2025 QKCPrice Prediction: Future Outlook and Market Analysis for QuarkChain Cryptocurrency

Introduction: QKC's Market Position and Investment Value

QuarkChain (QKC), as a blockchain underlying technology solution based on sharding technology, has achieved significant milestones since its inception in 2018. As of 2025, QuarkChain's market capitalization has reached $44,256,445, with a circulating supply of approximately 7,165,875,180 tokens and a price hovering around $0.006176. This asset, known for its "high throughput and scalability," is playing an increasingly crucial role in blockchain infrastructure development.

This article will comprehensively analyze QuarkChain's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. QKC Price History Review and Current Market Status

QKC Historical Price Evolution

- 2018: Initial launch, price reached all-time high of $0.338765 on June 5

- 2020: Market downturn, price hit all-time low of $0.00137714 on March 13

- 2025: Current market cycle, price fluctuating around $0.006176

QKC Current Market Situation

As of October 1, 2025, QuarkChain (QKC) is trading at $0.006176, with a 24-hour trading volume of $90,310.85. The token has shown a positive trend in the short term, with a 1.36% increase in the last 24 hours and a 1.08% gain in the past hour. However, longer-term performance indicates a downward trend, with a 1.44% decrease over the past week, a 9.62% decline in the last 30 days, and a significant 34.56% drop over the past year.

QKC's market capitalization currently stands at $44,256,445, ranking it 741st in the cryptocurrency market. The circulating supply is 7,165,875,180 QKC, representing 71.66% of the total supply of 10,000,000,000 tokens. The fully diluted market cap is $61,760,000.

Despite the recent positive short-term momentum, QKC is still trading significantly below its all-time high of $0.338765, achieved on June 5, 2018. The current price represents a 98.18% decrease from this peak. However, it's worth noting that the token has shown resilience since its all-time low of $0.00137714 on March 13, 2020, having increased by 348.47% since then.

Click to view the current QKC market price

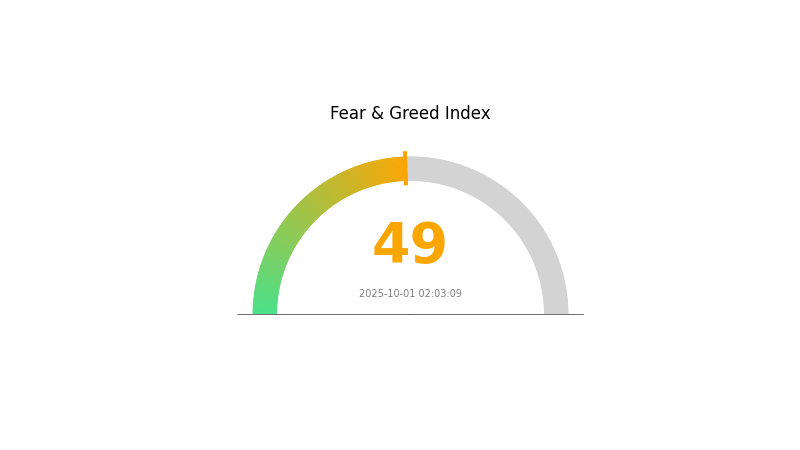

QKC Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently exhibiting a balanced sentiment, with the Fear and Greed Index at 49, indicating a neutral position. This suggests that investors are neither overly pessimistic nor excessively optimistic about the market's direction. Such equilibrium often presents opportunities for cautious traders to reassess their strategies and potentially identify undervalued assets. However, it's crucial to remain vigilant as market conditions can swiftly change. As always, thorough research and risk management are essential when navigating the crypto landscape.

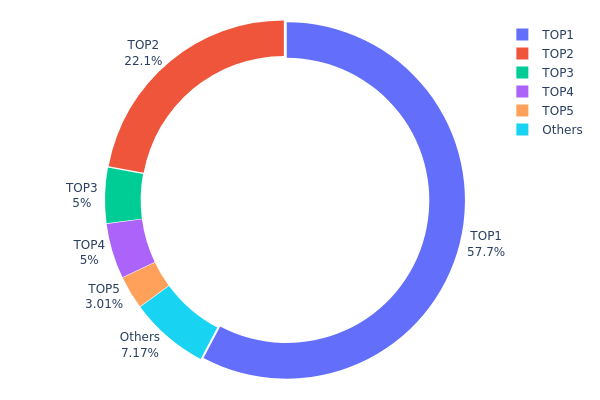

QKC Holdings Distribution

The address holdings distribution data for QKC reveals a highly concentrated ownership structure. The top address holds a staggering 57.73% of the total supply, while the second-largest holder accounts for 22.09%. This means that nearly 80% of QKC tokens are controlled by just two addresses. The third and fourth largest holders each possess 5% of the supply, further concentrating ownership among a small group of entities.

