2025 SWTCH Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of SWTCH

Switchboard (SWTCH) operates as the fastest, most customizable, and only truly permissionless oracle network in the blockchain ecosystem. Since its launch, Switchboard has established itself as a trusted infrastructure provider, delivering market data 50 times faster than competing oracle solutions while maintaining unwavering commitment to decentralization. As of December 2025, SWTCH has achieved a market capitalization of $5.16 million, with a circulating supply of 171.6 million tokens, currently trading at approximately $0.03007. This innovative "permissionless oracle network" is playing an increasingly critical role in securing billions of assets across 51+ protocols and powering faster, more secure on-chain trading ecosystems.

This article will comprehensively analyze SWTCH's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and actionable investment strategies for navigating the evolving oracle infrastructure market.

Switchboard (SWTCH) Market Analysis Report

I. SWTCH Price History Review and Current Market Status

SWTCH Historical Price Evolution

- September 10, 2025: All-time high (ATH) reached at $0.2049, reflecting peak market optimism during the early growth phase of the Switchboard oracle network.

- December 23, 2025: All-time low (ATL) recorded at $0.0297, marking a significant pullback from historical highs as market conditions shifted.

SWTCH Current Market Condition

As of December 23, 2025, Switchboard (SWTCH) is trading at $0.03007, representing a decline of 1.58% over the past 24 hours. The token has experienced notable downward pressure across multiple timeframes: 1-hour decline of 1.06%, 7-day decrease of 14.14%, and a 30-day drop of 26.61%.

The 24-hour trading range shows a high of $0.03251 and a low of $0.0297, indicating relatively tight volatility during recent trading sessions. Trading volume in the past 24 hours reached $52,270.30, reflecting moderate market activity.

With a circulating supply of 171,600,000 tokens (17.16% of total supply) and a maximum supply of 1,000,000,000 tokens, the current market capitalization stands at $5,160,012. The fully diluted valuation (FDV) is $30,070,000, with SWTCH commanding a market dominance of 0.00094%. The token maintains a market ranking of 1,510.

The holder base comprises 8,544 addresses, demonstrating a distributed token ownership structure across the network.

Visit SWTCH Market Price on Gate.com for real-time pricing information

SWTCH Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, market volatility tends to increase substantially. Experienced traders often view extreme fear as potential buying opportunities, as assets may be undervalued. However, it's crucial to conduct thorough research and implement proper risk management strategies before making investment decisions. Monitor market developments closely and consider your risk tolerance carefully.

SWTCH Holdings Distribution

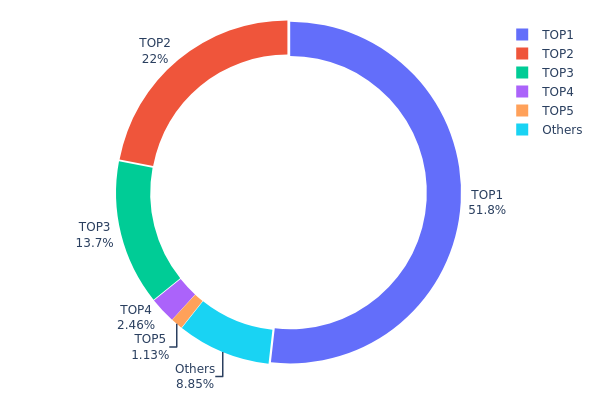

An address holdings distribution map illustrates the concentration of token ownership across the blockchain network by displaying the percentage of total supply held by individual addresses ranked by holding size. This metric serves as a crucial indicator for assessing the decentralization level and potential market structure risks of a cryptocurrency project.

The current holdings data for SWTCH reveals a highly concentrated distribution pattern that warrants careful examination. The top three addresses collectively control approximately 87.54% of the total token supply, with the largest address alone holding 51.80%. This extreme concentration in the hands of a few entities suggests significant centralization risk. The distribution follows a steep hierarchical structure, where the second-largest holder commands 22.03% and the third possesses 13.71%, while the remaining addresses combined account for only 12.46% of the supply.

Such pronounced concentration levels present notable implications for market dynamics and governance. The substantial holdings by a small number of addresses create potential vulnerabilities to price volatility, as coordinated movements or liquidation events by major holders could trigger significant market disruptions. Additionally, this distribution pattern may reflect an early-stage project where token allocations remain concentrated among founders, early investors, or institutional stakeholders. The 8.88% held by dispersed addresses indicates limited retail participation and distribution breadth, suggesting that SWTCH has not yet achieved meaningful decentralization. To improve market stability and token utility, broader distribution to a larger base of independent holders would be essential for long-term ecosystem health.

Click to view current SWTCH holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 55VUch...n32P7W | 518028.49K | 51.80% |

| 2 | HnPmir...m47tgf | 220390.88K | 22.03% |

| 3 | 7Gs9n5...8HkvNa | 137114.15K | 13.71% |

| 4 | Cpo8uj...g9DHFo | 24631.32K | 2.46% |

| 5 | GXF239...uT5jQo | 11290.94K | 1.12% |

| - | Others | 88543.58K | 8.88% |

II. Core Factors Affecting SWTCH Future Price

Macroeconomic Environment

-

Inflation Hedge Potential: SWTCH, as a cryptocurrency asset, possesses certain potential to hedge against inflation. Its actual performance is influenced by multiple market and environmental factors working in concert.

