Gate Research: BSOL Inflows Surpass $600 Million | Leverage in the Bitcoin Derivatives Market Rises Rapidly

Summary

- The $93,000–94,000 zone has become a key short-term level for BTC, requiring close attention to whether resistance holds or breaks;

- BTC’s weakness stems from major vulnerabilities in the balance sheets of one or two primary market makers, with Bitmine claiming to continue accumulating ETH;

- Vitalik calls on all community stakeholders to collaborate in completing Ethereum’s quantum-resistant upgrade over the next four years;

- NVIDIA’s earnings exceeded market expectations, driving rebounds in U.S. stocks and the crypto market;

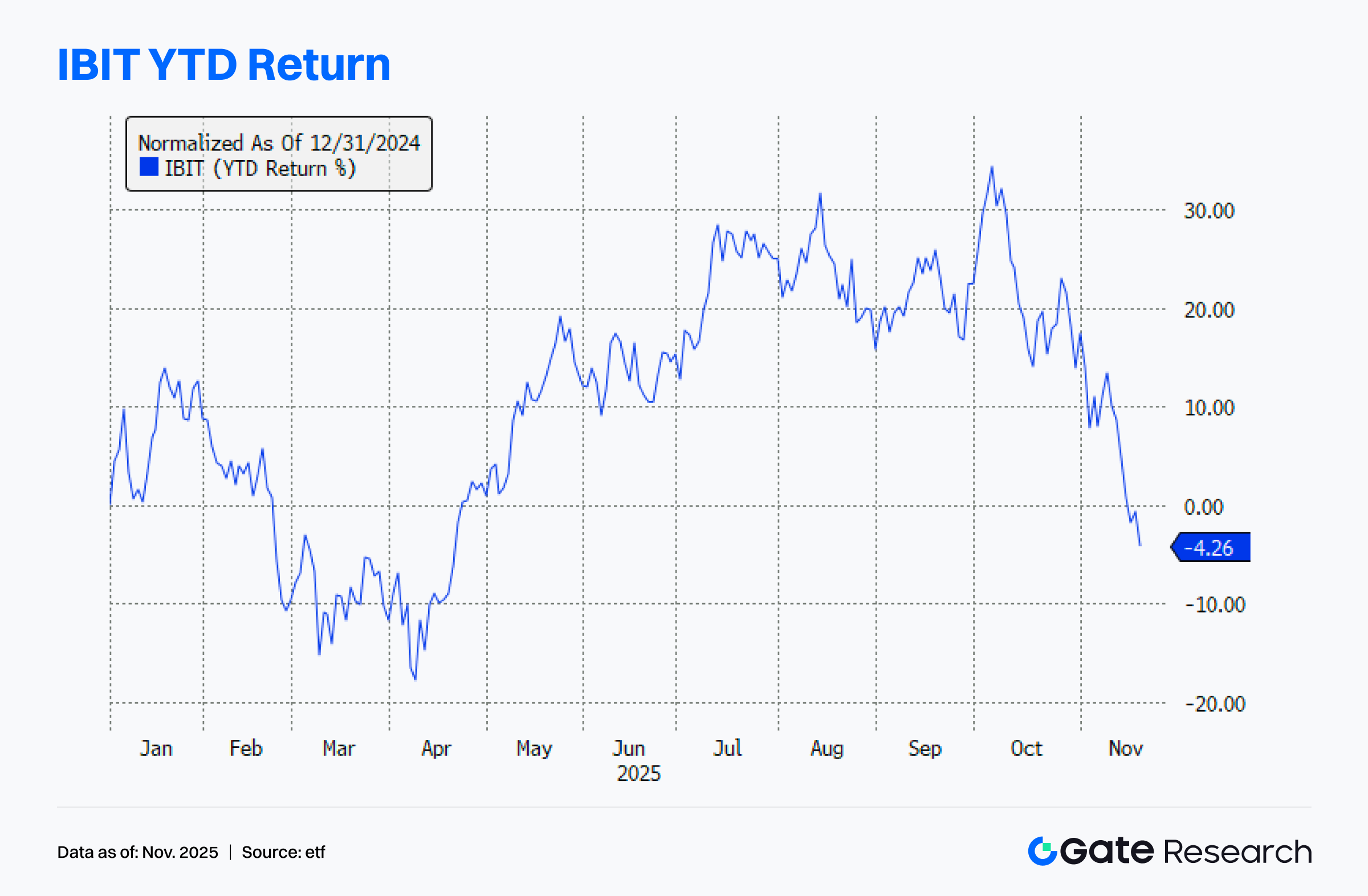

- IBIT reported net outflows of $523.15 million on Tuesday, marking its largest net outflow ever;

