Is Dogecoin Entering a New Bull Market? On-Chain Data and Futures Market Reveal Its Future Potential

Market frenzy is back, with Dogecoin leading the way for ‘veteran Memecoins’

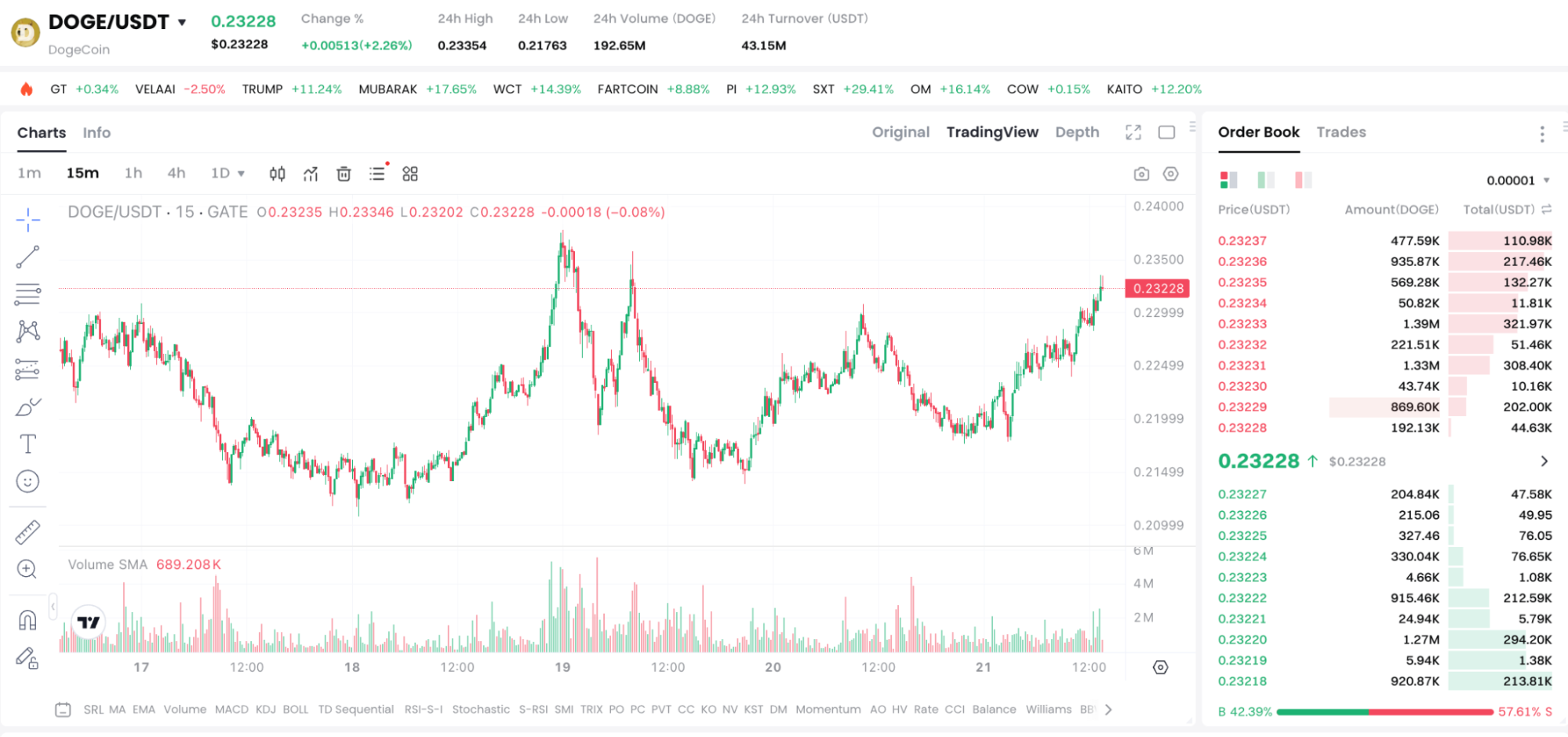

Chart:https://www.gate.com/trade/DOGE_USDT

Dogecoin is once again in the spotlight. Since the beginning of May, the old Memecoin, which was “born as a joke”, has suddenly become active, and the price has risen from $0.169 to $0.248 in the short term, an increase of more than 35%. Although it has now retraced to around $0.227, there is no lack of structural changes behind the rally. Unlike previous short-term sentiment hype, this rally is accompanied by on-chain activity, continued inflows of derivatives funds, and intensive discussions on the topic of ETFs, and the market seems to be reassessing the potential value of DOGE.

Key resistance has turned into support, and the watershed for long and short positions has shifted upwards

From a technical perspective, DOGE has recently completed an effective breakthrough of the key downtrend line within the year. This trend line had previously repeatedly suppressed the rebound of DOGE prices, and is now serving as a reference support line. More notably, DOGE has stabilized above the Ichimoku cloud chart, and the leading indicator has shown a bullish cross, indicating an upward trend in the medium term.

Currently, DOGE is building a consolidation platform in the range of $0.22 to $0.23. If this area holds and there is another surge to $0.25, the short-term target may quickly extend to the $0.29 to $0.31 range. On the contrary, breaking below $0.218 will temporarily end the short-term uptrend structure.

On-chain data releases strong signal: funds and users return synchronously

What’s really striking is the ‘explosive’ change in on-chain data. According to IntoTheBlock data, the number of new Dogecoin addresses surged by over 100% in a week, active wallets grew by more than 110%, and the sharp increase in zero-balance addresses also reflects a large number of new users trying to participate in the DOGE ecosystem.

This is different from many short-term speculative tokens: Dogecoin’s user growth this time is accompanied by a synchronous increase in on-chain interaction and transfer frequency, indicating that funds are not simply concentrated on exchanges, but more occurs between wallets and contracts. In other words, the ‘vitality’ of DOGE on-chain is reignited.

Derivatives market releases optimistic expectations, leveraged funds continue to enter the market

The activity in the futures market corresponds to on-chain behavior. According to CoinGlass data, the open interest of Dogecoin futures contracts surged from less than $1 billion to over $1.62 billion in two weeks, hitting a recent high. This indicates that not only spot investors but also leverage traders are actively betting on the future performance of DOGE.

Unlike the phased fluctuations from February to April, the DOGE futures open interest is still rising during price pullbacks, indicating that long funds have not withdrawn. This ‘strong expectation, weak reality’ situation may foreshadow the brewing of a mid-term market: price consolidation, waiting for new catalysts to drive the next breakthrough.

ETF topic remains hot, potentially becoming a key trigger for a $1 explosion

Although the Dogecoin ETF has not yet been approved, the ‘delay, not denial’ of the related ETF proposal by the SEC in May this year has sparked positive market interpretations. Some analysts pointed out that this may indicate that regulatory agencies have begun to seriously consider the financialization potential of Memecoins. If the DOGE ETF is eventually approved, the institutional buying and market attention it brings could replicate the explosive impact of the Bitcoin ETF.

Market data shows that ETF expectations are often important leading indicators of price trends, and even if they have not yet officially launched, they may provide positive support for the medium-term market.

Changes in group psychology: from ‘jokes’ to ‘part of asset allocation’

In the past, DOGE was often seen as a “community joke” or a product of Elon Musk’s jokes. However, over time, it has gradually built a stable community and a strong trading infrastructure. Today, DOGE has been incorporated into multiple mainstream wallets, exchanges, and payment platforms, and its “joke coin” label is gradually fading.

Especially in the context of the new AI boom and the emergence of Memecoins in the Solana ecosystem, DOGE, as the longest-standing and most active community Memecoin, its ‘classic’ nature has become a moat.

Market risks still exist, and the potential for growth needs to be viewed rationally

Despite the optimistic market expectations, there are still significant volatility risks in the short term:

- On-chain activity may involve ‘address brushing’ behavior, further verification is needed to confirm the authenticity of user growth;

- Technical breakthroughs may retreat due to insufficient volume;

- Macro environment such as Fed rate hikes or regulatory policy changes could also weigh on the entire crypto market.

Therefore, even if you are bullish on the long-term potential of DOGE, investors should also reasonably control their positions and avoid blindly chasing high prices in extreme emotional situations.

Conclusion: Can DOGE fulfill the promise of reaching $1?

Dogecoin has once again come to a crossroads of destiny. From on-chain data to the futures market, from technical charts to ETF expectations, signals from all aspects indicate that DOGE is on the eve of the next bull run. Although $1 still sounds distant, what the market may need is perhaps just a spark. Finding signals in turmoil, staying calm in emotions, may be the true way to unlock the ‘DOGE dream’.

Nasdaq 100 Index Latest Updates and Investment Strategies

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Dogecoin price latest analysis in 2025: DOGE market dynamics and investment strategies

2025 Top Crypto Overview: Leading the Market in Innovation

Decoding Top Crypto: How to Choose the Most Promising Digital Assets

Investor Must-Read: Revealing Top Crypto Assets Ranking and Future Promising Coins

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?