analysis. Traders predict whether pairs will rise or fall to profit from price fluctuations. Success depends on analyzing market trends and economic factors affecting currencies.

What are the commonly used technical analysis indicators in forex price prediction?

Common forex technical indicators include MACD, KDJ, and RSI. These indicators analyze historical price data to forecast future market movements, helping traders identify trends and potential entry/exit points effectively.

What are the main factors affecting forex price fluctuations?

Major factors include supply and demand dynamics, international trade conditions, central bank policies, economic indicators, geopolitical events, and interest rate differentials between currencies. These elements collectively drive currency pair movements and price volatility.

How to use fundamental analysis to predict forex price trends?

Analyze key economic indicators like GDP growth, inflation rates, and interest rates. These factors drive currency supply and demand, helping forecast forex price movements effectively.

How accurate is forex price prediction? What are the limitations?

Forex price prediction accuracy depends on multiple factors including economic data and market sentiment. Predictions are inherently imprecise due to constantly changing markets and unpredictable events that can significantly shift exchange rates.

How should beginners start learning forex price prediction?

Beginners should first master forex fundamentals, learn technical analysis tools like moving averages and RSI, study candlestick patterns, and understand basic economic indicators. Practice with demo accounts to build confidence before trading with real capital.

What are the applications of machine learning and AI in forex price prediction?

Machine learning and AI analyze historical data to identify patterns and predict future price trends. Supervised learning models recognize market patterns, enabling traders to make informed decisions based on data-driven insights.

What is the relationship between risk management and price prediction in forex trading?

Price prediction guides risk management by identifying potential market movements, enabling traders to set strategic stop-losses and position sizes. Effective risk management reduces uncertainty in predictions, optimizing profit potential while controlling downside exposure.

Will Crypto Recover in 2025?

2025 DYDX Price Prediction: Evaluating Growth Potential and Market Factors for the Leading Derivatives Exchange Token

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 1INCH Price Prediction: Will This DeFi Protocol Token Reach New Heights in the Decentralized Exchange Market?

2025 CETUS Price Prediction: Analyzing Growth Potential and Market Factors in the Evolving DeFi Landscape

2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

Is Crypto Legal in Netherlands?

Marina Protocol Daily Quiz Answer for 7 january 2026

Spur Protocol Daily Quiz Answer Today 7 january 2026

Top dApps in The Open Network (TON) Ecosystem

Dropee Question of the Day for 7 january 2026