- BSOL saw inflows of $23 million on Tuesday, with total inflows now surpassing $600 million;

- Perpetual futures traders rapidly increased leverage during Bitcoin’s price decline, contributing to one of the reasons Bitcoin fell 14% over the past week.

Market Overview

Market Commentary

- BTC Market — BTC is currently trading around $92,700, continuing the weak consolidation from early on the 20th before finding support in the major demand zone at $89,000 and staging a rebound. While buying shows signs of warming up, the overall market structure indicates that if trading volume fails to sustain amplification, this rebound may only be a phased repair. Technically, the $93,000–94,000 zone has turned into a key short-term supply area: short-term moving averages show repair with MA5 crossing above MA10 and MA30, and MACD forming a bottom bullish crossover with expanding red bars, but overhead pressure remains significant. If buyers can break through with strong volume and hold above $94,000, the next upside targets $96,000–98,000; conversely, if it loses the $90,000 level again, the rebound may end, with price potentially retesting support at $87,000–88,000.

- ETH Market — ETH is currently trading around $3,040, having briefly probed the major demand zone at $2,900 in the early hours today before quickly finding support and launching a rebound that peaked at $3,080, followed by a minor pullback on resistance. Buying has warmed up, but overall volume hasn’t yet shown clear amplification, with market structure suggesting the current rebound remains phased repair in nature. Technically, the $3,100–3,150 zone has turned into a key short-term supply area: MA5 has successfully crossed above MA10 and is approaching MA30, repairing the short-term trend; MACD has just formed a bottom bullish crossover with red bars starting to expand, indicating gradual recovery in bullish momentum. If follow-through comes with volume amplification to break and hold above $3,150, upside targets $3,300–3,400; otherwise, persistent resistance and a loss below the $3,000 psychological level could end the rebound, with price potentially retesting the $2,900–3,000 support band.

- Altcoins — This week, altcoins overall followed the broader market’s weakness downward, with some low-cap tokens achieving brief rebounds through controlled accumulation and contract pumps/dumps—traders should exercise extreme caution.

- Stablecoins — Stablecoin total market cap currently stands at $303.28 billion, down $2.164 billion over the past week amid market adjustments, showing signs of a pullback from highs.

- Gas Fees — Ethereum network gas fees have generally stayed below 1 Gwei over the past week, with the highest hourly peak at 4.02 Gwei; as of November 20, the daily average gas fee is 0.587 Gwei.

Trending Tokens

Over the past 24 hours, the crypto market has declined overall. BTC has shown relative resilience, but most major altcoins are under pressure, with ETH down 2.5%. However, some tokens and sectors have carved out independent trends, with the privacy sector maintaining strong momentum—ZEC up over 10%—while SOL and HYPE have seen modest gains. Amid adjustments in most mainstream assets, TNSR, GIGA, and STRK tokens have stood out with impressive performances; the following will analyze the reasons for each token’s rise one by one.

TNSR Tensor (+102.63%, Market Cap $27M)

According to Gate market data, the TNSR token is currently quoted at $0.08375, up over 100% in the past 24 hours. Tensor is one of the earliest professional NFT trading platforms in the Solana ecosystem (launched in July 2022), holding the majority market share in Solana NFTs, and providing institutional-grade depth charts, real-time order books, and fast execution terminals. During the 2024 meme coin frenzy, Tensor capitalized by launching the socialized meme trading terminal Vector.

