Post content & earn content mining yield

placeholder

CoinRelyOnUniversal

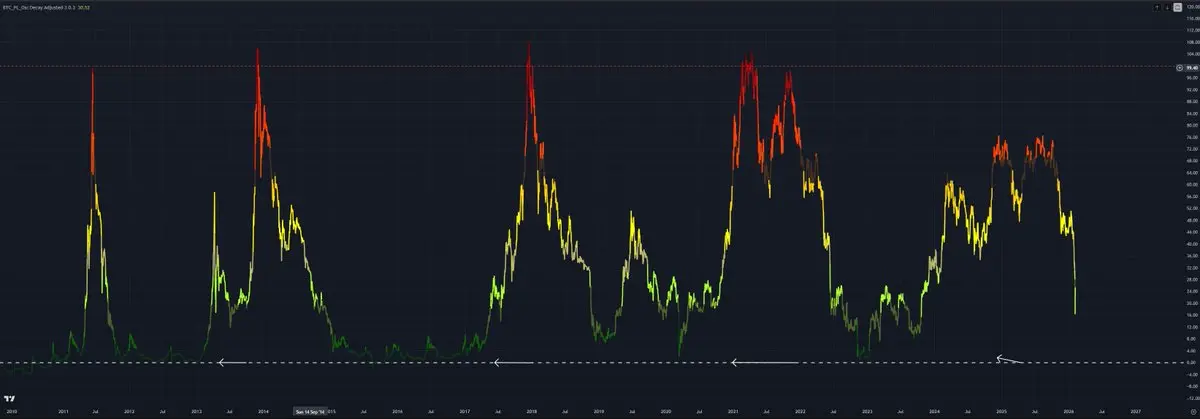

The Behind-the-Scenes of the Triple Sell-Off: Liquidity Is the Real Driver

Gold, silver, US stocks, and cryptocurrencies are all weakening simultaneously, indicating that the issue isn't confined to a single market but lies at the capital level. When the market faces uncertain expectations about interest rates, inflation, or geopolitical situations, the first reaction of funds is to reduce risk, not to choose a direction.

Many people wonder: Isn't gold a safe-haven asset? Why is it also falling? The answer is quite straightforward—under the margin system, gold is often used as a liquidity sour

View OriginalGold, silver, US stocks, and cryptocurrencies are all weakening simultaneously, indicating that the issue isn't confined to a single market but lies at the capital level. When the market faces uncertain expectations about interest rates, inflation, or geopolitical situations, the first reaction of funds is to reduce risk, not to choose a direction.

Many people wonder: Isn't gold a safe-haven asset? Why is it also falling? The answer is quite straightforward—under the margin system, gold is often used as a liquidity sour

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 3

- Repost

- Share

CoinWay :

:

2026 Go Go Go 👊View More

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

Gold and silver markets are surging, and the High-Multiplier Trading Challenge is officially live. Simply sign up to instantly claim 10 USDT, then start trading futures to unlock a variety of rewards... https://www.gate.com/id/campaigns/3968?ref=VVFHU1GLVA&ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

baby

baby

Created By@GateUser-df1d4a45

Listing Progress

0.00%

MC:

$2.41K

Create My Token

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4027?ref=VVIXVLPBCQ&ref_type=132&utm_cmp=7doQBcVs

- Reward

- like

- Comment

- Repost

- Share

Good morning. Are there any "money generation" experts who have mastered the secrets of TradFi trading? Please share your tips for making money.

- Reward

- 3

- 5

- Repost

- Share

SheenCrypto :

:

2026 GOGOGO 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/id/campaigns/3994?ref=VVFHU1GLVA&ref_type=132

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊#WhyAreGoldStocksandBTCFallingTogether?

