Predicción del precio de ZRC para 2025: análisis de las tendencias del mercado y el potencial futuro en el ámbito de los activos digitales

Introducción: Posición de mercado y valor de inversión de ZRC

Zircuit (ZRC), como rollup de conocimiento cero totalmente compatible con EVM, ha avanzado notablemente desde su lanzamiento. A 2025, la capitalización de mercado de ZRC alcanza los $45 412 966, con un suministro circulante de alrededor de 2 194 923 458 tokens y un precio que ronda los $0,02069. Este activo, conocido como «solución de escalabilidad de capa 2», está adquiriendo un papel cada vez más esencial en la mejora de la escalabilidad y el rendimiento de Ethereum.

En este artículo se analizarán en detalle las tendencias de precio de ZRC entre 2025 y 2030, teniendo en cuenta los patrones históricos, el suministro y la demanda del mercado, el desarrollo del ecosistema y los factores macroeconómicos, para ofrecer previsiones profesionales y estrategias prácticas de inversión.

I. Revisión histórica del precio de ZRC y situación de mercado actual

Evolución histórica del precio de ZRC

- 2024: ZRC alcanzó su máximo histórico de $0,14844 el 16 de noviembre, un hito relevante para el proyecto.

- 2025: El mercado sufrió una corrección. ZRC marcó su mínimo histórico de $0,01944 el 27 de junio.

- 2025: ZRC ha recuperado algo de valor respecto a su mínimo, aunque sigue muy por debajo de su pico máximo.

Situación de mercado actual de ZRC

A 30 de septiembre de 2025, ZRC tiene un precio de $0,02069 y su capitalización de mercado asciende a $45 412 966. El token ha registrado caídas en distintos periodos. Ha descendido un 1,89 % en las últimas 24 horas y ha bajado un 24,79 % en los últimos 30 días. El precio actual ha caído un 84,94 % respecto al año anterior, lo que refleja una tendencia bajista prolongada.

El volumen negociado de ZRC en las últimas 24 horas es de $469 881,94. Esto indica una actividad moderada. Circulan 2 194 923 458 ZRC, equivalentes al 21,95 % del suministro total de 10 000 000 000 ZRC. Esta proporción baja de circulación puede influir en la liquidez y la estabilidad de precios.

La cuota de mercado de ZRC es del 0,0050 %. Esto evidencia su tamaño reducido en el conjunto del mercado de criptomonedas. El token está listado en 24 plataformas y cuenta con 2 249 titulares, manteniendo así su presencia, aunque afronta dificultades para lograr una adopción masiva y mejorar su liquidez.

Consulta el precio de mercado actual de ZRC

Indicador de sentimiento de mercado de ZRC

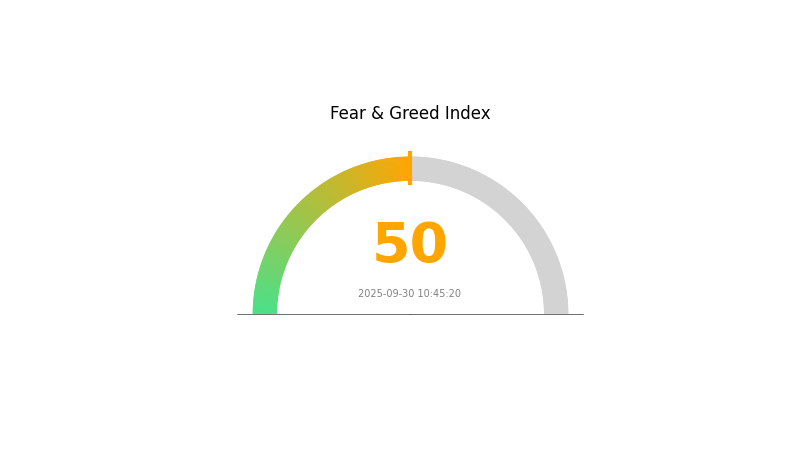

30-09-2025 Índice de Miedo y Codicia: 50 (Neutral)

Consulta el Índice de Miedo y Codicia de ZRC

Hoy el sentimiento de mercado de ZRC está equilibrado, con el Índice de Miedo y Codicia en 50. Esta posición neutral sugiere que los inversores no muestran excesivo pesimismo ni optimismo ante la situación actual. Aunque la prudencia sigue siendo recomendable, el equilibrio en el sentimiento puede abrir oportunidades para quienes operan de manera estratégica. Como siempre, es esencial investigar a fondo y valorar tu perfil de riesgo antes de invertir en el volátil mercado cripto.

