2025 PSG Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: PSG's Market Position and Investment Value

Paris Saint-Germain Fan Token (PSG) is a functional token designed to provide fans of Paris Saint-Germain Football Club with tokenized shares to participate in club decisions through the Socios platform. Since its launch in 2020, PSG has become an innovative bridge connecting sports entertainment with blockchain technology. As of December 2025, PSG's market capitalization has reached approximately $16.72 million, with a circulating supply of 13.36 million tokens trading at around $0.84 per token. This asset, recognized for its unique approach to fan engagement and governance participation, is playing an increasingly important role in the sports and entertainment ecosystem.

This article will comprehensively analyze PSG's price trends from 2025 to 2030, combining historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

PSG Fan Token Market Analysis Report

I. PSG Price History Review and Current Market Status

PSG Historical Price Evolution

All-Time High (ATH): On August 10, 2021, PSG reached its peak price of $61.23, representing the maximum valuation achieved by the fan token during its trading history.

All-Time Low (ATL): On October 11, 2025, PSG hit its lowest price of $0.537, marking a significant decline from historical peaks.

Long-Term Performance: Over the past year, PSG has experienced a substantial decline of -73.86%, reflecting challenging market conditions and shifting investor sentiment in the fan token sector.

PSG Current Market Condition

As of December 21, 2025, PSG is trading at $0.8408. The token demonstrates recent price volatility with the following characteristics:

Short-term Performance:

- 1-hour change: +0.61%

- 24-hour change: +5.5% (up $0.044)

- 7-day change: -3.50%

- 30-day change: -5.46%

Market Metrics:

- 24-hour trading range: $0.7904 - $0.8995

- 24-hour trading volume: $16,211.59

- Market capitalization: $11,237,099.46

- Fully diluted valuation: $16,723,512.00

- Circulating supply: 13,364,771 PSG (66.82% of total supply)

- Total supply: 19,890,000 PSG

- Market dominance: 0.00052%

- Number of holders: 4,487

- Number of supported exchanges: 17

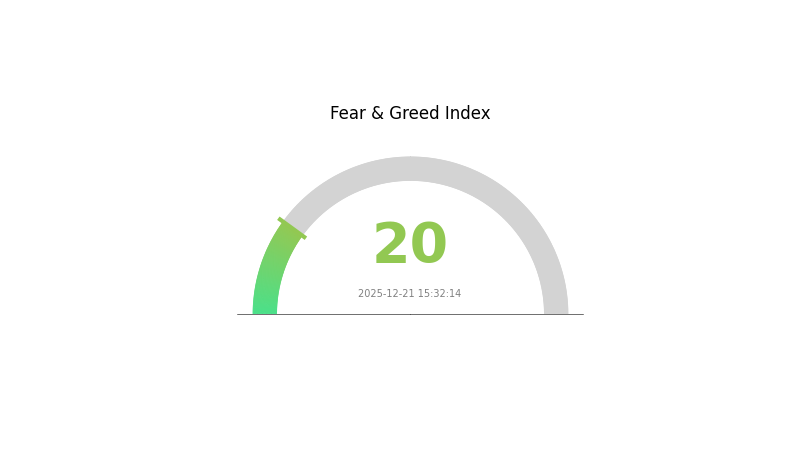

Market Sentiment: The current market sentiment shows extreme fear (VIX rating: 20), indicating heightened risk aversion among investors.

Click to view current PSG market price

PSG Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with a reading of 20, indicating severe pessimism among investors. This level typically reflects significant market uncertainty, panic selling, and negative sentiment. Such extreme readings often present contrarian opportunities for long-term investors, as markets tend to recover from these lows. However, exercise caution and conduct thorough research before making investment decisions. Monitor key support levels and market catalysts closely during this volatile period.

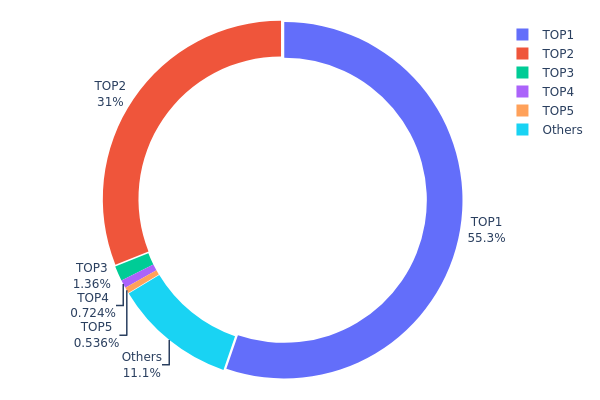

PSG Holdings Distribution

The address holdings distribution chart illustrates the concentration of PSG tokens across different wallet addresses on the blockchain. This metric is critical for assessing market structure, identifying potential risks associated with token concentration, and evaluating the overall decentralization level of the asset. By analyzing the top holders and their respective stakes, investors and analysts can determine whether the token supply is distributed equitably or concentrated among a limited number of entities.

PSG exhibits significant concentration characteristics in its current holdings distribution. The top two addresses collectively control 86.27% of the total token supply, with the leading address (0x9bf4...632d59) holding 55.26% and the second address (0x8894...e2d4e3) commanding 31.01%. This substantial concentration among just two entities suggests a highly centralized token structure. The remaining top five addresses contribute only 3.14% combined, while the broader holder base represented by "Others" accounts for 11.12%, indicating that the vast majority of tokens are held by a minimal number of stakeholders.

This pronounced concentration pattern carries notable implications for market dynamics and stability. The dominance of two primary holders creates potential vulnerability to significant price volatility, as any substantial movement of these concentrated holdings could exert considerable downward pressure on the token price. Furthermore, such centralization increases the risk of coordinated actions or unilateral decisions that could materially impact market sentiment and liquidity conditions. The limited distribution among retail and smaller institutional holders suggests that PSG's current on-chain structure reflects relatively low decentralization, which may warrant caution regarding long-term market sustainability and independence from the controlling entities' intentions.

For detailed PSG holdings analysis, visit Gate.com Crypto Market Data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9bf4...632d59 | 155.30K | 55.26% |

| 2 | 0x8894...e2d4e3 | 87.14K | 31.01% |

| 3 | 0x6f45...41a33d | 3.83K | 1.36% |

| 4 | 0xd2a3...6a2785 | 2.03K | 0.72% |

| 5 | 0xdafe...a00656 | 1.50K | 0.53% |

| - | Others | 31.18K | 11.12% |

II. Core Factors Influencing PSG's Future Price

Macroeconomic Environment

- Anti-inflation Attributes: As a digital asset, PSG has the potential to serve as an inflation hedge tool under certain economic conditions.

Technology Development and Ecosystem Building

- Ecosystem Applications: PSG's commercial strategies and player acquisition policies impact its market value, with competitive performance in European tournaments playing a key role in future price movements.

III. 2025-2030 PSG Price Forecast

2025 Outlook

- Conservative Prediction: $0.50 - $0.84

- Neutral Prediction: $0.84 - $1.19

- Bullish Prediction: $1.19 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing institutional interest and platform adoption

- Price Range Predictions:

- 2026: $0.97 - $1.28 (20% upside potential)

- 2027: $0.60 - $1.38 (36% upside potential)

- Key Catalysts: Expansion of platform features, increased user adoption, market sentiment recovery, and integration partnerships

2028-2030 Long-term Outlook

- Base Case Scenario: $0.95 - $1.82 (assumes steady ecosystem growth and moderate market expansion)

- Bullish Scenario: $1.11 - $2.23 (assumes accelerated adoption, strategic partnerships, and favorable regulatory environment)

- Transformative Scenario: $1.13 - $2.19 (assumes breakthrough technological innovations, mainstream institutional adoption, and significant market capitalization growth)

- 2030-12-21: PSG reaching $2.19 average valuation (potential peak with 124% cumulative gain from base reference)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.18627 | 0.8354 | 0.50124 | 0 |

| 2026 | 1.28376 | 1.01083 | 0.9704 | 20 |

| 2027 | 1.37676 | 1.1473 | 0.59659 | 36 |

| 2028 | 1.81732 | 1.26203 | 0.94652 | 50 |

| 2029 | 2.23252 | 1.53967 | 1.10856 | 83 |

| 2030 | 2.18787 | 1.8861 | 1.13166 | 124 |

Paris Saint-Germain Fan Token (PSG) Investment Strategy and Risk Management Report

IV. PSG Professional Investment Strategy and Risk Management

PSG Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Sports fans and long-term believers in fan tokenization ecosystem

- Operational Recommendations:

- Accumulate PSG tokens during market downturns, particularly when prices approach historical lows ($0.537)

- Hold tokens to participate in club governance decisions and earn rewards through the Socios platform

- Set a multi-year investment horizon aligned with Paris Saint-Germain's strategic developments

(2) Active Trading Strategy

- Trading Tools:

- Price Action Analysis: Monitor the 24-hour and 7-day price movements to identify entry and exit points around support ($0.79) and resistance ($0.90) levels

- Volume Indicators: Track trading volume relative to the 24-hour average of 16,211.59 PSG to confirm price movements

- Wave Trading Key Points:

- Execute buy orders when the token shows positive daily momentum (current 24H: +5.5%)

- Take profit targets at 15-25% gains above entry prices given PSG's historical volatility

- Use stop-loss orders set 10-15% below entry prices to manage downside risk

PSG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation

- Active Investors: 3-5% of total crypto portfolio allocation

- Professional Investors: 5-8% of total crypto portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine PSG holdings with other established cryptocurrencies to reduce concentration risk from a single fan token

- Staking Strategy: Participate in PSG token staking on Socios to generate NFT rewards, offsetting potential price depreciation through yield generation

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active trading and frequent Socios platform participation