However, TNSR’s current surge is not driven by Tensor fundamentals, but rather a classic short squeeze from extremely high negative funding rates. Coinglass data shows that TNSR’s open interest has rapidly stacked up over the past 24 hours, with annualized funding rates exceeding 1,000% negative—the most extreme in the entire market; liquidations have surpassed $5 million in the past 24 hours, triggering a chain reaction squeeze.

GIGA Giga Chad meme (+61.29%, Market Cap $68.97M)

According to Gate market data, the GIGA token is currently quoted at $0.0071, up over 60% in the past 24 hours. GIGA is a community-driven token on the Solana chain themed around the classic “Giga Chad” meme, positioned as a lifestyle project blending fitness and self-deprecating culture.

GIGA’s recent surge is a classic case of whale-driven momentum combined with event catalysis. A well-known on-chain player publicly made large purchases, instantly igniting market sentiment; meanwhile, Gigachad supplements were listed on Walmart, with the post garnering over 360,000 views in the past 7 hours, bringing significant exposure to the GIGA meme coin. With whales leading the rhythm + community narrative resonance, and genuine product progress providing a compelling story, these factors together propelled the token’s rise.

STRK StarkNet (+22.63%, Market Cap $1.21B)

According to Gate market data, the STRK token is currently quoted at $0.2753, up about 22% in the past 24 hours. Starknet is a leading ZK-Rollup Layer 2 solution based on Ethereum, utilizing the STARK proof system and supporting the Cairo programming language to deliver high throughput, low fees, and privacy-protected scalability.

STRK’s rise benefits from an upgrade in Starknet’s narrative. The recent sharp rebound in the ZEC privacy narrative, combined with Starknet sharing founder Eli Ben-Sasson with Zcash, has propelled the “Ztarknet” concept: merging Zcash’s zero-knowledge privacy with Starknet’s scalability, where quantum-secure STARKs can provide protection for BTC. Additionally, Starknet’s underlying ZK technology has become the core architecture for multiple Perp DEX platforms. Starknet’s ZK infrastructure is shifting from potential to real-world implementation, boosting holder confidence.

Key Market Data Highlights

Tom Lee: Short-Term Market Volatility Due to Market Makers in Crisis, Requiring 6-8 Weeks for Repair

Tom Lee, chairman of the board at BitMine—one of Ethereum’s largest treasury firms—analyzed the recent sharp fluctuations in the cryptocurrency market. He pointed out that the current weakness in assets like BTC is not a fundamental collapse or systemic risk, but rather stems from major vulnerabilities in the balance sheets of one or two primary market makers, leading to liquidity exhaustion and thinned order books that amplify price swings. At the same time, “whale” investors are poised to offload BTC to trigger chain liquidations and leverage blowups, forming a classic short-selling trap—this echoes the aftermath of the largest deleveraging event in history on October 10, with the market fear index surging to extreme fear levels and total market cap evaporating over $1 trillion.

Lee emphasized that this is merely short-term pain and won’t alter Wall Street’s “super cycle” trend for Ethereum based on blockchain. He expects market makers to need 6-8 weeks to repair the liquidity gap—roughly starting after Thanksgiving (November 27), around early or mid-December—after which the market will gradually stabilize and rebound. He advises investors to avoid leverage to prevent further forced liquidations, view current lows as strategic accumulation opportunities, and notes that BitMine has already capitalized by increasing its ETH positions.

Ethereum Needs to Complete Quantum-Resistant Upgrade Within 4 Years; Vitalik Calls for Community Collaboration

Ethereum co-founder Vitalik Buterin warned at the recent Devconnect conference that if quantum computers continue developing at their current pace, they could crack elliptic curve cryptography (ECC) as early as before 2028, posing a substantial threat to Ethereum. In the next roughly four years, the Ethereum ecosystem must complete the migration to quantum-resistant cryptographic systems—not just replacing signature algorithms, but also supporting post-quantum signature schemes, key rotation, address structure updates, and more—meaning that wallets, nodes, protocols, Layer 2 solutions, and even users all need to collaborate.

Additionally, Vitalik discussed “ossification” at the protocol level, suggesting that Ethereum’s core Layer 1 should minimize frequent changes to facilitate stable and secure implementation of major structural upgrades, with all innovation better directed toward Layer 2, wallets, and privacy tools.

