2025 NUTS Price Prediction: Global Supply Challenges and Market Volatility Drive Uncertainty

Introduction: NUTS Market Position and Investment Value

Thetanuts Finance (NUTS), as a decentralized on-chain options protocol focusing on altcoin options, has made significant strides since its inception in 2021. As of 2025, NUTS has a market capitalization of $3,600,743, with a circulating supply of approximately 2,314,102,216 tokens, and a price hovering around $0.001556. This asset, often referred to as a "niche options trading solution," is playing an increasingly crucial role in the decentralized finance (DeFi) and cryptocurrency derivatives markets.

This article will comprehensively analyze NUTS price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. NUTS Price History Review and Current Market Status

NUTS Historical Price Evolution Trajectory

- 2024: All-time high reached, price peaked at $0.0442

- 2025: Market downturn, price dropped to an all-time low of $0.001287

NUTS Current Market Situation

As of October 13, 2025, NUTS is trading at $0.001556. The token has experienced a slight recovery of 0.19% in the past 24 hours, with a trading volume of $63,993.38. However, NUTS is still down 3.23% over the past week and has seen a significant decline of 32.6% over the past year.

The current market capitalization of NUTS stands at $3,600,743.05, ranking it at 1974th position in the overall cryptocurrency market. The circulating supply is 2,314,102,216.55 NUTS, which represents 23.14% of the total supply of 10 billion tokens.

Despite the recent positive 24-hour movement, the long-term trend remains bearish, as evidenced by the substantial yearly decline. The token is currently trading at a 96.48% discount from its all-time high, indicating significant downward pressure in the market.

Click to view the current NUTS market price

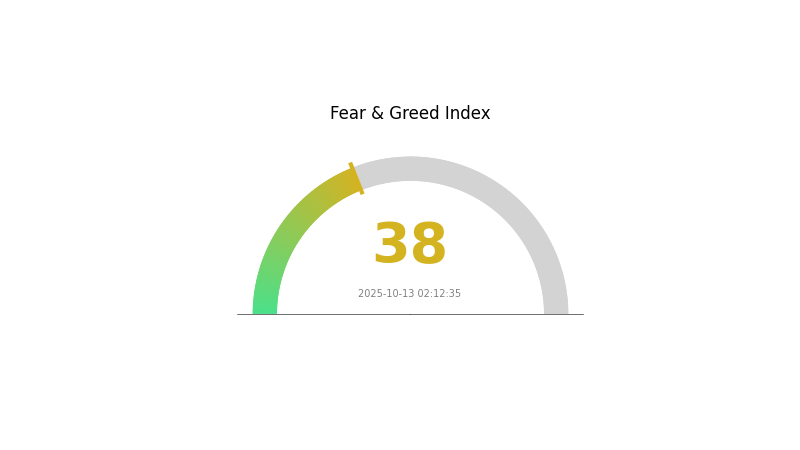

NUTS Market Sentiment Indicator

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the NUTS Fear and Greed Index reading of 38. This suggests that investors are cautious and uncertain about market conditions. During such times, it's crucial to remain vigilant and avoid making impulsive decisions. While fear can present buying opportunities for some, it's essential to conduct thorough research and consider your risk tolerance before making any investment moves. Remember, market sentiment can shift quickly, so stay informed and adjust your strategy accordingly.

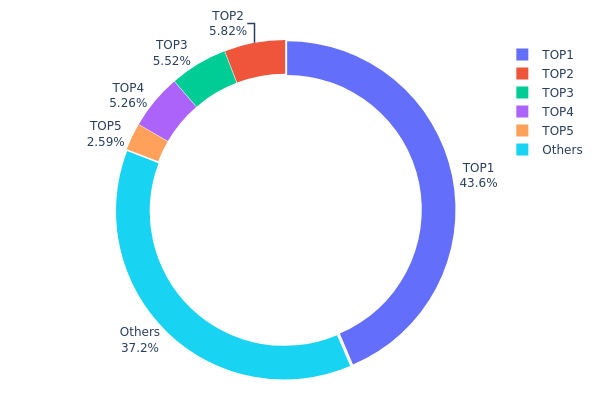

NUTS Holdings Distribution

The address holdings distribution data for NUTS reveals a highly concentrated ownership structure. The top address holds a substantial 43.60% of the total supply, indicating significant centralization. The subsequent four largest addresses collectively account for an additional 19.17% of NUTS tokens. This concentration pattern suggests potential vulnerabilities in the token's market dynamics.

Such a distribution raises concerns about market manipulation and price volatility. The dominant position of the top holder could exert undue influence on NUTS' price movements, potentially leading to increased market instability. Furthermore, the concentration of tokens in a few hands may impact the overall decentralization ethos of the project, as it could lead to centralized decision-making power within the ecosystem.

This concentration level also implies a relatively low degree of token dispersion among smaller holders, which may affect liquidity and trading volumes. Investors should be aware that such a distribution pattern could potentially lead to heightened price fluctuations, especially if large holders decide to move their assets.

Click to view the current NUTS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf48e...3bef11 | 552862.86K | 43.60% |

| 2 | 0xe2f7...edc17e | 73789.43K | 5.81% |

| 3 | 0x0d07...b492fe | 69980.48K | 5.51% |

| 4 | 0x3154...0f2c35 | 66700.00K | 5.26% |

| 5 | 0x17e6...288205 | 32843.97K | 2.59% |

| - | Others | 471811.78K | 37.23% |

II. Key Factors Affecting NUTS Future Price

Supply Mechanism

- Market Supply and Demand: The price of NUTS is influenced by market supply and demand dynamics, which can lead to price fluctuations.

