The Aave Effect

Partners get immediate access to infrastructure, users, and liquidity that could take years to build independently. That’s what we’re calling the Aave effect.

Some numbers

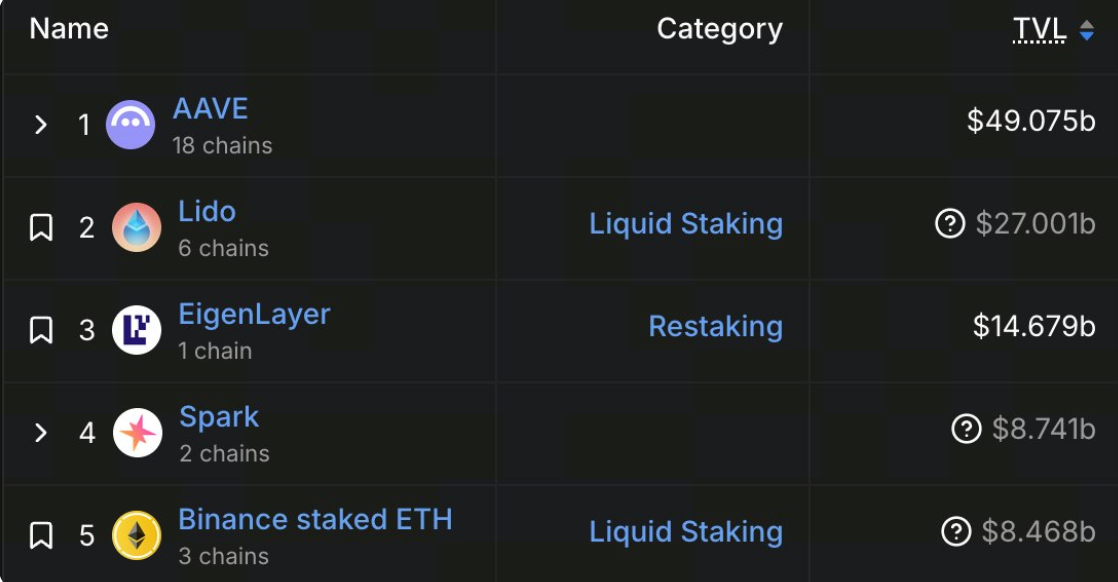

source: DeFi Llama

Aave is the largest protocol in DeFi. The largest ever to be exact. It holds 21% of all DeFi TVL, 51% of all lending/borrowing TVL, and over $49B in net deposits. While the top line numbers are impressive, the real story is the impact of Aave’s distribution. For example:

- Ethena’s sUSDe went from 2 million dollars deposited to 1.1 billion dollars in deposits within two months of doubling down on Aave.

- Pendle saw users deposit 1 billion dollars worth of PT tokens in a couple of weeks after they were added to Aave. That number has since grown to $2B and makes Aave the largest market for supplied Pendle tokens.

- KelpDAO grew from 65,000 ETH TVL to 255,000 ETH TVL in four months after rsETH was added to Aave (a 4x increase).

And the list goes on. Aave also hosts over 50% of all active stablecoins and is the top destination for BTC in DeFi. Lastly, it’s the only protocol with $1B+ TVL on four separate networks. This level of distribution is unparalleled.

Why this happens

Anyone can incentivize deposits and grow the supply side through token rewards and yield farming programs. That’s why TVL at face value isn’t always an interesting stat. Attracting supply is actually a well-understood challenge at this point, but demand to use assets is much harder to conjure up… unless you’re Aave.

