ENSO Tokens: Rules and Project Details

Today, Binance officially announced the 52nd HODLer airdrop project, ENSO, which will begin trading on October 14 at 09:00 UTC.

This airdrop will release 1.75 million ENSO tokens, accounting for 1.75% of the total supply, with another 500,000 tokens designated for post-listing marketing activities. Notably, the Binance Alpha platform will simultaneously launch a points-based airdrop redemption, giving early participants two chances to benefit.

Although the BNB holding snapshot period (October 7–9) is over and HODLer airdrop eligibility is finalized, the Binance Alpha points redemption channel remains open. Unlike standard airdrops, ENSO adopts a community-first approach:

Public sale buyers receive 100% of tokens immediately unlocked at Token Generation Event (TGE), while VCs and team members are subject to a one-year cliff, followed by linear vesting over two years. At least on paper, retail investors are given preference over VCs.

Previously, ENSO’s public sale price on CoinList was $1.25 per token, corresponding to a fully diluted valuation (FDV) of $125 million.

If you’re unfamiliar with the project, here are some key details.

Airdrop Mechanism Breakdown

- HODLer Airdrop Confirmed

Eligibility requirements: To be eligible, deposit BNB into the following products during the October 7–9 snapshot period:

- Simple Earn flexible or fixed-term products

- On-chain yield products (staking, etc.)

- KYC must be completed and residency in a supported region is required

Distribution logic: Binance will distribute 1.75 million ENSO tokens proportionally based on your average daily BNB balance during the snapshot period. There is no minimum holding requirement. Allocation increases proportionally with your holdings.

- Binance Alpha Airdrop (Still Open)

ENSO is one of this week’s top five new tokens on Binance Alpha, along with CLO, RECALL, WBAI, and LAB. Users can redeem ENSO airdrop shares using Alpha points; specific rules will be released when the event goes live.

Participation steps:

- Complete Binance KYC verification

- Earn points through Alpha platform activities (trading, referrals, etc.; previous events required around 195 points)

- After launch on October 14, visit the Alpha Events page to redeem ENSO with points

- First come, first served; redemptions close when allocation is exhausted (previous windows typically lasted five hours)

Project Introduction

What problem does ENSO solve?

The blockchain ecosystem is highly fragmented: there are over 1,000 chains and more than 41 million smart contracts, each with its own standards and invocation methods. Developers face increased costs and integration time for every DApp and chain, severely impeding Web3’s mainstream adoption.

ENSO’s solution is to abstract all blockchains into a unified API/SDK interface, enabling “one-click cross-chain operations” through two core concepts:

- Actions (modular interactions): Each smart contract function is standardized as an “Action” (e.g., Aave deposit, Uniswap swap)

- Shortcuts (workflow combinations): Like building with LEGOs, combine multiple Actions to perform complex cross-chain operations. For example: “Withdraw assets from any chain → bridge across chains → deposit into a lending protocol on the target chain.”

This is similar to how iOS unified app development interfaces—ENSO standardizes blockchain interactions. Developers express their intent, and the ENSO network automatically plans and executes the optimal workflow, with no need to understand underlying chain details.

Real-world use cases include:

- Berachain mainnet launch: Public data shows that in February 2025, Berachain processed $3.1 billion in volume via ENSO, using 84 pre-built Shortcuts—making it one of the most successful L1 launches.

- Ether.fi cross-chain vault: Users can deposit from any chain (Ethereum, Arbitrum, Base, etc.) with one click; ENSO automates bridging, swapping, and deposit processes—users do not need to manually switch networks or provide multiple signatures.

- Uniswap LP migration: The Block reported that ENSO partnered with LayerZero to enable Uniswap V4 migration on Unichain. Users can complete the withdrawal of Uniswap V2/V3 LP liquidity, cross-chain bridging, and redeployment to V4 LP—all in a single transaction.

The following summarizes current ENSO protocol partnerships:

Tokenomics

Supply Structure and Unlock Mechanism

Total supply: 100 million at genesis, maximum supply of 127.3 million, calculated at an initial annualized inflation rate of 8%, dropping to 0.35% after 10 years.

Initial circulating supply: 20.59 million (20.59%), including:

- CoinList public sale: 4 million tokens (100% unlocked)

- Binance HODLer airdrop: 1.75 million tokens (100% unlocked)

- Additional 500,000 ENSO tokens for market activities after spot listing (100% unlocked)

- Ecosystem allocation releasing around 14.34 million tokens

According to public information, public sale buyers (who purchased at $1.25 on CoinList) can trade 100% of their tokens at TGE, while VCs and team members must wait one year before a two-year linear unlock begins.

This means, in theory, that until October 2026, 56.8% of tokens (VCs, team, and advisors) will remain locked, so sell pressure will mainly come from circulating supply.

