2025 RAY Price Prediction: Analyzing Market Trends and Potential Growth Factors for Raydium's Native Token

Introduction: RAY's Market Position and Investment Value

Raydium (RAY), as an automated market maker (AMM) and liquidity provider built on the Solana blockchain, has made significant strides since its inception in 2021. As of 2025, Raydium's market capitalization has reached $353,640,076, with a circulating supply of approximately 268,254,628 tokens, and a price hovering around $1.3183. This asset, often referred to as the "Solana DeFi Pioneer," is playing an increasingly crucial role in decentralized finance and automated market making.

This article will provide a comprehensive analysis of Raydium's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. RAY Price History Review and Current Market Status

RAY Historical Price Evolution

- 2021: Raydium launched on Solana, price reached all-time high of $16.83 in September

- 2022: Crypto winter, price dropped significantly to $0.134391 by end of December

- 2023-2024: Gradual recovery as overall crypto market improved

RAY Current Market Situation

As of November 15, 2025, RAY is trading at $1.3183, down 4.8% in the last 24 hours. The current price represents a 92.17% decrease from its all-time high of $16.83 set on September 13, 2021. RAY has a market cap of $353.64 million, ranking 183rd among all cryptocurrencies. The circulating supply is 268,254,628 RAY, which is 48.33% of the total supply of 555 million tokens. Trading volume in the past 24 hours stands at $3.13 million. Despite recent declines, RAY still maintains a significant presence in the Solana ecosystem as a key DEX and liquidity provider.

Click to view the current RAY market price

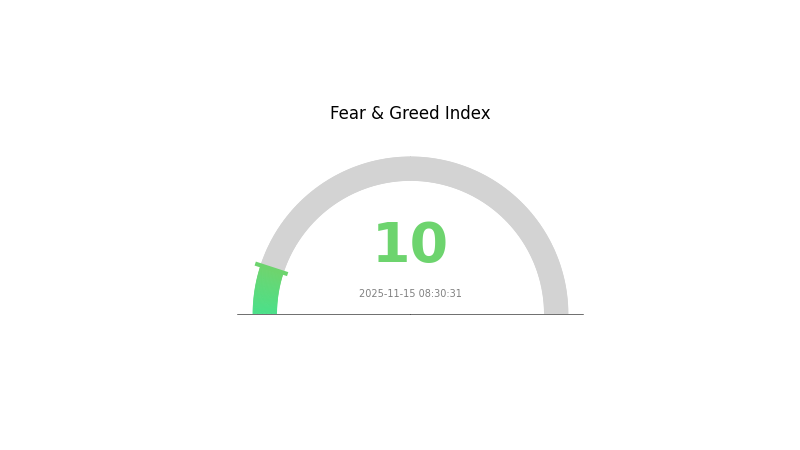

RAY Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index plummeting to 10. This level of pessimism often indicates a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed, diversify your portfolio, and consider using Gate.com's advanced trading tools to navigate these turbulent market conditions.

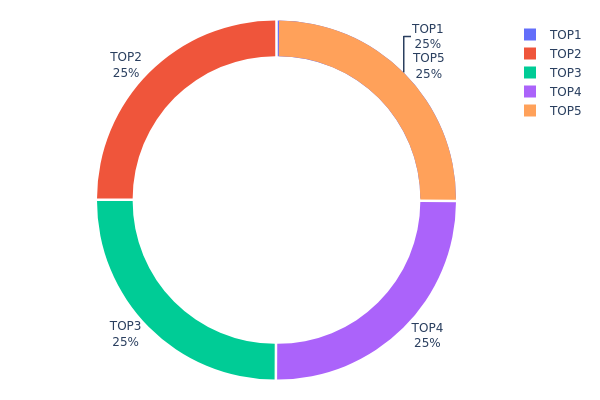

RAY Holdings Distribution

The address holdings distribution data for RAY reveals a highly concentrated ownership structure. The top 5 addresses each hold 138,590.93K RAY tokens, accounting for 24.97% of the total supply individually. Collectively, these top 5 addresses control 124.85% of RAY tokens, indicating a significant level of concentration.

This extreme concentration of RAY tokens in a few addresses raises concerns about market manipulation and price volatility. With such a large portion of the supply controlled by a small number of entities, there is potential for coordinated actions that could significantly impact the market. The negative percentage (-24.85%) for "Others" suggests a complex distribution structure, possibly involving staking, lending, or other DeFi mechanisms.

The current distribution pattern reflects a low degree of decentralization for RAY, which may affect its on-chain stability and resistance to market shocks. This concentration could lead to increased price volatility and susceptibility to large-scale sell-offs or accumulation events, potentially impacting smaller holders and overall market dynamics.

Click to view the current RAY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 8pFhUq...tVQc6G | 138590.93K | 24.97% |

| 2 | 8pFhUq...tVQc6G | 138590.93K | 24.97% |

| 3 | 8pFhUq...tVQc6G | 138590.93K | 24.97% |

| 4 | 8pFhUq...tVQc6G | 138590.93K | 24.97% |

| 5 | 8pFhUq...tVQc6G | 138590.93K | 24.97% |

| - | Others | -137956786.31 | -24.85% |

II. Core Factors Affecting RAY's Future Price

Technical Development and Ecosystem Building

- Ecosystem Applications: Raydium, as a decentralized exchange and automated market maker protocol on the Solana blockchain, has several key DApps and ecosystem projects. These include the Raydium DEX for token swaps, liquidity pools for yield farming, and the AcceleRaytor launchpad for new project fundraising.

III. RAY Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.71 - $1.00

- Neutral prediction: $1.00 - $1.32

- Optimistic prediction: $1.32 - $1.45 (requires strong market recovery)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase

- Price range forecast:

- 2027: $1.19 - $2.00

- 2028: $1.24 - $2.37

- Key catalysts: Broader crypto market recovery, increased DeFi adoption

2030 Long-term Outlook

- Base scenario: $1.51 - $2.51 (assuming steady growth in Solana ecosystem)

- Optimistic scenario: $2.51 - $3.69 (with significant DeFi and NFT market expansion)

- Transformative scenario: $3.69+ (with breakthrough applications on Solana)

- 2030-12-31: RAY $3.69 (potential peak if market conditions are highly favorable)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.44837 | 1.3167 | 0.71102 | 0 |

| 2026 | 1.47931 | 1.38254 | 0.85717 | 4 |

| 2027 | 2.00329 | 1.43092 | 1.18767 | 8 |

| 2028 | 2.36961 | 1.71711 | 1.23632 | 30 |

| 2029 | 2.9833 | 2.04336 | 1.59382 | 54 |

| 2030 | 3.6946 | 2.51333 | 1.508 | 90 |

IV. Professional RAY Investment Strategies and Risk Management

RAY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate RAY tokens during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens in secure hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Solana ecosystem developments for potential catalysts

- Set strict stop-loss orders to manage downside risk

RAY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance RAY with other assets in the Solana ecosystem

- Options strategies: Use put options for downside protection when available

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for RAY

RAY Market Risks

- Volatility: High price fluctuations common in the crypto market

- Liquidity: Potential challenges during extreme market conditions

- Competition: Emerging DEX platforms on Solana or other blockchains

RAY Regulatory Risks

- Regulatory uncertainty: Potential impact of future DeFi regulations

- Compliance challenges: Adapting to evolving global cryptocurrency laws

- Geopolitical factors: Changes in government stances on cryptocurrencies

RAY Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Dependence on Solana's network performance

- Interoperability challenges: Limited cross-chain functionality

VI. Conclusion and Action Recommendations

RAY Investment Value Assessment

RAY offers exposure to the growing Solana DeFi ecosystem but faces significant competition and regulatory uncertainties. Long-term potential exists, but short-term volatility is expected.

RAY Investment Recommendations

✅ Beginners: Start with small positions, focus on education and understanding the Solana ecosystem ✅ Experienced investors: Consider RAY as part of a diversified DeFi portfolio, implement risk management strategies ✅ Institutional investors: Conduct thorough due diligence, consider RAY for strategic exposure to Solana-based DeFi

RAY Participation Methods

- Spot trading: Purchase RAY tokens on Gate.com

- Yield farming: Participate in liquidity pools on the Raydium platform

- Staking: Earn rewards by staking RAY tokens through supported platforms

Cryptocurrency investments carry extremely high risks and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and it is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

Does Raydium have a future?

Yes, Raydium has a promising future. As a leading DEX on Solana, it's poised for growth with increasing DeFi adoption and Solana's scalability. Its innovative features and strong community support suggest continued relevance in the evolving crypto landscape.

Is Raydium a buy or sell?

Raydium is a buy. Its innovative DeFi features and growing ecosystem on Solana make it a promising investment in the Web3 space.

Is Raydium a good project?

Yes, Raydium is a promising project in the Solana ecosystem. It offers fast, low-cost trading and yield farming opportunities, making it attractive for DeFi users.

What is the price prediction for rad crypto in 2030?

Based on market trends and potential growth, RAY crypto could reach $50-$75 by 2030, driven by increased adoption and ecosystem expansion.

What is MET: Understanding Metabolic Equivalent of Task and Its Impact on Fitness

What is SLIM: Understanding the Simple Linear Iterative Clustering Algorithm for Image Segmentation

What is SRM: Understanding Supplier Relationship Management in Modern Business

2025 SNTR Price Prediction: Analyzing Market Trends and Potential Growth Factors

BOME vs SNX: A Comprehensive Comparison of Two Leading DeFi Tokens in 2024

Solana2025 price prediction: breakthrough potential and multiple analysis interpretation

Is cryptocurrency mining legal in Ukraine?

Dubai Pilots Crypto Payments, No Direct Ethereum Acceptance Confirmed

Lệnh Market là gì?

Tài Chính Phi Tập Trung Là Gì?

Buy The Dip Trong Tiền Điện Tử Là Gì?