2025 HGPT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of HGPT

HyperGPT (HGPT) is a marketplace for AI solutions and seamless SDK that powers Web3 with artificial intelligence capabilities. Since its launch in June 2023, the project has established itself as a platform providing integrated AI solutions accessible to all users. As of December 2025, HGPT has achieved a market capitalization of approximately $4.44 million, with a circulating supply of around 846.43 million tokens, trading at approximately $0.005248. This asset, recognized as a "Web3 AI Solution Provider," is playing an increasingly important role in bridging artificial intelligence and decentralized ecosystems.

This article will provide a comprehensive analysis of HGPT's price trends from 2025 to 2030, incorporating historical patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

HyperGPT (HGPT) Market Analysis Report

I. HGPT Price History Review and Current Market Status

HGPT Historical Price Movement

Based on available data, HyperGPT has experienced significant volatility since its market debut:

- February 22, 2024: All-time low (ATL) reached at $0.0038, marking the lowest point in the token's trading history.

- March 29, 2024: All-time high (ATH) achieved at $0.10876, representing a peak valuation period for the project.

- 2024-2025 Period: Sustained downward pressure, with the token declining approximately 84.04% year-over-year from its previous highs.

HGPT Current Market Status

As of December 24, 2025:

- Current Price: $0.005248

- 24-Hour Change: -5.16% (-$0.000286)

- 7-Day Performance: -11.70% (-$0.000695)

- 30-Day Performance: -0.48% (-$0.000025)

- 1-Hour Change: +0.15% (+$0.000008)

Market Capitalization & Supply Metrics:

- Circulating Market Cap: $4,442,088.38

- Fully Diluted Valuation (FDV): $5,236,151.98

- Circulating Supply: 846,434,523.81 HGPT (84.64% of total supply)

- Total Supply: 997,742,373.49 HGPT

- Maximum Supply: 1,000,000,000 HGPT

- 24-Hour Trading Volume: $208,345.20

Market Position:

- Global Ranking: #1,604 by market capitalization

- Market Dominance: 0.00016%

- Circulating to Total Supply Ratio: 84.64%

- Token Holders: 110,858 addresses

Price Range (24-Hour):

- High: $0.00574

- Low: $0.005144

Check the current HGPT market price on Gate.com

HGPT Market Sentiment Indicator

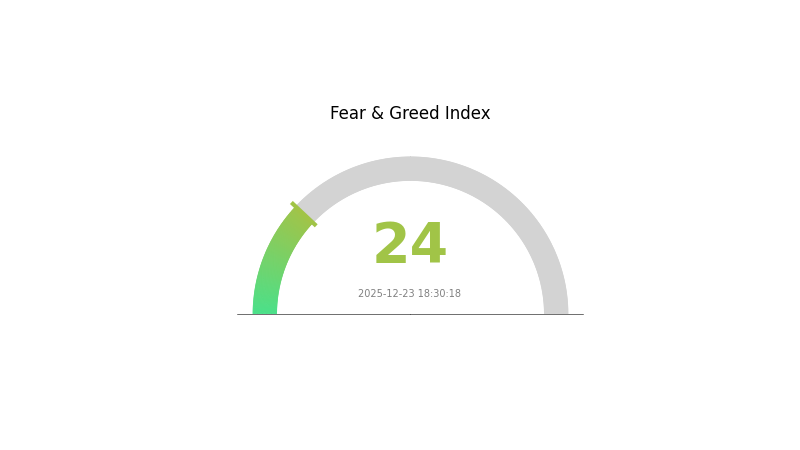

2025-12-23 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear & Greed Index plunging to 24. This represents a significant shift in market sentiment, indicating widespread investor anxiety and pessimistic outlooks. During periods of extreme fear, market volatility typically intensifies as panic selling accelerates. However, savvy investors often view such conditions as potential buying opportunities, as assets may be undervalued. Monitor market movements carefully on Gate.com and consider your risk tolerance before making investment decisions during this heightened uncertainty phase.

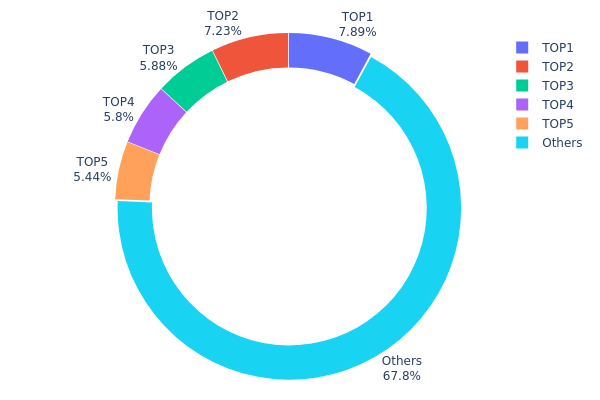

HGPT Holdings Distribution

The address holdings distribution represents the concentration of HGPT tokens across the blockchain, revealing the degree of asset decentralization and potential market power concentration among major stakeholders. This metric is crucial for assessing token holder diversity and understanding potential risks associated with wealth concentration.

