The Great Expansion: A New Era of Consumer Software

AI has ushered in a wave of new consumer products that are growing faster than ever before. Companies are going from zero to millions of users and surpassing $100M ARR in less than two years – a growth trajectory unheard of before AI.

What explains this? Distribution is faster, and ARPU is higher. But in my view, the biggest shift has gone largely unmentioned: AI has transformed revenue retention patterns for consumer software.

The Old Model: Built for Churn

Before AI, consumer software companies made money in two primary ways:

Advertising-based revenue – primarily for social apps, directly tied to usage and therefore usually flat per user over time. Examples: Instagram, TikTok, Snapchat.

One-tier subscriptions – where all premium users pay the same flat fee per month or year for product access. Examples: Duolingo, Calm, YouTube Premium.

Under both models, revenue retention – the percentage of revenue a cohort retains year-over-year – was almost always below 100%. Some percentage of users churned each year, and those who stayed kept paying the same amount. For consumer subscription products, cohorts with 30-40% user and revenue retention at the end of year 1 were considered “best in class”.

This created a fundamental constraint: companies had to constantly replace churned revenue just to maintain growth, let alone expand.

The AI Era: Enter the Great Expansion

The fastest growing consumer AI companies are now seeing revenue retention above 100% – what I call the “Great Expansion”. This happens in two ways: 1) consumers spending more as usage-based revenue replaces flat “access” fees, and (2) consumers bringing tools into their workplaces at unprecedented speed, where they can be expensed and supported with larger budgets.

The difference in trajectory is dramatic. At 50% revenue retention, a company must replace half its base every year just to stay even. At more than 100%, every cohort is expanding – growth compounding on top of growth.

The question becomes: how can consumer companies seize this opportunity and take part in the Great Expansion?

Strategy 1: Sophisticated Pricing Architecture

Price Segmentation + Usage-Based Billing

The most successful consumer AI companies are not relying on a single subscription fee. Instead, they use hybrid models with multiple subscription tiers plus usage-based components. If a user maxes out their included credits, they can buy more or upgrade to a higher plan.

There are lessons here from gaming, where companies have long generated the majority of their revenue from high-spend “whales”. Limiting pricing to one or two tiers is likely leaving money on the table. Smart companies build tiers around variables such as number of generations or tasks, speed and priority, or access to specific models, while also offering credits and upgrades.

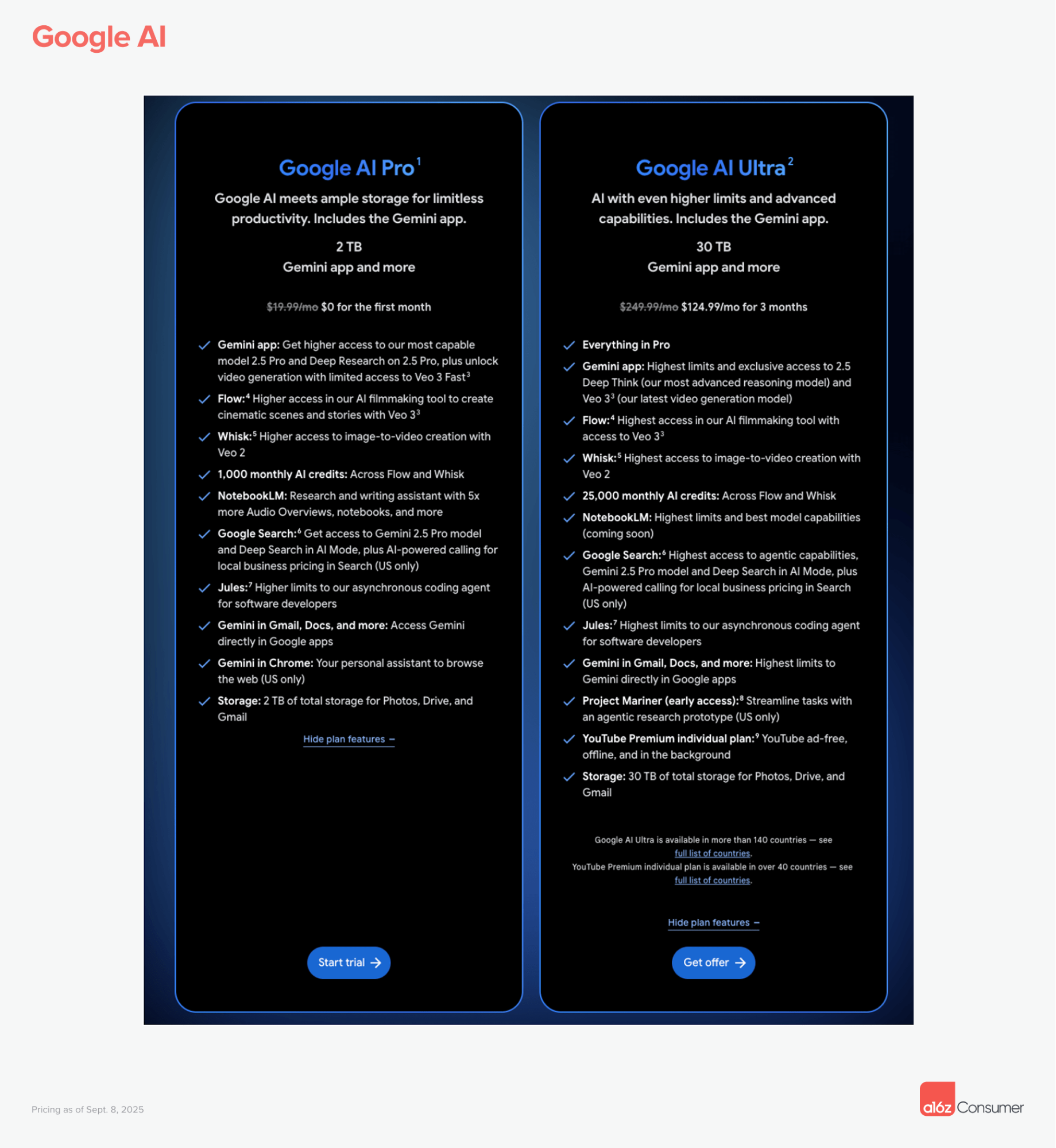

Google AI: $20/month Pro subscription and $249/month Ultra subscription with additional charges for Veo3 credits when users (inevitably) exceed their included amount. Extra credit packages start at $25 and scale all the way up to $200. Anecdotally, I’ve probably spent as much on additional Veo credits as on my base subscription.

