2025 ARRR Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: ARRR's Market Position and Investment Value

Pirate Chain (ARRR) is a truly private, decentralized privacy coin that holds an important position within the Zcash ecosystem and Komodo blockchain network. Since its inception in 2019, ARRR has established itself as a cryptocurrency that prioritizes financial privacy with 100% private transactions. As of December 2025, ARRR has a market capitalization of approximately $56.41 million, with a circulating supply of around 196.21 million coins, currently trading at $0.2875 per token. This asset, recognized as a "privacy-focused cryptocurrency," is playing an increasingly significant role in enabling truly anonymous and secure financial transactions on the blockchain.

This article will comprehensively analyze ARRR's price trends and market dynamics through 2030, combining historical performance patterns, market supply and demand dynamics, ecosystem developments, and broader macroeconomic factors. We will provide investors with professional price forecasts and practical investment strategies to navigate the evolving landscape of privacy-centric digital assets and make informed decisions about their ARRR holdings.

I. ARRR Price History Review and Current Market Status

ARRR Historical Price Movement Trajectory

- 2021: Peak valuation reached, ARRR hit its all-time high of $16.76 on April 24, 2021, representing the strongest market sentiment period for Pirate Chain.

- 2020: Project establishment phase, ARRR reached its all-time low of $0.00797788 on November 26, 2020, during the early market discovery phase.

- 2020-2025: Extended consolidation period, ARRR has experienced significant volatility with a price decline of approximately 98.3% from its peak, reflecting the broader market cycles and competitive pressures within the privacy coin sector.

ARRR Current Market Status

As of December 18, 2025, ARRR is trading at $0.2875, with the following market characteristics:

Price Performance:

- 24-hour change: -5.17%

- 7-day change: +11.59%

- 30-day change: -50.64%

- 1-year change: +20.54%

- Current 24-hour trading range: $0.2778 - $0.3196

Market Capitalization and Liquidity:

- Market capitalization: $56,411,466.92

- Fully diluted valuation: $57,500,000.00

- 24-hour trading volume: $16,912.89

- Market dominance: 0.0018%

- Circulating supply: 196,213,797.97 ARRR (98.11% of total supply)

- Total supply: 200,000,000 ARRR

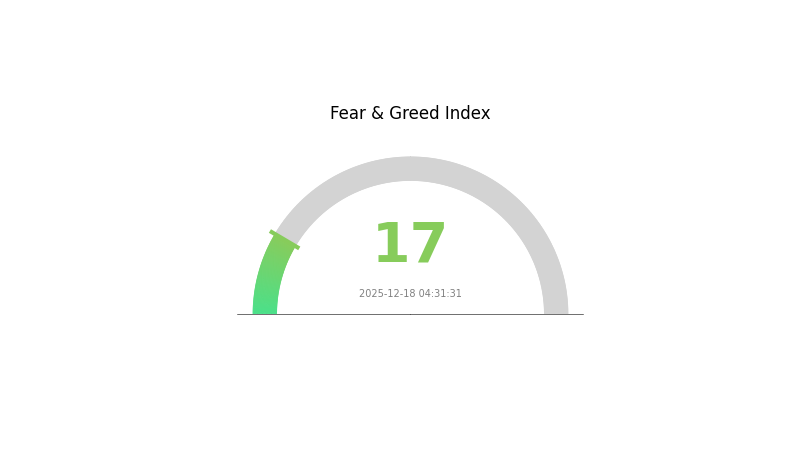

Market Sentiment: The current market emotion indicator shows "Extreme Fear" (VIX: 17), reflecting heightened market volatility and risk aversion among investors.

View current ARRR market price

ARRR Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The ARRR market is currently experiencing extreme fear, with the Fear and Greed Index at 17. This historically low reading suggests significant market pessimism and potential capitulation among investors. During such periods, contrarian investors often identify compelling accumulation opportunities. However, extreme fear can also indicate further downside risks ahead. Monitor key support levels closely and consider dollar-cost averaging strategies. On Gate.com, you can track real-time market sentiment data to make informed trading decisions.

ARRR Address Distribution

The address holding distribution represents the concentration of ARRR tokens across blockchain addresses, serving as a critical metric for assessing network decentralization and market structure. By analyzing the proportion of total token supply held by top addresses, this distribution reveals potential concentration risks and the overall health of the token's holder ecosystem.

Currently, the ARRR token distribution data presented shows limited addressable information in the provided dataset. However, when evaluating such metrics generally, a healthy token ecosystem typically exhibits a diversified holder base where no single entity or small group of addresses controls an excessive percentage of total supply. Significant concentration among top holders can indicate higher vulnerability to market manipulation, sudden price volatility, and reduced network resilience. The degree of decentralization reflected through address distribution directly correlates with the token's robustness and long-term sustainability in the market.

To obtain comprehensive insights into ARRR's current holding concentration and its implications for market dynamics, detailed tracking of top address movements and their accumulation or distribution patterns is essential. Such analysis helps market participants understand potential selling pressure, whale activity risks, and the likelihood of price manipulation. A well-distributed holder base generally supports more stable price movements and reflects genuine market demand rather than speculative concentration.

