Meteora ($MET) Latest News Analysis: Opportunities and Risks Behind Price Fluctuations

What Is $MET?

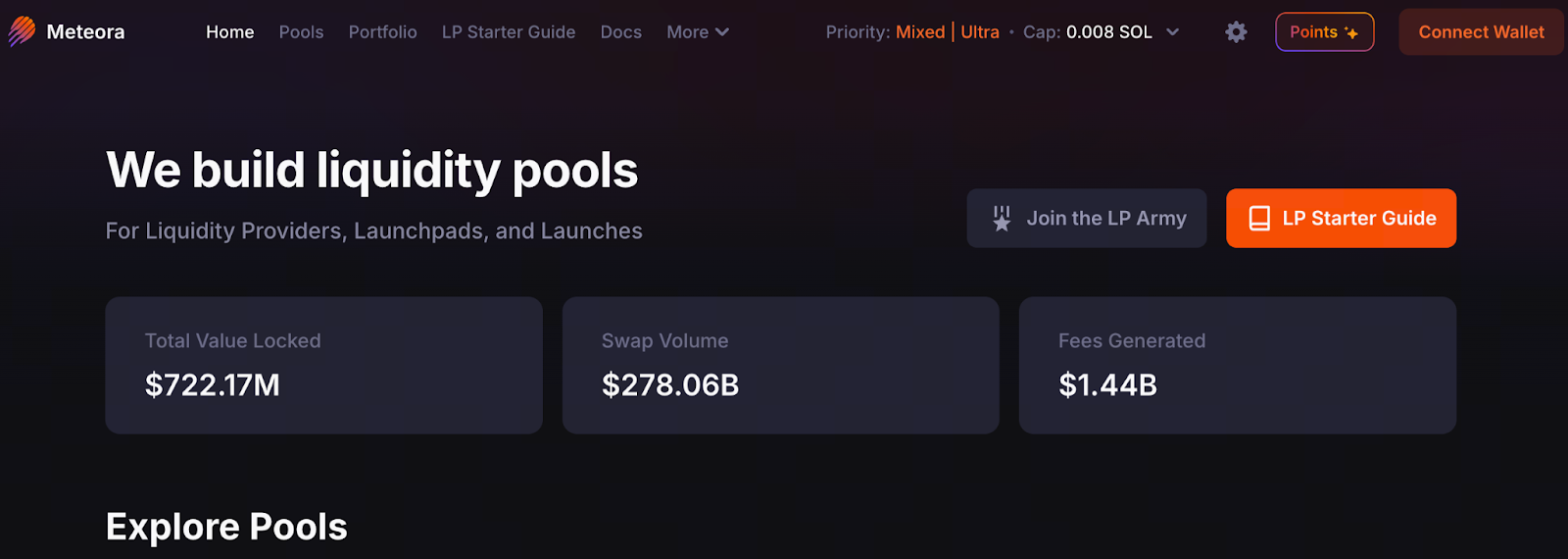

Source: https://www.meteora.ag/

Meteora (token symbol $MET) is a DeFi infrastructure project built on Solana, focused on delivering modular liquidity management across protocols. By leveraging Solana’s high-performance network, it maximizes capital efficiency. Idle funds are allocated across multiple pools. According to Coinlive, MET currently has a circulating supply of approximately 477.74 million, with a total supply nearing 997.74 million.

Recent Major Developments

Binance Listing and Liquidity Boost: In November 2025, MET became available as a spot trading pair on Binance, significantly increasing its visibility and liquidity. CoinMarketCap analysts characterized this as a high-risk listing but noted that it also provided MET with additional exposure on centralized exchanges (CEXs).

Whale Airdrops and Sell-Off Controversy

Recently, blockchain monitoring revealed that certain individual wallets received MET airdrops valued up to $10 million. These whales then sold their tokens, which prompted community concerns about the fairness of the distribution process. Earlier reports indicated that wallets associated with the TRUMP team held and sold substantial amounts of MET, sparking a trust crisis.

Current Price and Market Performance

Source: https://www.gate.com/trade/MET_USDT

As of November 20, 2025, MET trades at approximately $0.479, with a 24-hour price change of –1.35%. On November 12, MET surged more than 18% in a single day, reaching approximately $0.4816. Nonetheless, despite significant volatility, the token’s market cap and daily trading volume remain strong.

Core Value Propositions and Risks of $MET

Value Drivers:

- Modular Liquidity: As a DeFi infrastructure platform, Meteora allocates capital more efficiently across different protocols, increasing overall capital efficiency.

- Solana Blockchain Advantages: Solana’s high throughput and low transaction fees make MET highly scalable.

- CEX Expansion: Listings on Binance and the introduction of Coinbase perpetual futures contracts increase liquidity and attract a broader range of traders and institutions.

Risk Factors:

- Airdrop Sell Pressure: Whale sell-offs following airdrops can trigger sharp price declines.

- High Volatility: New listings on major platforms and the launch of perpetual contracts may result in significant short-term price swings.

- Trust Issues: Ongoing debates over airdrop distribution and fairness could undermine long-term community confidence.

Key Signals for Investors to Watch

- Exchange Activity: Track MET’s listings (spot and derivatives) on other leading exchanges.

- Whale Wallet Movements: Monitor changes in large token holders, airdrop claims, and subsequent sales.

- On-chain Metrics: Watch Meteora’s total value locked (TVL), trading volume, and performance of liquidity pools.

- Market Sentiment: As a DeFi infrastructure project, overall crypto market sentiment can have a significant impact on MET.

Summary

Recent milestones for Meteora ($MET)—including the Binance listing and whale airdrop sell-offs—have shaped its short-term volatility and long-term outlook. For investors confident in DeFi infrastructure and prepared for volatility, MET remains a noteworthy project. Nevertheless, significant risks remain: uncertainty and trust challenges may create major obstacles. Investors should closely monitor whale wallet behavior, on-chain data, and future exchange listings and activity to make informed decisions.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution