PVU vs MANA: A Comparative Analysis of Two Leading Blockchain Gaming Tokens

Introduction: Investment Comparison of PVU vs MANA

In the cryptocurrency market, the comparison between PVU vs MANA has always been a topic that investors cannot ignore. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning.

PlantVsUndead (PVU): Since its launch, it has gained market recognition for its combination of the popular Plants vs Zombies game with NFT technology.

Decentraland (MANA): Since its inception in 2017, it has been hailed as a blockchain-based virtual world platform, aiming to solve the problem of platform providers earning intermediate profits for decentralized open-source projects.

This article will comprehensively analyze the investment value comparison between PVU vs MANA, focusing on historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, and attempt to answer the question that investors care about most:

"Which is the better buy right now?" I. Historical Price Comparison and Current Market Status

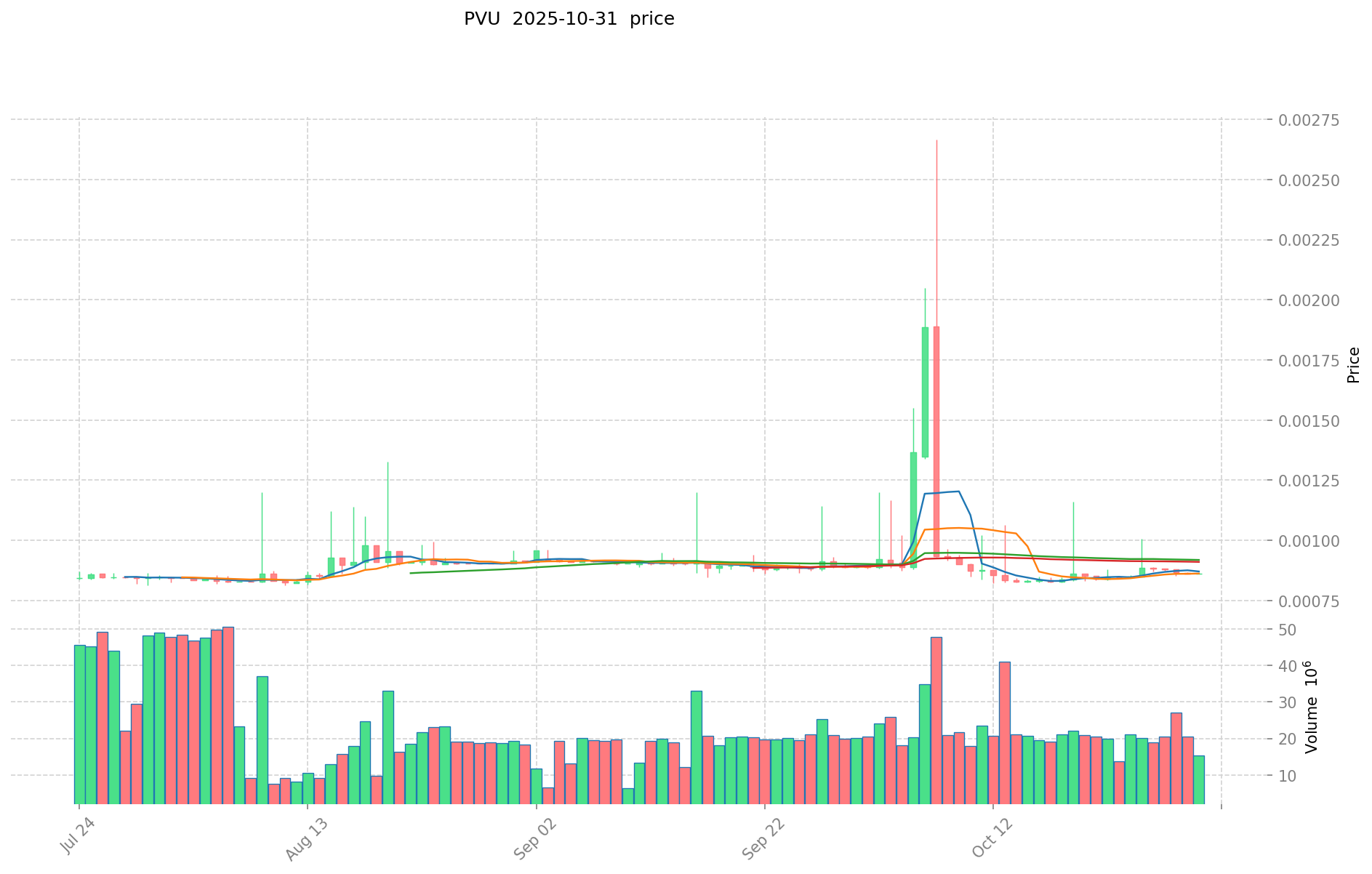

PlantVsUndead (PVU) and Decentraland (MANA) Historical Price Trends

- 2021: PVU reached its all-time high of $24.73 due to the initial hype around play-to-earn games.

- 2021: MANA hit its all-time high of $5.85 in November, driven by the metaverse boom.

- Comparative analysis: During the bear market cycle, PVU plummeted from $24.73 to $0.00076988, while MANA showed more resilience, dropping from $5.85 to its current level.

Current Market Situation (2025-11-01)

- PVU current price: $0.0006541

- MANA current price: $0.226

- 24-hour trading volume: PVU $18,951.16 vs MANA $125,826.76

- Market Sentiment Index (Fear & Greed Index): 29 (Fear)

Click to view real-time prices:

- Check PVU current price Market Price

- Check MANA current price Market Price

II. Key Factors Affecting PVU vs MANA Investment Value

Supply Mechanism Comparison (Tokenomics)

- PVU: Limited supply mechanism with potential deflationary model

- MANA: Fixed supply with controlled issuance

