XRP Price Prediction: Short-Term Resistance At 1.95 Could Decide Next Move

XRP Price Overview

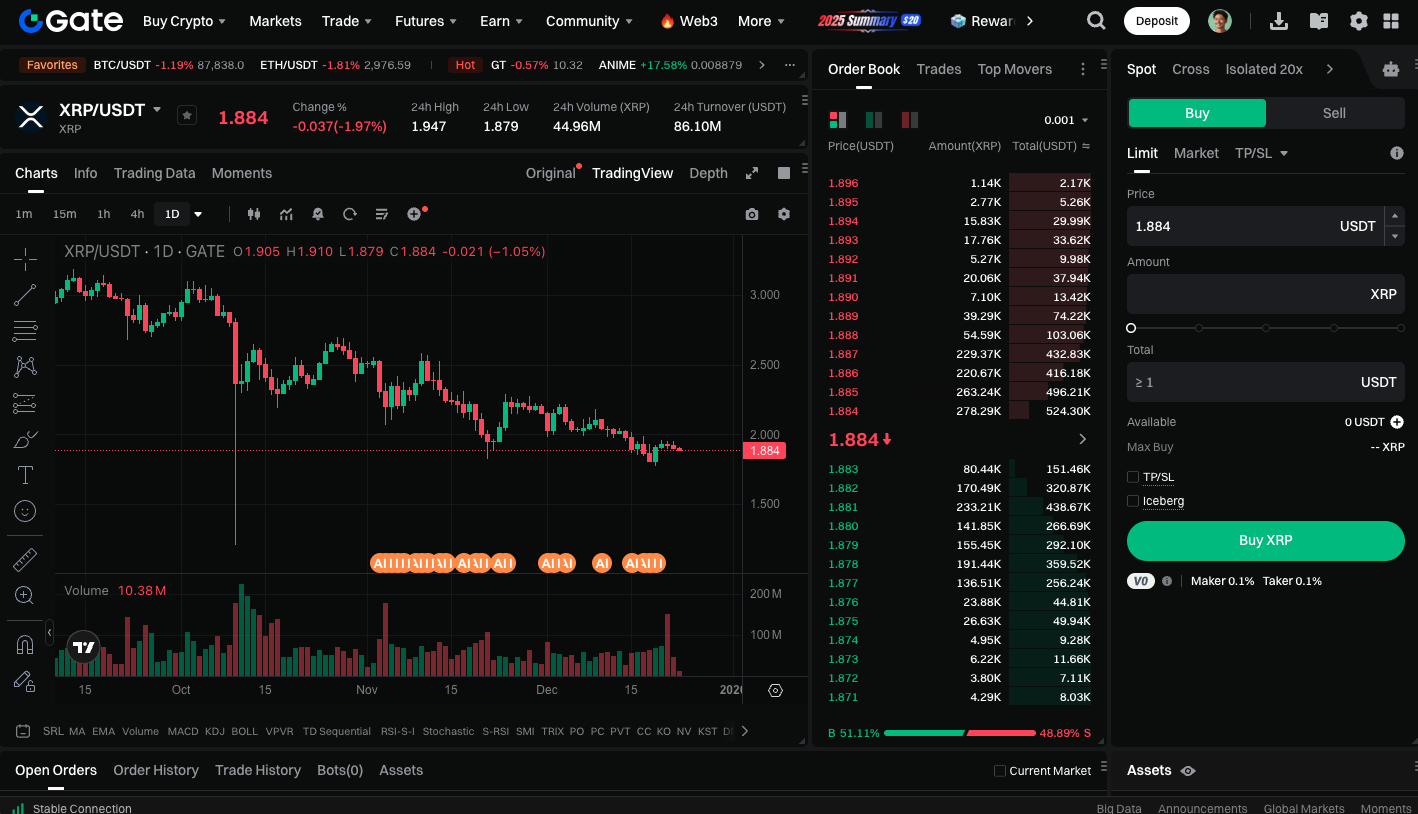

XRP recently climbed above $1.95 but then pulled back. At the time of writing, the price is trading near $1.88, below the 100-hour Simple Moving Average. Short-term volatility has increased, and XRP remains in a consolidation range, forming a potential descending channel or a bullish flag pattern.

Resistance and Support

After retreating from the $1.95 high, XRP dropped below the $1.92 and $1.90 support levels, entering a period of consolidation. The price also touched the 23.6% Fibonacci retracement level of the upward move from $1.77 to $1.95.

If XRP initiates another rally, immediate resistance is in the $1.90–$1.92 range. A breakout above this level could set the stage for a test of $1.95. Moving past $1.95 would open the door for XRP to challenge resistance at $2.00–$2.05, with further gains potentially extending to $2.12.

Downside Risk

If XRP cannot break through the $1.95 resistance zone, it may weaken again. Initial support is at $1.86 and the 50% Fibonacci retracement level, with the next major support at $1.84. If the price falls below $1.84, it could decline to $1.81, with further support at $1.77. A break below $1.77 may lead to a drop toward $1.72.

Start trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Summary

XRP is in a pivotal consolidation phase, with the short-term price fluctuating between $1.8650 and $1.950. A breakout above the $1.92–$1.95 resistance zone could fuel the next upward move, targeting $2.00 or even $2.12. On the other hand, if support breaks down, the price could retreat to $1.84 or lower, testing the $1.77–$1.72 region. Traders should monitor resistance and support levels closely to assess XRP’s next direction.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution