2025 HOOK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: HOOK's Market Position and Investment Value

Hooked Protocol (HOOK) serves as a governance and utility token for Web3 infrastructure development, designed to facilitate the large-scale adoption of Web3 through gamified learning experiences and community-driven innovation. Since its launch in November 2022, HOOK has established itself as a key component within an ecosystem focused on making Web3 accessible to mainstream users. As of December 2025, HOOK maintains a market capitalization of approximately $16.65 million with a circulating supply of approximately 311.67 million tokens, currently trading around $0.03329. This innovative token, recognized for its multi-functional utility model including governance rights, community rewards, and in-app transaction capabilities, is playing an increasingly important role in Web3 education and infrastructure development.

This article will provide a comprehensive analysis of HOOK's price dynamics and market trends as of December 22, 2025, combining historical performance patterns, market supply and demand dynamics, ecosystem development progress, and macroeconomic factors to offer professional price forecasts and practical investment strategies for investors seeking to understand this Web3-focused asset.

Hooked Protocol (HOOK) Market Analysis Report

I. HOOK Price History Review and Current Market Status

HOOK Historical Price Evolution

- February 2023: Hooked Protocol reached its all-time high of $4.07, marking the peak of early market enthusiasm following the project's token launches in early 2023.

- 2023-2025: The token experienced a prolonged bearish phase, declining significantly from peak levels as market sentiment shifted and the broader cryptocurrency market faced headwinds.

- October 2025: HOOK touched its all-time low of $0.02786378 on October 11, 2025, representing approximately a 92% decline from the all-time high over the 2.5-year period.

HOOK Current Market Position

As of December 22, 2025, HOOK is trading at $0.03329, reflecting recent short-term weakness with a 24-hour price decline of -5.64%. The token has experienced notable negative performance across multiple timeframes: -0.15% over the past hour, -10.95% over the past week, and -27.38% over the past 30 days. The one-year performance shows a substantial -92% decline from prior levels.

Market Metrics:

- Current Price: $0.03329

- 24-Hour Volume: $41,603.01

- Market Capitalization: $10,375,383.31

- Fully Diluted Valuation: $16,645,000.00

- Circulating Supply: 311,666,666 HOOK (62.33% of total supply)

- Total Supply: 500,000,000 HOOK

- Market Ranking: #1150

- Total Holders: 220,889

- Listed on 26 exchanges

Price Range (24-Hour):

- High: $0.03562

- Low: $0.03291

View current HOOK market price

II. Project Overview

Mission and Vision

Hooked Protocol is building infrastructure for the large-scale adoption of Web3. The project provides customized learning and monetization products alongside ecosystem infrastructure, enabling users and businesses to transition into the Web3 environment. The protocol's mission is to create an attractive, community-owned ecosystem through tailored product experiences, mainstream market promotion, and comprehensive Web3 education.

Core Products and Features

Wild Cash Platform: The flagship product features a "test and earn" experience combined with gamified learning mechanisms. The platform has achieved significant user adoption with over 2 million monthly active users, demonstrating strong market traction in the Web3 education and onboarding space.

Three Strategic Pillars:

-

Web3 Community Gateway: The protocol has established various incentive mechanisms, providing easy-to-use wallets and decentralized user identities to facilitate community entry into Web3.

-

Gamified Learning Experience: A simplified educational system combining immersive (experiential) and exploratory (curiosity-based) learning approaches. The platform teaches Web3 concepts through gamification, offers Web3 simulation experiences for participation in popular cryptocurrency domains such as NFT and GameFi, and delivers innovative learning content through engaging short-video formats.

-

Application Infrastructure: Infrastructure integration designed to onboard additional applications and businesses into the Web3 and Hooked ecosystems.

III. Token Economics

HOOK Token Structure

Hooked Protocol employs an innovative single-token (HOOK) structure complemented by HGT (Hooked Gold Token), a practical utility token within the ecosystem.

HOOK Token Functions

- Governance Token: HOOK serves as the governance token of the Hooked ecosystem, granting token holders decision-making authority.

- Community and Access Token: Provides access to community activities and exclusive NFT privileges.

- In-App Utility: Used for certain in-app purchases including game tools and secret boxes. HOOK spent on these purchases is burned, reducing overall token supply and creating deflationary mechanisms.

- Gas Fee Token: Designed for future use as a gas fee token within Hooked infrastructure.

- staking Rewards: Incorporates a pledge reward plan directly linked to platform profitability, aligning token holder incentives with protocol success.