- 📌 Historical Pattern: Supply mechanisms drive cyclical price movements with scarcity creating value appreciation during adoption phases.

Institutional Adoption and Market Applications

- Institutional Holdings: Limited institutional participation in both tokens compared to major cryptocurrencies

- Enterprise Adoption: MANA shows stronger integration within metaverse platforms and virtual experiences

- Regulatory Stance: Varying regulatory approaches across jurisdictions with greater clarity emerging for metaverse tokens

Technical Development and Ecosystem Building

- PVU Technical Development: Focus on gaming ecosystem sustainability and play-to-earn mechanics

- MANA Technical Development: Continued development of Decentraland platform with virtual land economics

- Ecosystem Comparison: MANA demonstrates stronger ecosystem integration with established NFT marketplaces and virtual experiences

Macroeconomic Factors and Market Cycles

- Inflation Environment Performance: Digital assets generally positioned as alternative investments during inflation

- Macroeconomic Monetary Policy: Interest rates and dollar strength impact overall crypto market sentiment including both tokens

- Geopolitical Factors: Growing interest in digital ownership and metaverse participation across borders

III. 2025-2030 Price Prediction: PVU vs MANA

Short-term Forecast (2025)

- PVU: Conservative $0.000429 - $0.00065 | Optimistic $0.00065 - $0.0008515

- MANA: Conservative $0.142695 - $0.2265 | Optimistic $0.2265 - $0.251415

Mid-term Forecast (2027)

- PVU may enter a growth phase, with expected price range of $0.000489864375 - $0.000945945

- MANA may enter a bullish market, with expected price range of $0.269006405625 - $0.353955796875

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Forecast (2030)

- PVU: Base scenario $0.001016130740625 - $0.001244760157265 | Optimistic scenario $0.001244760157265 - $0.001854692634325

- MANA: Base scenario $0.300720685744891 - $0.411946144856015 | Optimistic scenario $0.411946144856015 - $0.609680294386903

Disclaimer: This forecast is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