-

Global Liquidity Conditions: As long as global M2 continues to expand, cryptocurrency assets as the most liquidity-sensitive instruments will maintain their upward trend. True bear market signals would emerge only when central banks begin substantially tightening liquidity or when the real economy experiences severe recession leading to liquidity depletion.

-

Monetary Policy Impact: The Federal Reserve has initiated a rate-cutting cycle, and the liquidity "tap" remains open. This supportive monetary policy environment provides tailwinds for cryptocurrency assets.

Technology Development and Ecosystem Building

-

Switchboard Network Adoption: Increased adoption of Switchboard's Oracle services by more DApps and protocols will enhance SWTCH's utility and demand. The integration of Switchboard's oracle infrastructure across the ecosystem represents a key driver for token value growth.

-

Ecosystem Applications: DApp and protocol integration with Switchboard's oracle services expands the network's use cases and strengthens its position as infrastructure within the broader blockchain ecosystem.

III. 2025-2030 SWTCH Price Forecast

2025 Outlook

- Conservative Forecast: $0.02616 - $0.03007

- Base Case Forecast: $0.03007

- Optimistic Forecast: $0.0436 (requires sustained market recovery and increased adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.03315 - $0.04604 (22% upside potential)

- 2027: $0.02238 - $0.04766 (37% upside potential)

- Key Catalysts: Ecosystem expansion, partnership announcements, market sentiment improvement, and increased institutional interest

2028-2030 Long-term Outlook

-

Base Case Scenario: $0.03464 - $0.06514 (48-71% cumulative appreciation from 2025 levels) Assumes steady adoption growth and stable macroeconomic conditions

-

Optimistic Scenario: $0.05346 - $0.06514 (targeting 2030 peak) Assumes accelerated platform adoption and positive regulatory developments

-

Transformation Scenario: Beyond $0.06514 Requires breakthrough technological innovation, mainstream institutional adoption, and significant market expansion

December 23, 2025: SWTCH currently trading near yearly mid-range, positioned for potential multi-year appreciation cycle as outlined in comprehensive forecast models available on Gate.com

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0436 | 0.03007 | 0.02616 | 0 |

| 2026 | 0.04604 | 0.03684 | 0.03315 | 22 |

| 2027 | 0.04766 | 0.04144 | 0.02238 | 37 |

| 2028 | 0.05346 | 0.04455 | 0.0245 | 48 |

| 2029 | 0.05439 | 0.049 | 0.04655 | 62 |

| 2030 | 0.06514 | 0.0517 | 0.03464 | 71 |

Switchboard (SWTCH) Professional Investment Analysis Report

IV. SWTCH Professional Investment Strategy and Risk Management

SWTCH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Institutional investors and retail investors with medium to long-term horizons who believe in the oracle infrastructure narrative

- Operational Recommendations:

- Accumulate SWTCH during market corrections, particularly when price trades below $0.035

- Hold through protocol expansion phases as Switchboard integrates with additional blockchain ecosystems

- Reinvest any protocol revenues or staking rewards to compound returns over time

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor $0.0297 (all-time low as of December 23, 2025) as critical support and $0.2049 (all-time high from September 10, 2025) as resistance

- Volume Analysis: Track the 24-hour trading volume ($52,270) to identify breakout opportunities when volume exceeds the 30-day average

- Wave Trading Key Points:

- Enter positions when price stabilizes above key support levels following market-wide corrections

- Exit positions when momentum indicators show overbought conditions near resistance zones

SWTCH Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Active Investors: 2-5% of crypto portfolio allocation

- Professional Investors: 5-10% of crypto portfolio allocation, with additional positions in complementary DeFi infrastructure

(2) Risk Hedging Solutions

- Volatility Hedging: Maintain diversified holdings across multiple oracle solutions and blockchain platforms to mitigate single-protocol risk

- Portfolio Rebalancing: Implement quarterly rebalancing to maintain target allocation percentages as market conditions evolve

(3) Secure Storage Solutions

- Hot Wallet Strategy: Use Gate.com Web3 Wallet for active trading and frequent transactions, with only operational capital stored in hot wallets

- Cold Storage Approach: Transfer long-term holdings to secure hardware solutions, maintaining strict private key security protocols

- Security Considerations: Never share private keys or seed phrases; enable multi-signature authentication where available; regularly verify wallet addresses before transactions

V. SWTCH Potential Risks and Challenges

SWTCH Market Risk

- Price Volatility: SWTCH has experienced significant price depreciation, declining 26.61% over the past 30 days and 14.14% over the past 7 days, indicating elevated market sentiment risk

- Liquidity Constraints: With a 24-hour trading volume of only $52,270 against a market cap of $5.16 million, the token exhibits relatively low trading liquidity that could amplify price movements