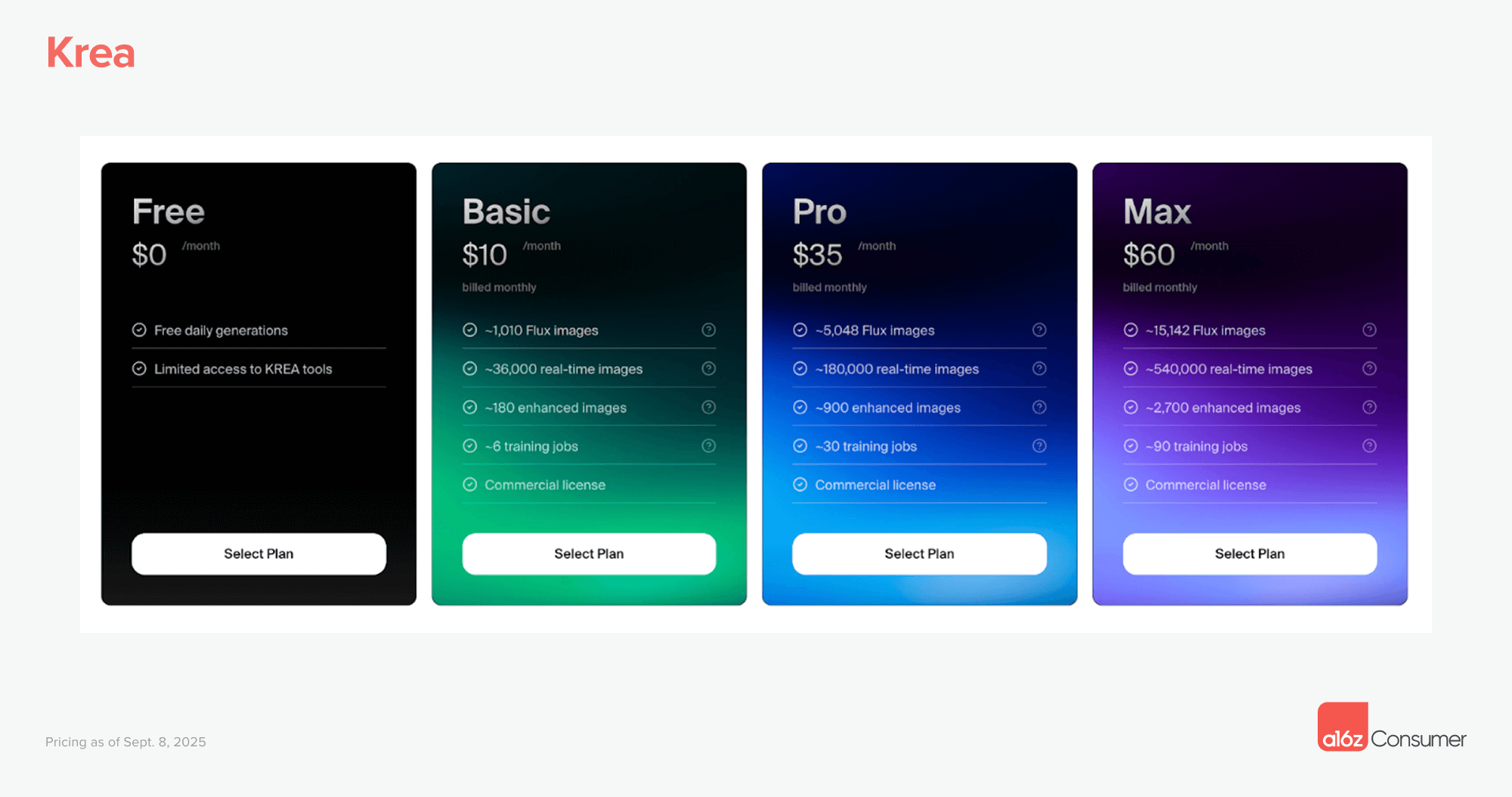

Krea: plans ranging from $10-$60/month based on anticipated usage and training jobs, with the ability to purchase additional credits in packs between $5 – $40 (valid for 90 days) if you exceed your included compute units.

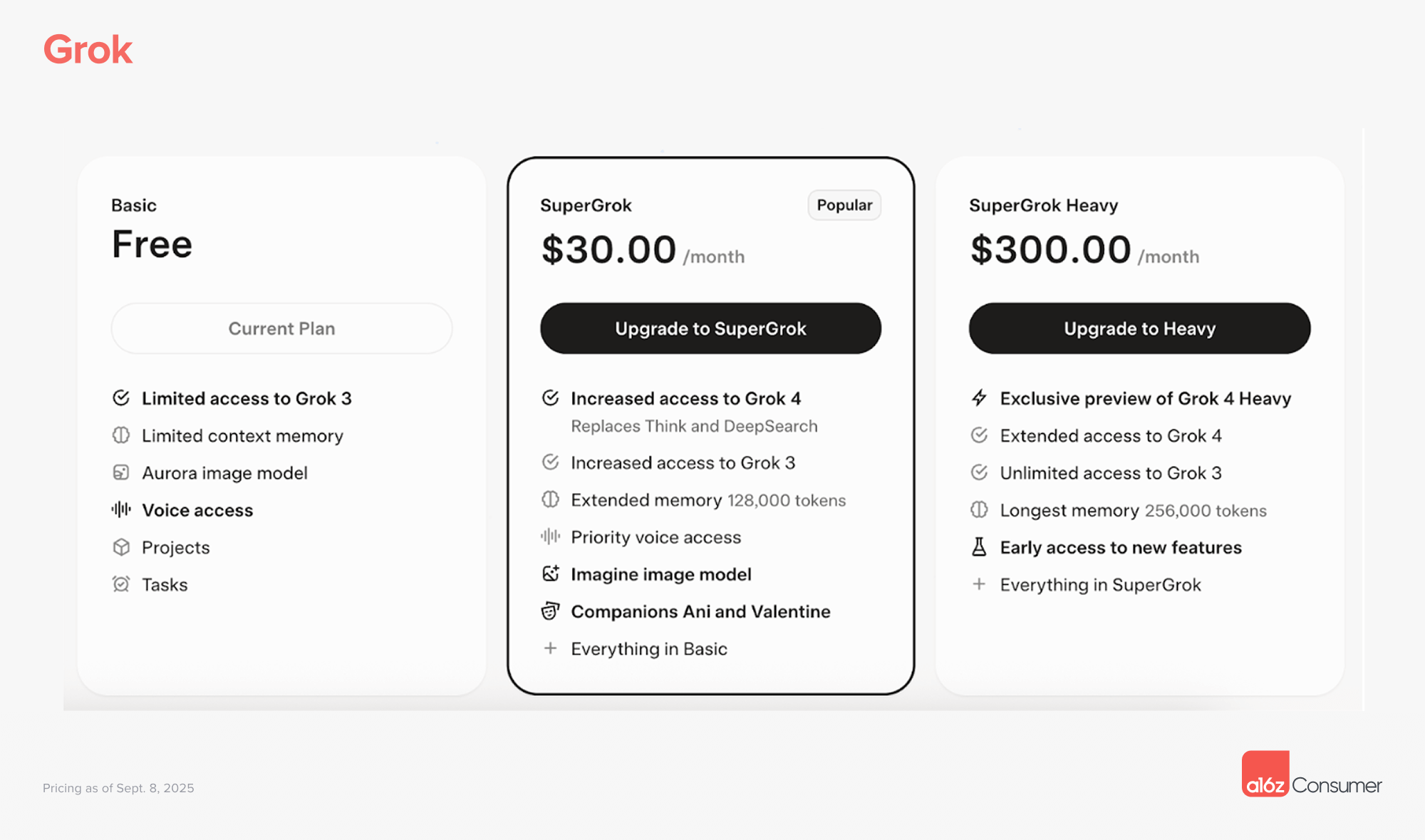

Grok: SuperGrok plan at $30/month with SuperGrok Heavy plan at $300/month, which unlocks new models (Grok 4 Heavy), extended access to models, longer memory, and new feature testing.