Token Supply Metrics

- Circulating Supply: 311,666,666 HOOK (62.33%)

- Total Supply: 500,000,000 HOOK

- Maximum Supply: 500,000,000 HOOK

- Market Cap to FDV Ratio: 62.33%

IV. Fundraising History

Hooked Protocol raised approximately $6 million through two token sale rounds conducted in early 2023. The fundraising valued the project between $30 million and $60 million in fully diluted valuation. Twenty percent (20%) of tokens were allocated to primary market investors, indicating institutional participation in the protocol's early development phase.

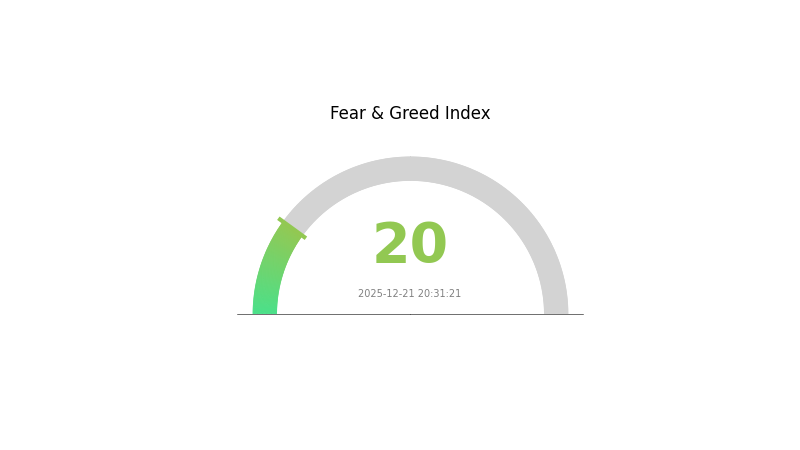

V. Market Sentiment

Current market sentiment reflects extreme fear, with a VIX reading of 20 as of December 21, 2025, indicating heightened risk aversion across cryptocurrency markets during this period.

HOOK Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index hitting 20. This indicates severe market pessimism and potential panic selling. Such extreme readings often present contrarian trading opportunities, as markets tend to reverse after reaching these lows. Investors should exercise caution and avoid emotional decision-making during volatile periods. Consider dollar-cost averaging strategies to build positions gradually. On Gate.com, you can monitor real-time sentiment indicators and adjust your portfolio accordingly during extreme market conditions.

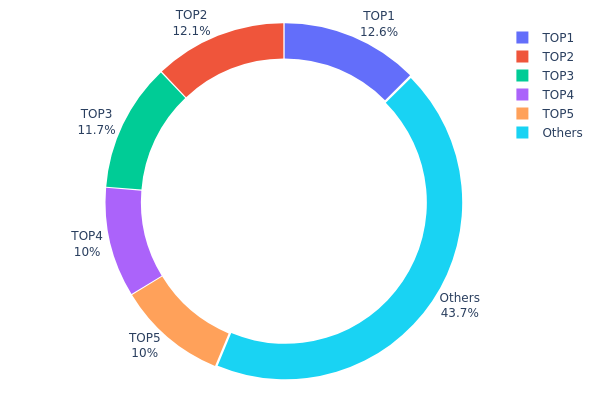

HOOK Holdings Distribution

The address holdings distribution represents the concentration of HOOK tokens across the top wallet addresses on the blockchain. This metric provides critical insight into token ownership structure, potential centralization risks, and the likelihood of large-scale liquidations or coordinated market movements. By examining how tokens are distributed among major holders versus the broader population, analysts can assess the health of the token's decentralized governance and market stability.

HOOK's current holdings distribution reveals moderate concentration characteristics. The top five addresses collectively control approximately 56.27% of the total supply, with the largest holder commanding 12.55% and the second-largest holding 12.06%. While these positions are substantial, the remaining 43.73% distributed among other addresses suggests a meaningful degree of decentralization compared to more concentrated tokens. However, the relatively tight clustering among the top four holders—each holding between 10% and 12.55%—indicates a coordinated or institutional ownership pattern that warrants monitoring.

This distribution pattern presents both structural stability and potential risk factors. The significant holdings by institutional or large players could provide price stability during minor market turbulence, as these entities typically maintain longer-term positions. Conversely, if these major holders were to execute large sell orders simultaneously, the market could experience substantial downward pressure. The concentration threshold of approximately 56% among top holders falls within the range where tokens maintain reasonable decentralization while remaining vulnerable to coordinated movements. This balance suggests HOOK exhibits a moderately centralized structure typical of established tokens with institutional participation, though ongoing monitoring of these major positions remains essential for assessing long-term market dynamics.

