2025 FTNPrice Prediction: Analyzing Market Trends, Tokenomics and Growth Potential of FTN in the Next Bull Cycle

Introduction: FTN's Market Position and Investment Value

Fasttoken (FTN), as the official cryptocurrency of the Fastex ecosystem and the native token of Bahamut blockchain, has achieved significant milestones since its inception. As of 2025, FTN's market capitalization has reached $1.89 billion, with a circulating supply of approximately 431,845,846 tokens, and a price hovering around $4.383. This asset, known as the "SoftConstruct's crypto powerhouse," is playing an increasingly crucial role in settling business arrangements, gaming, and blockchain transactions.

This article will comprehensively analyze FTN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

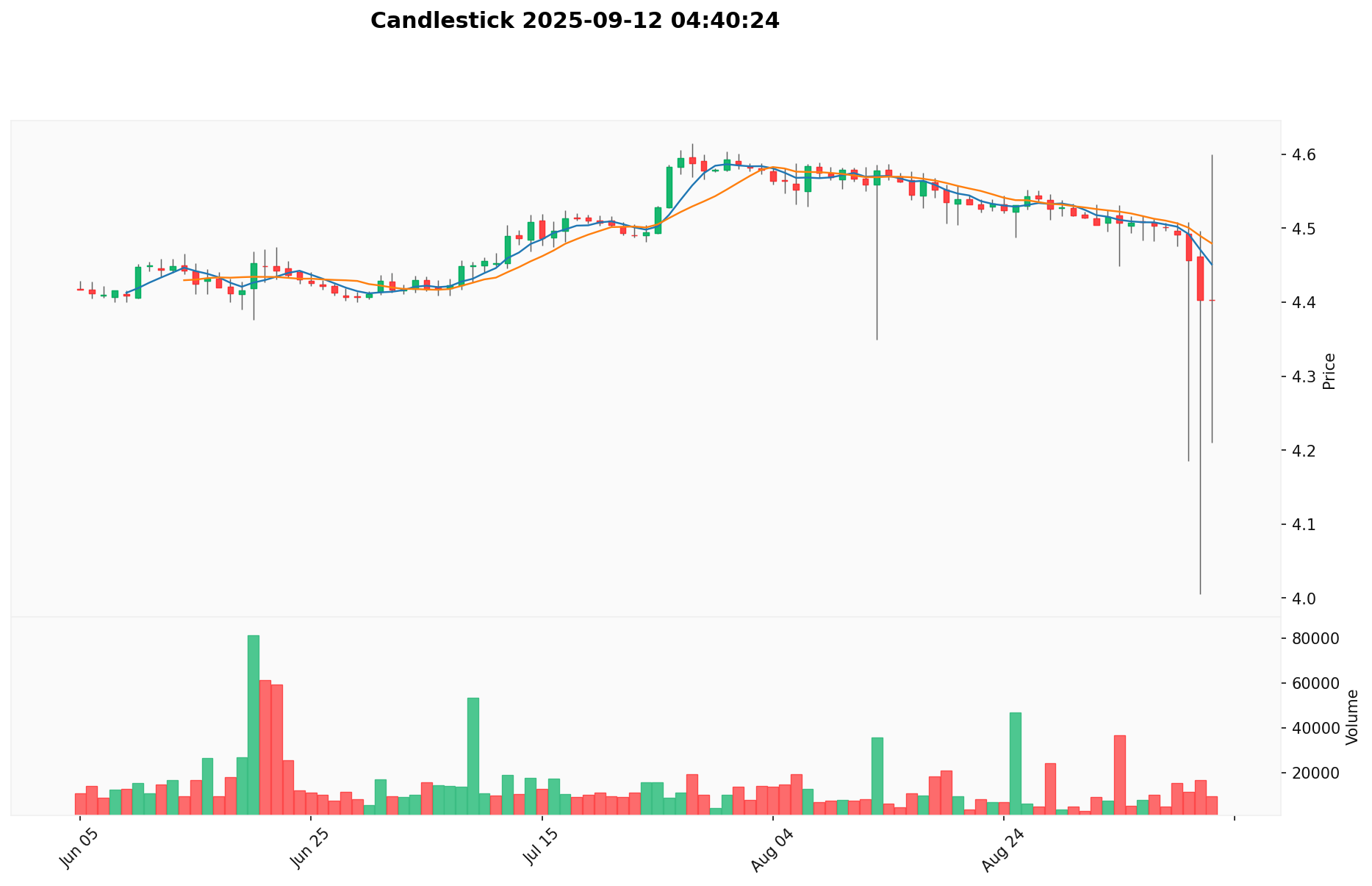

I. FTN Price History Review and Current Market Status

FTN Historical Price Evolution

- 2023: Project launch, price reached an all-time low of $0.5 on November 1

- 2024: Significant growth, hitting an all-time high of $5.217 on December 16

- 2025: Market consolidation, price fluctuating between $4 and $5

FTN Current Market Situation

As of September 12, 2025, FTN is trading at $4.383, with a 24-hour trading volume of $46,488.56. The token has experienced a slight decrease of 0.04% in the last 24 hours. FTN's market capitalization stands at $1,892,780,345, ranking it 76th in the overall cryptocurrency market.

The current price represents a significant increase of 71.78% over the past year, despite showing minor declines in shorter timeframes (-1.06% in 1 hour, -3.08% in 7 days, and -4.31% in 30 days). This suggests a long-term upward trend with short-term volatility.

FTN's circulating supply is 431,845,846.6 tokens, which is 43.18% of its maximum supply of 1 billion tokens. The fully diluted market cap is estimated at $4,383,000,000.

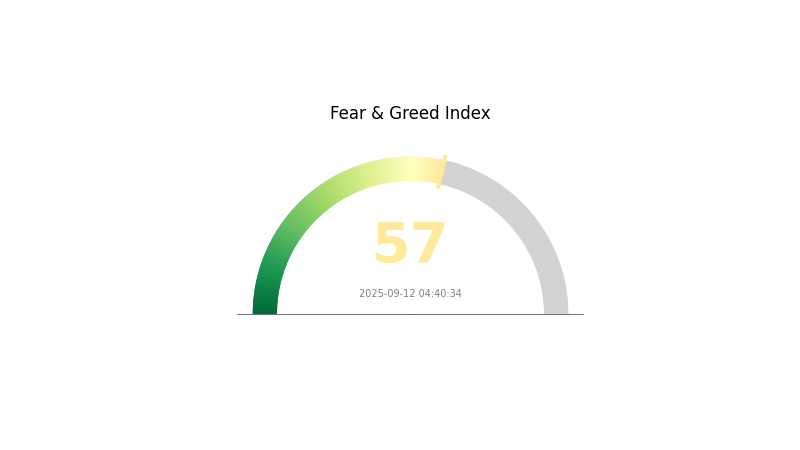

The token's price is currently closer to its all-time high than its all-time low, indicating overall positive market sentiment. The market emotion index for FTN is currently at "Greed" with a VIX of 57, suggesting high investor optimism.

Click to view the current FTN market price

FTN Market Sentiment Indicator