These models let revenue grow in step with user engagement – and some consumer companies are seeing >100% revenue retention on this alone, not even including any expansion into enterprise.

Strategy 2: The Consumer-to-Enterprise Bridge

Basic Team Functionality Creates Massive ARPU Expansion

Consumers are actively rewarded for bringing AI tools into their workplaces. In some companies, failing to become “AI-native” is now considered unacceptable. Any product with potential work applications – essentially anything not NSFW – should assume that users will want to bring it into their teams, and they will pay significantly more when they can expense it.

The transition from price-sensitive consumers to price-insensitive enterprise buyers creates major expansion opportunities. But it requires basic sharing and collaboration features such as team folders, shared libraries, collaborative canvases, authentication, and security.

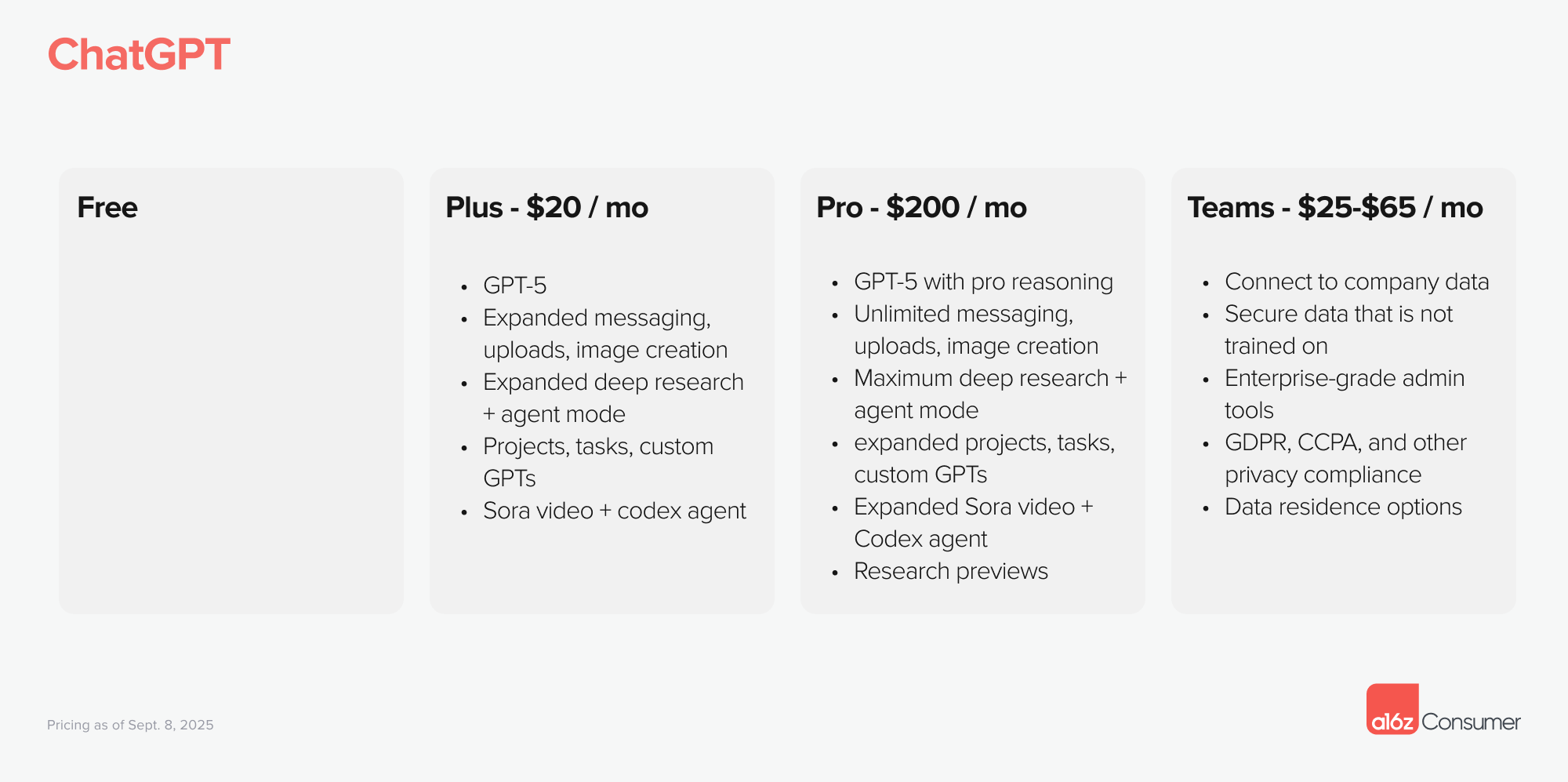

Equipped with these features, the pricing differential can be substantial. ChatGPT, for example, is not widely regarded as a teams product, yet its pricing highlights the difference: individual subscriptions cost $20 per month, while enterprise plans range from $25 to $60 per user.

