How to Do Copy Trading: A Complete Guide to Gate Futures Copy Trading

What Is Copy Trading

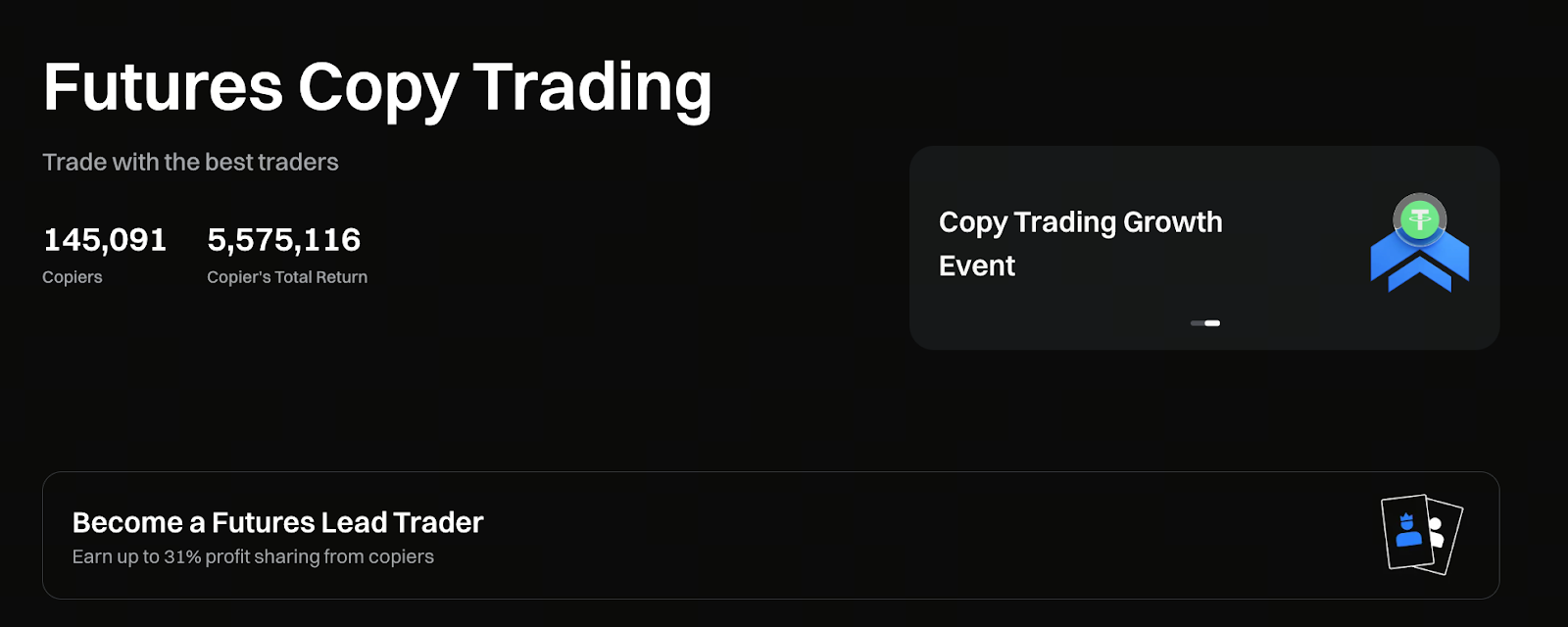

Image source: https://www.gate.com/copytrading

Copy Trading is a mechanism that enables investors to automatically mirror the trades of other market participants, most commonly found in crypto derivatives markets.

With this approach, followers can forgo their own market analysis. The system synchronizes the trader’s opening and closing positions, as well as any changes in their portfolio.

Understanding the underlying logic of Copy Trading is the essential first step in answering “how to copy trade.”

Why Are More People Searching “How to Copy Trade”

As volatility in the crypto market intensifies, contract trading demands sharper timing, deeper experience, and stronger emotional discipline.

Copy Trading appeals to many newcomers because it’s straightforward to execute and offers transparent strategies, making it a preferred entry point in derivatives trading.

However, Copy Trading is not a guaranteed profit tool. Success depends on following correct procedures and setting appropriate risk parameters.

Gate Copy Trading for Contracts: An Overview

Gate’s contract Copy Trading features:

- Access to major crypto derivatives trading pairs

- Full transparency of trader historical performance

- Customizable copy amounts and risk management settings

- Users can stop or adjust copy trades at any time

These capabilities provide users with significant flexibility as they learn how to copy trade.

How to Copy Trade: Gate Copy Trading Step-by-Step

To execute contract Copy Trading on Gate, follow these steps:

Step 1: Visit the Gate Copy Trading page. Review the list of available traders and evaluate their returns, drawdowns, and trading styles.

Step 2: Select traders. Focus on those with consistent long-term results and well-managed drawdowns, rather than short-term top performers.

Step 3: Configure copy parameters, including copy amount, maximum position ratio, and stop-loss limits.

Step 4: Confirm and activate copy trading. The system will automatically mirror the trader’s subsequent actions.

How to Select the Right Trader to Copy

Choosing the right trader is often more critical than the copying process itself.

Key metrics to assess include:

- Complete historical trading cycles

- Maximum drawdown within acceptable limits

- Stable profit curve

- Avoidance of frequent heavy-position trading

These factors directly impact the long-term success of Copy Trading.

Copy Amount, Leverage, and Risk Management Settings

Proper risk parameter configuration is vital for Gate contract Copy Trading:

- Do not invest all capital in one go

- Avoid excessive leverage

- Set clear maximum loss thresholds

Most Copy Trading failures stem from poor risk management rather than flawed strategies.

Common Copy Trading Mistakes and How to Avoid Them

Typical errors for beginners learning how to copy trade include:

- Focusing solely on returns while ignoring drawdowns

- Copying too many high-risk strategies simultaneously

- Overlooking changes in market conditions

- Neglecting regular reviews of copy trading performance

Avoiding these pitfalls can help stabilize your Copy Trading outcomes.

How to Continuously Improve Copy Trading Performance

Copy Trading requires ongoing adjustment, not just a one-time setup:

- Periodically evaluate trader performance

- Update strategies in response to market trends

- Diversify your copy trading portfolio

- Maintain emotional discipline and avoid frequent intervention

Continuous optimization increases the sustainability of Copy Trading.

Summary: How to Approach Copy Trading Rationally?

Success in Copy Trading requires more than simply clicking to copy. You need to understand the mechanism, carefully select traders, set risk parameters, and manage your positions over time. In Gate contract Copy Trading, maintaining rational expectations and prioritizing risk management can make Copy Trading an effective way to participate in the crypto derivatives market.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution