Privacy as the Key to Institutional Adoption: How ZKsync Redefines Blockchain Confidentiality

Blockchain Privacy

During periods of cryptocurrency market volatility, privacy coins have demonstrated exceptional resilience. Historically, market attention centered on user-focused privacy projects like Zcash. Today, the spotlight is shifting toward banks and major financial institutions—traditional powerhouses now actively exploring Zero-Knowledge Proof (ZK) technology to enable blockchain transactions that are transparent yet confidential.

Matter Labs CEO Alex Gluchowski highlights that privacy exists on two levels: user-level and system-level. User-level privacy focuses on protecting account information, while system-level privacy involves institutional data segregation and internal visibility. Simply put, financial institutions must keep their own transactions transparent while ensuring outsiders cannot access their internal activities.

Verifiable Privacy

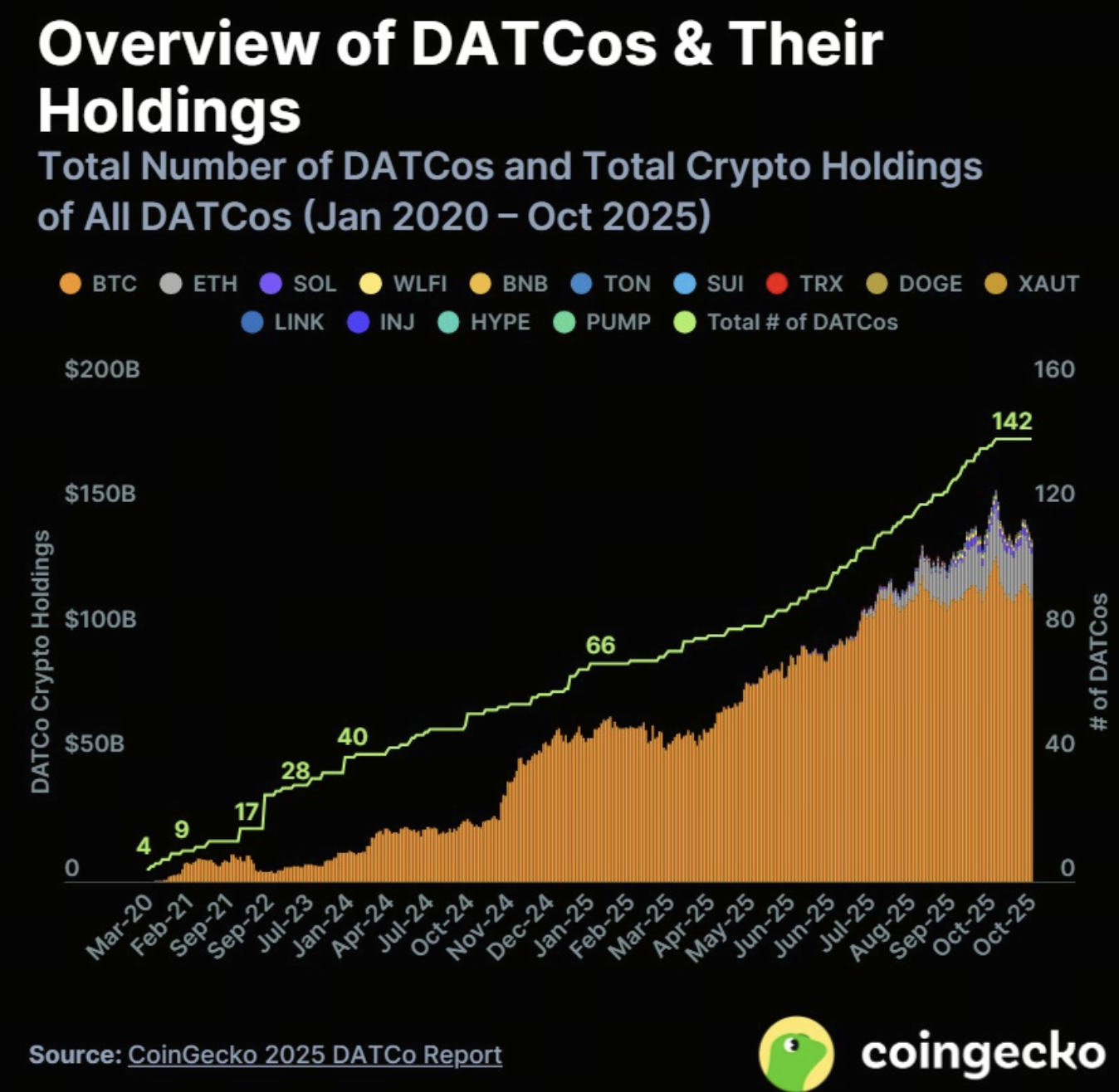

CoinGecko reports that more than 140 enterprises collectively hold around $137 billion in crypto assets. The pivotal factor in ushering institutional capital into blockchain settlement is the advancement of privacy protection layers.