PVU:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0008515 | 0.00065 | 0.000429 | 0 |

| 2026 | 0.0009384375 | 0.00075075 | 0.0003828825 | 14 |

| 2027 | 0.000945945 | 0.00084459375 | 0.000489864375 | 29 |

| 2028 | 0.00113699210625 | 0.000895269375 | 0.000752026275 | 36 |

| 2029 | 0.001473389573906 | 0.001016130740625 | 0.000650323674 | 55 |

| 2030 | 0.001854692634325 | 0.001244760157265 | 0.000709513289641 | 90 |

MANA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.251415 | 0.2265 | 0.142695 | 0 |

| 2026 | 0.327371775 | 0.2389575 | 0.2007243 | 5 |

| 2027 | 0.353955796875 | 0.2831646375 | 0.269006405625 | 25 |

| 2028 | 0.423685088859375 | 0.3185602171875 | 0.1911361303125 | 40 |

| 2029 | 0.452769636688593 | 0.371122653023437 | 0.29689812241875 | 64 |

| 2030 | 0.609680294386903 | 0.411946144856015 | 0.300720685744891 | 82 |

IV. Investment Strategy Comparison: PVU vs MANA

Long-term vs Short-term Investment Strategies

- PVU: Suitable for investors focused on gaming ecosystems and play-to-earn potential

- MANA: Suitable for investors interested in metaverse development and virtual real estate

Risk Management and Asset Allocation

- Conservative investors: PVU 10% vs MANA 90%

- Aggressive investors: PVU 30% vs MANA 70%

- Hedging tools: Stablecoin allocation, options, cross-currency combinations

V. Potential Risk Comparison

Market Risks

- PVU: High volatility, limited liquidity, and dependence on gaming trends

- MANA: Sensitive to overall metaverse market sentiment and adoption rates

Technical Risks

- PVU: Scalability, network stability, and game ecosystem sustainability

- MANA: Platform security, virtual land scarcity management, and user experience

Regulatory Risks

- Global regulatory policies may have different impacts on gaming tokens (PVU) and metaverse tokens (MANA)

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- PVU advantages: Niche gaming market, potential for rapid growth if play-to-earn model gains traction

- MANA advantages: Established metaverse platform, stronger ecosystem integration, potential for long-term value appreciation

✅ Investment Advice:

- New investors: Consider MANA for its more established ecosystem and lower volatility

- Experienced investors: Diversify with a larger allocation to MANA and a smaller, speculative position in PVU

- Institutional investors: Focus on MANA for its broader market applications and potential institutional adoption

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between PVU and MANA? A: PVU is focused on the play-to-earn gaming ecosystem, while MANA is centered around the metaverse and virtual real estate. PVU has shown higher volatility and is considered more speculative, whereas MANA has a more established ecosystem and broader market applications.

Q2: Which token has performed better historically? A: MANA has shown more resilience during market downturns. While PVU reached a higher all-time high of $24.73, it has since experienced a more significant drop. MANA, despite also declining from its all-time high of $5.85, has maintained a higher relative value.

Q3: How do the supply mechanisms of PVU and MANA differ? A: PVU has a limited supply mechanism with a potential deflationary model, while MANA has a fixed supply with controlled issuance. These differences can impact their long-term value propositions and price dynamics.

Q4: What are the main risk factors for investing in PVU and MANA? A: PVU faces risks related to high volatility, limited liquidity, and dependence on gaming trends. MANA's risks include sensitivity to overall metaverse market sentiment and adoption rates. Both tokens are subject to regulatory risks, which may vary depending on global policies towards gaming and metaverse tokens.

Q5: Which token is better suited for long-term investment? A: MANA is generally considered better suited for long-term investment due to its more established ecosystem, stronger institutional adoption potential, and broader market applications within the metaverse sector. However, individual investment decisions should be based on personal risk tolerance and investment goals.

Q6: How might institutional adoption affect PVU and MANA in the future? A: Institutional adoption could significantly impact both tokens, but MANA is more likely to benefit in the near term. MANA's integration with metaverse platforms and virtual experiences makes it more attractive for institutional investors looking to gain exposure to the growing digital asset and virtual world markets.

Q7: What factors should be considered when allocating investments between PVU and MANA? A: Investors should consider their risk tolerance, investment horizon, and belief in the potential of gaming ecosystems versus metaverse development. A conservative approach might allocate more towards MANA (e.g., 90% MANA, 10% PVU), while a more aggressive strategy could increase exposure to PVU (e.g., 70% MANA, 30% PVU). Additionally, overall market conditions, regulatory developments, and technological advancements in both sectors should be monitored closely.

Share

Content