2025 GRIFFAIN Price Prediction: Expert Analysis and Market Forecast for the Next Generation Digital Asset

Introduction: GRIFFAIN's Market Position and Investment Value

GRIFFAIN, as an AI agent creator platform on the Solana network, has emerged as a notable digital asset in the blockchain ecosystem. Since its launch in November 2024, GRIFFAIN has demonstrated significant market activity. As of December 21, 2025, GRIFFAIN's market capitalization stands at approximately $16.6 million, with a circulating supply of approximately 999.85 million tokens, trading at around $0.0166 per token. This innovative platform, which enables users to create AI agents capable of trading tokens, creating meme tokens, transferring SOL, and managing social media interactions, is playing an increasingly significant role in the AI-powered blockchain applications space.

This article will provide a comprehensive analysis of GRIFFAIN's price trajectory and market trends as of December 21, 2025, combining historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price insights and practical investment guidance for investors considering exposure to this emerging asset class.

GRIFFAIN Market Analysis Report

I. GRIFFAIN Price History Review and Current Market Status

GRIFFAIN Historical Price Trajectory

- December 21, 2025: Current market conditions show GRIFFAIN trading at $0.016604, reflecting significant volatility since launch

- January 22, 2025: All-time high (ATH) reached at $0.6428, representing peak market enthusiasm

- October 10, 2025: All-time low (ATL) recorded at $0.0101, marking the lowest valuation point in the token's history

GRIFFAIN Current Market Conditions

GRIFFAIN is currently trading at $0.016604 as of December 21, 2025. The token exhibits mixed short-term performance with a 2.24% increase over the last 24 hours, though it faces notable headwinds with a 1.29% decline in the past hour. Over longer timeframes, the token shows weakness, declining 10.34% over seven days and experiencing a severe 92.30% depreciation over one year from its historical high.

The token's market capitalization stands at approximately $16.60 million with a fully diluted valuation of $16.60 million, indicating nearly complete circulation of its token supply. Trading volume in the past 24 hours totals $305,513.90, demonstrating moderate liquidity. GRIFFAIN maintains a market ranking of 934 with a market dominance of 0.00051%, reflecting its position as a smaller-cap asset within the broader cryptocurrency ecosystem.

The token maintains $0.016859 as the 24-hour high and $0.015888 as the 24-hour low, showing relatively contained volatility within this compressed trading range. With 53,456 token holders and availability across 21 exchanges, GRIFFAIN has established a modest but growing distribution network.

View current GRIFFAIN market price

GRIFFAIN Market Sentiment Index

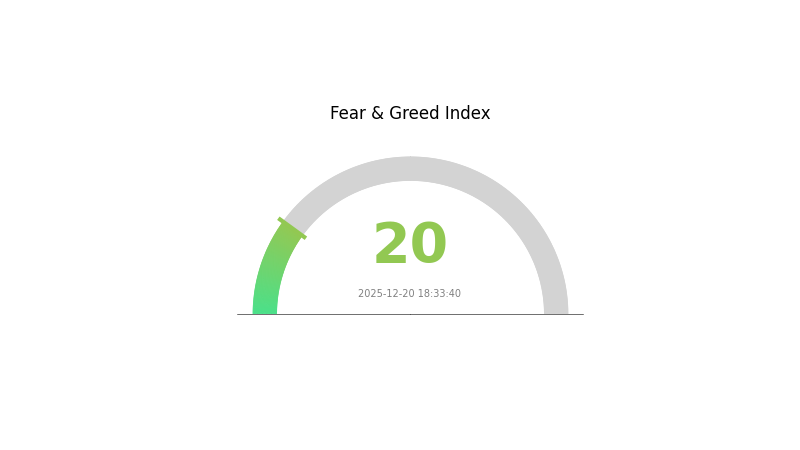

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates severe market pessimism and heightened risk aversion among investors. During such periods, market volatility typically increases as participants rush to reduce positions. However, extreme fear often creates contrarian opportunities for long-term investors. Monitor key support levels and consider building positions strategically. On Gate.com, you can track real-time market sentiment indicators to make informed trading decisions and capitalize on potential turning points in the market cycle.

