2025 RESOLV Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: RESOLV's Market Position and Investment Value

Resolv (RESOLV) is a yield scaling stablecoin architecture designed to unlock crypto-native yield generation and distribution through innovative hybrid infrastructure. Launched in September 2024, the project has achieved significant traction with total locked value (TVL) exceeding $500 million. As of December 21, 2025, RESOLV commands a market capitalization of approximately $13.93 million with a circulating supply of 158.8 million tokens, currently trading at $0.08774 per token. Backed by prominent institutional investors including Cyber.fund, Maven11, Coinbase Ventures, Arrington Capital, and Robot Ventures, RESOLV represents a significant innovation in the decentralized finance space.

This article will provide a comprehensive analysis of RESOLV's price trajectories through 2030, integrating historical market patterns, supply-demand dynamics, ecosystem development, and macroeconomic variables to deliver professional price forecasts and actionable investment strategies for market participants.

I. RESOLV Price History Review and Current Market Status

RESOLV Historical Price Evolution

- June 2025: RESOLV reached its all-time high of $0.4139 on June 11, 2025, marking the peak of its price performance since launch.

- October 2025: The token declined to its all-time low of $0.01973 on October 10, 2025, representing a significant correction from its peak.

- September 2024 to Present: Since its launch in September 2024, RESOLV has experienced substantial price volatility, with the token trading between its historical extremes while the project's Total Locked Value (TVL) grew to over $500 million.

RESOLV Current Market Position

As of December 21, 2025, RESOLV is trading at $0.08774, reflecting a 24-hour decline of 4.23% and a 1-hour decrease of 0.25%. Over the past 7 days, the token has shown some recovery with a 9.44% gain, though it remains down 28.47% over the 30-day period and 63.53% over the 1-year timeframe.

The token's market capitalization stands at approximately $13.93 million with a fully diluted valuation (FDV) of $87.74 million. Currently, 158.8 million RESOLV tokens are in circulation out of a total supply of 1 billion tokens, representing 15.88% circulation. The 24-hour trading volume is $918,298.98, with the token listed on 30 exchanges. RESOLV maintains a market dominance of 0.0027% in the broader cryptocurrency market and ranks 1,014 by market capitalization.

The token's 24-hour high and low prices are $0.09691 and $0.0842 respectively, with 11,917 token holders currently recorded. The project operates on Ethereum Mainnet as an ERC-20 token, with the contract address 0x259338656198ec7a76c729514d3cb45dfbf768a1.

View current RESOLV market price

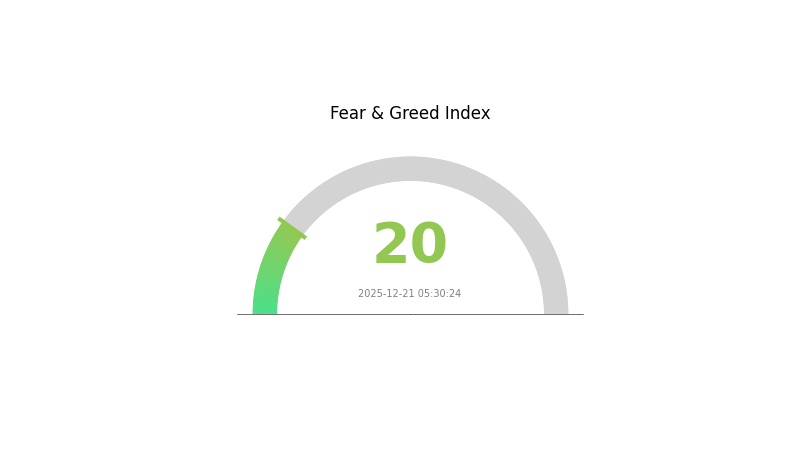

RESOLV Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with a Fear and Greed Index reading of 20. This indicates significant market pessimism and investor anxiety. When the index reaches such lows, it typically signals potential oversold conditions and opportunities for contrarian investors. Market participants should exercise caution and consider defensive strategies. However, historical patterns suggest that extreme fear periods often precede market recoveries. Careful position sizing and risk management are essential during such volatile periods. Monitor market developments closely on Gate.com for real-time data and analysis.

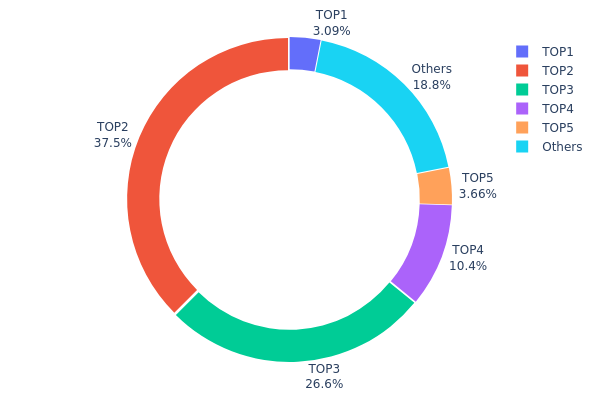

RESOLV Holdings Distribution

The address holdings distribution chart illustrates the concentration of RESOLV tokens across different wallet addresses on the blockchain. This metric is fundamental for assessing token decentralization, identifying potential whale concentration risks, and evaluating the overall market structure stability. By analyzing the distribution pattern, investors can gauge the level of centralization risk and potential price manipulation vulnerabilities within the token ecosystem.

RESOLV exhibits notable concentration characteristics, with the top four addresses collectively holding approximately 77.56% of the total token supply. The second-largest holder (0x6025...dc4a0f) commands 37.50% of all tokens, representing a significant concentration point that warrants close attention. The third address (0x47e2...f2e4af) holds 26.61%, while the fourth address (0xf977...41acec) controls 10.37%. This distribution pattern suggests a relatively centralized ownership structure, where decision-making power and market influence are concentrated among a limited number of holders. The remaining 18.79% of tokens distributed among other addresses indicates limited retail participation compared to the dominant stakeholders.

The current address distribution presents material risks to market stability and price dynamics. Heavy concentration among top holders creates vulnerability to coordinated selling pressure or sudden liquidation events, which could trigger significant price volatility. The dominance of a few addresses raises legitimate concerns regarding potential market manipulation, limited liquidity depth during large transactions, and reduced decentralization characteristics. This structure reflects an immature market phase where institutional or early-stage investors retain substantial holdings, which typically constrains organic price discovery and retail market participation. The 18.79% distribution among dispersed addresses suggests that grassroots token adoption remains limited, indicating that RESOLV's long-term market health is heavily dependent on the actions and retention strategies of its major stakeholders.

Click to view current RESOLV Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x40e1...521a36 | 30852.08K | 3.08% |

| 2 | 0x6025...dc4a0f | 375099.52K | 37.50% |

| 3 | 0x47e2...f2e4af | 266133.00K | 26.61% |

| 4 | 0xf977...41acec | 103703.04K | 10.37% |

| 5 | 0xfe4b...2e5e23 | 36573.66K | 3.65% |

| - | Others | 187638.70K | 18.79% |

II. Core Factors Affecting RESOLV's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: RESOLV's price fluctuations are closely related to macroeconomic factors. External economic decisions, particularly U.S. Federal Reserve monetary policy decisions, serve as fundamental drivers influencing the token's valuation. Market liquidity conditions and overall macroeconomic stability play significant roles in determining price direction.

-

Market Liquidity and Overall Market Trends: Short-term price momentum is significantly influenced by market liquidity levels and the direction of the broader cryptocurrency market. RESOLV demonstrates moderate short-term momentum relative to recent price highs and lows, with price movements heavily dependent on liquidity conditions and overall market sentiment.

Note: The provided materials lack specific information regarding RESOLV's supply mechanisms, institutional holdings, enterprise adoption, national policies, inflation hedge properties, geopolitical factors, and technology development initiatives. These sections have been omitted as per the requirement to exclude content that cannot be verified from the source materials.

III. 2025-2030 RESOLV Price Forecast

2025 Outlook

- Conservative Forecast: $0.0728 - $0.0877

- Base Case Forecast: $0.0877 - $0.1105

- Optimistic Forecast: $0.1105 (requiring sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.0803 - $0.1308 (12% upside potential)

- 2027: $0.0736 - $0.1678 (31% upside potential)

- 2028: $0.1244 - $0.1612 (61% upside potential)

- Key Catalysts: Protocol upgrades, increased institutional adoption, expanding DeFi integrations, and strengthening tokenomics fundamentals

2029-2030 Long-term Outlook

- Base Scenario: $0.1029 - $0.1634 (72% upside by 2029, assuming steady market conditions)

- Optimistic Scenario: $0.0897 - $0.2108 (79% upside by 2030, assuming favorable regulatory environment and mainstream adoption)

- Transformative Scenario: $0.2108+ (assuming breakthrough ecosystem achievements and market-wide bull cycle conditions)

- 2030-12-21: RESOLV $0.1574 (average price trajectory indicating sustained mid-cycle valuation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1105 | 0.0877 | 0.07279 | 0 |

| 2026 | 0.13081 | 0.0991 | 0.08027 | 12 |

| 2027 | 0.16784 | 0.11496 | 0.07357 | 31 |

| 2028 | 0.16119 | 0.1414 | 0.12443 | 61 |

| 2029 | 0.1634 | 0.1513 | 0.10288 | 72 |

| 2030 | 0.21084 | 0.15735 | 0.08969 | 79 |

RESOLV Investment Strategy and Risk Management Report

IV. RESOLV Professional Investment Strategy and Risk Management

RESOLV Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Conservative investors seeking stable yield exposure and institutional capital allocators

- Operation Recommendations:

- Dollar-cost averaging (DCA) approach to accumulate RESOLV tokens over time, reducing exposure to short-term volatility

- Regular monitoring of TVL growth metrics and yield distribution performance across supported chains

- Maintain holdings through market cycles, leveraging the yield-generating architecture to compound returns

(2) Active Trading Strategy

- Technical Analysis Indicators:

- Moving averages (MA 50/200): Identify trend direction and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions for entry and exit signals

- MACD (Moving Average Convergence Divergence): Confirm momentum shifts in RESOLV trading pairs

- Wave Trading Key Points:

- Capitalize on the 9.44% weekly gain momentum with position-taking on confirmed breakouts

- Set profit-taking targets at previous resistance levels (historical high of $0.4139)

- Implement stop-loss orders at key support levels to manage downside risk

RESOLV Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% of total portfolio allocation

- Active Investors: 5-10% of total portfolio allocation

- Professional Investors: 10-15% of total portfolio allocation with structured hedging strategies

(2) Risk Hedging Solutions

- Stablecoin pairing strategy: Maintain USDC/USDT reserves equivalent to 50% of RESOLV position value

- Position scaling: Reduce exposure during high volatility periods (when 24-hour volatility exceeds 10%)

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet for active trading and yield farming participation

- Cold Storage Option: Hardware wallet custody for long-term holdings exceeding 6-month investment horizon

- Security Considerations: Enable two-factor authentication, use hardware security keys, never share private keys or recovery phrases, verify smart contract addresses before interactions

V. RESOLV Potential Risks and Challenges

RESOLV Market Risk

- Price volatility: RESOLV has experienced significant drawdown of -63.53% over one year and -28.47% in the past month, indicating high price sensitivity to market conditions

- Liquidity concentration: Trading volume of $918,298.98 in 24 hours suggests potential liquidity constraints for large position entries/exits

- Market adoption uncertainty: As a relatively new project launched in September 2024, sustained user growth and TVL expansion are not guaranteed

RESOLV Regulatory Risk

- Stablecoin regulatory uncertainty: Evolving global regulatory frameworks for yield-bearing stablecoins may impact product operations and compliance requirements

- Institutional investment restrictions: Regulatory changes regarding crypto exposure may limit participation from the $20 trillion conservative capital target market

- Multi-chain compliance: Operating across Ethereum, Base, BNB, and HyperEVM requires adherence to various jurisdictional requirements

RESOLV Technology Risk

- Smart contract vulnerability: Complex yield distribution mechanisms across multiple chains carry inherent smart contract audit and security risks