For the Ethereum ecosystem, this topic is of critical importance. If quantum computers break through ahead of schedule and the ecosystem hasn’t completed the migration, scenarios could arise involving mass private key cracks, asset thefts, and total trust collapse. “Four years” may seem ample, but for such a vast, decentralized, and slowly iterating system, it’s actually extremely urgent—this isn’t just a technical issue, but one of governance, compatibility, user migration costs, and ecosystem coordination.

NVIDIA Earnings Exceed Market Expectations; Jensen Huang Emphasizes “The AI Revolution Is Far From Peaking”

NVIDIA released its fiscal 2026 third-quarter earnings on November 19, with revenue reaching $57.01 billion—a 62% year-over-year surge and 22% sequential growth—surpassing market expectations of $54.92 billion. Adjusted EPS came in at $1.30, also topping the anticipated range of $1.25–1.27. Data center revenue hit $51.2 billion, accounting for nearly 90% of total revenue, fueled by strong demand for Hopper and Blackwell GPUs in generative AI and large language model training. Gross margins dipped slightly to 73.6% due to supply chain cost pressures, but the company reaffirmed that AI chip orders for 2025–2026 have exceeded $500 billion and raised its Q4 revenue guidance to $65 billion, well above the expected $61.66 billion.

CEO Jensen Huang stressed that the AI revolution is far from peaking, aiming to quell recent market concerns over an AI bubble and driving the stock up nearly 3% after hours. This positive spillover reached the crypto market, easing the prior weakness—triggered by missing Fed data and government shutdown fears that had pushed Bitcoin below the $90,000 level and evaporated over $1 trillion from total market cap—with BTC rebounding above $92,000.

Focus of the Week

BlackRock’s IBIT Fund Records Largest Net Outflow in History

As the world’s largest spot Bitcoin ETF, BlackRock’s iShares Bitcoin Trust Fund IBIT reported a net outflow of $523.15 million on Tuesday, surpassing the $463 million record set on November 14 and becoming the largest single-day outflow since its launch in January 2024. IBIT has seen continuous outflows since late October, with cumulative net outflows reaching $2.19 billion over the past four weeks. During November 11–17, IBIT recorded net outflows totaling $1.43 billion across five consecutive trading days. IBIT’s current assets under management stand at $72.76 billion, down from a peak of $99.4 billion on October 6 to around $70 billion now.

This wave of selling occurs amid heightened overall risk aversion in financial markets, so IBIT is not the only spot Bitcoin ETF facing downward pressure. Despite the significant recent outflows, market analysts generally believe that institutional investors are not exiting the Bitcoin market but rather rebalancing portfolios. The outflows align closely with the timing of Bitcoin breaking below $90,000, indicating that institutions are reducing risk exposure and adjusting positions rather than engaging in true “capitulation selling.” Large institutions are currently adopting more of a wait-and-see strategy, awaiting clearer macroeconomic signals. Once uncertainty eases, risk appetite and allocation intensity are expected to rebound swiftly.

Bitwise CEO: BSOL Total Inflows Surpass $600 Million

Bitwise CEO Hunter Horsley posted on X that on Tuesday, the Bitwise Solana ETF (BSOL) saw inflows of $23 million. Since its launch three and a half weeks ago, BSOL has recorded inflows every single day, with total inflows now exceeding $600 million.

Bitwise’s BSOL is the first spot Solana ETF. Since BSOL launched on October 28, Solana ETFs overall have posted net inflows for 16 consecutive days, with cumulative net inflows reaching $420.4 million. Meanwhile, two new Solana ETFs launched on Tuesday—from Fidelity’s FSOL and Canary Capital’s SOLC—with FSOL attracting $2.07 million in inflows on its first day, while SOLC saw no inflows. In contrast to the continuous net outflows from Bitcoin ETFs, Solana ETFs’ 16 straight days of inflows signal that altcoins are drawing investor interest and gradually gaining market recognition, with capital shifting from Bitcoin assets toward innovative altcoin ETFs featuring staking mechanisms. As one of the newest and most eye-catching ETFs currently, the massive inflows could further drive long-term demand for the SOL token.

