2025 MOODENG Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: MOODENG's Market Position and Investment Value

MOODENG (MOODENG), a memecoin built on Solana, has emerged as a notable digital asset in the cryptocurrency landscape. Since its launch in September 2024, MOODENG has attracted considerable attention from the crypto community. As of December 18, 2025, MOODENG has achieved a market capitalization of approximately $68.47 million, with a circulating supply of around 989.94 million tokens, currently trading at $0.06917 per token. This unique digital asset continues to demonstrate its presence within the Solana ecosystem's vibrant memecoin sector.

This article will provide a comprehensive analysis of MOODENG's price trends and market dynamics through 2025-2030, incorporating historical patterns, market supply and demand factors, ecosystem developments, and macroeconomic conditions. The analysis aims to equip investors with professional price forecasts and actionable investment strategies for navigating MOODENG's market movements. Whether you are considering trading on Gate.com or conducting deeper fundamental analysis, this guide will offer valuable insights into MOODENG's investment potential and risk considerations.

MOODENG Market Analysis Report

I. MOODENG Price History Review and Current Market Status

MOODENG Historical Price Evolution Trajectory

- September 2024: MOODENG launched on Solana at an initial price of $0.02, marking the beginning of the memecoin's market journey.

- November 2024: The token reached its all-time high (ATH) of $0.70047 on November 15, 2024, representing a remarkable 3,402% gain from the launch price within approximately two months.

- December 2025: Following a prolonged correction phase, MOODENG traded at $0.06917, down 80.33% from its ATH over the 12-month period, with the all-time low (ATL) recorded at $0.0206 on April 7, 2025.

MOODENG Current Market Positioning

As of December 18, 2025, MOODENG is ranked #419 by market capitalization among cryptocurrencies. The token exhibits the following market metrics:

Price Metrics:

- Current Price: $0.06917

- 24-Hour Range: $0.06642 - $0.07642

- 24-Hour Change: -7.01%

Market Capitalization:

- Market Cap: $68,474,087.07

- Fully Diluted Valuation (FDV): $68,476,348.78

- Market Dominance: 0.0022%

Trading Activity:

- 24-Hour Trading Volume: $862,756.60

- Available on 31 cryptocurrency exchanges

- Active holder base: 68,619 addresses

Recent Price Performance:

- 1-Hour Change: -1.26%

- 7-Day Change: -23.03%

- 30-Day Change: -9.45%

Supply Metrics:

- Circulating Supply: 989,939,093.14 MOODENG

- Total Supply: 989,971,791 MOODENG

- Circulating Ratio: 99.9967%

- Maximum Supply: 989,971,791 MOODENG

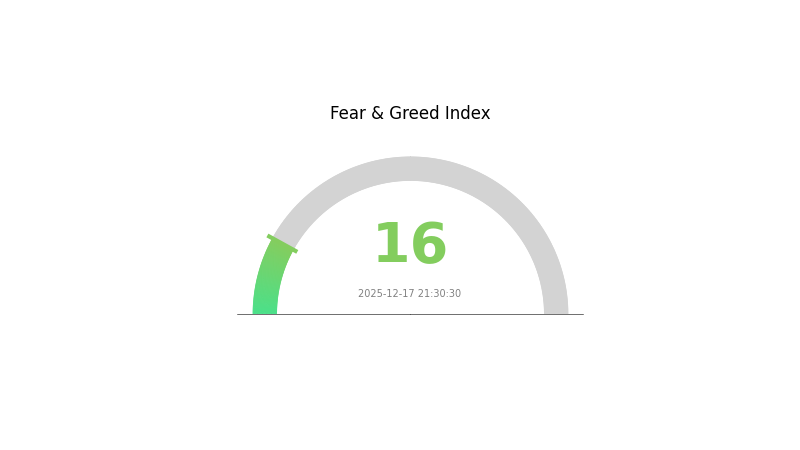

The token operates on the Solana blockchain and maintains a high circulating supply ratio, indicating nearly complete token distribution. Market sentiment as of December 17, 2025, reflects "Extreme Fear" (VIX: 16), suggesting challenging market conditions for memecoin assets.