Visit HOOK Holdings Distribution on Gate.com for real-time data.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5a52...70efcb | 62775.71K | 12.55% |

| 2 | 0xf977...41acec | 60334.21K | 12.06% |

| 3 | 0x7c26...8e108c | 58333.33K | 11.66% |

| 4 | 0x008c...c265fd | 50000.00K | 10.00% |

| 5 | 0xfb6b...0c1515 | 50000.00K | 10.00% |

| - | Others | 218556.75K | 43.73% |

II. Core Factors Influencing HOOK's Future Price

Macroeconomic Environment

-

Market Sentiment and Adoption Trends: HOOK's future price is significantly influenced by overall market sentiment, regulatory news, technological advancements, and global adoption trends. As the broader cryptocurrency ecosystem evolves, investor perception and confidence in emerging protocols like Hooked Protocol will play a crucial role in determining price movements.

-

Regulatory Clarity: The cryptocurrency market has benefited from improved regulatory conditions. Favorable regulatory environments and clearer guidelines for digital assets can accelerate institutional adoption and public acceptance, thereby supporting sustained price appreciation for protocols like HOOK.

-

Global Adoption Dynamics: The expansion of cryptocurrency services and increasing global adoption rates directly impact token valuations. As more financial services built on blockchain protocols like Hooked Protocol are deployed worldwide, network utility and demand for HOOK tokens are expected to increase correspondingly.

III. 2025-2030 HOOK Price Forecast

2025 Outlook

- Conservative Forecast: $0.02568

- Neutral Forecast: $0.03335

- Optimistic Forecast: $0.04702

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation and recovery phase with steady growth trajectory

- Price Range Forecast:

- 2026: $0.02130 - $0.05707 (20% upside potential)

- 2027: $0.03501 - $0.06613 (45% upside potential)

- 2028: $0.04476 - $0.07230 (71% upside potential)

- Key Catalysts: Protocol adoption expansion, ecosystem development maturation, market sentiment recovery, institutional interest growth

2029-2030 Long-term Outlook

- Base Case: $0.06289 - $0.09077 (94% upside by 2029, continued momentum)

- Optimistic Scenario: $0.06458 - $0.09259 (132% upside by 2030 under sustained adoption and positive market conditions)

- Transformative Scenario: Price targets contingent upon breakthrough ecosystem developments, major partnership announcements, or significant protocol upgrades that drive mainstream adoption

- 2025-12-22: HOOK trading at moderate levels with consolidation pattern observed

Note: These forecasts are based on historical data analysis and should be monitored through platforms like Gate.com for real-time price movements and updated market conditions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04702 | 0.03335 | 0.02568 | 0 |

| 2026 | 0.05707 | 0.04019 | 0.0213 | 20 |

| 2027 | 0.06613 | 0.04863 | 0.03501 | 45 |

| 2028 | 0.0723 | 0.05738 | 0.04476 | 71 |

| 2029 | 0.09077 | 0.06484 | 0.06289 | 94 |

| 2030 | 0.09259 | 0.07781 | 0.06458 | 132 |

Hooked Protocol (HOOK) Investment Analysis Report

I. Executive Summary

Hooked Protocol (HOOK) is establishing infrastructure for large-scale Web3 adoption by providing customized learning and monetization products for users and businesses entering the Web3 ecosystem. The project's flagship product, "Wild Cash," has achieved impressive growth with over 2 million monthly active users through its "test and earn" experience combined with gamified learning features.

Current Market Data (as of December 22, 2025):

- Current Price: $0.03329

- 24h Change: -5.64%

- All-Time High: $4.07 (February 6, 2023)

- All-Time Low: $0.02786378 (October 11, 2025)

- Market Cap: $10,375,383.31

- Fully Diluted Valuation: $16,645,000

- Circulating Supply: 311,666,666 HOOK

- Total Supply: 500,000,000 HOOK

- Market Ranking: 1150

II. Project Overview and Fundamentals

Project Mission and Vision

Hooked Protocol aims to form an attractive community-owned ecosystem by developing communities through customized product experiences, mainstream market promotion, and Web3 education while providing infrastructure for enterprise Web3 development.