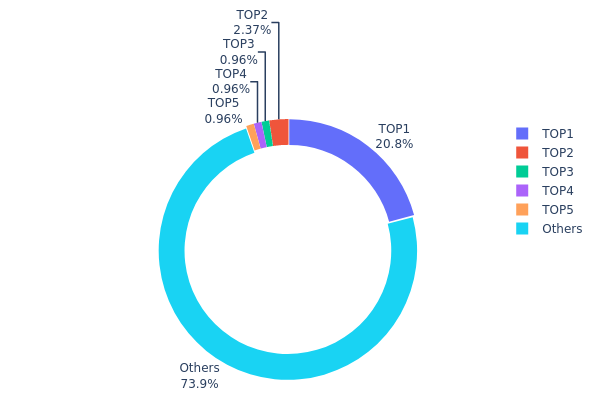

Distribución de tenencias de ZRC

La distribución de tenencias por direcciones de ZRC refleja una propiedad relativamente concentrada. La principal dirección controla el 20,82 % del suministro total. Esto le otorga una influencia considerable en el ecosistema. Las siguientes cuatro direcciones principales poseen menos del 3 % cada una. La segunda mayor acumula el 2,37 %. Las otras tres tienen alrededor del 0,96 % cada una.

Este patrón muestra que la dirección principal controla los tokens ZRC y puede influir significativamente en la dinámica del mercado. Sin embargo, el hecho de que el 73,93 % de los tokens esté repartido entre otras direcciones indica una participación más amplia. Este equilibrio entre concentración y dispersión puede repercutir en la estabilidad y liquidez del mercado.

La actual estructura de tenencias puede aumentar la volatilidad del precio. Movimientos de gran volumen desde la dirección principal podrían influir notablemente en el sentimiento de mercado y en el valor del token. Aunque la concentración no es extrema, es recomendable monitorizar la distribución para prevenir riesgos de manipulación y preservar la salud del ecosistema de ZRC.

Consulta la distribución de tenencias de ZRC

| Top | Dirección | Cantidad en tenencia | Tenencia (%) |

|---|---|---|---|

| 1 | 0x386b...b26dd8 | 2 082 605,07K | 20,82 % |

| 2 | 0x6522...837e90 | 237 001,95K | 2,37 % |

| 3 | 0xfb0f...5e8595 | 96 000,10K | 0,96 % |

| 4 | 0x8033...0a9e6b | 96 000,00K | 0,96 % |

| 5 | 0xcbd4...c04a8e | 96 000,00K | 0,96 % |

| - | Otros | 7 392 392,88K | 73,93 % |

II. Factores clave que afectan al precio futuro de ZRC

Entorno macroeconómico

- Impacto de la política monetaria: Las decisiones de los bancos centrales y los tipos de interés pueden alterar los mercados de criptomonedas, incluido ZRC.

- Propiedades como activo de cobertura ante la inflación: Si la inflación aumenta, la capacidad de ZRC como refugio podría influir en su precio.

- Factores geopolíticos: Situaciones internacionales y conflictos pueden afectar los mercados globales, repercutiendo en el valor de ZRC.

Desarrollo tecnológico y del ecosistema

- Aplicaciones del ecosistema: El desarrollo de DApps clave y nuevos proyectos dentro de la red ZRC impulsa la adopción y la evolución del precio.

III. Predicción de precio de ZRC para 2025-2030

Perspectiva para 2025

- Estimación conservadora: $0,01783 - $0,02000

- Estimación neutral: $0,02000 - $0,02100

- Estimación optimista: $0,02100 - $0,02197 (si el mercado es favorable)

Perspectiva para 2027-2028

- Fase esperada: Potencial etapa de crecimiento

- Rango de precio previsto:

- 2027: $0,02254 - $0,03538

- 2028: $0,02176 - $0,03905

- Catalizadores principales: Más adopción y avances tecnológicos

Perspectiva a largo plazo 2029-2030

- Escenario base: $0,03443 - $0,03942 (con crecimiento sostenido del mercado)

- Escenario optimista: $0,04441 - $0,05401 (con fuerte desempeño del mercado)

- Escenario transformador: $0,05500 - $0,06000 (con innovación disruptiva y adopción masiva)

- 31-12-2030: ZRC $0,05401 (posible máximo anual)

| Año | Máximo previsto | Precio medio previsto | Mínimo previsto | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,02197 | 0,02073 | 0,01783 | 0 |

| 2026 | 0,02712 | 0,02135 | 0,019 | 3 |

| 2027 | 0,03538 | 0,02423 | 0,02254 | 17 |

| 2028 | 0,03905 | 0,02981 | 0,02176 | 44 |

| 2029 | 0,04441 | 0,03443 | 0,02479 | 66 |

| 2030 | 0,05401 | 0,03942 | 0,02444 | 90 |

IV. Estrategia profesional de inversión y gestión de riesgos en ZRC

Metodología de inversión en ZRC

(1) Estrategia de tenencia a largo plazo

- Ideal para: Inversores a largo plazo con alta tolerancia al riesgo

- Sugerencias operativas:

- Acumula ZRC en caídas de mercado

- Mantén la inversión entre 1 y 2 años para amortiguar la volatilidad

- Almacena los tokens en un monedero de hardware seguro

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Indicadores de medias móviles: Identifica tendencias y puntos de entrada o salida