For real-time analysis and current ARRR address distribution data, visit ARRR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting ARRR's Future Price

Monetary Policy Impact

- Central Bank Policies: Central bank policy decisions, interest rate adjustments, and fiscal stimulus measures directly influence market liquidity, which subsequently transmits to ARRR price fluctuations.

Geopolitical Factors

- International Tensions: Geopolitical events such as international conflicts and regional tensions affect global markets and commodity prices, thereby exerting downstream pressure on cryptocurrency valuations including ARRR.

Three: ARRR Price Prediction for 2025-2030

2025 Outlook

- Conservative Forecast: $0.1922 - $0.2869

- Base Case Forecast: $0.2869

- Bullish Forecast: $0.3041 (requires sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation and gradual recovery phase with moderate volatility

- Price Range Predictions:

- 2026: $0.2807 - $0.3664 (2% upside potential)

- 2027: $0.2284 - $0.3475 (15% upside potential)

- 2028: $0.2171 - $0.3867 (17% upside potential)

- Key Catalysts: Enhanced protocol development, improved market liquidity on platforms like Gate.com, expanded use case adoption, and overall crypto market sentiment recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.2359 - $0.4392 (26% upside by 2029, assuming steady ecosystem growth and moderate market conditions)

- Bullish Scenario: $0.2407 - $0.5295 (39% upside by 2030, assuming strong fundamentals development and positive regulatory environment)

- Transformational Scenario: $0.5295+ (requiring breakthrough technological achievements, mainstream institutional adoption, and significant ecosystem expansion)

Key Observation: The forecast data suggests a general uptrend trajectory from 2025 through 2030, with cumulative gains potentially reaching 39% by end of 2030 under favorable conditions, though near-term volatility remains a significant factor through 2025-2026.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.30411 | 0.2869 | 0.19222 | 0 |

| 2026 | 0.36643 | 0.29551 | 0.28073 | 2 |

| 2027 | 0.34752 | 0.33097 | 0.22837 | 15 |

| 2028 | 0.38674 | 0.33924 | 0.21711 | 17 |

| 2029 | 0.43922 | 0.36299 | 0.23594 | 26 |

| 2030 | 0.52946 | 0.4011 | 0.24066 | 39 |

Pirate Chain (ARRR) Professional Investment Strategy and Risk Management Report

IV. ARRR Professional Investment Strategy and Risk Management

ARRR Investment Methodology

(1) Long-Term Holding Strategy

- Target Investor Profile: Privacy-focused investors, portfolio diversifiers seeking exposure to privacy-oriented cryptocurrencies, and investors with high risk tolerance

- Operational Recommendations:

- Accumulate ARRR during market downturns, particularly when 24-hour volatility exceeds -5%, as evidenced by current market conditions

- Establish a dollar-cost averaging (DCA) approach by allocating fixed capital amounts at regular intervals to mitigate timing risk

- Maintain minimum holding periods of 12-24 months to benefit from long-term appreciation potential, supported by the 1-year performance of +20.54%

(2) Active Trading Strategy

-

Technical Analysis Tools:

- 24-Hour Price Volatility Analysis: Monitor the current -5.17% daily change and 24-hour trading range between $0.2778 and $0.3196 to identify entry and exit points

- 7-Day and 30-Day Trend Analysis: Utilize the 7-day positive momentum (+11.59%) against the 30-day weakness (-50.64%) to identify mean reversion opportunities and support/resistance levels

-

Wave Trading Key Points:

- Identify accumulation zones around the 30-day lows following the -50.64% decline

- Execute partial profit-taking when price approaches the 24-hour high of $0.3196 or higher resistance levels

- Monitor market sentiment through the project's social channels (Twitter, Reddit, Facebook) for catalysts that may drive price movement

ARRR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Moderate Investors: 3-8% of total portfolio allocation

- Aggressive Investors: 8-15% of total portfolio allocation

(2) Risk Hedging Approaches

- Diversification Strategy: Allocate ARRR as part of a broader privacy-coin portfolio rather than as a concentrated position, given the 0.0018% market dominance

- Position Sizing Protocol: Limit individual trade sizes to no more than 5% of personal investment capital to manage downside exposure during volatile periods

(3) Secure Storage Solutions

- Hot Wallet Management: For active trading purposes, maintain only working capital amounts (typically 10-20% of holdings) in exchange wallets on Gate.com

- Cold Storage Approach: Transfer long-term holdings to secure, offline storage solutions, utilizing the project's official explorer at explorer.pirate.black to verify transaction integrity

- Security Precautions: Enable two-factor authentication (2FA) on all exchange accounts, use unique passwords, and never share private keys or seed phrases with third parties

V. ARRR Potential Risks and Challenges

ARRR Market Risks

- Liquidity Constraints: With 24-hour trading volume of only $16,912.89 and a circulating market cap of $56.41 million, ARRR exhibits limited liquidity that may result in significant slippage during large trades