Some companies even price individual plans at break-even or at a slight loss in order to accelerate team adoption. Notion used this approach effectively in 2020, offering unlimited free pages for solo users while charging aggressively for collaboration features, which drove its most explosive period of growth.

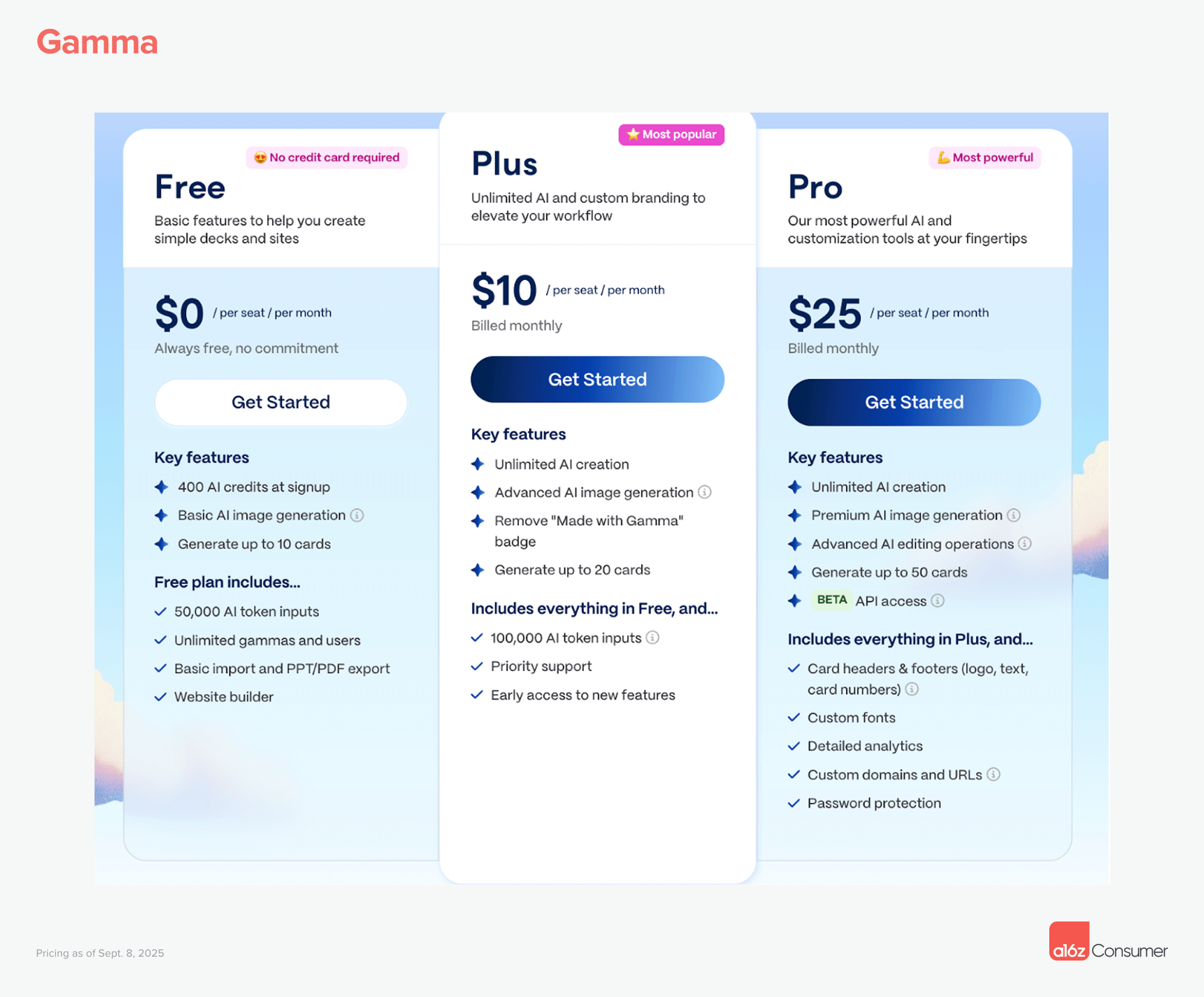

Gamma: Plus plan ($8/month) to remove watermarks – a requirement for most corporate use – along with other features. Users then pay for each collaborator added to their workspace.