Click to view current MOODENG market price

MOODENG Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 16, signaling significant market pessimism and risk aversion among investors. At this level, historically astute traders have often viewed such extreme fear conditions as potential buying opportunities, as markets tend to reverse after reaching such lows. However, exercise caution and conduct thorough due diligence before making investment decisions. Monitor market developments closely and consider your risk tolerance carefully during this volatile period.

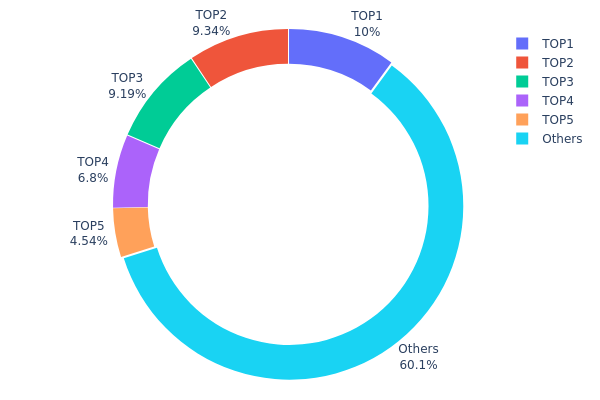

MOODENG Holdings Distribution

Address holdings distribution refers to the concentration pattern of MOODENG tokens across different wallet addresses on the blockchain. This metric serves as a critical indicator for assessing market structure, decentralization level, and potential risks associated with token concentration. By analyzing how tokens are distributed among top holders and the general population, investors and analysts can evaluate the stability and vulnerability of the asset to potential market manipulation or sudden liquidity events.

The current MOODENG holdings distribution reveals a moderately concentrated structure. The top five addresses collectively hold approximately 39.85% of the total token supply, with the largest holder commanding 10.01% of all tokens in circulation. This concentration level, while not extreme, warrants careful observation. The first three addresses alone control nearly 28.52% of the supply, indicating that decision-making power is somewhat concentrated among a limited number of stakeholders. However, the remaining 60.15% distribution among other addresses demonstrates a meaningful degree of decentralization, suggesting that the majority of token holders maintain individual control over their assets rather than being concentrated in single points of failure.

This distribution pattern presents both structural implications and market considerations. The presence of substantial holdings among the top five addresses could create potential volatility triggers, as coordinated movements or large-scale liquidations from these wallets might exert downward pressure on price discovery. Conversely, the absence of extremely dominant single holders—where one entity controls over 20% of supply—suggests reduced manipulation risk compared to highly centralized token distributions. The on-chain structure indicates a relatively stable foundation, though ongoing monitoring of large holder movements remains prudent for assessing future market dynamics and potential redistribution patterns.

View current MOODENG holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 4xLpwx...k99Qdg | 99184.21K | 10.01% |

| 2 | FYchVw...9GTxq6 | 92413.76K | 9.33% |

| 3 | 8Mm46C...zrMZQH | 90943.87K | 9.18% |

| 4 | DZCRUw...txPhaz | 67308.28K | 6.79% |

| 5 | 8Tp9fF...DdeBzG | 44964.97K | 4.54% |

| - | Others | 595124.00K | 60.15% |

II. Core Factors Affecting MOODENG's Future Price

Supply Mechanism

-

Community-Driven Supply Dynamics: MOODENG operates as a memecoin with supply mechanics tied to market demand rather than traditional token halving events. The token's availability is determined by trading volume and liquidity on various blockchain networks.

-

Current Impact: MOODENG has demonstrated significant price volatility with a recorded maximum gain of 4,344%, reflecting the highly speculative nature of supply and demand dynamics in the memecoin market. Supply scarcity and trading concentration on Solana and Ethereum chains directly influence price movements.

Institutional and Major Holder Dynamics

-

High-Profile Endorsement Effect: Vitalik Buterin's recent token sales for charitable purposes created multi-fold price movements, demonstrating the outsized influence of major figures on MOODENG's valuation. Such actions from prominent crypto personalities directly trigger significant market reactions.

-

Key Opinion Leader (KOL) Influence: The project relies heavily on social media personalities and influential community members for market momentum. Multiple KOL endorsements can rapidly elevate market capitalization and create explosive price movements within short timeframes.

-

Celebrity and Public Figure Impact: Similar to broader memecoin trends, references to influential figures such as Elon Musk, Vitalik Buterin, and other prominent personalities can substantially impact MOODENG's price trajectory and investor sentiment.

Macroeconomic Environment

-

Global Economic Conditions: MOODENG's price is indirectly affected by broader macroeconomic factors including global economic conditions, inflation rates, and monetary policy decisions. Investor behavior and capital allocation to cryptocurrency markets are influenced by these macro-level dynamics.

-

Market Sentiment and Information Flow: As a memecoin, MOODENG is highly susceptible to social media discussions, internet trends, and public sentiment. Information advantage and real-time market monitoring are critical factors determining price movements.

Technology Development and Ecosystem Building

-

Multi-Chain Deployment: MOODENG operates across multiple blockchain networks, with particularly strong presence on Solana and Ethereum. The token's distribution across chains affects liquidity, trading dynamics, and price stability across different platforms.

-

Social Media Integration: TikTok's role in popularizing animal-themed memecoins has been instrumental in MOODENG's viral adoption. The token has captured significant imagination within internet and cryptocurrency communities through social platform virality.

-

Cross-Chain Market Dynamics: MOODENG's presence on both Solana and Ethereum provides different market characteristics. Ethereum chain deployments typically exhibit longer-term sustainability compared to Solana's more volatile, short-term price explosions, creating distinct trading environments and investor opportunities across networks.

III. 2025-2030 MOODENG Price Forecast

2025 Outlook

- Conservative forecast: $0.04218 - $0.06914

- Neutral forecast: $0.06914 (average expected level)

- Bullish forecast: $0.07467 (requires sustained market interest and positive sentiment)

2026-2028 Medium-term Outlook

- Market phase expectation: Gradual accumulation and consolidation phase with modest growth trajectory

- Price range predictions:

- 2026: $0.03739 - $0.08125

- 2027: $0.05897 - $0.10185

- 2028: $0.04728 - $0.11063

- Key catalysts: Increased adoption within the community, improved liquidity conditions on platforms like Gate.com, and strengthened market fundamentals

2029-2030 Long-term Outlook

- Base case scenario: $0.07194 - $0.10492 (steady ecosystem development and mainstream adoption)

- Bullish scenario: $0.08706 - $0.12905 (strong community growth and increased institutional interest)

- Transformative scenario: $0.12905+ (breakthrough in utility adoption and significant market expansion)

- December 18, 2025: MOODENG trading range reflects early market discovery phase with moderate volatility

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07467 | 0.06914 | 0.04218 | 0 |

| 2026 | 0.08125 | 0.07191 | 0.03739 | 3 |

| 2027 | 0.10185 | 0.07658 | 0.05897 | 10 |

| 2028 | 0.11063 | 0.08922 | 0.04728 | 28 |

| 2029 | 0.10492 | 0.09992 | 0.07194 | 44 |

| 2030 | 0.12905 | 0.10242 | 0.08706 | 47 |

MOODENG Investment Strategy and Risk Management Report

IV. MOODENG Professional Investment Strategy and Risk Management

MOODENG Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Retail investors seeking exposure to Solana-based memecoin ecosystem with high risk tolerance

- Operational Suggestions:

- Establish initial position during market consolidation phases to minimize entry cost

- Maintain position through 6-12 month cycles to capture potential recovery upside

- Dollar-cost averaging approach recommended given the volatile nature of memecoin assets

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price points at $0.07642 (24H high) and $0.06642 (24H low) for entry and exit signals

- Volume Analysis: Utilize 24H trading volume of $862,756.60 as baseline for volatility assessment and breakout confirmation

- Wave Trading Key Points:

- Consider short-term reversals when price approaches 1-week low of $0.06642

- Monitor resistance at all-time high of $0.70047 as long-term target benchmark

MOODENG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0.5-1% of portfolio allocation

- Active investors: 2-3% of portfolio allocation

- Professional investors: 5-8% of portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Position Sizing Control: Limit single trade size to maximum 2% of total trading capital to contain downside exposure

- Stop-Loss Implementation: Establish hard stops at 15-20% below entry point to prevent catastrophic losses

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and accessibility

- Cold Storage Approach: Transfer holdings to secure offline storage for long-term position management