Valuation benchmarks:

Funding and Team

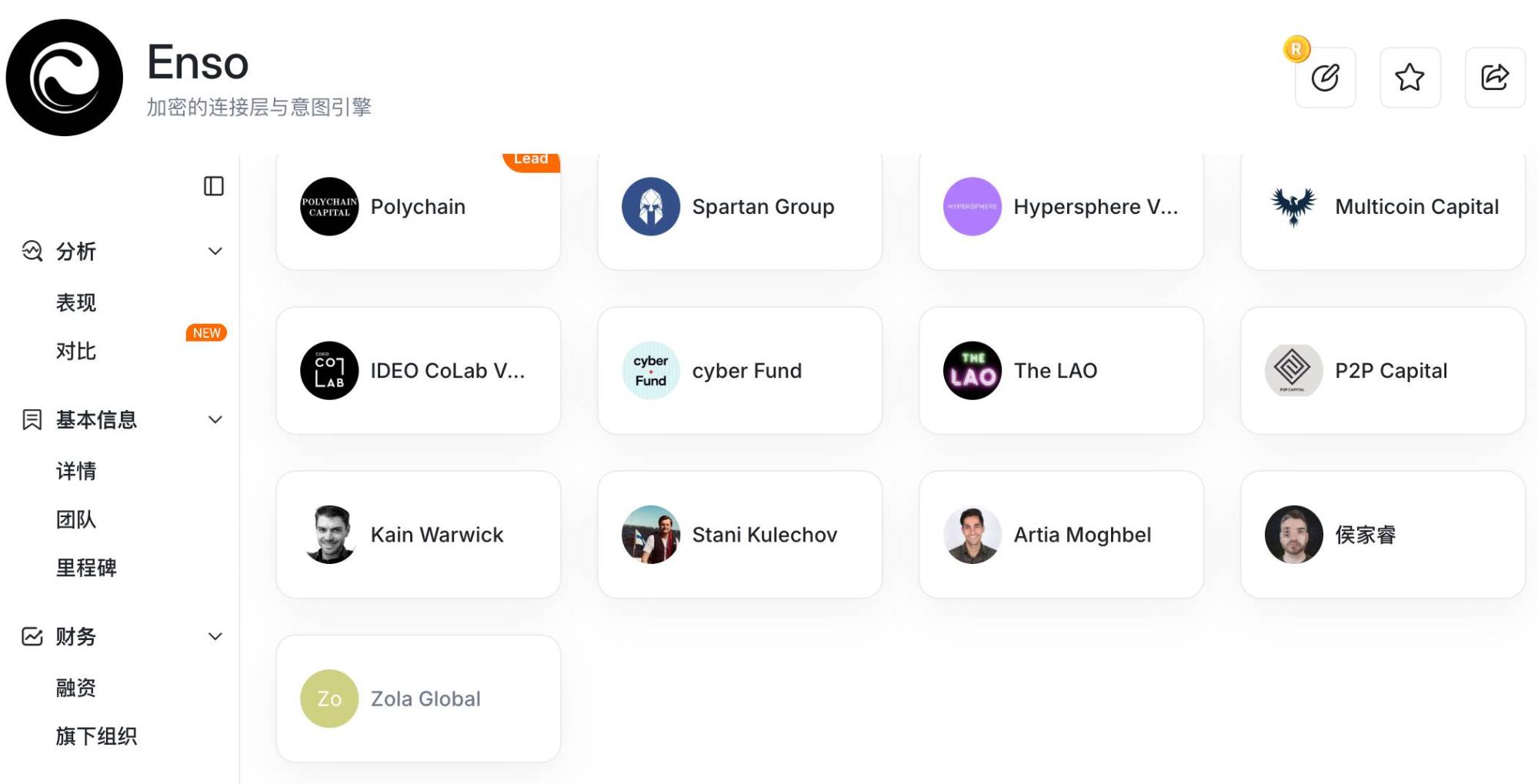

VC Lineup and Fundraising History

Total disclosed funding: $14.2 million across three rounds

- 2021 Strategic round ($5 million): Led by Spartan Group, with Polychain Capital, Multicoin Capital, The LAO, P2P Capital, and Zora participating. Used for core engine development.

- 2024 Undisclosed round ($4.2 million): Led by IDEO CoLab Ventures and Hypersphere Ventures, focused on scaling intent centralization.

- 2025 CoinList public sale ($5 million): Community round, 4% of tokens sold at $1.25 each.

Angel investors (70+): Includes Naval Ravikant (AngelList founder), plus key members from LayerZero, Safe, 1inch, Yearn, Flashbots, Dune, Pendle, and other projects.

Team: Ethereum Fundamentalists

Connor Howe (Founder/CEO): Early Bitcoin developer since 2012, part of Ethereum’s founding team in 2016; previously at Sygnum (Switzerland’s first crypto bank), with responsibilities spanning stablecoins, multisig solutions, and tokenization.

Core tech team members Milos Costantini, Peter Phillips, and Lindy Han lead Solidity core development, backend architecture, and business development, respectively.

Overall, the team combines Ethereum roots with traditional finance compliance experience, positioning ENSO strongly for both technical innovation and institutional integration.

Connor’s crypto custody expertise is especially critical, explaining why institutional-grade projects like Ether.fi and Infinex have chosen ENSO as their foundational layer.

Participation Considerations

For participants: If you already hold BNB and joined the snapshot, consider holding some airdropped tokens to observe the project’s progress; if joining through Alpha, purchasing at launch may carry significant risk—waiting for post-airdrop selling pressure could offer a better entry.

Chain abstraction and cross-chain themes are not new, nor are they current market hotspots; if you’re bullish on this sector, consider including ENSO as part of a diversified chain abstraction portfolio.

Always remember that new listings come with extreme volatility, and Binance’s Seed label indicates both opportunity and risk. Manage your risk and only invest what you can afford to lose.

Statement:

- This article is republished from [TechFlow]. Copyright belongs to the original author [TechFlow]. If you have concerns about republication, contact the Gate Learn team, who will address your request promptly.

- Disclaimer: The views and opinions in this article are those of the author only and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate (Gate) is credited, translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?