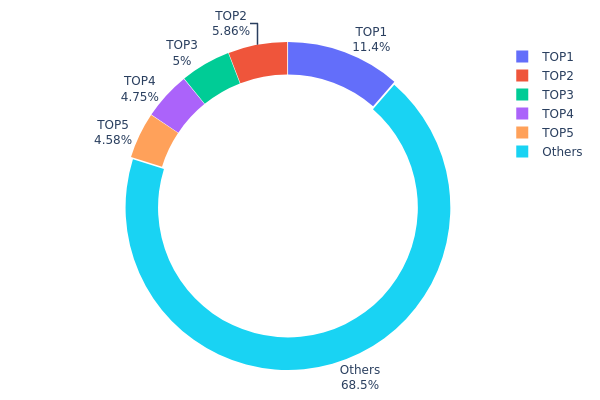

GRIFFAIN Holding Distribution

The holding distribution map illustrates the concentration of token ownership across blockchain addresses, providing critical insights into the decentralization status and potential market manipulation risks of the asset. By analyzing the top holders and their respective percentages of total supply, investors can assess the degree of token concentration and evaluate the stability of the on-chain ecosystem structure.

GRIFFAIN's current holding distribution reveals a moderately concentrated ownership structure. The top five addresses collectively control approximately 31.52% of the total token supply, with the largest holder commanding 11.35%. While this concentration level suggests some degree of centralization, it remains within a range that does not necessarily indicate severe concentration risk. The fact that the remaining 68.48% of tokens are distributed among other addresses ("Others") demonstrates a relatively dispersed secondary tier of holders, which provides a buffer against extreme concentration scenarios. However, the top address's substantial 11.35% position warrants monitoring, as individual large holders retain meaningful influence over supply dynamics.

The current distribution pattern presents mixed implications for market structure and price stability. The concentration among top holders could potentially facilitate coordinated selling pressure or rapid liquidity events during market stress, yet the substantial "Others" category suggests sufficient holder diversity to absorb localized movements. From a decentralization perspective, GRIFFAIN demonstrates moderate tokenomics health, with the 31.52% combined top-5 concentration indicating neither excessive centralization typical of early-stage projects nor the near-uniform distribution of fully mature protocols. This configuration suggests an intermediate development stage where governance influence remains partially concentrated while gradual decentralization remains achievable through continued token distribution and organic holder expansion.

Click to view current GRIFFAIN Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 113564.94K | 11.35% |

| 2 | 5Q544f...pge4j1 | 58640.78K | 5.86% |

| 3 | AGVhmr...gHAk8N | 50000.00K | 5.00% |

| 4 | E2RvJg...qnatYy | 47477.86K | 4.74% |

| 5 | 5PAhQi...cnPRj5 | 45747.69K | 4.57% |

| - | Others | 684420.65K | 68.48% |

II. Core Factors Influencing GRIFFAIN's Future Price

Technology Development and Ecosystem Building

-

AI Agent Platform Integration: GRIFFAIN is deployed on Solana as a multifunctional AI Agent platform supporting natural language interaction with GRIFFAIN Copilot, enabling on-chain operations including asset queries, token swaps, NFT trading, and LP management. The platform features 10+ core agent modules with strong execution capabilities and ecosystem coordination.

-

DeFi Automation Evolution: GRIFFAIN operates within the broader DeFi intelligence ecosystem, representing the "Intent-Centric Copilot" stage of development. This approach emphasizes understanding user intentions and providing optimal execution paths, significantly lowering the barrier to DeFi participation. The platform integrates with Jupiter and Tensor components, emphasizing mobile adaptation and composable front-end architecture.

-

Solana Ecosystem Integration: GRIFFAIN has received official support from the Solana network, positioning it as part of the broader strategy for transforming user thoughts directly into actionable results—evolving from read-write modes to read-write-execute modalities. The platform benefits from Solana's technical infrastructure and ecosystem partnerships.

Market Characteristics

-

Market Position: GRIFFAIN is characterized as a highly volatile low market cap project, with recent trading price around $0.036, market capitalization approximately $36 million, and 24-hour trading volume around $3.5 million. This low market cap and high volatility profile indicates significant price sensitivity to adoption momentum and community sentiment.