This extreme concentration of QKC holdings raises significant concerns about market stability and vulnerability to price manipulation. With such a large portion of tokens in few hands, there is an increased risk of sudden large-scale sell-offs that could dramatically impact the market price. Moreover, this concentration undermines the principle of decentralization, which is fundamental to many cryptocurrency projects.

The current distribution pattern suggests a low level of on-chain structural stability for QKC. It also indicates that the token's circulation among a broader base of users and investors is limited, potentially hindering organic market growth and adoption. This concentration could deter new investors due to perceived risks of market dominance by a few large holders.

Click to view the current QKC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...514b43 | 5773253.15K | 57.73% |

| 2 | 0xbb3d...8fc34b | 2209496.93K | 22.09% |

| 3 | 0xb4c9...897ee1 | 500000.00K | 5.00% |

| 4 | 0x9539...2d4cd0 | 500000.00K | 5.00% |

| 5 | 0xf977...41acec | 300647.88K | 3.00% |

| - | Others | 716602.04K | 7.18% |

II. Key Factors Influencing QKC's Future Price

Institutional and Whale Dynamics

- Corporate Adoption: Major companies adopting QKC technology could significantly impact its price and market perception.

- National Policies: Government regulations and policies related to cryptocurrencies may affect QKC's adoption and value.

Macroeconomic Environment

- Hedge Against Inflation: QKC's performance in inflationary environments could influence investor interest.

- Geopolitical Factors: International political and economic situations may impact cryptocurrency markets, including QKC.

Technological Development and Ecosystem Building

- Ecosystem Applications: Major DApps and ecosystem projects built on QKC could drive demand and value.

III. QKC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00594 - $0.00619

- Neutral prediction: $0.00619 - $0.00724

- Optimistic prediction: $0.00724 - $0.00829 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00666 - $0.00931

- 2028: $0.00678 - $0.01035

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00964 - $0.01176 (assuming steady market growth)

- Optimistic scenario: $0.01176 - $0.01388 (assuming strong market performance)

- Transformative scenario: $0.01388 - $0.01728 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: QKC $0.01728 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00829 | 0.00619 | 0.00594 | 0 |

| 2026 | 0.00984 | 0.00724 | 0.00601 | 17 |

| 2027 | 0.00931 | 0.00854 | 0.00666 | 38 |

| 2028 | 0.01035 | 0.00892 | 0.00678 | 44 |

| 2029 | 0.01388 | 0.00964 | 0.00771 | 56 |

| 2030 | 0.01728 | 0.01176 | 0.00729 | 90 |

IV. QKC Professional Investment Strategies and Risk Management

QKC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Value investors and blockchain technology enthusiasts

- Operational suggestions:

- Accumulate QKC during market dips

- Set price targets for partial profit-taking

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to manage downside risk

- Take profits at resistance levels

QKC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for QKC

QKC Market Risks

- High volatility: QKC price can experience significant fluctuations

- Limited liquidity: May affect ability to enter or exit positions

- Market sentiment: Susceptible to overall crypto market trends

QKC Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations

- Cross-border compliance: Varying regulations across jurisdictions

- Tax implications: Evolving tax laws for cryptocurrency transactions

QKC Technical Risks

- Network security: Potential vulnerabilities in blockchain infrastructure

- Scalability challenges: Meeting increasing transaction demands

- Smart contract risks: Potential bugs or exploits in smart contracts

VI. Conclusion and Action Recommendations

QKC Investment Value Assessment

QuarkChain offers potential long-term value through its sharding technology and high TPS capabilities. However, short-term risks include market volatility and regulatory uncertainties.

QKC Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the technology

✅ Experienced investors: Consider dollar-cost averaging and set clear exit strategies

✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large trades

QKC Trading Participation Methods

- Spot trading: Buy and sell QKC on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore DeFi protocols supporting QKC

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is QKC a good investment?

QKC shows potential for long-term growth. Predictions indicate value increase by 2030, despite current bearish sentiment. Consider it for diversified crypto portfolios.

What is the price prediction for QuarkChain in 2030?

Based on current forecasts, QuarkChain's price is predicted to reach approximately $0.007056 by 2030. This projection reflects a bearish sentiment in the long-term market outlook for QKC.

What is the price prediction for Qtum in 2025?

Based on expert analysis, the estimated average price for Qtum in 2025 is around $16.63. This prediction suggests potential growth, but price fluctuations are possible.

What is the XRP price prediction in 2025?

Based on current trends, XRP is predicted to reach around $1.50 to $2.00 by the end of 2025, with potential for higher peaks during bullish periods.

2025 SUTPrice Prediction: Comprehensive Analysis and Forecast of Market Trends and Value Projections

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

ICP Crypto: Why Internet Computer Could Surge to $30 AUD

2025 FET Price Prediction: Analyzing Market Trends and Future Potential for Fetch.ai's Native Token

Calculate Pi Coin to GBP: Price, Forecast, and Profit Potential

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?