- Cold Storage Method: Transfer long-term holdings to hardware wallets for enhanced security against cyber threats

- Security Precautions: Enable two-factor authentication on all accounts, use hardware wallets for storage exceeding $10,000 USD equivalent, never share private keys or seed phrases

V. PSG Potential Risks and Challenges

PSG Market Risk

- Price Volatility: PSG has experienced extreme volatility with a 73.86% annual decline and a historical peak-to-current decline of 98.63% from its all-time high of $61.23

- Low Trading Liquidity: With 24-hour volume of only 16,211.59 PSG and a market cap of $11.24 million, the token may face liquidity challenges during rapid sell-offs

- Speculative Nature: Fan tokens are primarily sentiment-driven assets tied to sports team performance and fan engagement rather than fundamental economic metrics

PSG Regulatory Risk

- Sports League Compliance: Regulatory changes in European sports regulations regarding fan tokens could impact PSG's utility and legal status

- Securities Classification: Potential reclassification of fan tokens as securities in certain jurisdictions could restrict trading and holding options

- Geographic Restrictions: Certain countries may prohibit or restrict the purchase and holding of sports-linked tokens, limiting market expansion

PSG Technical Risk

- Chiliz Chain Dependency: PSG's primary deployment on Chiliz Chain creates technical vulnerability if the chain experiences network disruptions or security breaches

- Smart Contract Risk: Governance mechanisms and staking functions rely on smart contracts that could contain vulnerabilities

- Cross-Chain Bridge Risk: The availability of PSG on both Chiliz Chain and BSC creates additional technical complexity and potential bridge-related vulnerabilities

VI. Conclusion and Action Recommendations

PSG Investment Value Assessment

PSG represents a speculative investment opportunity within the emerging fan tokenization ecosystem. The token provides utility through governance participation in Paris Saint-Germain's club decisions and reward generation via the Socios platform. However, the 73.86% year-over-year decline and 98.63% decline from all-time highs indicate significant market challenges. The token's value is highly dependent on sustained fan engagement, successful Socios platform adoption, and positive regulatory treatment. Current valuation represents either a recovery opportunity or a declining asset depending on future adoption metrics.

PSG Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of crypto portfolio) through Gate.com to test the platform and understand fan token mechanics before increasing exposure

✅ Experienced Investors: Consider 3-5% allocations combined with staking strategies to generate NFT rewards while maintaining disciplined stop-loss orders around the $0.70 support level

✅ Institutional Investors: Conduct thorough regulatory due diligence regarding fan token classification in target markets before accumulating meaningful positions; consider the asset primarily for sports industry exposure rather than core portfolio holdings

PSG Trading Participation Methods

- Gate.com Platform: Execute spot trading of PSG/USDT pairs with competitive fees and access to multiple blockchain networks (CHZ2 and BSC)

- Socios Application: Purchase PSG directly through the Socios platform to participate in club governance and earn platform-specific rewards

- Staking Programs: Lock PSG tokens on Socios to earn NFT rewards, combining yield generation with governance participation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

How much is a PSG token worth?

As of today, 1 PSG token is worth approximately $0.80 USD. The token's value fluctuates based on market demand and trading volume. You can exchange 1 USD for about 1.26 PSG tokens at current rates.

How much is PSG worth now?

As of December 21, 2025, Paris Saint-Germain Fan Token (PSG) is trading at approximately $0.82. The token has experienced minor price fluctuations recently, with a 0.3% decline from the previous hour and a 2.1% decline over the past 24 hours.

How much is 1000 PSG?

1000 PSG equals approximately 1119.61 USD as of December 21, 2025. The value fluctuates based on real-time market conditions and trading volume.

What is the price of PSG?

The current price of PSG is $0.927 USD. The token has experienced a significant decline of 87.92% from its all-time high of $7.68. PSG maintains active trading volume across multiple platforms.

What factors influence PSG token price movements?

PSG token price movements are driven by market demand, investor sentiment, trading volume, broader crypto market conditions, and news events. Supply dynamics and platform adoption also impact price fluctuations significantly.

Where can I buy PSG tokens and what is the current market price?

PSG tokens are available on major cryptocurrency platforms. The current market price is $0.804034 per token, with a 24-hour trading volume of $3.63M USD and market cap of $10.75M USD.

What is the price prediction for PSG token in the future?

PSG token is predicted to reach a maximum price of $53.15 and a minimum of $28 by 2026, based on current market trends and trading volume analysis.

2025 ACM Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 ALA Price Prediction: Expert Analysis and Market Outlook for the Coming Year

What Does 'Stonks' Mean ?

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

why is crypto crashing and will it recover ?

What is Stop Loss Hunting? How to Avoid Whale Liquidity Traps

Snoop Dogg and Bored Ape Yacht Club Launch Animated Avatars on Telegram via TON

Bill Gates on Digital Currency

Hamster Kombat Cipher Code Guide: How to Enter Codes and Earn Rewards

Why Is China Banning Cryptocurrencies?