- Price Volatility: The 30-day decline of -50.64% and the historical price range from $0.00797788 to $16.76 demonstrate extreme volatility, creating substantial drawdown risks for retail investors

- Market Concentration: Ranked 467th by market capitalization with only 4 active trading pairs, ARRR faces concentration risk with limited trading venues and reduced price discovery mechanisms

ARRR Regulatory Risks

- Privacy Coin Regulation: As a privacy-focused cryptocurrency with enhanced anonymity features, ARRR faces increasing regulatory scrutiny in multiple jurisdictions considering privacy coin restrictions or bans

- Exchange Delisting Risk: Several major exchanges have delisted privacy coins due to regulatory pressure, potentially reducing ARRR's accessibility and liquidity further

- Compliance Uncertainty: Evolving regulatory frameworks across different regions create uncertainty regarding ARRR's long-term legal status and operational sustainability

ARRR Technology Risks

- Adoption and Development: Limited information on recent protocol updates or technological innovations may indicate slower development cycles compared to competing privacy solutions

- Security Audit History: The absence of publicly documented security audits or formal verification processes raises questions about the robustness of the underlying privacy protocol

- Ecosystem Dependencies: As part of the Komodo ecosystem and Zcash lineage, ARRR's long-term viability is partially dependent on parent protocol developments and maintenance

VI. Conclusions and Action Recommendations

ARRR Investment Value Assessment

Pirate Chain (ARRR) represents a specialized investment within the privacy-coin sector, characterized by robust privacy guarantees and decentralization principles. However, investors must weigh the project's technical merits against significant market challenges: a market dominance of only 0.0018%, extreme historical volatility with a 99.95% decline from all-time highs, and recent 30-day underperformance of -50.64%. The current price point of $0.2875, with circulating supply at 98.1% of total supply, suggests limited upside from new token issuance but also constrained growth potential. The +20.54% year-over-year performance indicates some recovery momentum, yet regulatory headwinds facing privacy cryptocurrencies present ongoing structural challenges.

ARRR Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) through Gate.com's spot trading platform, focus on understanding privacy-coin fundamentals before expanding positions, and prioritize secure self-custody practices

✅ Experienced Traders: Implement systematic accumulation strategies during 20%+ monthly declines, utilize technical analysis against the 7-day/30-day trend divergence, and maintain strict position sizing (maximum 5-8% of trading capital per position)

✅ Institutional Investors: Conduct comprehensive due diligence on the project's development roadmap and regulatory compliance framework before allocation, consider ARRR as a specialized hedge within privacy-focused cryptocurrency allocations, and maintain liquidity reserves given the 4-exchange trading constraint

ARRR Trading Participation Methods

- Spot Trading: Access ARRR through Gate.com's spot trading pairs with direct purchase and self-custody capabilities

- Technical Analysis Integration: Monitor real-time price feeds on Gate.com platforms while cross-referencing the official Pirate Chain explorer (explorer.pirate.black) for on-chain activity metrics

- Community Engagement: Track project developments through official channels (Twitter: @PirateChain, Reddit: r/piratechain) to identify potential catalysts for price movement and protocol updates

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must assess their personal risk tolerance and financial situation before participation. Consult qualified financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely. Privacy-coin investments face heightened regulatory uncertainty and should represent only a minor portfolio allocation.

FAQ

What crypto will 1000x prediction?

Emerging altcoins with strong fundamentals and early-stage pricing show highest 1000x potential. Projects with innovative use cases, solid community support, and technological advantages are most likely candidates for exponential growth in the current market cycle.

Can XRP reach $100 by 2025?

XRP reaching $100 by 2025 is possible but uncertain. While some analysts predict this price target, it depends on regulatory clarity, market adoption, and overall crypto market conditions. Current momentum suggests potential, though no guarantee exists.

How much is Pirate Chain Arrr worth today?

Pirate Chain Arrr is currently worth $0.2891, with a 24-hour trading volume of $445,498. The price has declined by 0.17% in the last 24 hours.

Will the pirate chain go up?

Yes, Pirate Chain is expected to continue rising. Current market trends and historical performance suggest positive momentum, with analysts forecasting sustained growth potential in the coming period.

How Has the Boost (BOOST) Price Surged 82.79% in the Past Week?

How Does the Crypto Market Overview Look in Late 2025?

NKN (NKN) price soaring: What is the driving force behind the 2025 craze?

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

Where to Find Alpha in the 2025 Crypto Spot Market

Canada Bitcoin Price: 2025 Market Analysis and Investment Outlook

CROSS vs LTC: A Comprehensive Comparison of Two Leading Blockchain Solutions in the Cryptocurrency Market

YGG vs BTC: Which Cryptocurrency Offers Better Investment Potential in 2024?

Uncovering Ethereum Code Fraud

Understanding Aave Liquidity Pools: A Comprehensive User Guide

Limited Bitcoin Supply: Understanding the Circulation and Future Implications