2025-09-12 Fear and Greed Index: 57 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of greed, with the Fear and Greed Index at 57. This suggests investors are becoming increasingly optimistic, potentially driven by recent positive market movements or news. However, it's crucial to remain cautious as excessive greed can lead to overvaluation and increased volatility. Traders should consider diversifying their portfolios and setting stop-loss orders to protect against sudden market shifts. As always, thorough research and risk management are essential in navigating the dynamic crypto landscape.

FTN Holdings Distribution

The address holdings distribution data for FTN reveals a unique situation where no specific addresses are listed as top holders. This unusual pattern suggests an extremely decentralized token distribution or potentially indicates that the data is not currently available.

In the absence of detailed address holdings information, it's challenging to assess the concentration of FTN tokens accurately. However, this lack of visible large holders could be interpreted as a positive sign for decentralization, as it implies that no single entity or small group of addresses holds a disproportionate amount of tokens.

This distribution pattern, if accurate, could contribute to a more stable market structure for FTN, potentially reducing the risk of price manipulation by large holders. It may also indicate a broader base of token holders, which could be beneficial for the token's long-term prospects and community engagement.

Click to view the current FTN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting FTN's Future Price

Supply Mechanism

- Total Supply: The total supply of FTN is capped at 1,000,000,000 tokens.

- Circulating Supply: As of September 12, 2025, the circulating supply is 436,261,513 FTN.

- Current Impact: The limited supply may create scarcity, potentially supporting the token's value.

Institutional and Whale Dynamics

- Corporate Adoption: Fasttoken's ecosystem expansion may attract more corporate users, potentially increasing demand for FTN.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's interest rate decisions may influence FTN's price. As of the latest data, there's a 72.3% probability of a rate cut in September.

- Geopolitical Factors: International trade tensions and global economic uncertainties could impact the crypto market, including FTN.

Technological Development and Ecosystem Building

- Ecosystem Expansion: The continuous growth and improvement of the Fountain ecosystem are expected to strengthen FTN's value foundation.

- Platform Support: FTN is supported on multiple blockchain platforms, including BNB Smart Chain (BEP20), Base, and Arbitrum, enhancing its accessibility and potential use cases.

III. FTN Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $3.67 - $4.00

- Neutral forecast: $4.00 - $4.38

- Optimistic forecast: $4.38 - $4.73 (requires positive market sentiment and increased adoption)

2027 Mid-term Outlook

- Market phase expectation: Potential volatility with growth opportunities

- Price range forecast:

- 2026: $4.23 - $5.28

- 2027: $3.19 - $7.33

- Key catalysts: Technological advancements, wider institutional acceptance, and regulatory clarity

2030 Long-term Outlook

- Base scenario: $6.50 - $7.24 (assuming steady market growth and adoption)

- Optimistic scenario: $7.24 - $8.61 (assuming strong bullish trends and widespread integration)

- Transformative scenario: $8.61+ (extreme favorable conditions such as major partnerships or technological breakthroughs)

- 2030-12-31: FTN $7.23 (65% increase from 2025 levels)

IV. Risk Analysis and Investment Considerations

Disclaimer: The cryptocurrency market is highly volatile and unpredictable. This analysis is for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a professional financial advisor before making investment decisions.

Potential Risks:

- Regulatory uncertainties

- Market volatility

- Technological challenges

- Competition from other cryptocurrencies

Investment Considerations:

- Diversify your portfolio to manage risk

- Stay informed about FTN developments and market trends

- Consider dollar-cost averaging for long-term investments

- Use reputable exchanges like Gate.com for secure trading

Remember to always prioritize security and use trusted platforms such as Gate.com for your cryptocurrency transactions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.72932 | 4.379 | 3.67836 | 0 |

| 2026 | 5.28283 | 4.55416 | 4.23537 | 3 |

| 2027 | 7.32855 | 4.91849 | 3.19702 | 12 |

| 2028 | 6.85835 | 6.12352 | 5.51117 | 39 |

| 2029 | 7.98385 | 6.49093 | 5.19275 | 48 |

| 2030 | 8.6125 | 7.23739 | 5.06617 | 65 |

IV. Professional Investment Strategies and Risk Management for FTN

FTN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate FTN during market dips

- Set price targets and rebalance portfolio periodically

- Store FTN in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor FTN's correlation with major cryptocurrencies

- Set strict stop-loss orders to manage risk

FTN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Options strategies: Consider using options to hedge downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for FTN

FTN Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity: Potential challenges in large-scale trading during market stress

- Competition: Emerging projects in the Fastex ecosystem could impact FTN's value

FTN Regulatory Risks

- Regulatory uncertainty: Changing global crypto regulations may affect FTN's adoption

- Compliance challenges: Potential issues with adhering to evolving AML/KYC requirements

- Legal status: Risk of FTN being classified as a security in some jurisdictions

FTN Technical Risks

- Smart contract vulnerabilities: Potential bugs in the underlying code

- Scalability issues: Challenges in handling increased transaction volume

- Blockchain security: Theoretical risks of 51% attacks or other network compromises

VI. Conclusion and Action Recommendations

FTN Investment Value Assessment

FTN shows promise as a utility token within the Fastex ecosystem, supported by SoftConstruct's extensive network. However, investors should be aware of the high volatility and regulatory uncertainties in the crypto market.

FTN Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the Fastex ecosystem ✅ Experienced investors: Consider a balanced approach, combining long-term holding with tactical trading ✅ Institutional investors: Conduct thorough due diligence and consider FTN as part of a diversified crypto portfolio

FTN Trading Participation Methods

- Spot trading: Buy and sell FTN on Gate.com

- Staking: Participate in FTN staking programs for passive income

- DeFi integration: Explore DeFi opportunities within the Fastex ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the best token price prediction in 2025?

BlockchainFX (BFX) is predicted to be the best token in 2025. It's already generating daily revenue as a crypto super app and is considered the top presale opportunity.

How much is 1 ftn in dollars?

As of 2025-09-12, 1 FTN is worth approximately $4.49.

What is the XRP price prediction in 2025?

Based on current trends, XRP is predicted to decrease by 1.72% by September 13, 2025, indicating a bearish outlook for the cryptocurrency in the near future.

What is the future of flux coin?

Flux is projected to grow significantly, with price estimates reaching $0.368838 by 2030. This represents a substantial increase from current levels, based on market trends and analysis.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?