2025 HFT Price Prediction: Market Analysis and Growth Prospects for Hashflow Token in a Maturing DeFi Landscape

Introduction: HFT's Market Position and Investment Value

Hashflow (HFT), as a universal zk-settlement layer for provable trust across exchanges, has established itself as one of DeFi's largest RFQ liquidity sources since its inception. As of 2025, Hashflow's market capitalization has reached $44,606,476, with a circulating supply of approximately 606,973,413 tokens, and a price hovering around $0.07349. This asset, dubbed the "trust benchmark for exchange ecosystems," is playing an increasingly crucial role in facilitating cross-exchange transactions and preventing MEV exploits.

This article will provide a comprehensive analysis of Hashflow's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. HFT Price History Review and Current Market Status

HFT Historical Price Evolution

- 2022: Initial launch, price reached all-time high of $3.61 on November 7

- 2023: Market consolidation, price experienced significant volatility

- 2025: Bearish trend, price dropped to all-time low of $0.04339757 on June 23

HFT Current Market Situation

As of October 1, 2025, HFT is trading at $0.07349, representing a 2.43% increase in the last 24 hours. The token has a market capitalization of $44,606,476, ranking 735th in the overall cryptocurrency market. HFT's current price is 97.96% below its all-time high and 69.34% above its all-time low. The token's 24-hour trading volume stands at $1,457,951, indicating moderate market activity. Despite recent gains, HFT shows negative performance over longer time frames, with a 5.45% decrease in the past week and a 54.03% decline over the year.

Click to view the current HFT market price

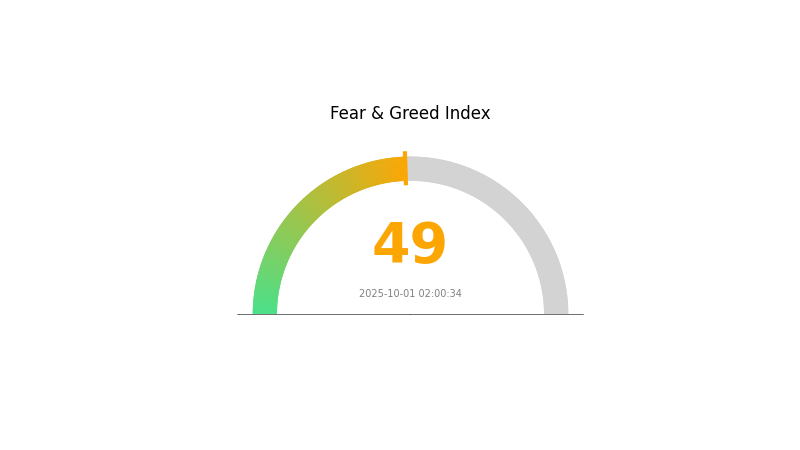

HFT Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of equilibrium, with the Fear and Greed Index registering a neutral reading of 49. This balanced sentiment suggests that investors are neither overly pessimistic nor excessively optimistic about the market's prospects. It's an ideal time for traders to reassess their strategies and conduct thorough research before making any significant moves. While the market doesn't show extreme emotions, it's crucial to remain vigilant and monitor key indicators for potential shifts in sentiment that could impact asset prices.

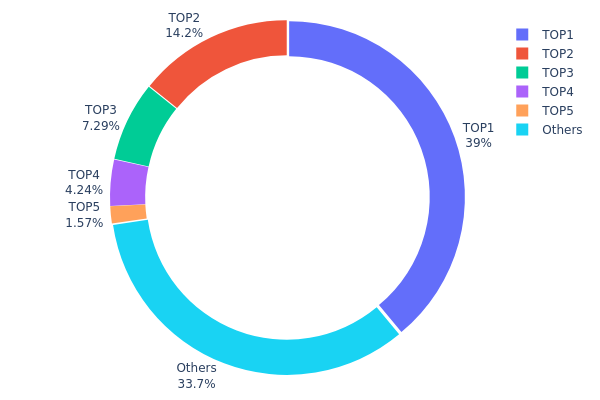

HFT Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of HFT tokens among various wallet addresses. Analysis of this data reveals a significant concentration of HFT tokens in a small number of addresses. The top address holds a substantial 38.97% of the total supply, while the top five addresses collectively control 66.3% of all HFT tokens.

This high level of concentration raises concerns about potential market manipulation and volatility. With such a large portion of tokens held by a few entities, any significant movement or decision by these major holders could have an outsized impact on HFT's price and market dynamics. Furthermore, this concentration suggests a relatively low level of decentralization in HFT's ownership structure, which may be at odds with the principles of decentralized finance.

However, it's worth noting that 33.7% of tokens are distributed among other addresses, indicating some level of broader participation. This distribution pattern reflects a market structure that is currently dominated by a few large players but still has room for increased decentralization and wider token distribution in the future.

Click to view the current HFT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xff83...8e34fc | 389721.27K | 38.97% |

| 2 | 0xf977...41acec | 142480.98K | 14.24% |

| 3 | 0xa312...4ab647 | 72909.72K | 7.29% |

| 4 | 0x4d9f...1e994e | 42440.82K | 4.24% |

| 5 | 0x8ce0...c1ec16 | 15693.51K | 1.56% |

| - | Others | 336753.70K | 33.7% |

II. Key Factors Affecting Future HFT Prices

Supply Mechanism

- Price Impact Risk: Permanent and temporary impact parameters affect market price trends and trading costs.