Analysis of the current HGPT holdings data indicates a moderate concentration pattern. The top five addresses collectively hold approximately 32.23% of the circulating supply, with the largest holder controlling 7.88% and the second-largest controlling 7.23%. While these figures suggest a degree of concentration, they remain below critical thresholds typically indicative of severe centralization concerns. The remaining 67.77% distributed among other addresses demonstrates relatively distributed ownership, which mitigates extreme concentration risks and suggests a reasonably diversified holder base.

The current address distribution architecture presents mixed implications for market structure and stability. The moderate concentration among top holders creates potential for coordinated market movements, though the substantial proportion held by dispersed addresses provides meaningful counterbalance. The absence of a single dominant holder exceeding 10% suggests that HGPT maintains sufficient decentralization to resist arbitrary price manipulation by individual actors. This distribution pattern reflects a maturing token ecosystem with institutional and significant participant involvement, while the broader holder base indicates genuine community participation and market resilience.

Click to view current HGPT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 78882.83K | 7.88% |

| 2 | 0x2e8f...725e64 | 72303.11K | 7.23% |

| 3 | 0x064e...07635d | 58849.63K | 5.88% |

| 4 | 0x7510...1eef8e | 58000.00K | 5.80% |

| 5 | 0x33af...a4f25f | 54440.00K | 5.44% |

| - | Others | 677524.43K | 67.77% |

II. Core Factors Affecting HGPT's Future Price

Supply Mechanism

- Fixed Supply: HGPT has a fixed total supply, which increases scarcity and provides long-term value support for the token.

- Scarcity Impact: The limited supply mechanism enhances the token's potential to maintain value stability over extended periods.

Institutional and Major Holder Dynamics

- Enterprise Adoption: Technology companies are exploring the application and adoption of HGPT tokens, which could drive increased market demand and price appreciation.

Technology Development and Ecosystem Building

- Platform Development: Continuous development of the HyperGPT platform combined with user growth is expected to drive significant price increases in the medium term, with price targets potentially reaching the 0.03-0.05 USDT range.

- AI and Blockchain Integration: HyperGPT's core advantage lies in its unique technical architecture and market positioning that bridges artificial intelligence and blockchain technology.

III. 2025-2030 HGPT Price Forecast

2025 Outlook

- Conservative Forecast: $0.0044 - $0.00524

- Neutral Forecast: $0.00524 (average expected price)

- Optimistic Forecast: $0.00665 (under favorable market conditions)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation and consolidation phase with steady upward momentum, supported by incremental adoption and ecosystem development.

- Price Range Predictions:

- 2026: $0.0041 - $0.00766 (13% potential upside)

- 2027: $0.00354 - $0.00796 (29% cumulative growth)

- 2028: $0.00502 - $0.00945 (40% cumulative growth)

- Key Catalysts: Platform expansion, increased utility adoption, growing institutional interest in emerging digital assets, and potential regulatory clarity improvements.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00774 - $0.01128 (60% growth by 2029), advancing to $0.00857 - $0.01241 (87% growth by 2030) assuming sustained ecosystem growth and moderate market expansion.

- Optimistic Scenario: $0.01128 - $0.01241 (60-87% cumulative appreciation by 2030), contingent upon accelerated mainstream adoption and breakthrough technological developments.

- Bullish Scenario: Exceeding $0.01241 (87%+ growth) under conditions of exponential user base expansion, significant partnerships, and favorable macroeconomic conditions for digital assets.

- 2030-12-24: HGPT reaches $0.01241 (peak yearly valuation indicating sustained bullish trajectory through decade-end).

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00665 | 0.00524 | 0.0044 | 0 |

| 2026 | 0.00766 | 0.00594 | 0.0041 | 13 |

| 2027 | 0.00796 | 0.0068 | 0.00354 | 29 |

| 2028 | 0.00945 | 0.00738 | 0.00502 | 40 |

| 2029 | 0.01128 | 0.00841 | 0.00774 | 60 |

| 2030 | 0.01241 | 0.00985 | 0.00857 | 87 |

HyperGPT (HGPT) Professional Investment Strategy and Risk Management Report

IV. HGPT Professional Investment Strategy and Risk Management

HGPT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with belief in AI-powered Web3 solutions and long-term commitment to emerging technologies

- Operational recommendations:

- Accumulate during market downturns, particularly when the token trades below historical support levels

- Hold through market cycles to capture potential upside from ecosystem development

- Reinvest any rewards or gains to compound positions over time

(2) Active Trading Strategy

- Price momentum analysis:

- Monitor 24-hour and 7-day price movements to identify trend reversals

- Current 24H change: -5.16% and 7D change: -11.70% suggest potential support-level testing

- Wave trading considerations:

- Trade around resistance levels (recent 24H high: $0.00574)

- Scale positions during high volatility periods (current 24H volume: $208,345.20)

HGPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of total portfolio allocation

- Active investors: 3-7% of total portfolio allocation

- Professional investors: 5-10% of total portfolio allocation

(2) Risk Hedging Approaches

- Portfolio diversification: Balance HGPT exposure with stable assets and other utility tokens

- Dollar-cost averaging: Spread purchases over multiple transactions to reduce timing risk

(3) Secure Storage Solutions

- Self-custody security: Use hardware wallets with proper key management protocols

- Smart contract risk: Be aware that HGPT operates on BSC (BEP20 standard) with inherent smart contract vulnerabilities

- Security best practices: Never share private keys, use multi-signature wallets for large holdings, and maintain offline backup copies of recovery phrases

V. HGPT Potential Risks and Challenges

HGPT Market Risks

- Extreme volatility: HGPT has experienced an -84.04% decline over the past year, from historical high of $0.10876 to current price of $0.005248, indicating significant price instability

- Low trading liquidity: Current 24-hour volume of $208,345 represents relatively low liquidity, which may lead to slippage on larger trades

- Market concentration: With only 110,858 holders, the token faces distribution risks and potential whale manipulation

HGPT Regulatory Risks

- Emerging AI regulation: Global regulatory frameworks for AI-integrated tokens remain uncertain and evolving

- Blockchain compliance: BSC-based tokens may face varying regulatory treatment across different jurisdictions

- Compliance uncertainty: Lack of clarity regarding AI marketplace regulatory status could impact project viability

HGPT Technology Risks

- Market competition: The AI solutions marketplace sector faces increasing competition from both centralized and decentralized platforms

- Technology adoption: Successful integration of seamless SDK and AI solutions requires continuous development and user adoption

- Blockchain dependency: Performance relies on BSC network stability and transaction costs

VI. Conclusion and Action Recommendations

HGPT Investment Value Assessment

HyperGPT positions itself at the intersection of AI and Web3, offering integrated AI solutions through a marketplace model. However, the token exhibits significant volatility with an 84% decline over the past year, suggesting either substantial selling pressure or limited market confidence. The project maintains a market cap of $4.44M with 84.64% of total supply in circulation, indicating moderate tokenomics maturity. The relatively small holder base of 110,858 addresses presents both concentration risk and potential growth opportunity if adoption accelerates. Given the nascent state of AI-Web3 integration and current market conditions, HGPT carries elevated risk suitable only for investors with high risk tolerance.

HGPT Investment Recommendations

✅ Beginners: Start with minimal positions (1-2% of portfolio) using dollar-cost averaging to understand AI-Web3 narratives without excessive exposure ✅ Experienced investors: Conduct thorough due diligence on AI marketplace adoption metrics and SDK integration progress before significant allocation ✅ Institutional investors: Evaluate team credentials, partnership validations, and competitive positioning within the AI solutions market before considering allocation

HGPT Trading Participation Methods

- Direct spot trading: Purchase HGPT on Gate.com through the BSC network using BNB or stablecoins

- Liquidity provision: Consider providing liquidity on decentralized platforms to generate additional yield (for advanced users only)

- Strategic accumulation: Participate in market weakness by setting limit orders below current support levels during volatility

Cryptocurrency investments carry extreme risk and may result in total loss of capital. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult qualified financial advisors. Never invest more than you can afford to lose completely.

FAQ

Will hamster coin prices increase?

Yes, based on current market analysis, Hamster coin is projected to experience significant growth. Predictions suggest substantial price increases driven by growing adoption and market momentum in the Web3 sector.

What factors influence HGPT price predictions?

HGPT price predictions are influenced by market sentiment, trading volume, technological developments, user adoption rates, and overall crypto market conditions.

What is the historical price performance of HGPT?

HGPT has declined 86.47% over the past year, trading between $0.004878 and $0.036000. The token experienced significant downward pressure, reflecting broader market conditions and reduced trading volume in this period.

What are the risks associated with HGPT price volatility?

HGPT price volatility can cause significant value fluctuations, leading to potential financial losses for investors. Market uncertainty and rapid price swings may complicate investment decisions and risk management strategies in the cryptocurrency market.

Is Assemble AI (ASM) a Good Investment?: Analyzing Growth Potential and Market Position in the AI Sector

D vs BAT: The Evolution of Tech Giants in the Digital Economy

KAITO vs CHZ: The Battle of Virtual Vocalists Heats Up the Music Scene

Is Think Protocol (THINK) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Chappyz (CHAPZ) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 SAPIEN Price Prediction: Will This AI Token Reach New Heights in the Crypto Market?

TET vs ZIL: Comprehensive Comparison of Two Leading Blockchain Platforms for Enterprise Solutions

Top 10 Cryptocurrencies with 2025 Price Predictions | Future Investment Opportunities

What is fueling APE Coin’s explosive growth?

How to Get Your Own Cristiano Ronaldo NFT

Guide to Withdrawing Bitcoin from Popular Payment Apps