Core Components

1. Web3 Community Gateway

- Established various incentive mechanisms to lower entry barriers

- Provides easy-to-use wallets and decentralized user identities

- Creates a welcoming environment for mainstream users

2. Gamified Learning Experience

- Simplified educational system combining immersive (experiential) and exploratory (curiosity-based) learning

- Web3 simulation experiences enabling users to participate in popular cryptocurrency areas such as NFT and GameFi

- Innovative learning delivered through short videos in entertaining and engaging formats

3. Application Infrastructure

- Infrastructure integration to onboard more applications and businesses into Web3 and Hooked ecosystems

- Backend support for enterprise Web3 adoption

Token Ecosystem

HOOK Token (Governance Token):

- Governance token of the Hooked ecosystem

- Access token for community activities and exclusive NFT privileges

- In-app purchase utility (game tools, secret boxes) with HOOK burning mechanism to reduce total supply

- Future gas fee token for Hooked infrastructure

- Staking rewards program linked to platform profitability

HGT Token (Hooked Gold Token):

- Practical utility token within the ecosystem complementing HOOK

III. Financial Performance and Market Position

Historical Performance Metrics

| Timeframe | Price Change | Amount Change |

|---|---|---|

| 1 Hour | -0.15% | -$0.00005 |

| 24 Hours | -5.64% | -$0.00199 |

| 7 Days | -10.95% | -$0.00409 |

| 30 Days | -27.38% | -$0.01255 |

| 1 Year | -92.00% | -$0.38284 |

Market Capitalization Analysis

- Current Market Cap: $10,375,383.31

- Fully Diluted Valuation: $16,645,000

- Market Capitalization to FDV Ratio: 62.33%

- Market Dominance: 0.00051%

- 24h Trading Volume: $41,603.01

- Number of Holders: 220,889

- Listed on 26 Exchanges

Fundraising History

Hooked Protocol raised approximately $6 million from two rounds of token sales conducted earlier in the year, with FDV ranging from $30 million to $60 million. Twenty percent of tokens were allocated to primary market investors.

IV. HOOK Professional Investment Strategy and Risk Management

HOOK Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Community builders, Web3 education advocates, long-term ecosystem believers

- Operational Recommendations:

- Dollar-cost averaging (DCA) to accumulate positions over time, reducing timing risk

- Focus on the project's user growth metrics and adoption rates as key performance indicators

- Participate in staking rewards program to generate yield linked to platform profitability

- Monitor quarterly updates on Wild Cash monthly active users and new product launches

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Identify key price levels at $0.03291 (24h low) and $0.03562 (24h high) for swing trading entry and exit points

- Volume Analysis: Track 24h trading volume of $41,603.01 to assess liquidity and market interest

-

Swing Trading Key Points:

- Enter positions during local support levels with clear resistance targets

- Maintain strict stop-loss orders 5-10% below entry points given high volatility

- Scale out profits at identified resistance levels rather than holding for extended rallies

HOOK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio maximum allocation for speculative positions

- Active Investors: 3-5% of portfolio for core Web3 education exposure

- Professional Investors: 5-10% of portfolio with active trading and staking strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit individual HOOK positions to prevent catastrophic losses, especially given 92% one-year decline

- Portfolio Diversification: Balance HOOK exposure with other Web3 infrastructure plays and stablecoins to manage concentration risk

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet for convenient active trading with two-factor authentication enabled

- Cold Storage Option: For long-term holdings, transfer HOOK to self-custody solutions with hardware-level security

- Security Precautions: Never share private keys, use hardware-backed signing when available, enable withdrawal whitelisting on exchanges, and maintain backups of seed phrases in secure offline locations

V. HOOK Potential Risks and Challenges

HOOK Market Risks

- Severe Price Decline: HOOK has experienced a 92% one-year decline from $0.1 to $0.03329, indicating significant market skepticism and potential further downside risk

- Low Trading Liquidity: Daily trading volume of $41,603.01 is relatively low for effective position exits during market stress, creating slippage concerns

- Competition in Learning Platform Segment: Multiple Web3 onboarding and education platforms compete for user attention and liquidity, potentially diluting Hooked Protocol's market share

HOOK Regulatory Risks

- Uncertain Regulatory Classification: Governance tokens like HOOK may face evolving regulatory treatment across different jurisdictions, impacting trading and staking functionality

- International Compliance Requirements: As Hooked Protocol expands globally through Wild Cash and other products, regulatory changes in major markets could restrict user access or token functionality