- Indicador RSI (Índice de Fuerza Relativa): Vigila niveles de sobrecompra o sobreventa

- Claves para el swing trading:

- Establece stop-loss y take-profit claros

- Observa la correlación de ZRC con las tendencias generales del mercado

Marco de gestión de riesgos para ZRC

(1) Principios de asignación de activos

- Inversores conservadores: 1-3 % de la cartera cripto

- Inversores agresivos: 5-10 % de la cartera cripto

- Inversores profesionales: Hasta el 15 % de la cartera cripto

(2) Soluciones de cobertura de riesgo

- Diversificación: Invierte en distintos proyectos L2

- Órdenes de stop-loss: Limitan las pérdidas potenciales

(3) Soluciones de almacenamiento seguro

- Monedero caliente recomendado: Gate Web3 monedero

- Almacenamiento en frío: Usa monederos de hardware para tenencias largas

- Recomendaciones de seguridad: Activa la verificación en dos pasos y emplea contraseñas robustas

V. Riesgos y desafíos potenciales de ZRC

Riesgos de mercado de ZRC

- Alta volatilidad: El precio de ZRC puede fluctuar intensamente

- Competencia: Otras soluciones L2 podrían captar más cuota de mercado

- Riesgo de liquidez: Un volumen bajo de negociación puede afectar a la estabilidad del precio

Riesgos regulatorios de ZRC

- Regulación incierta: Puede aumentar el escrutinio sobre soluciones L2

- Desafíos de cumplimiento: Cambios normativos pueden impactar a ZRC

- Restricciones internacionales: Las regulaciones globales pueden limitar la adopción

Riesgos técnicos de ZRC

- Vulnerabilidades en contratos inteligentes: Riesgo de exploits o errores en código

- Retos de escalabilidad: Capacidad para asumir mayor volumen de transacciones

- Problemas de integración: Compatibilidad con la infraestructura existente de Ethereum

VI. Conclusión y recomendaciones de acción

Valoración de la inversión en ZRC

ZRC tiene potencial como solución L2 compatible con EVM a largo plazo, aunque afronta riesgos a corto plazo por la volatilidad del mercado y la competencia en el segmento L2.

Recomendaciones de inversión en ZRC

- Si eres principiante: Comienza con pequeñas posiciones y céntrate en formarte sobre tecnología L2

- Si tienes experiencia: Valora destinar parte de tu inversión en L2 a ZRC

- Si eres institucional: Considera ZRC dentro de una cartera L2 diversificada

Formas de operar con ZRC

- Spot trading: Compra y vende ZRC en Gate.com

- Staking: Participa en programas de staking de ZRC, si están disponibles

- DeFi: Explora las aplicaciones DeFi disponibles basadas en ZRC en la red Zircuit

Invertir en criptomonedas conlleva riesgos muy elevados. Este artículo no constituye asesoramiento financiero. Se recomienda actuar con precaución, evaluar la tolerancia al riesgo y consultar con profesionales. No se recomienda invertir más de lo que se pueda asumir como pérdida.

Preguntas frecuentes

¿Es ZRC una buena moneda?

ZRC es una criptomoneda prometedora, con potencial de crecimiento y respaldo comunitario. En 2025 se considera una opción interesante para invertir en el sector cripto.

¿Hasta dónde puede llegar Zircuit?

Zircuit podría alcanzar los $0,094592 en 2029 según las previsiones actuales, el valor máximo proyectado para ZRC en los próximos años.

¿Cuánto vale ZRC hoy?

Al 30 de septiembre de 2025, ZRC tiene un precio de $0,02093. El precio ha caído un 1,03 % en las últimas 24 horas.

¿Qué es ZRC crypto?

ZRC es la criptomoneda nativa de Zircuit, una blockchain de capa 2 basada en IA y tecnología ZK rollup. Busca ofrecer alta escalabilidad, bajas comisiones y mayor seguridad.

¿Es Zircuit (ZRC) una buena inversión?: Análisis del potencial y los riesgos de esta plataforma blockchain emergente

¿Scroll (SCR) es una buena inversión?: Análisis exhaustivo sobre su potencial de precio, tecnología y oportunidades de mercado en 2024

¿Scroll (SCR) es una buena inversión?: Análisis integral de riesgos, potencial de rentabilidad y panorama de mercado para 2024

¿Es Union (U) una buena inversión?: Análisis del rendimiento, el potencial de crecimiento y la posición en el mercado en la economía actual

URANUS vs OP: La batalla de las soluciones de escalabilidad Layer-2 en el ecosistema de Ethereum

¿Cuál es la situación actual del mercado del token ZK en noviembre de 2025?

Comprender el calendario de liberación y adquisición de derechos de los tokens de Solana

Fin del asombroso viaje de Solana: Lo más destacado del Tour de Sun 2022

Novedades Recientes del Ecosistema Solana

Tendencias de Crecimiento de Tokens Meme en el Último Mes