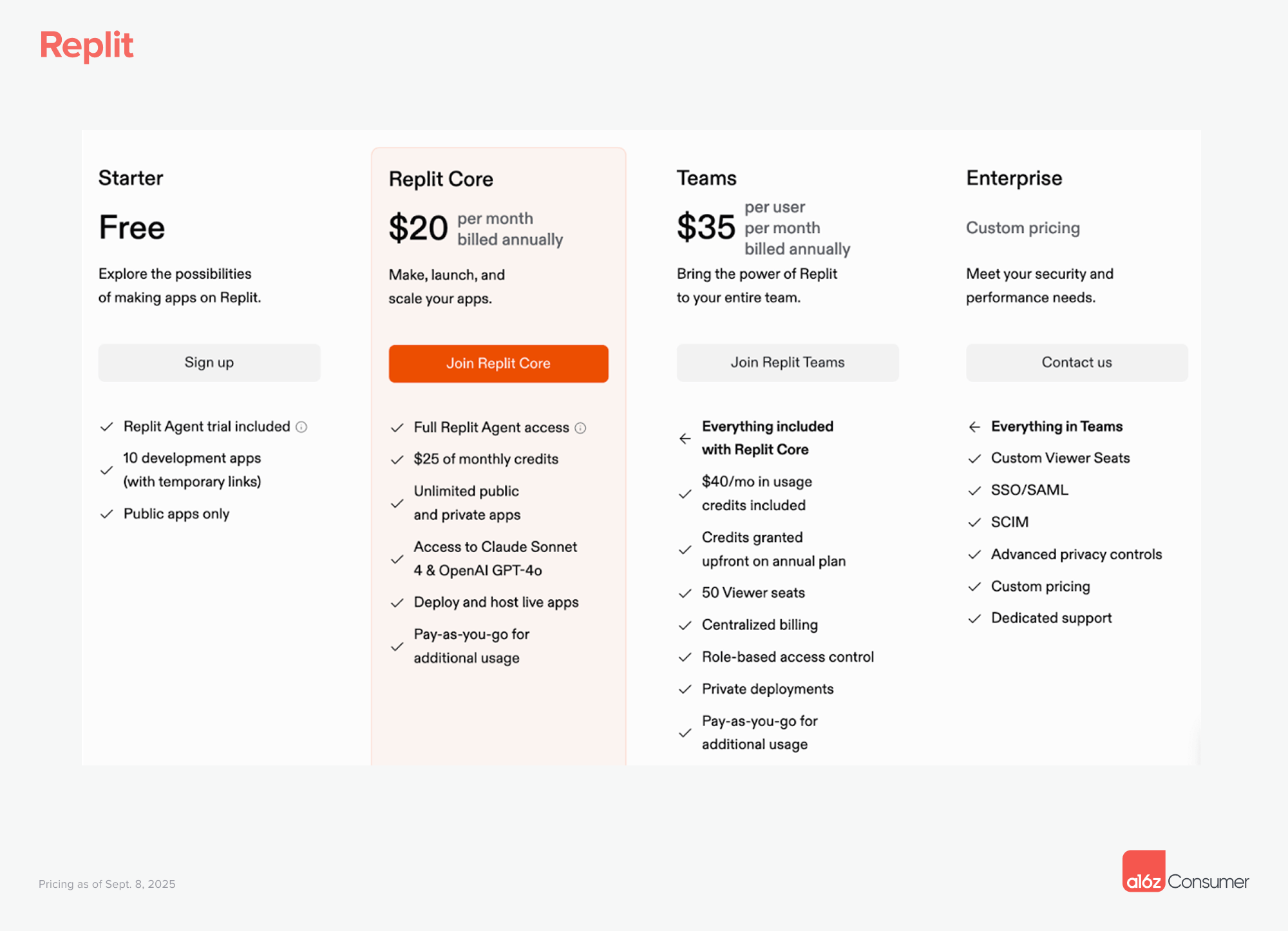

Replit: $20/month for Core users. Team plan starts at $35/month including additional credits, viewer seats, centralized billing, role-based access control, private deployments, and more.