(Source: CoinGecko)

This need has driven the emergence of new technical architectures: financial institutions want to operate on public blockchains without exposing internal cash flows, counterparties, or inventory positions. ZK technology strikes this balance, allowing outsiders to verify transaction legitimacy without revealing sensitive details.

Privacy as a Functional Layer of Financial Infrastructure

In past crypto bull markets, speculative themes like meme coins and NFTs often dominated, rather than actionable technologies. As regulatory policy becomes more defined, governments are starting to distinguish between privacy technologies and illicit uses.

For instance, while Tornado Cash was previously sanctioned by U.S. authorities, those restrictions have since eased, signaling that regulators now recognize the technical necessity of privacy rather than viewing it solely as a risk.

Today, privacy is no longer the preserve of crypto idealists—it is now an essential operational function for financial institutions.

Ethereum Ecosystem Privacy Upgrades

The rise of ZKsync exemplifies this trend. The Matter Labs team is dedicated to creating a verifiable private computation environment within the Ethereum ecosystem, empowering enterprises to run internal transactions on-chain while maintaining external auditability.

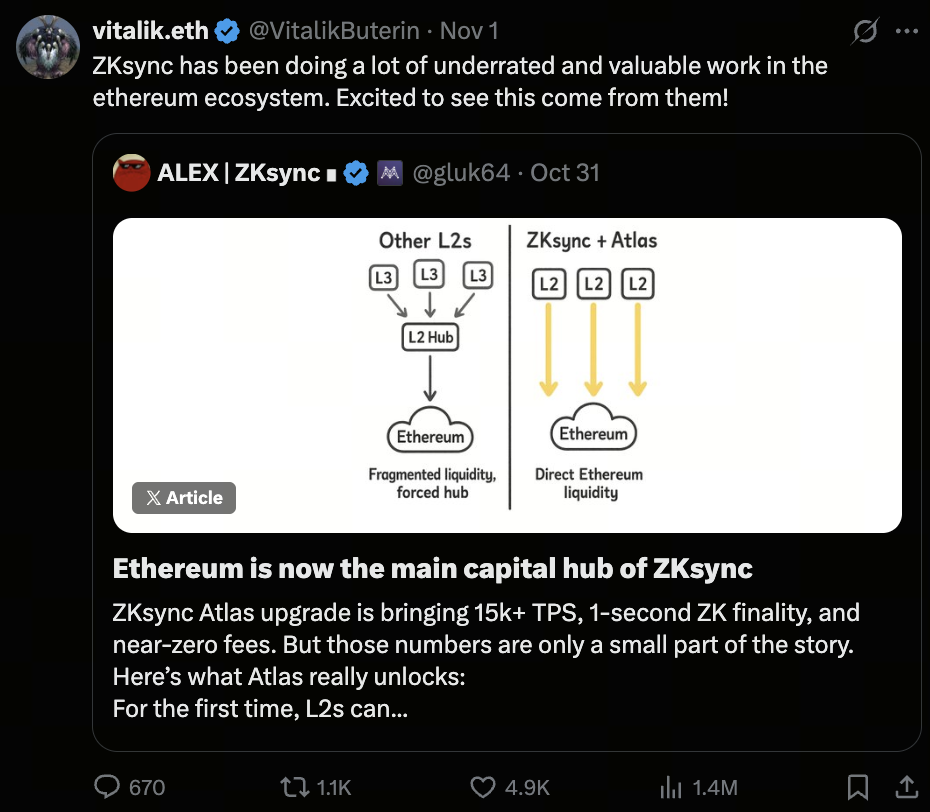

Traditional private chain solutions—such as Hyperledger Fabric and Corda—provide confidentiality but remain isolated from public markets, lacking both liquidity and openness. In contrast, ZKsync enables financial institutions to process sensitive transactions on local private chains and synchronize their state with public chains via ZK proofs, achieving both privacy and public trust. Vitalik Buterin has publicly endorsed this model, noting that it introduces a new paradigm of shared liquidity to Ethereum Layer 2.

(Source: VitalikButerin)

To learn more about Web3, click to register: https://www.gate.com/

Conclusion

As the market transitions from speculation to real-world application, privacy will become the foundational layer for institutional blockchain adoption. The maturity of ZK technology enables transaction models that are both provable and private. The transformation led by ZKsync represents not just a technological breakthrough, but a turning point as decentralized finance evolves from open, retail-driven participation to institutional-grade implementation. In the next phase, the true competition will not be about price speculation, but about who can build the most trustworthy infrastructure balancing privacy and transparency.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data