- Securities Law Exposure: Staking rewards and governance mechanisms could attract regulatory scrutiny regarding securities classification in certain jurisdictions

HOOK Technical Risks

- Smart Contract Vulnerabilities: Token burning mechanisms and in-app purchase systems require continuous auditing to prevent exploits or fund loss

- Scaling Infrastructure: As user base grows beyond 2 million monthly active users, the underlying blockchain infrastructure must reliably support transactions without congestion or failed operations

- Cross-Chain Interoperability: If Hooked Protocol expands across multiple blockchains, technical complexity increases with potential bridge vulnerabilities and liquidity fragmentation

VI. Conclusions and Action Recommendations

HOOK Investment Value Assessment

Hooked Protocol addresses a significant market opportunity in Web3 education and onboarding with its gamified learning approach and Wild Cash product demonstrating real user traction at 2+ million monthly active users. However, the token has experienced severe depreciation (92% one-year decline) and currently trades significantly below its initial launch price of $0.1, suggesting substantial market repricing may have already occurred or further downside remains possible.

The project's value proposition depends heavily on sustained user growth, successful monetization of its user base, and continued expansion into enterprise Web3 infrastructure. While the underlying business model shows promise through user adoption metrics, the token's market reception remains skeptical as evidenced by continued price pressure and low trading volumes.

HOOK Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of total crypto allocation) only if deeply interested in Web3 education thesis; prioritize learning about the project fundamentals before deploying capital; use dollar-cost averaging over 6-12 months to reduce timing risk; avoid leverage or margin trading given volatility.

✅ Experienced Investors: Consider HOOK as a speculative Web3 infrastructure play with defined risk parameters (5% maximum allocation); monitor Wild Cash user growth metrics and tokenomics changes quarterly; participate in staking if annual yields exceed 15-20% to compensate for risk; establish clear exit strategies at predetermined profit targets or losses.

✅ Institutional Investors: Evaluate HOOK only after comprehensive due diligence on team credentials, competitive positioning, and technical audit results; negotiate directly with project for large position stakes; structure positions with derivatives hedging if needed; maintain quarterly rebalancing discipline based on performance milestones.

HOOK Trading Participation Methods

- Spot Trading on Gate.com: Buy and hold HOOK directly through Gate.com's spot market with competitive trading fees and high liquidity; ideal for long-term positioning and staking strategies

- DCA Strategy via Gate.com: Establish automated recurring purchases at set intervals to build positions gradually while averaging entry prices across market cycles

- Liquidity Provision: Consider providing HOOK liquidity to trading pairs on supported platforms to generate trading fees, though this exposes capital to impermanent loss during volatile price movements

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions carefully according to their risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for HOOK crypto in 2030?

Based on historical price analysis, HOOK crypto is predicted to reach approximately 10.31 USD by 2030. This forecast reflects past market trends and performance data.

What is the all time high of HOOK?

The all-time high of HOOK is $4.062533059080115. This represents the peak price the token has reached since its inception, reflecting strong market interest and investor confidence during that period.

What factors influence HOOK token price predictions?

HOOK token price predictions are influenced by supply and demand dynamics, protocol updates, block reward changes, market sentiment, real-world adoption rates, and trading volume.

What is HOOK crypto and what problem does it solve?

Hooked Protocol (HOOK) is a cryptocurrency designed to facilitate user onboarding into Web3 through educational resources. It solves the critical problem of user accessibility and understanding barriers in the blockchain space by providing educational pathways for newcomers.

What are the risks and challenges for HOOK price growth?

HOOK faces high volatility and intense competition from other Web3 projects. Regulatory uncertainty, market sentiment shifts, and adoption barriers present significant challenges to sustained price growth.

How do exchange net inflows and institutional holdings impact ICP crypto holdings and capital flows in 2025?

TUT Token in 2025: Use Cases, Staking, and Buying Guide

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

Is Propchain (PROPC) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors for 2024

Is Manchester City Fan Token (CITY) a good investment?: A Comprehensive Analysis of Risks, Benefits, and Market Potential

Is Heima (HEI) a good investment?: A Comprehensive Analysis of Performance, Potential, and Market Outlook

Is Parcl (PRCL) a good investment? A comprehensive analysis of tokenomics, market potential, and risk factors in 2024

MDT vs SAND: A Comprehensive Comparison of Two Leading Sandbox and Metaverse Platforms