2025 RBNT Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

Introduction: RBNT's Market Position and Investment Value

Redbelly Network (RBNT) represents the world's first formally verified blockchain, developed through collaboration between the University of Sydney, CSIRO, and the Australian National Science Agency. As of December 2025, RBNT has achieved a market capitalization of $75.69 million with a circulating supply of approximately 2.31 billion tokens, trading at $0.007569. This innovative blockchain platform, distinguished as "the world's first formally verified blockchain," is playing an increasingly vital role in enabling asset issuers to build digital registries and create structured financial products from tokenized assets.

This article will comprehensively analyze RBNT's price trends through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Redbelly Network (RBNT) Market Analysis Report

I. RBNT Price History Review and Current Market Status

RBNT Historical Price Evolution Trajectory

Redbelly Network token (RBNT) was published on December 16, 2024, at an initial price of $0.19. The token has experienced significant volatility since its launch:

- December 29, 2024: All-time high (ATH) reached $0.449, representing a 136% increase from the launch price within approximately two weeks of trading.

- November 21, 2025: All-time low (ATL) recorded at $0.005575, marking a 98.76% decline from the historical peak, reflecting extreme market pressure and potential capitulation phase.

- December 2024 - November 2025: Price witnessed a dramatic downtrend over this approximately one-year cycle, declining from $0.449 to $0.005575.

RBNT Current Market Status

As of December 21, 2025, RBNT is trading at $0.007569, demonstrating a modest recovery from its all-time low. The token exhibits the following characteristics:

Price Performance Metrics:

- 1-hour change: +0.64%

- 24-hour change: -0.85%

- 7-day change: -7.19%

- 30-day change: +20.45%

- 1-year change: -97.07%

Market Capitalization Indicators:

- Current market cap: $17,456,140.05

- Fully diluted valuation (FDV): $75,690,000

- Market cap to FDV ratio: 23.06%

- Current market dominance: 0.0023%

Liquidity and Supply Metrics:

- Circulating supply: 2,306,267,676.701 RBNT

- Total supply: 10,000,000,000 RBNT

- Circulating supply ratio: 23.06%

- 24-hour trading volume: $44,916.60

- Available on 3 exchanges

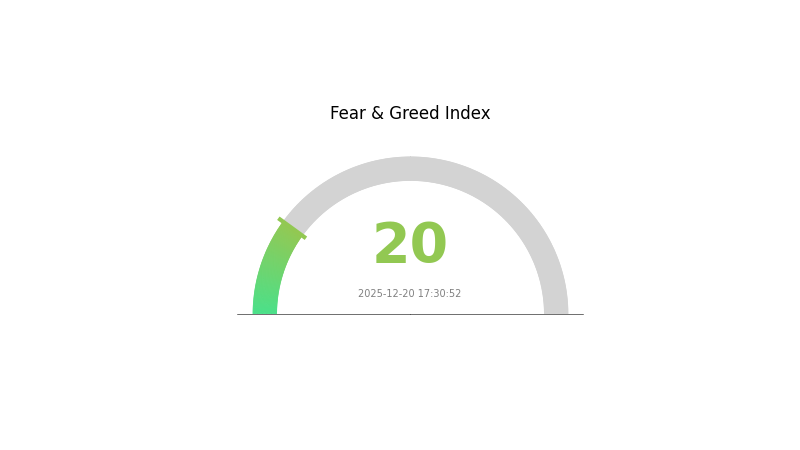

Market Sentiment: The current market emotion reading indicates extreme fear (VIX score: 20), suggesting heightened risk aversion among market participants and potential oversold conditions that may create contrarian trading opportunities.

Click to view current RBNT market price

RBNT Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index at 20. This indicates heightened market anxiety and pessimistic investor sentiment. During such periods, assets are typically undervalued as panic selling dominates. Experienced traders often view extreme fear as a potential buying opportunity, as markets tend to recover from excessive pessimism. However, caution is advised when entering positions during high uncertainty. Monitor market developments closely and consider dollar-cost averaging strategies to mitigate timing risks.

RBNT Holdings Distribution

The address holdings distribution map serves as a critical on-chain metric that visualizes the concentration of token ownership across the network. By analyzing the top holder positions and their respective percentages of total supply, this metric provides essential insights into the decentralization level of RBNT and the potential vulnerability of the token to price manipulation or sudden market shifts driven by large stakeholders.

Currently, the available data for RBNT's top address holdings appears to be limited or unavailable in the provided dataset. Without specific concentration data, a comprehensive assessment of whether excessive centralization exists cannot be definitively concluded at this moment. However, the absence of clearly defined top holder positions could indicate a relatively distributed ownership structure, which would generally suggest a healthier decentralization profile compared to tokens where a small number of addresses control a significant percentage of circulating supply.

The structural distribution of token holders directly influences market dynamics and price stability. A well-distributed holder base typically reduces the risk of coordinated sell-offs or price manipulation by dominant stakeholders, thereby fostering a more stable and resilient market environment. Monitoring these on-chain metrics remains crucial for understanding RBNT's long-term sustainability and the strength of its decentralized ecosystem. Investors and analysts can track these holdings in real-time through on-chain data platforms to detect any significant shifts in ownership concentration.

Visit RBNT Holdings Distribution on Gate.com for current data.

</Holdings Distribution Analysis>

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing RBNT's Future Price

Market Demand and Network Utilization

-

Network Usage Rate: Investor focus on network utilization and transaction volume serves as a key indicator of RBNT's long-term value proposition. Higher network activity typically correlates with increased demand for the token.

-

Market Demand Dynamics: Future price movements of RBNT are significantly influenced by overall market demand for the token and broader cryptocurrency market trends. As adoption increases, demand pressure on the token supply may intensify.

Technology Development and Ecosystem Growth

-

Technical Advancement: RBNT's future price trajectory is closely tied to the project's technology development and innovation roadmap. Continuous technological improvements enhance the network's competitive positioning.

-

Ecosystem Partnerships: Community support and strategic collaborations play crucial roles in driving adoption and ecosystem expansion. Strong partnerships can accelerate network growth and token utility.

III. 2025-2030 RBNT Price Forecast

2025 Outlook

- Conservative Estimate: $0.00539 - $0.00759

- Neutral Estimate: $0.00759

- Optimistic Estimate: $0.00819 (requiring sustained market demand and ecosystem development)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Consolidation period with gradual accumulation, followed by emerging growth momentum as network utility expands

- Price Range Forecast:

- 2026: $0.00686 - $0.0082

- 2027: $0.00426 - $0.01054

- Key Catalysts: Enhanced protocol adoption, strategic partnerships, ecosystem expansion initiatives, and increased institutional interest in the asset class

2028-2030 Long-term Outlook

- Base Case: $0.00651 - $0.01134 (assuming moderate market growth and steady technological advancement)

- Optimistic Case: $0.00896 - $0.01424 (assuming accelerated mainstream adoption and favorable regulatory environment)

- Transformation Case: $0.01228 - $0.01473 (assuming breakthrough innovations, significant ecosystem milestones, and macroeconomic tailwinds)

Note: Price predictions are subject to significant market volatility and regulatory uncertainty. Investors should conduct thorough due diligence and consider using established platforms such as Gate.com for secure trading and asset management. Past performance does not guarantee future results.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00819 | 0.00759 | 0.00539 | 0 |

| 2026 | 0.0082 | 0.00789 | 0.00686 | 4 |

| 2027 | 0.01054 | 0.00805 | 0.00426 | 6 |

| 2028 | 0.01134 | 0.00929 | 0.00651 | 22 |

| 2029 | 0.01424 | 0.01032 | 0.00691 | 36 |

| 2030 | 0.01473 | 0.01228 | 0.00896 | 62 |

Redbelly Network (RBNT) Professional Investment Strategy and Risk Management Report

IV. RBNT Professional Investment Strategy and Risk Management

RBNT Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors, blockchain technology believers, and asset tokenization advocates

- Operational Recommendations:

- Accumulate RBNT tokens during market corrections when price falls below $0.008

- Hold for 2-3 years minimum to benefit from potential ecosystem adoption and asset issuance growth

- Monitor quarterly updates on digital registry implementations and enterprise partnerships

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Use historical price points at $0.007569 (current), $0.005575 (all-time low), and $0.449 (all-time high) to identify trading zones

- Volume Analysis: Monitor 24-hour trading volume trends; current $44,916.60 volume indicates relatively low liquidity, requiring careful position sizing

- Wave Trading Key Points:

- Enter positions during positive price momentum (24-hour change: -0.85%, but 30-day change: +20.45%)

- Exit positions when resistance levels are approached to lock in gains

- Avoid oversized positions due to limited exchange listings (only 3 exchanges including Gate.com)

RBNT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio

- Active Investors: 2-5% of total crypto portfolio

- Professional Investors: 5-8% of total crypto portfolio

(2) Risk Hedging Solutions

- Position Sizing Hedge: Limit individual RBNT positions to no more than 2% of total investment capital given the 97.069% one-year decline

- Diversification Strategy: Combine RBNT holdings with other established blockchain projects to mitigate concentration risk

- Stop-Loss Implementation: Set stop-loss orders at 15-20% below entry price to protect against sudden market downturns

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 wallet for frequent trading and active position management

- Security Precautions: Enable two-factor authentication, use strong passwords, regularly backup seed phrases, and never share private keys with third parties