- Market Adoption Risk: Oracle networks face competitive pressures; if Switchboard fails to expand its protocol integrations beyond the current 51+ protocols, market share could erode

SWTCH Regulatory Risk

- Classification Uncertainty: Oracle networks may face evolving regulatory classifications, potentially subjecting SWTCH to additional compliance requirements or trading restrictions

- Jurisdiction-Specific Restrictions: Different regulatory jurisdictions may restrict or prohibit trading in oracle network tokens, affecting global market access

- Smart Contract Liability: Legal frameworks governing oracle failures and data accuracy disputes remain underdeveloped, creating potential liability exposure

SWTCH Technical Risk

- Oracle Failure Risk: Any technical failure in Switchboard's Trusted Execution Environment infrastructure could result in incorrect data feeds, causing significant economic losses across integrated protocols

- Network Congestion: As transaction throughput increases across Solana and other integrated chains, oracle network delays could occur, undermining Switchboard's 50x speed advantage

- Smart Contract Vulnerabilities: Exploits or bugs in Switchboard's underlying code could compromise the permissionless oracle design and threaten user funds across integrated protocols

VI. Conclusion and Action Recommendations

SWTCH Investment Value Assessment

Switchboard represents a foundational infrastructure play in the decentralized oracle ecosystem. The project's permissionless design, 50x speed advantage over traditional oracles, and backing from premier venture capital firms (Tribe Capital, RockawayX) and leading blockchain foundations demonstrate technical credibility and market confidence. However, the current market price of $0.0301 reflects significant skepticism, with the token trading at 85.3% below its all-time high, indicating either deep undervaluation or fundamental concerns about oracle network adoption and monetization. The limited trading liquidity and moderate circulating supply ratio (17.16%) suggest this remains an early-stage, speculative infrastructure token.

SWTCH Investment Recommendations

✅ For Beginners: Start with a small exploratory position (0.5-1% of crypto portfolio) through Gate.com to understand oracle network mechanics. Use dollar-cost averaging over 3-6 months during volatile periods rather than attempting to time the market.

✅ For Experienced Investors: Consider 2-5% portfolio allocation with a focus on accumulation during broader crypto market corrections. Actively monitor Switchboard's protocol integration announcements and community development activities on Discord for catalysts.

✅ For Institutional Investors: Evaluate 5-10% infrastructure allocation to oracle networks, potentially combining Switchboard with complementary data infrastructure investments. Engage with the Switchboard Foundation directly to understand roadmap priorities and long-term tokenomics.

SWTCH Trading Participation Methods

- Gate.com Spot Trading: Purchase SWTCH directly using the SPL-20 token contract (SW1TCHLmRGTfW5xZknqQdpdarB8PD95sJYWpNp9TbFx) on the Solana blockchain through Gate.com's trading interface

- Dollar-Cost Averaging: Implement systematic monthly purchases to reduce timing risk and benefit from potential market recoveries

- Ecosystem Integration: Participate in protocols utilizing Switchboard's oracle feeds, gaining indirect exposure to the network's growth through protocol token incentives

Cryptocurrency investment carries extreme risk and is highly speculative. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors before committing capital. Never invest funds that you cannot afford to lose completely.

FAQ

What is the price prediction for the switch token?

Switch Token is projected to reach a minimum of $0.00014583874 and a maximum of $0.0012283472 by 2027, based on current market trends and technical analysis.

What factors influence SWTCH token price predictions?

SWTCH token price predictions are influenced by supply and demand dynamics, block reward changes, protocol updates, market sentiment, and broader cryptocurrency market trends.

Is SWTCH token a good investment based on price forecasts?

Based on technical analysis and market forecasts, SWTCH token shows strong investment potential. Current projections indicate positive growth trajectory, making it an attractive option for investors seeking exposure to quality blockchain projects with solid fundamentals and upside potential.

How does SWTCH token compare to other similar tokens in terms of price potential?

SWTCH demonstrates strong foundational metrics with a market cap of BTC54.7887 and substantial trading volume of $7,796,343.66. While currently underperforming similar Solana tokens, its established infrastructure positions it for significant upside potential as the market recovers and adoption increases.

2025 RAYPrice Prediction: Analyzing Growth Factors and Market Potential for RAY Token in the Coming Years

2025 RAY Price Prediction: Will This Layer-1 Protocol Reach New Heights in the Evolving DeFi Landscape?

2025 KMNO Price Prediction: Market Trends, Key Factors and Investment Outlook

2025 JUP Price Prediction: Analyzing Jupiter's Potential in the Evolving Crypto Market

2025 JTO Price Prediction: Will the Jito Network Token Reach New Heights in the DeFi Landscape?

2025 RAY Price Prediction: Analyzing Market Trends and Potential Growth Factors

Top Cryptocurrencies Poised for Explosive Growth in 2025

Exploring Yescoin: Features and Benefits of a Blockchain Platform

What is ALPHA: A Comprehensive Guide to Understanding the Leading Performance Metric in Investment and Portfolio Management

What is EVAA: A Comprehensive Guide to Electric Vehicle Advanced Analytics

Cardano Prepares for Significant Price Surge with High Trading Volume Analysis