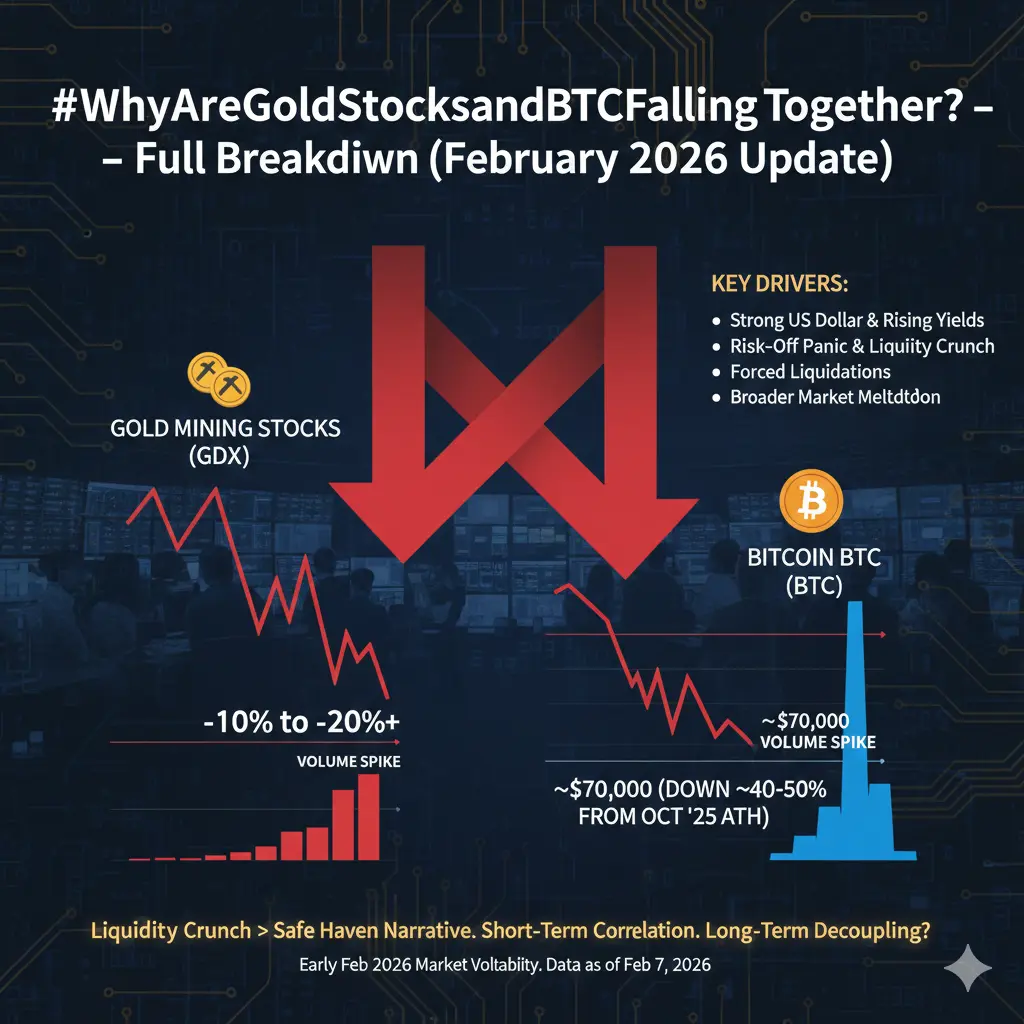

Right now in early February 2026, we're seeing a surprising correlation: gold mining stocks (like those in the NYSE Arca Gold Miners Index) and Bitcoin (BTC) are both declining sharply, even though they're often viewed as "safe havens" or hedges against inflation/debasement. This has puzzled many investors — gold itself has been volatile but generally held up better long-term, while BTC has taken a brutal hit.

The core reason? This isn't about fundamentals diverging forever — it's short-term liquidity stress, risk-off behavior, and forced selling in a p

Right now in early February 2026, we're seeing a surprising correlation: gold mining stocks (like those in the NYSE Arca Gold Miners Index) and Bitcoin (BTC) are both declining sharply, even though they're often viewed as "safe havens" or hedges against inflation/debasement. This has puzzled many investors — gold itself has been volatile but generally held up better long-term, while BTC has taken a brutal hit.

The core reason? This isn't about fundamentals diverging forever — it's short-term liquidity stress, risk-off behavior, and forced selling in a p

- Reward

- 6

- 10

- Repost

- Share

BlockRider :

:

2026 GOGOGO 👊View More

The market has been volatile recently. Whether you suffered trading losses or not, don't worry, Gate has launched the new round of 5,000,000 USDT Subsidy Care Program open to all users across the network. Simply meet the following requirements to receive up to 100 USDT in subsidies. If you are a newly registered user or making your first futures trade during the event, you will also receive an extra 50 USDT care bonus. Gate will always stand with you, powering your wealth growth journey. https://www.gate.com/campaigns/4032?ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

Is 60K a defensive line or just psychological comfort? The market is notorious for dismissing all objections.

When BTC fluctuates around 60K, many people focus on the candlestick charts, but you should actually pay more attention to your account's heartbeat. This level is never just a technical point; it's also an emotional amplifier — bulls see it as a bottom, bears see it as a door.

My personal strategy is simple: position size is more important than opinions.

The market can be wrong, but your position size cannot be too large.

🔹Risk Control

During pullbacks, my first task is not to m

When BTC fluctuates around 60K, many people focus on the candlestick charts, but you should actually pay more attention to your account's heartbeat. This level is never just a technical point; it's also an emotional amplifier — bulls see it as a bottom, bears see it as a door.

My personal strategy is simple: position size is more important than opinions.

The market can be wrong, but your position size cannot be too large.