Bitcoin Derivatives Market Forms “Dangerous” Setup, with Expectations of Quick Rebound Driving Leverage Surge

In the recent Bitcoin derivatives market, K33 Research has issued a warning: perpetual futures traders rapidly increasing leverage during Bitcoin’s price decline has not only formed a “dangerous market structure” but is also one of the reasons Bitcoin fell 14% over the past week. K33 points out that this combination of “rapid leverage addition + hope for a quick rebound” has in the past signaled subsequent more severe pullbacks or liquidation events.

Currently, perpetual futures traders’ open interest has increased by over 36,000 Bitcoins—the largest single-week gain since April 2023. At the same time, funding rates are significantly climbing, indicating traders are engaging in “catching a falling knife” behavior rather than defensive positioning. From a market impact perspective, this situation suggests that while a price rebound may occur, the risks hidden in the current structure are equally noteworthy. If leverage addition encounters a trigger point—such as failure to sustain upward momentum or liquidity blockage—it could lead to more longs being forced to liquidate, thereby sparking a chain reaction downside. Additionally, the divergence between relatively cautious institutional investors and aggressive retail participation could result in more violent short-term volatility.

Funding Weekly Recap

According to RootData, between November 14 and November 20, 2025, a total of 12 crypto and related projects announced completed financing rounds or acquisitions, spanning sectors including incubators, infrastructure, security solutions, gaming, AI, and more. Below is a brief overview of the top projects by funding size this week:

Doppel

Doppel announced on November 19 the completion of $70 million in funding, led by Bessemer Venture. Doppel aims to protect organizations from social engineering threats such as phishing, identity impersonation, and deepfake fraud. This new funding will support building a digital protection infrastructure that combines generative AI with expert human analysis.

Obex

Obex announced on November 18 that it has raised $37 million in funding, led by Framework Ventures.

Obex is a cryptocurrency incubator focused on incubating institutional-grade stablecoin projects, bringing innovative and diversified yield opportunities to the Sky ecosystem.

Deblock

Deblock announced on November 19 that it has raised €30 million in funding, led by Speedinvest.

Deblock is a digital currency institution regulated by European authorities and licensed by the French bank/ACPR. It is the first fintech company to obtain a crypto-asset market (MiCA) license from the French Financial Markets Authority (AMF), enabling it to offer integrated services that connect traditional payment functions with decentralized finance tools such as vaults.

Next Week to Watch

Token Unlocks

According to Tokenomist data, the market will see significant token unlocks for several major tokens over the next 7 days (November 21–28, 2025). The top 3 unlocks are as follows:

- ZRO will unlock tokens worth approximately $36.25 million in the next 7 days, accounting for 13.0% of its circulating supply.

- XRL will unlock approximately $21.83 million in the next 7 days, representing 4.8% of its circulating supply.

- SOON will unlock tokens worth approximately $18.71 million in the next 7 days, accounting for 4.2% of its circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- Coingecoko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

- TheBlock, https://www.theblock.co/post/379437/blackrock-bitcoin-etf-record-outflows

- ETF, https://www.etf.com/sections/features/ibit-suffers-record-daily-outflow-bitcoin-tumbles-below-90k

- TheBlock, https://www.theblock.co/post/379464/bitcoin-derivatives-market-forming-dangerous-setup-as-hopes-of-swift-bounce-fuel-rapid-leverage-climb-k33

- DLNews, https://www.dlnews.com/articles/defi/ethereum-cofounder-vitalik-buterin-favours-ossification/?utm_source=chatgpt.com

- Wu Blockchain, https://www.wublock123.com/article/6/52121

- CoinDesk, https://www.coindesk.com/markets/2025/11/19/nvidia-earnings-beat-strong-outlook-calms-jittery-markets-bitcoin-re-takes-usd90k

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

How to Do Your Own Research (DYOR)?

What Is Technical Analysis?

12 Best Sites to Hunt Crypto Airdrops in 2025