-

Ecosystem Demand: Community adoption and market demand for AI-driven DeFi solutions represent critical price drivers. The convergence of stablecoin payments and DeFi application as verified demand channels positions AI Agents as actual implementation interfaces in the AI industry, serving as key intermediaries between AI capabilities and user needs.

Three、2025-2030 GRIFFAIN Price Forecast

2025 Outlook

- Conservative Forecast: $0.0115 - $0.01666

- Neutral Forecast: $0.01666

- Optimistic Forecast: $0.02433 (requires sustained market momentum and positive sentiment)

2026-2027 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with emerging bullish signals and increasing institutional interest

- Price Range Forecast:

- 2026: $0.01435 - $0.02316

- 2027: $0.01135 - $0.02357

- Key Catalysts: Ecosystem development, technology upgrades, regulatory clarity, and increased adoption within DeFi protocols

2028-2030 Long-term Outlook

- Base Case Scenario: $0.02202 - $0.03291 (assumes steady market adoption and stable macroeconomic conditions)

- Optimistic Scenario: $0.03291 - $0.04004 (assumes accelerated protocol adoption and positive market cycles)

- Transformational Scenario: $0.04308 and above (extreme favorable conditions including mainstream institutional adoption and breakthrough technological developments)

- 2030-12-31: GRIFFAIN projected at $0.04308 (representing 104% appreciation from current baseline, indicating significant long-term growth potential)

Note: All price predictions are derived from technical analysis models and market data accessible through platforms like Gate.com. Investors should conduct independent research and risk assessment before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02433 | 0.01666 | 0.0115 | 0 |

| 2026 | 0.02316 | 0.02049 | 0.01435 | 23 |

| 2027 | 0.02357 | 0.02183 | 0.01135 | 31 |

| 2028 | 0.03291 | 0.0227 | 0.02202 | 36 |

| 2029 | 0.04004 | 0.02781 | 0.02086 | 67 |

| 2030 | 0.04308 | 0.03392 | 0.02307 | 104 |

GRIFFAIN Professional Investment Strategy and Risk Management Report

IV. GRIFFAIN Professional Investment Strategy and Risk Management

GRIFFAIN Investment Methodology

(1) Long-term Holding Strategy

-

Target Audience: Investors with high risk tolerance seeking exposure to AI agent technology on Solana

-

Operational Recommendations:

- Accumulate GRIFFAIN during market downturns when volatility is high

- Dollar-cost averaging (DCA) to mitigate entry point risk, especially given the -92.30% annual decline

- Maintain a 12-24 month holding horizon to capitalize on potential platform adoption growth

-

Storage Solutions:

- Use Gate Web3 Wallet for secure self-custody with easy access to trading

- Enable two-factor authentication for enhanced account security

- Consider hardware wallet backup for large holdings

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support/Resistance Levels: Monitor the 24-hour range ($0.015888 to $0.016859) for trading signals

- Moving Average Analysis: Track 7-day and 30-day trends to identify momentum shifts

-

Swing Trading Key Points:

- Capitalize on the recent 2.24% 24-hour gain against the -10.34% 7-day decline for potential mean reversion plays

- Watch for volume confirmation above $305,513 daily average to validate breakout moves

- Set stop-losses at recent 24-hour lows ($0.015888) to manage downside risk

GRIFFAIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.0% portfolio allocation

- Aggressive Investors: 2-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Balance GRIFFAIN holdings with established cryptocurrencies to reduce single-asset concentration risk

- Position Sizing: Given the -92.30% annual performance, limit individual position size to prevent catastrophic losses

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for frequent trading with institutional-grade security protocols

- Cold Storage Strategy: For long-term holdings exceeding 6 months, maintain offline backup copies of private keys in secure locations

- Security Precautions: Never share private keys or recovery phrases; enable whitelist address functionality when available; verify contract address (KENJSUYLASHUMfHyy5o4Hp2FdNqZg1AsUPhfH2kYvEP on Solana) before executing transfers

V. GRIFFAIN Potential Risks and Challenges

GRIFFAIN Market Risk

- Extreme Volatility: The asset shows severe price fluctuations (ATH $0.6428 vs ATL $0.0101), indicating high market instability