🔹Risk Control

During pullbacks, my first task is not to m

BTC9,38%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 5

- 5

- Repost

- Share

HighAmbition :

:

hop on boardView More

- Reward

- 3

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Tesla1 :

:

Happy New Year! 🤑p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$1.76K

Create My Token

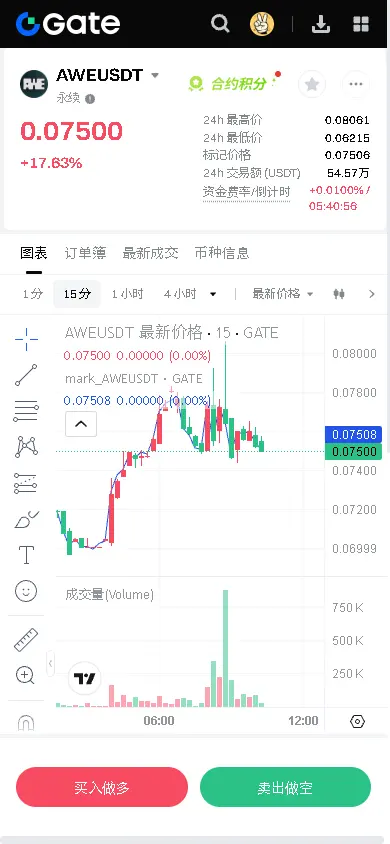

【$AWE Signal】Healthy Pullback After Long Position + Volume Breakout

After volume breakout on the 4-hour timeframe, the price is consolidating tightly above the previous high resistance zone. This is a typical healthy reset after a breakout, not a top formation. Buying pressure is continuously absorbing sell orders in the 0.074-0.075 range. Market logic indicates that the main bullish force is entering to push the price higher.

🎯 Direction: Long

🎯 Entry: 0.0750 - 0.0755

🛑 Stop Loss: 0.0738 $AWE Rigid stop loss, below the previous 4-hour candle low and dense buy zone (

🚀 Target 1: 0.0805 )

View OriginalAfter volume breakout on the 4-hour timeframe, the price is consolidating tightly above the previous high resistance zone. This is a typical healthy reset after a breakout, not a top formation. Buying pressure is continuously absorbing sell orders in the 0.074-0.075 range. Market logic indicates that the main bullish force is entering to push the price higher.

🎯 Direction: Long

🎯 Entry: 0.0750 - 0.0755

🛑 Stop Loss: 0.0738 $AWE Rigid stop loss, below the previous 4-hour candle low and dense buy zone (

🚀 Target 1: 0.0805 )

- Reward

- like

- Comment

- Repost

- Share

Good morning. Are there any "money generation" experts who have mastered the secrets of TradFi trading? Please share your tips for making money.

View Original

- Reward

- 6

- 10

- Repost

- Share

Jaytech001 :

:

Good morning, by managing your risk and staying consistently will make stay long in the money making generation cycle.View More

🔹 Bitcoin extends its rally, briefly breaking above $70,000 overnight — How will the weekend trend unfold?

- Reward

- like

- Comment

- Repost

- Share

hhhhffddfghhjjklllkjhghhhhlkbhhhhhhgfffghhhggggggghmmmknjjjjjjjjjjjj#GateJanTransparencyReport jjjjhhhhhgggggggghhhhhbbbbbbbbbbb

- Reward

- like

- Comment

- Repost

- Share

7-Day Friend Invite Fiesta: Check In Daily, Earn USDT Every Day https://www.gate.com/id/campaigns/4027?ref=VVFHU1GLVA&ref_type=132&utm_cmp=7doQBcVs

- Reward

- like

- Comment

- Repost

- Share

U.S. stocks opened higher and continued to rise last night, with the Nasdaq Composite Index surging 2.18%. Cryptocurrencies also rebounded accordingly, with Ethereum climbing to 2070 and Bitcoin reaching $70,000. The daily chart shows a volume-driven rally with some sustainability. On the 15-minute chart, a short-term bearish divergence trend has emerged, so it may be worth trying to go long at key support levels#当前行情抄底还是观望?

ETH9,47%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More120.82K Popularity

23.42K Popularity

389.68K Popularity

9.59K Popularity

7.94K Popularity

Hot Gate Fun

View More- MC:$2.47KHolders:10.00%

- MC:$2.47KHolders:00.00%

- MC:$2.51KHolders:20.06%

- MC:$2.47KHolders:00.00%

- MC:$2.47KHolders:20.06%

News

View MoreGlassnode: The market has entered the "deep bear" phase but has not yet experienced extreme panic selling. It is currently still in the process of bubble compression.

6 m

Su Zhu: Not optimistic about the prospects of privacy coins. The most noteworthy altcoin in China is BCH.

21 m

Project Hunt: The compliant blockchain ecosystem Rayls is the project with the most new followers in the past 7 days.

27 m

Data: 294.24 BTC transferred out from Anchorage Digital, then relayed to another anonymous address

29 m

Exchange shifts under liquidity pressure, Gate's full-asset deployment shows initial results

30 m

Pin