- Historical Patterns: Nut prices have historically been volatile, making it challenging for manufacturers to maintain consistent pricing and profitability.

- Current Impact: Climate change, droughts, and other natural disasters can affect nut production and supply, potentially leading to shortages and price volatility.

Institutional and Whale Dynamics

- Corporate Adoption: The increasing awareness of the health benefits of cashews, walnuts, and other nuts is driving demand, potentially influencing NUTS price.

Macroeconomic Environment

- Inflation Hedging Properties: As a commodity-related asset, NUTS may be affected by broader economic trends and inflation rates.

- Geopolitical Factors: International market conditions and trade policies can impact the global nut market, affecting NUTS price.

Technological Development and Ecosystem Building

- Processing Technology: Advancements in nut processing equipment and technology may influence production efficiency and, consequently, NUTS price.

- Ecosystem Applications: The growth of nut-based snacks (31% increase noted) and sustainable packaging innovations (influencing 26% of market participants) may impact overall product development strategies and NUTS demand.

III. NUTS Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00121 - $0.00156

- Neutral forecast: $0.00156 - $0.00182

- Optimistic forecast: $0.00182 - $0.00209 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00133 - $0.00269

- 2028: $0.00118 - $0.00302

- Key catalysts: Technological advancements, wider market adoption, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00237 - $0.00280 (assuming steady market growth and continued project development)

- Optimistic scenario: $0.00280 - $0.00308 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.00308+ (with groundbreaking use cases and mainstream integration)

- 2030-12-31: NUTS $0.00308 (potential peak price, subject to market dynamics)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00209 | 0.00156 | 0.00121 | 0 |

| 2026 | 0.00208 | 0.00182 | 0.00138 | 17 |

| 2027 | 0.00269 | 0.00195 | 0.00133 | 25 |

| 2028 | 0.00302 | 0.00232 | 0.00118 | 49 |

| 2029 | 0.00293 | 0.00267 | 0.00237 | 71 |

| 2030 | 0.00308 | 0.0028 | 0.0016 | 80 |

IV. NUTS Professional Investment Strategies and Risk Management

NUTS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors interested in decentralized finance and options trading

- Operation suggestions:

- Accumulate NUTS tokens during market dips

- Participate in Thetanuts Finance's Basic Vaults for yield generation

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use to identify overbought and oversold conditions

- Moving Averages: Utilize for trend identification and potential entry/exit points

- Key points for swing trading:

- Monitor altcoin market trends as NUTS is focused on altcoin options

- Pay attention to Thetanuts Finance protocol upgrades and new features

NUTS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different DeFi protocols

- Options strategies: Utilize Thetanuts Finance's own options products for hedging

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for NUTS

NUTS Market Risks

- Volatility: High price fluctuations common in altcoin markets

- Liquidity: Potential low trading volume may affect price stability

- Competition: Emerging DeFi options protocols may impact market share

NUTS Regulatory Risks

- Regulatory uncertainty: Evolving global regulations on DeFi and options trading

- Compliance challenges: Potential difficulties in adhering to future regulatory requirements

- Geographical restrictions: Possible limitations on user participation in certain jurisdictions

NUTS Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol's code

- Scalability issues: Challenges in handling increased user demand and transaction volume

- Interoperability concerns: Possible limitations in cross-chain functionality

VI. Conclusion and Action Recommendations

NUTS Investment Value Assessment

NUTS presents a unique opportunity in the DeFi options space, with potential for long-term growth. However, investors should be aware of the high volatility and regulatory uncertainties in the short term.

NUTS Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about DeFi options ✅ Experienced investors: Consider allocating a portion of DeFi portfolio to NUTS, actively participate in Thetanuts Finance ecosystem ✅ Institutional investors: Explore strategic partnerships and larger-scale involvement in the protocol's governance

NUTS Trading Participation Methods

- Spot trading: Buy and hold NUTS tokens on Gate.com

- Yield farming: Participate in Thetanuts Finance's Basic Vaults for passive income

- Governance: Stake NUTS tokens to participate in protocol decision-making

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What meme coin will explode in 2025 price prediction?

Shiba Inu is predicted to explode in price in 2025, driven by strong community support and viral trends. Its popularity remains high due to sustained interest and market dynamics.

What is the price prediction for seed in 2025?

The price prediction for SEED in 2025 is bullish, with a potential gain of 68.70% based on current market trends and technical analysis.

What is the price prediction for crypto in 2025?

Bitcoin is expected to reach $60,000, Ethereum $3,000, and Solana $100 by 2025. Other major cryptocurrencies are also predicted to see significant growth.

How much is the Nutcoin?

As of October 13, 2025, Nutcoin is trading at $0.15 per coin. The price has seen a 5% increase over the past 24 hours.

What is BANANA: The Nutritional Powerhouse Revolutionizing Global Diets

2025 APP Price Prediction: Navigating the Future of Mobile Software Costs

2025 BANANA Price Prediction: Potential Surge in Value as Demand for Digital Assets Grows

What is BANANA: The Versatile Tropical Fruit That's More Than Just a Snack

What is EDGE: The Next Generation of Mobile Internet Technology

What is BANANA: A Comprehensive Guide to the Popular Tropical Fruit and Its Health Benefits

What is spot trading?

BTC Dominance at 59%: The $2 Trillion Rotation That Could Ignite Alt Season

Top Ethereum ETFs to Consider

Bearish candlestick patterns

Bitcoin Lifestyle