- Inventory Risk: Terminal and operational risks of positions are reflected through penalty functions, influencing HFT trading rhythm.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions and hedge funds are adopting HFT strategies, indicating significant capital and technological barriers to entry.

Macroeconomic Environment

- Monetary Policy Impact: Macroeconomic data and policy changes significantly influence HFT strategies, especially in futures markets.

- Geopolitical Factors: Global events and political shifts can cause sudden market volatility, impacting HFT operations.

Technological Development and Ecosystem Building

- Algorithmic Advancements: Continuous improvements in AI and machine learning are enhancing HFT models' ability to detect subtle market patterns and execute trades more efficiently.

- Infrastructure Upgrades: Investments in faster data transmission and processing capabilities are crucial for maintaining competitive advantage in HFT.

III. HFT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.04349 - $0.06000

- Neutral prediction: $0.06000 - $0.08000

- Optimistic prediction: $0.08000 - $0.10468 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.05745 - $0.11995

- 2028: $0.08057 - $0.15452

- Key catalysts: Increased adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.13245 - $0.16092 (assuming steady market growth)

- Optimistic scenario: $0.16092 - $0.20000 (assuming strong market performance)

- Transformative scenario: $0.20000 - $0.2269 (assuming exceptional market conditions)

- 2030-12-31: HFT $0.2269 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10468 | 0.07372 | 0.04349 | 0 |

| 2026 | 0.11239 | 0.0892 | 0.07404 | 21 |

| 2027 | 0.11995 | 0.1008 | 0.05745 | 37 |

| 2028 | 0.15452 | 0.11037 | 0.08057 | 50 |

| 2029 | 0.1894 | 0.13245 | 0.12715 | 80 |

| 2030 | 0.2269 | 0.16092 | 0.09012 | 118 |

IV. HFT Professional Investment Strategies and Risk Management

HFT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate HFT tokens during market dips

- Monitor Hashflow's technological developments and partnerships

- Store tokens in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Measure overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor trading volume for confirmation of price movements

HFT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, regular security audits

V. Potential Risks and Challenges for HFT

HFT Market Risks

- Price volatility: HFT may experience significant price swings

- Liquidity risk: Lower trading volumes may impact ability to exit positions

- Competitive landscape: Emerging DEX projects may challenge Hashflow's market share

HFT Regulatory Risks

- Regulatory uncertainty: Changing crypto regulations may impact HFT's operations

- Compliance challenges: Adapting to evolving global regulatory requirements

- Cross-border restrictions: Potential limitations on international transactions

HFT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol

- Scalability issues: Challenges in handling increased transaction volumes

- Integration risks: Complications in adopting new blockchain technologies

VI. Conclusion and Action Recommendations

HFT Investment Value Assessment

HFT presents a unique value proposition in the DEX space with its xOS and RFQ model. However, investors should be aware of short-term volatility and regulatory uncertainties.

HFT Investment Recommendations

✅ Beginners: Start with small positions, focus on understanding the technology

✅ Experienced investors: Consider dollar-cost averaging and utilize technical analysis

✅ Institutional investors: Conduct thorough due diligence and consider OTC options

HFT Trading Participation Methods

- Spot trading: Buy and sell HFT tokens on Gate.com

- Staking: Participate in liquidity provision if available

- DeFi integration: Utilize HFT in compatible DeFi protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Hashflow in 2040?

Based on a 5% annual growth rate, Hashflow is projected to reach $0.1519 by 2040. This prediction considers current market trends and long-term forecasts.

What is the price prediction for $hyper coin?

Based on its $0.0115 presale price, $HYPER is expected to rise due to Layer-2 adoption and market trends. Exact future price is uncertain.

What is the max supply of HFT coin?

The maximum supply of HFT coin is 1 billion tokens. This fixed cap ensures scarcity and potential value appreciation for HFT holders.

Will hamster coin prices increase?

Yes, hamster coin prices are expected to increase by 7.44% by September 2025, reaching $0.002928 according to recent forecasts.

Will Crypto Recover in 2025?

2025 1INCH Price Prediction: Will This DeFi Protocol Token Reach New Heights in the Decentralized Exchange Market?

2025 CETUS Price Prediction: Analyzing Growth Potential and Market Factors in the Evolving DeFi Landscape

2025 RION Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

2025 UPC Price Prediction: Market Analysis and Forecasting Trends for Universal Product Codes in the Global Retail Ecosystem

2025 LOGX Price Prediction: Navigating the Future of Decentralized Logistics Tokens

冷錢包交易是否需支付手續費?全面解析

How to Start Micro Trading with Just $1: A Guide for Beginners

Exploring the Features and Advantages of BNB Smart Chain

What is ADP: A Comprehensive Guide to Automated Data Processing Systems

What is READY: A Comprehensive Guide to Understanding the Framework for Excellence and Development