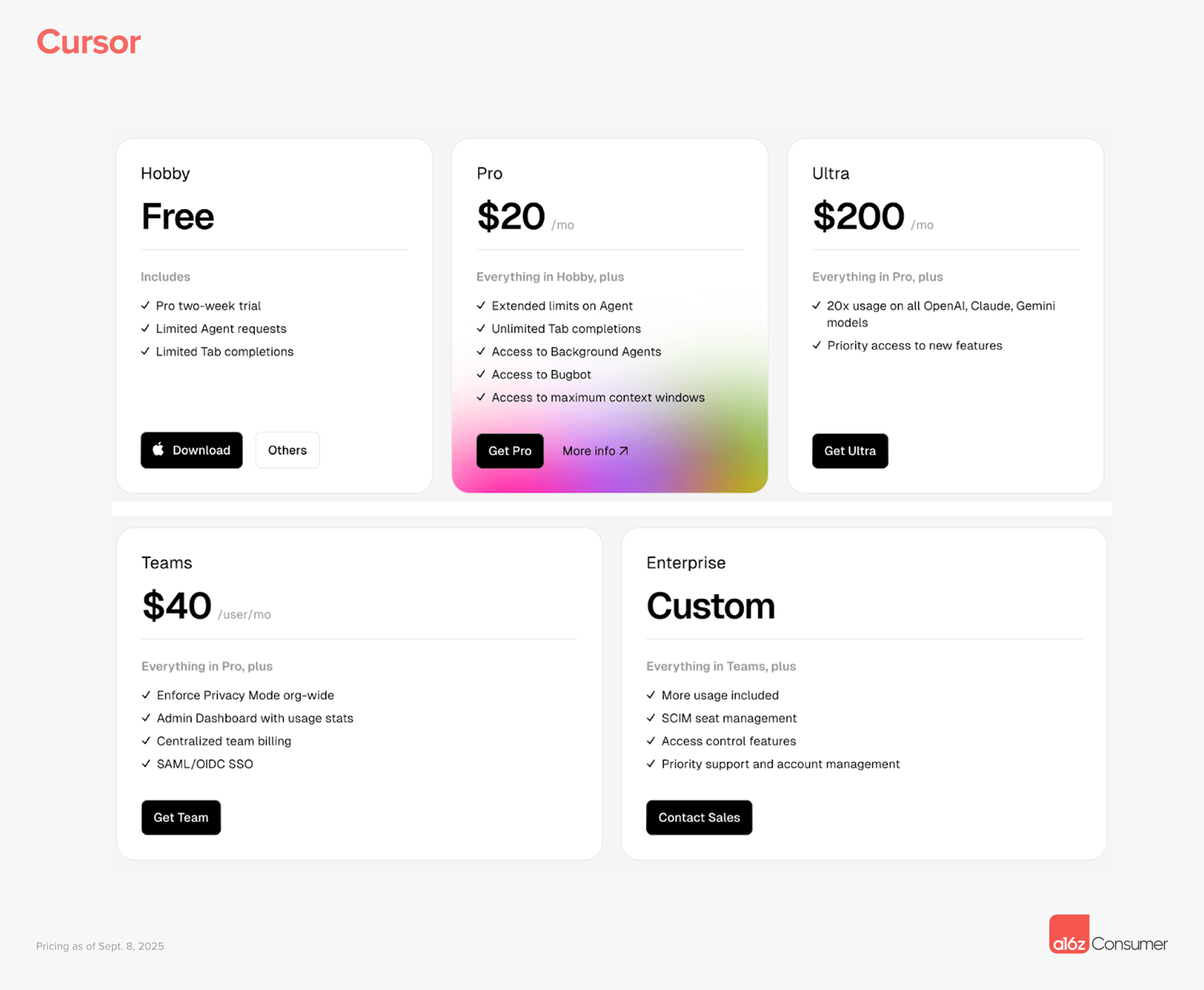

Cursor: $20 / month for Pro plan and $200 / month for Ultra plan (with 20x usage). Teams users pay $40 / month for the Pro product with org-wide privacy mode, a usage and admin dashboard, centralized billing, and SAML/ SSO.

These features are essential because they are what unlock enterprise-level ARPU expansion.

Strategy 3: Enterprise Investment from Day One

Build Sales Capabilities Early

This may feel counterintuitive, but consumer companies should now think about hiring a Head of Sales within their first one to two years. Grassroots adoption can only take a product so far; securing broad organizational use requires navigating enterprise procurement and closing high-value contracts.

Canva, founded in 2013, waited nearly seven years before launching its Teams product. In 2025, that kind of delay is no longer viable. The pace of enterprise AI adoption means that if you postpone enterprise features, a competitor will capture the opportunity instead.

Beyond sales capability, a few key features often determine outcomes.

- Security/Privacy: SOC-2 compliance, SSO/SAML support

- Operations/Billing: Role-based access control, centralized billing

- Product: Team templates, shared themes, collaborative workflows

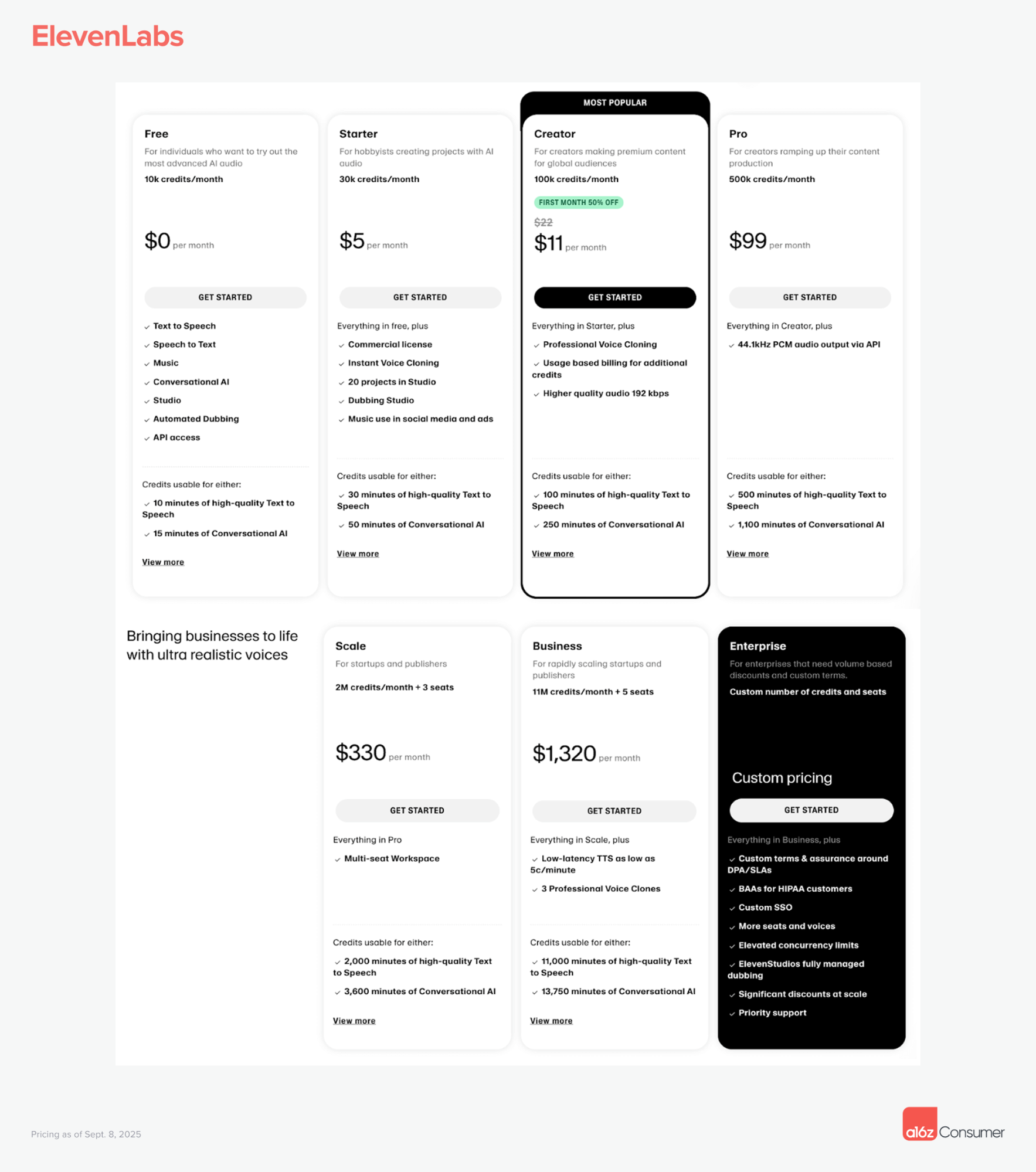

ElevenLabs is a good example: the company began with heavy consumer usage but moved quickly to build enterprise-grade capabilities, adding HIPAA compliance to its voice and conversational agents and positioning itself to serve healthcare and other regulated markets.

The Bottom Line: Consumer Companies Can Scale Bigger Than Ever

This shift allows consumer companies to scale in ways that were once impossible – and to become big businesses (on a revenue basis) in months, not decades. Monetization no longer needs to be delayed, and in fact our data shows that consumer businesses are outpacing B2B in early revenue growth. This gives them more “cushion” for customer acquisition, or even subsidizing lower margins to drive a land grab in the medium term (as they offset at least some of this with real revenue!)

We think many of the most important enterprise companies of the AI era will likely begin as consumer products. The founders who embrace sophisticated pricing, design bridges from consumer to enterprise, and invest early in enterprise capabilities will be best positioned to build the next generation of hyperscalers.

Disclaimer:

- This article is reprinted from [a16z]. All copyrights belong to the original author [a16z]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

AI Agents in DeFi: Redefining Crypto as We Know It

Dimo: Decentralized Revolution of Vehicle Data

What is AIXBT by Virtuals? All You Need to Know About AIXBT