V. RBNT Potential Risks and Challenges

RBNT Market Risks

- Extreme Price Volatility: RBNT experienced a 97.069% decline over one year, from approximately $0.19 to current levels, indicating extreme volatility and significant price discovery uncertainty

- Low Liquidity: Limited exchange availability (only 3 exchanges) and relatively modest 24-hour trading volume of $44,916.60 creates challenges for large position accumulation or liquidation

- Low Market Capitalization: Total market cap of $75.69 million makes RBNT susceptible to significant price movements from modest capital flows

RBNT Regulatory Risks

- Undefined Regulatory Status: Asset tokenization and digital registries face evolving regulatory frameworks across different jurisdictions, potentially impacting adoption timelines

- Compliance Uncertainty: Digital asset registration mechanisms may require regulatory approval in various markets, creating operational delays for enterprise deployments

- Geographic Restrictions: Regulatory changes in key markets could limit the addressable market for Redbelly's enterprise solutions

RBNT Technology Risks

- Formal Verification Execution: While Redbelly claims formal verification, real-world implementation risks and integration challenges with legacy asset systems remain

- Enterprise Adoption Barriers: Integrating with existing financial infrastructure requires significant organizational change, creating slower-than-anticipated adoption cycles

- Competitive Development: Other blockchain projects may develop competing solutions for asset tokenization and digital registries, potentially reducing RBNT's first-mover advantage

VI. Conclusion and Action Recommendations

RBNT Investment Value Assessment

Redbelly Network presents a technically innovative proposition as the world's first formally verified blockchain, developed through collaboration with University of Sydney and CSIRO. The project's focus on digital registries and structured financial products from tokenized assets addresses a genuine enterprise need. However, the 97% one-year price decline, limited liquidity across only three exchanges, and early-stage enterprise adoption present significant risks. The $75.69 million market capitalization suggests this remains a speculative, early-stage investment rather than an established protocol. Success depends heavily on enterprise partnerships materializing and regulatory frameworks supporting asset tokenization.

RBNT Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto portfolio) on Gate.com only after understanding formal verification technology and enterprise use cases. Consider this investment only if you have 3+ year time horizons and can withstand complete capital loss.

✅ Experienced Investors: Allocate 2-5% of crypto portfolio with disciplined entry points during corrections. Implement technical analysis strategies around $0.007-$0.008 support levels and monitor enterprise partnership announcements as key catalysts.

✅ Institutional Investors: Conduct detailed due diligence on digital registry partnerships, regulatory pathway clarity, and tokenized asset pipeline. Consider position building only upon validation of significant enterprise commitments and regulatory advancement.

RBNT Trading Participation Methods

- Gate.com Spot Trading: Purchase RBNT tokens directly on Gate.com for long-term holding or active trading strategies

- Dollar-Cost Averaging: Invest fixed amounts at regular intervals (weekly or monthly) to reduce timing risk and average entry prices

- Limit Orders: Use Gate.com's advanced trading features to set specific entry and exit prices, managing positions with predefined risk parameters

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Consulting professional financial advisors is strongly recommended. Never invest more capital than you can afford to lose completely.

FAQ

What is Redbelly Network crypto?

Redbelly Network is the world's first formally verified blockchain system designed to tokenize real-world assets. RBNT token powers this decentralized platform that brings physical assets into the digital ecosystem.

What factors influence RBNT price predictions?

RBNT price predictions are influenced by market trends, technology developments, regulatory changes, and trading volume. Technical analysis, investor sentiment, and overall crypto market conditions also play significant roles in price forecasting.

How to buy and store RBNT tokens?

Create a digital wallet and connect it to a decentralized exchange. Purchase RBNT using your preferred cryptocurrency. Transfer tokens to a secure, offline wallet such as a hardware wallet for optimal security and storage.

What is Redbelly Network's future roadmap and potential use cases?

Redbelly Network's roadmap focuses on technical expansion, governance enhancements, and strategic partnerships. Key use cases include decentralized data services, improved data management solutions, and enterprise-grade blockchain infrastructure development.

What are AliExpress Coin

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

ICP Crypto: Why Internet Computer Could Surge to $30 AUD

2025 FET Price Prediction: Analyzing Market Trends and Future Potential for Fetch.ai's Native Token

Calculate Pi Coin to GBP: Price, Forecast, and Profit Potential

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

What is SAROS: Understanding the Ancient Eclipse Cycle and Its Modern Applications

Can You Mine Bitcoin on Your Smartphone?

What is CHEQ: A Comprehensive Guide to Digital Quality and Ad Fraud Prevention

What is CESS: A Comprehensive Guide to the Decentralized Storage Network Revolutionizing Data Management

What is TRWA: A Comprehensive Guide to Total Recordable Work Accidents and Workplace Safety Management