- Limited Trading Volume: Daily volume of $305,513 with 21 trading pairs suggests potential liquidity constraints during market stress

- Historical Performance Decline: -92.30% annual return demonstrates significant value erosion and loss of investor confidence

GRIFFAIN Regulatory Risk

- Solana Network Dependency: Regulatory actions against the Solana ecosystem could directly impact GRIFFAIN's viability

- AI Token Classification Uncertainty: Evolving regulatory frameworks around AI-based tokens may create compliance challenges

- Meme Token Association Risk: Platform features including meme token creation could attract regulatory scrutiny

GRIFFAIN Technical Risk

- Smart Contract Vulnerability: As an SPL token on Solana, GRIFFAIN is exposed to potential smart contract exploits or platform-level failures

- Platform Adoption Uncertainty: Low holder count (53,456) relative to total supply raises questions about organic adoption and network effects

- Market Cap Concentration: Fully diluted valuation equals market cap ($16.6M), indicating high distribution concentration risk

VI. Conclusion and Action Recommendations

GRIFFAIN Investment Value Assessment

GRIFFAIN represents a high-risk, speculative investment in the AI agent creator space on Solana. While the platform offers novel functionality for AI-driven token creation and management, the -92.30% annual decline, extreme volatility, and limited trading volume present significant challenges. The asset is suitable only for experienced investors with capital preservation strategies and high risk tolerance. The project's success depends heavily on mainstream adoption of AI agents for token operations and continued Solana ecosystem growth.

GRIFFAIN Investment Recommendations

✅ Beginners: Avoid direct investment until the project demonstrates sustained product-market fit and revenue generation. Consider exposure through diversified Solana-focused funds instead.

✅ Experienced Investors: Implement strict position sizing (2-5% maximum portfolio allocation) with dollar-cost averaging over extended periods. Utilize technical analysis for swing trading opportunities around identified support/resistance levels.

✅ Institutional Investors: Conduct thorough due diligence on smart contract audits and team credibility. Consider small allocation sizes for exploratory exposure, with clear exit criteria if adoption metrics fail to materialize.

GRIFFAIN Trading Participation Methods

- Gate.com Trading: Access GRIFFAIN through Gate.com's spot trading markets with competitive fees and advanced order types

- Peer-to-Peer Exchange: Utilize Gate.com's P2P services for direct transactions with enhanced privacy options

- Staking and Yield Programs: Monitor Gate.com for any offered GRIFFAIN staking programs to generate additional returns on holdings

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

What is the future price of Griffain?

Griffain is expected to trade between $0.01130 and $0.04504 by 2030, representing a potential increase of 176.72% based on current market analysis and trends.

What happened to Griffain Coin?

Griffain Coin experienced a sudden collapse with the project team allegedly abandoning the project, resulting in significant investor losses. The incident occurred recently in late 2025.

How much is the Griffain meme coin worth?

As of today, Griffain (GRIFFAIN) is worth approximately $0.016068, reflecting a 24-hour decline of 14.45%. The current market valuation demonstrates typical meme coin volatility in the current market cycle.

2025 MAY Price Prediction: Bullish Trends and Key Factors Shaping the Cryptocurrency Market

QFS Crypto Explained: What the Quantum Financial System Means for Digital Assets

What is Moni ? A Guide

2025 RAYPrice Prediction: Analyzing Growth Factors and Market Potential for RAY Token in the Coming Years

2025 RAY Price Prediction: Will This Layer-1 Protocol Reach New Heights in the Evolving DeFi Landscape?

2025 SAROS Price Prediction: Comprehensive Analysis and Future Outlook for the Digital Asset Market

Is BNB Attestation Service (BAS) a good investment?: A Comprehensive Analysis of Its Potential Returns and Risk Factors in the Blockchain Ecosystem

Is Test Token (TSTBSC) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability

Is Camp Network (CAMP) a good investment?: A Comprehensive Analysis of Performance, Risk Factors, and Future Potential

AERO Token Price Prediction and Market Insights: An In-Depth Analysis

Is Mitosis (MITO) a good investment?: A Comprehensive Analysis of Price Performance, Technology, and Market Potential in 2024