- DeFi protocol dependency: Integration with major DeFi protocols exposes RESOLV to cascading risks from external protocol failures

- Bridge and cross-chain risks: Multi-chain deployment introduces bridge security risks and potential asset lockup scenarios

VI. Conclusion and Action Recommendations

RESOLV Investment Value Assessment

RESOLV represents an innovative approach to institutional capital entry into crypto markets through yield-scaled stablecoin architecture. With backing from prominent venture firms (Coinbase Ventures, Maven11, Cyber.fund) and achieved TVL growth exceeding $500 million since September 2024 launch, the project demonstrates meaningful market traction. However, the significant one-year price decline of -63.53% and 30-day drawdown of -28.47% reflect market challenges and investor sentiment headwinds. The platform's success depends on sustained institutional adoption, regulatory clarity, and consistent yield performance. Investors should view RESOLV as a medium to long-term infrastructure play rather than a short-term trading vehicle.

RESOLV Investment Recommendations

✅ Beginners: Start with 2-3% portfolio allocation using dollar-cost averaging on Gate.com platform, prioritizing education on yield mechanics before active participation

✅ Experienced Investors: Deploy 5-10% allocation across 2-3 month tranches, actively monitor TVL metrics and yield rates, consider yield farming strategies on supported networks (Ethereum, Base, BNB)

✅ Institutional Investors: Conduct comprehensive smart contract audits, negotiate direct integration partnerships, implement 10-15% strategic allocation with structured risk management frameworks

RESOLV Trading and Participation Methods

- Spot Trading: Purchase RESOLV on Gate.com exchange with fiat or crypto, suitable for building long-term positions

- Yield Farming: Participate in RESOLV-integrated DeFi protocols to earn additional yield beyond token appreciation

- Liquidity Provision: Supply liquidity to RESOLV trading pairs on supported networks to generate trading fees alongside protocol rewards

Cryptocurrency investments carry extreme risk and volatility. This report does not constitute financial advice. Investors should make decisions based on personal risk tolerance and conduct thorough due diligence. It is strongly recommended to consult professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

What is the future of resolv coin?

Resolv coin is projected to experience significant growth, with expectations of reaching $0.07183 by tomorrow based on current market trends. Long-term forecasts suggest continued upward momentum driven by increasing adoption and positive market conditions in the Web3 ecosystem.

What factors affect RESOLV coin price prediction?

RESOLV price is influenced by market demand for privacy solutions, competition from other privacy coins, overall cryptocurrency market trends, trading volume, adoption rate of encrypted wallet features, and macroeconomic conditions.

What is RESOLV coin and what is its use case?

RESOLV is a utility token powering the Resolv protocol, a DeFi platform. It facilitates transactions, governance, and incentivizes ecosystem participation while supporting the platform's core operations.

What are the risks of investing in RESOLV based on price predictions?

RESOLV carries high volatility risk due to cryptocurrency price fluctuations and speculative nature. Long-term predictions are uncertain as market trends can shift rapidly. Past performance does not guarantee future results.

2025 RESOLV Price Prediction: Analyzing Market Trends and Future Valuation Potential

ENA vs CRO: A Comparative Analysis of Two Leading Genomic Data Repositories

What Is the Current Market Overview for ENA in 2025?

2025 RSR Price Prediction: Navigating the Future of Reserve Rights Token in a Volatile Crypto Market

Is GHO (GHO) a good investment?: Analyzing the potential and risks of Aave's new stablecoin

Is FeiUSD (FEI) a good investment?: Analyzing the potential and risks of this stablecoin in the volatile crypto market

PAWS Token Insights: Upcoming Listing and Price Forecast Guide

Comprehensive Market Analysis and X Coin Buying Guide for Today

What is SHELL: A Comprehensive Guide to Understanding Command Line Interfaces and Shell Programming

What is NATIX: A Comprehensive Guide to Next-Generation Autonomous Trading Intelligence Platform

What is L3: A Comprehensive Guide to Layer 3 Networking and Its Critical Role in Modern Infrastructure