- Security Precautions: Implement two-factor authentication, use hardware security keys, never share private keys, and verify contract address (ED5nyyWEzpPPiWimP8vYm7sD7TD3LAt3Q3gRTWHzPJBY) before any transaction

V. MOODENG Potential Risks and Challenges

MOODENG Market Risks

- Memecoin Volatility: Extreme price fluctuations observed with -80.33% annual decline, making position management exceptionally challenging

- Liquidity Risk: With $862,756.60 in 24H volume relative to market cap of $68.47 million, liquidity events could cause significant slippage

- Speculative Nature: As a memecoin with limited utility, MOODENG lacks fundamental value drivers, exposing investors to sentiment-driven price movements

MOODENG Regulatory Risks

- Regulatory Classification: Memecoin regulatory status remains uncertain in multiple jurisdictions, potentially affecting listing and trading availability

- Policy Changes: Stricter stablecoin and memecoin regulations could impact trading volume and market access

- Compliance Uncertainty: Platforms may delist assets without notice due to evolving regulatory frameworks

MOODENG Technical Risks

- Smart Contract Vulnerability: As Solana-based token, dependent on both token and blockchain security implementations

- Network Dependency: Subject to Solana network congestion and operational issues affecting transaction execution

- Contract Immutability: Any discovered vulnerabilities in token contract (ED5nyyWEzpPPiWimP8vYm7sD7TD3LAt3Q3gRTWHzPJBY) cannot be reversed post-deployment

VI. Conclusion and Action Recommendations

MOODENG Investment Value Assessment

MOODENG represents a high-risk, speculative memecoin asset with extremely volatile characteristics. The token has declined 80.33% annually from peak prices, demonstrating the severe erosion of speculative enthusiasm. With primarily memetic utility and no fundamental revenue-generating mechanisms, MOODENG's valuation is entirely sentiment-driven. The asset should be regarded exclusively as a speculative position rather than a store of value, suitable only for experienced traders with substantial risk capital.

MOODENG Investment Recommendations

✅ Beginners: Limit exposure to maximum 0.5% portfolio allocation, use preset stop-losses at 15% below entry, and avoid leverage or margin trading

✅ Experienced Traders: Employ active trading strategies with technical analysis, maintain strict position sizing discipline at 2-3% portfolio allocation, and utilize Gate.com platform for efficient execution

✅ Institutional Investors: Conduct comprehensive risk-adjusted return analysis, implement quantitative hedging strategies, and consider memecoin exposure only as discrete speculative allocation separate from core holdings

MOODENG Trading Participation Methods

- Direct Spot Trading: Purchase MOODENG tokens directly through Gate.com spot market for immediate ownership

- Limit Order Strategy: Set predetermined buy orders at support levels ($0.06642) and sell orders at resistance levels to automate trading decisions

- Gate.com Trading Platform: Access professional-grade charting tools, order management features, and secure custody solutions for seamless trading experience

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Does MOODENG have a future?

Yes, MOODENG has potential for future growth. Its success will depend on community adoption, expanding use cases, and favorable market conditions. With growing interest in meme tokens and strong community support, MOODENG could establish itself as a significant player in the crypto space.

What price can MOODENG reach?

MOODENG could reach between $15.50 and $30.00 by 2035, driven by mass adoption, regulatory clarity, and market growth trends.

What is happening with MOODENG coin?

As of December 2025, MOODENG is showing early signs of recovery, trading near $0.100 after a sharp upside reaction. The price has stabilized following renewed investor interest, with current market trends indicating a positive outlook for the asset.

Why is MOODENG going up?

MOODENG surged due to viral buzz around its mascot hippo and increased community engagement. Strong social media momentum and growing trader interest drive buying pressure, pushing prices higher as adoption expands.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

GIGA Investor Loses $6M from Phishing: How to Protect Yourself from Fake Links

湯姆熊幣今日價格與走勢分析:即時TOM轉USD及購買指南

Unlocking EIP 4337: A Comprehensive Guide to Account Abstraction Implementation

Forecasting Jupiter's Value: Can JUP Reach $2 By 2030?

ARK Invest Divests $12.4 Million Position in Bitcoin ETF