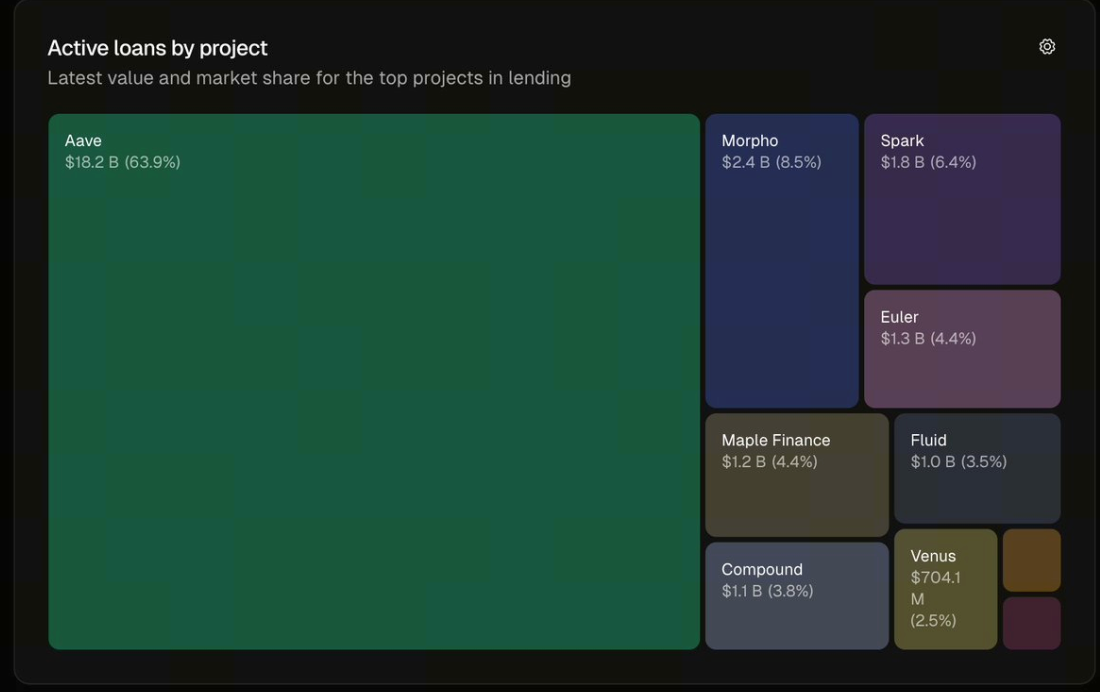

source: https://tokenterminal.com/explorer/markets/lending/metrics/active-loans

Aave has more active borrows ($18B+) than all of its competitors combined. The protocol isn’t a glorified staking contract, so when users deposit assets into Aave, those assets are either borrowed or used as collateral to borrow other assets. They’re not just sitting there.

This creates a reinforcing cycle of consistent demand. When an asset is added to a market on Aave, or a team builds on top of one, they benefit from this demand. Everyone benefits from real economic activity from a large and active user base.

For teams building on Aave, this really matters. The protocol has been used and trusted by developers and users across multiple market cycles for half a decade. And it’s been home to billions of dollars far longer than many of the protocols today.

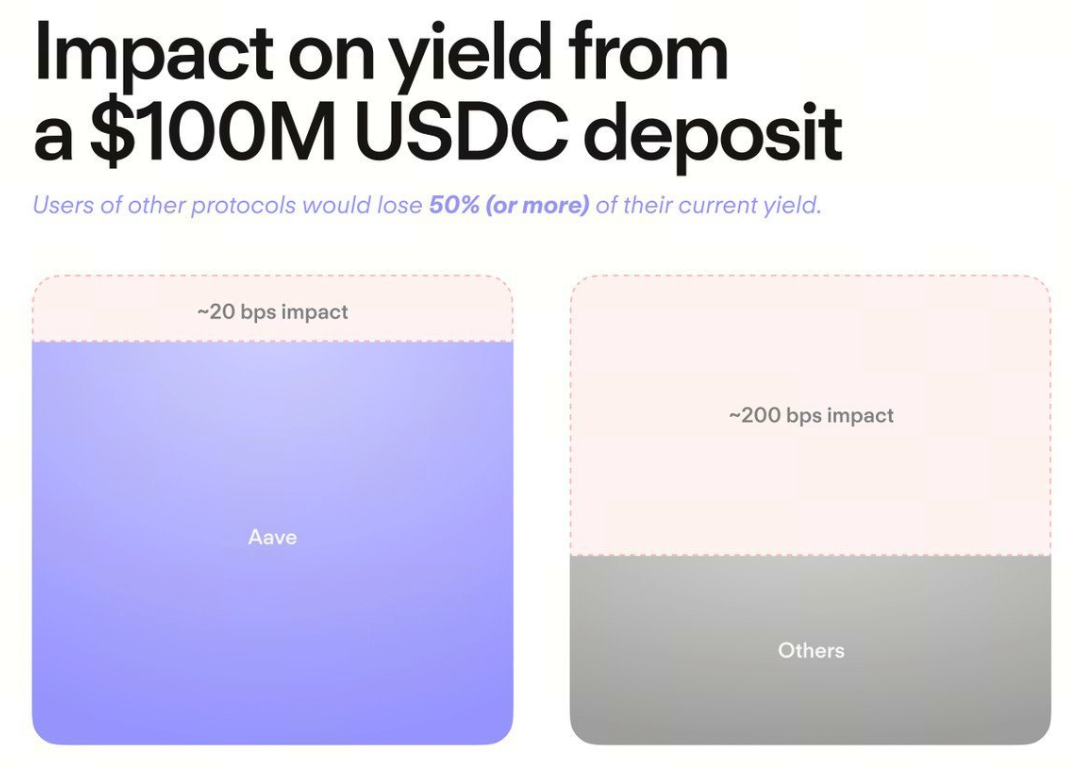

source: Block Analitica

Beyond that, builders on Aave aren’t constrained by ‘capacity.’ Aave can support tens of millions of dollars more in supply and borrow volume than competing protocols. This makes it viable for fintech apps of any size (retail, institutional, or both) to build with confidence.

Looking ahead

When Aave V4 launches, the engine behind the Aave effect will continue to grow. The new architecture will provide builders and users with access to more assets and unique borrowing strategies than ever before.

All the factors that make Aave valuable to DeFi today will become even more pronounced. I recommend checking out Understanding Aave V4’s Architecture to see what’s in store.

- This article is reprinted from [0xkolten]. All copyrights belong to the original author [0xkolten]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What Is a Yield Aggregator?

What is Stablecoin?