Massive Withdrawals from Bitcoin and Ethereum ETFs: Why Did $800 Million Suddenly Flow Out?

Image source: https://farside.co.uk/btc/

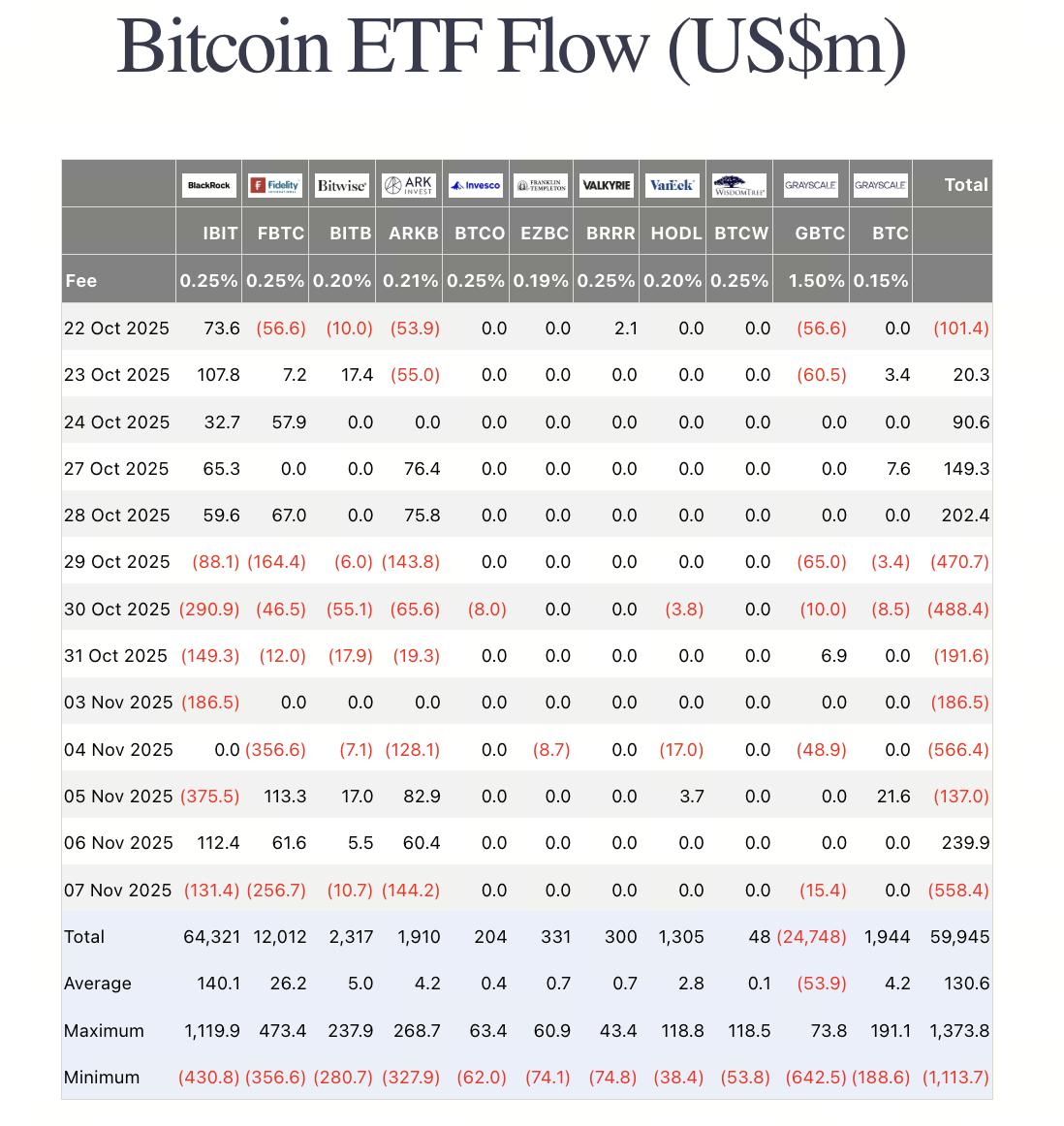

Recently, the digital asset market has sent a major signal: U.S. Bitcoin and Ethereum spot ETFs recorded a combined net outflow of approximately $797 million in a single day. For many new participants, this may seem like just another statistic. However, it actually reflects a notable shift in institutional investor sentiment. Let’s break down what happened.

Why Is This Withdrawal Considered Unusual?

First, we need to recognize the magnitude of these outflows. Data shows that Bitcoin ETFs saw single-day net outflows of around $577 million, while Ethereum ETFs lost about $219 million. This event sets a new record for recent months and marks the largest one-day Bitcoin ETF outflow since August 1, 2025. Second, this happened during a period of heightened market fear: the Crypto Fear & Greed Index dropped to 21 that day, placing it in extreme fear territory. For newcomers, this isn’t just money leaving—it’s a warning of changing institutional investment strategies.

What Drove the Capital Outflows?

Why did institutions make such large withdrawals at this time? Consider these factors:

- Macroeconomic dynamics: Federal Reserve Chair Jerome Powell signaled a hawkish stance, dampening hopes for rate cuts, and the U.S. Dollar Index (DXY) climbed above 100.

- Lower risk appetite: Crypto is closely linked to tech stocks, so when the tech sector underperforms, it exerts downward pressure on the crypto market.

- Institutional portfolio repositioning: Analysts view these consecutive, sizable outflows as active risk management and rebalancing by institutions, not mere panic selling.

How Is This Affecting Bitcoin and Ethereum Prices?

On the day of the outflows, the market remained stable, although there was evident downward pressure. Reports show Bitcoin briefly approached the $99,000 mark, while Ethereum fell below $3,150.

New investors should consider the following:

- ETF net flows are a signal, not a guaranteed turning point for prices.

- Large outflows mean weaker liquidity and increased downward pressure on prices, which could weigh on prices.

- This doesn’t mean the long-term trend has ended—it simply makes further adjustment more likely.

How Should New Investors Approach the Current Situation?

New investors should consider these strategies:

- Don’t panic or follow the crowd: Headlines like $800 Million Withdrawn can be alarming, but the key is understanding the underlying causes—not selling impulsively.

- Manage risk proactively: If you hold Bitcoin or Ethereum, consider realizing some gains. Alternatively, set reasonable stop-loss levels.

- Maintain a long-term perspective: If you’re bullish on crypto assets for the long haul, such events may present entry opportunities rather than serve as panic signals.

- Watch both capital flows and macroeconomic signals: Look beyond price alone to broader trends and policy shifts.

Outlook: Temporary Cool-Off or New Trend?

Currently, some analysts suggest:

- While short-term outflows are significant, the mid-term fundamentals of crypto—like Bitcoin’s scarcity and blockchain infrastructure—remain unchanged.

- If the dollar retraces, if quantitative tightening ceases, and rate-cut expectations return, capital could flow back into crypto assets.

- On the other hand, continued outflows and a loss of market confidence could trigger a longer adjustment period.

For new investors, treat this withdrawal as a signal, not an alarm. Stay calm, remain disciplined, and prepare for the next phase of the market cycle.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article