Post content & earn content mining yield

placeholder

CryptoEye

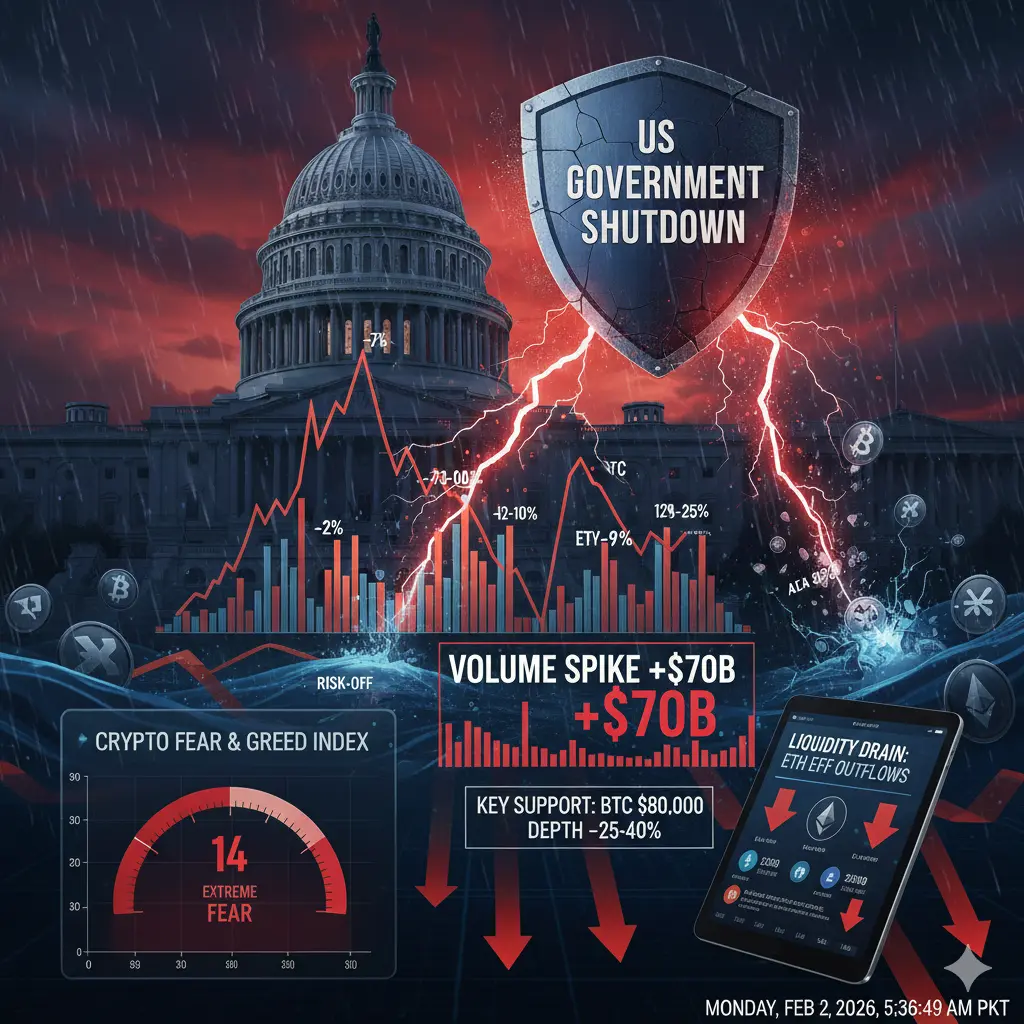

#USGovernmentShutdownRisk: Why Markets Are Paying Close Attention

The rising US Government Shutdown Risk has once again moved to the center of global financial discussions.

As political divisions in Washington intensify over budget approvals and spending priorities, investors, businesses, and global markets are closely watching the situation. A potential shutdown is not just a political event—it carries real economic and market consequences that extend far beyond the United States.

A government shutdown occurs when Congress fails to pass funding legislation, forcing non-essential federal agen

The rising US Government Shutdown Risk has once again moved to the center of global financial discussions.

As political divisions in Washington intensify over budget approvals and spending priorities, investors, businesses, and global markets are closely watching the situation. A potential shutdown is not just a political event—it carries real economic and market consequences that extend far beyond the United States.

A government shutdown occurs when Congress fails to pass funding legislation, forcing non-essential federal agen

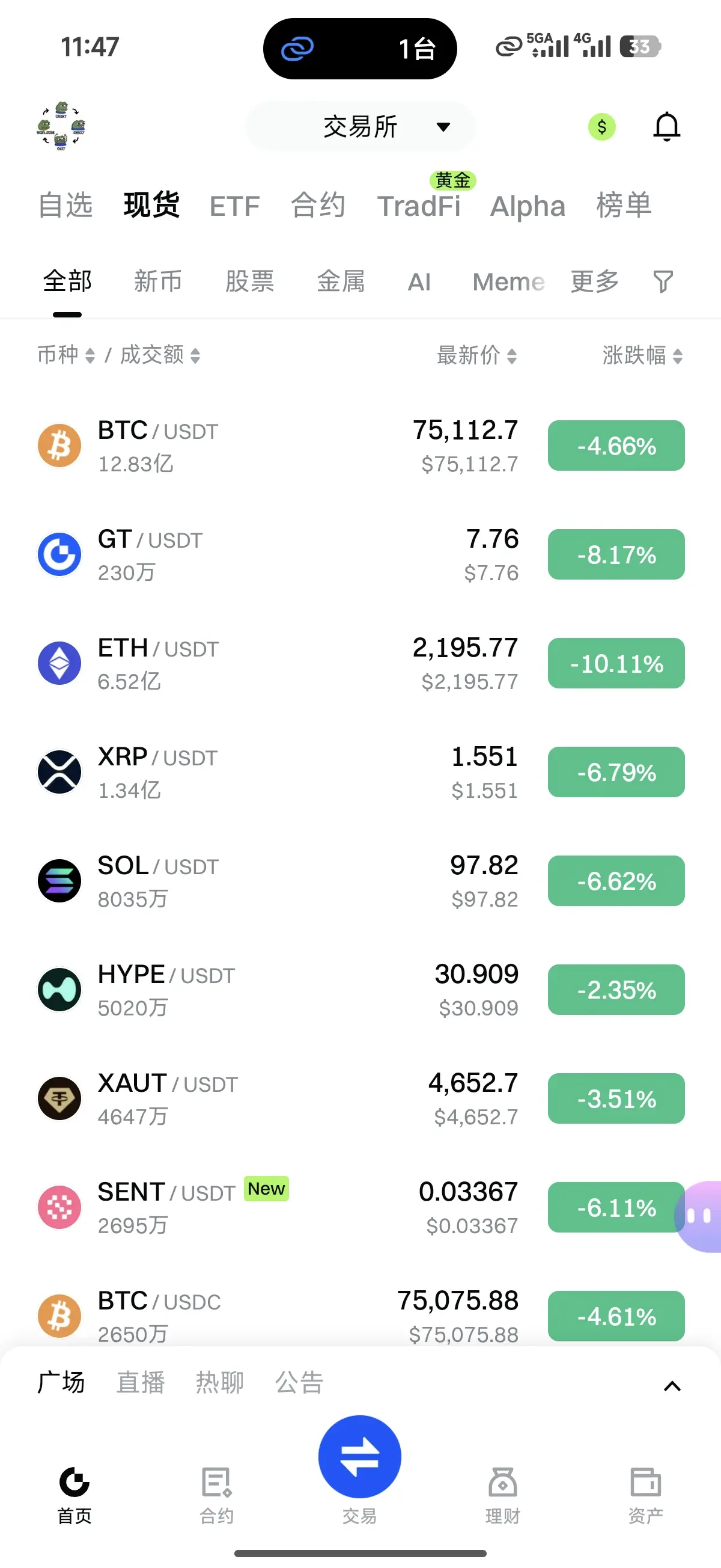

BTC-3.11%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊Spot Recommendation: Recommendation Index⭐⭐⭐⭐⭐

I have a feeling the big players will push the price again. Just now, they spent tens of thousands of U to push it to $4.2. It's impossible that they did this just for charity. I just sent over 1800 coins to them. Based on my observation, they currently hold at least 10,000 coins. Although I don't know them personally, heroes appreciate heroes. I believe the big players will make a comeback. Their cost basis for pushing the price is estimated to be above $3, so buying KTON now is like picking up money😎

I have a feeling the big players will push the price again. Just now, they spent tens of thousands of U to push it to $4.2. It's impossible that they did this just for charity. I just sent over 1800 coins to them. Based on my observation, they currently hold at least 10,000 coins. Although I don't know them personally, heroes appreciate heroes. I believe the big players will make a comeback. Their cost basis for pushing the price is estimated to be above $3, so buying KTON now is like picking up money😎

KTON7.74%

- Reward

- like

- 1

- Repost

- Share

SilenceIsGolden888 :

:

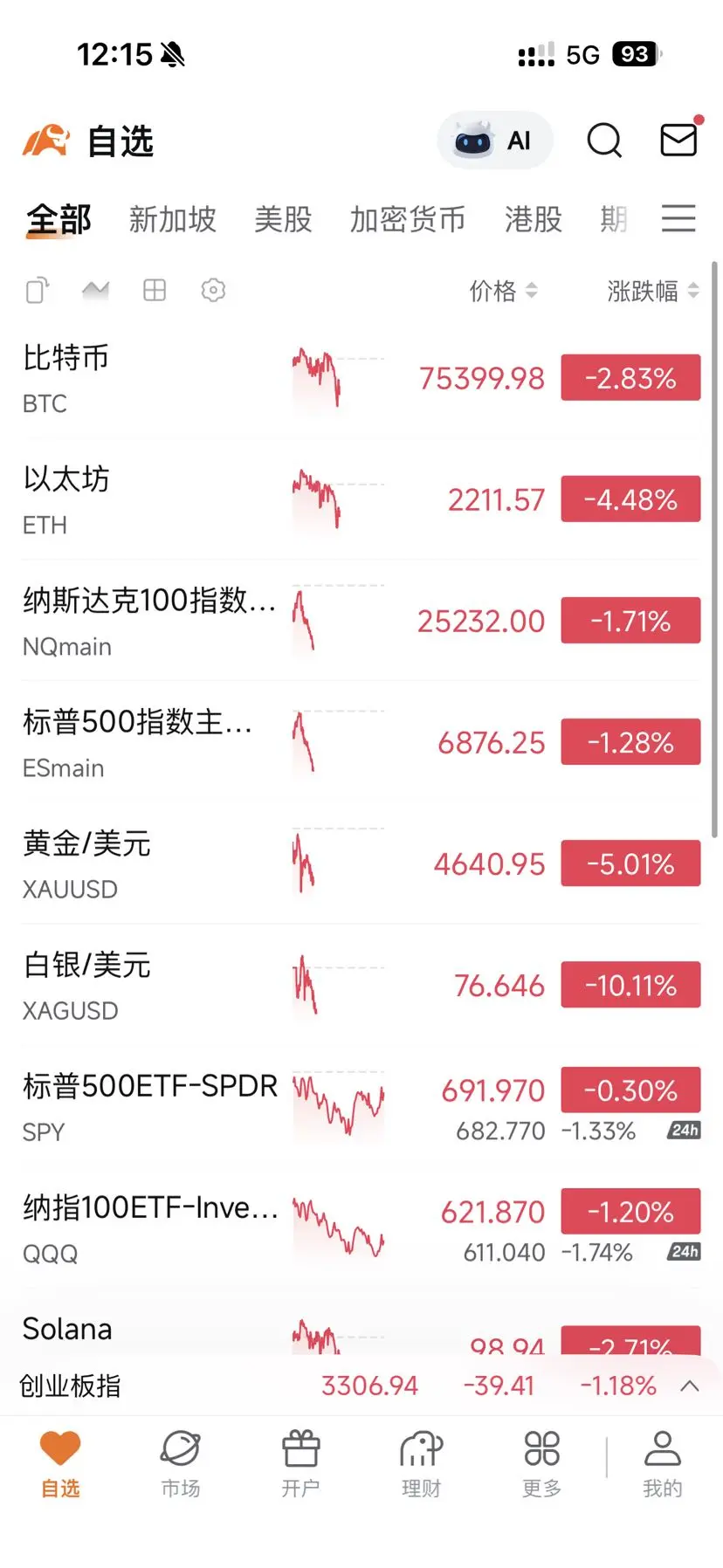

You are a character👍None of them can escape. This morning, as the international markets opened, gold and silver continued to decline. Gold dropped over 5%, silver fell more than 10%, US stock index futures plummeted over 1.7%, the Hang Seng Index in Asia dropped 2.4%, the KOSPI in South Korea hit the trading halt with a 5% decline, the Nikkei fell nearly 1%, and the three major A-share indices declined over 1%. Panic and selling pressure continue to spread. If the external markets cannot be effectively repaired in the short term and continue to decline, the impact will be significant. Ethereum is seen at 1600, Bi

ETH-7.56%

Peripheral markets plummet, speculation on the bottom of cryptocurrencies

2100, 74000

1600, 55000

41 ParticipantsEnds In 23 Hour

- Reward

- 1

- 4

- Repost

- Share

GateUser-cd13cdf0 :

:

It has already reached 2260. Is the temporary bottom at 2165?View More

祝大家马年好运年年

Build together

Created By@FortuñoRich

Subscription Progress

0.00%

MC:

$0

Create My Token

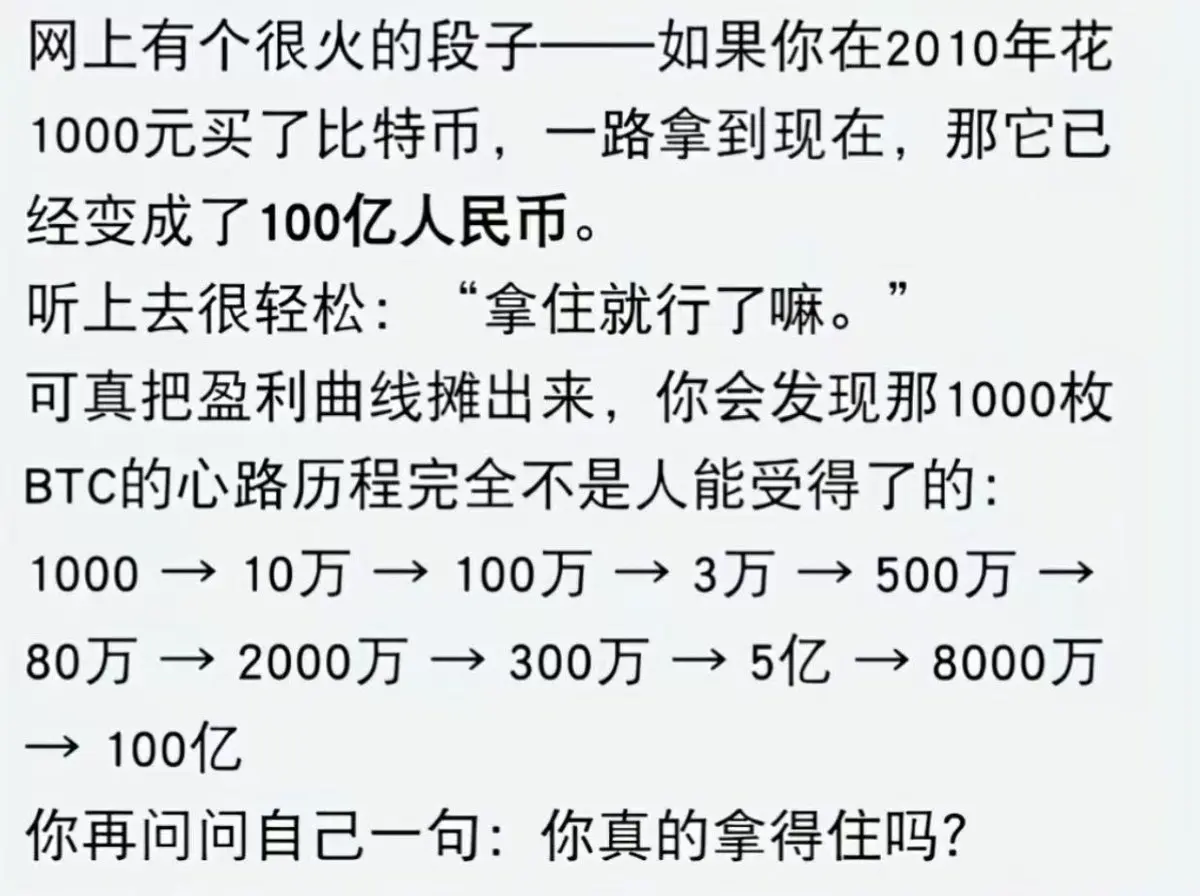

If you had 1,000 yuan principal and managed to always escape the top and fully buy the dip each time, do you know how much it would become in the end? 87 trillion yuan!!!😂 Sometimes, it's not that your ability doesn't allow you to be so awesome, but that the objective reality doesn't permit it. Tencent's market value is only 5 trillion yuan, BTC's current market value is less than 12 trillion yuan. If you earn 8.7 trillion yuan, you're even more impressive than Tencent. BTC is almost becoming your private property. Moreover, if 8.7 trillion yuan goes through another cycle, it could generate h

BTC-3.11%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3926?ch=1Dodk3Hk&ref=BVVEVQ9c&ref_type=132

- Reward

- 2

- 5

- Repost

- Share

xxx40xxx :

:

Buy To Earn 💎View More

High Volatility in BTC/ETH/SOL —washout or trend reversal

- Reward

- like

- Comment

- Repost

- Share

Currently, the market is causing U商 to rejoice wildly. How many people are pushing through immense pressure to add to their positions crazily!

How many others have been ruined by this wave of market movement, separated from their families.

And how many are desperately shorting, working against the entire world.

#加密市场回调

$BTC

How many others have been ruined by this wave of market movement, separated from their families.

And how many are desperately shorting, working against the entire world.

#加密市场回调

$BTC

BTC-3.11%

- Reward

- like

- Comment

- Repost

- Share

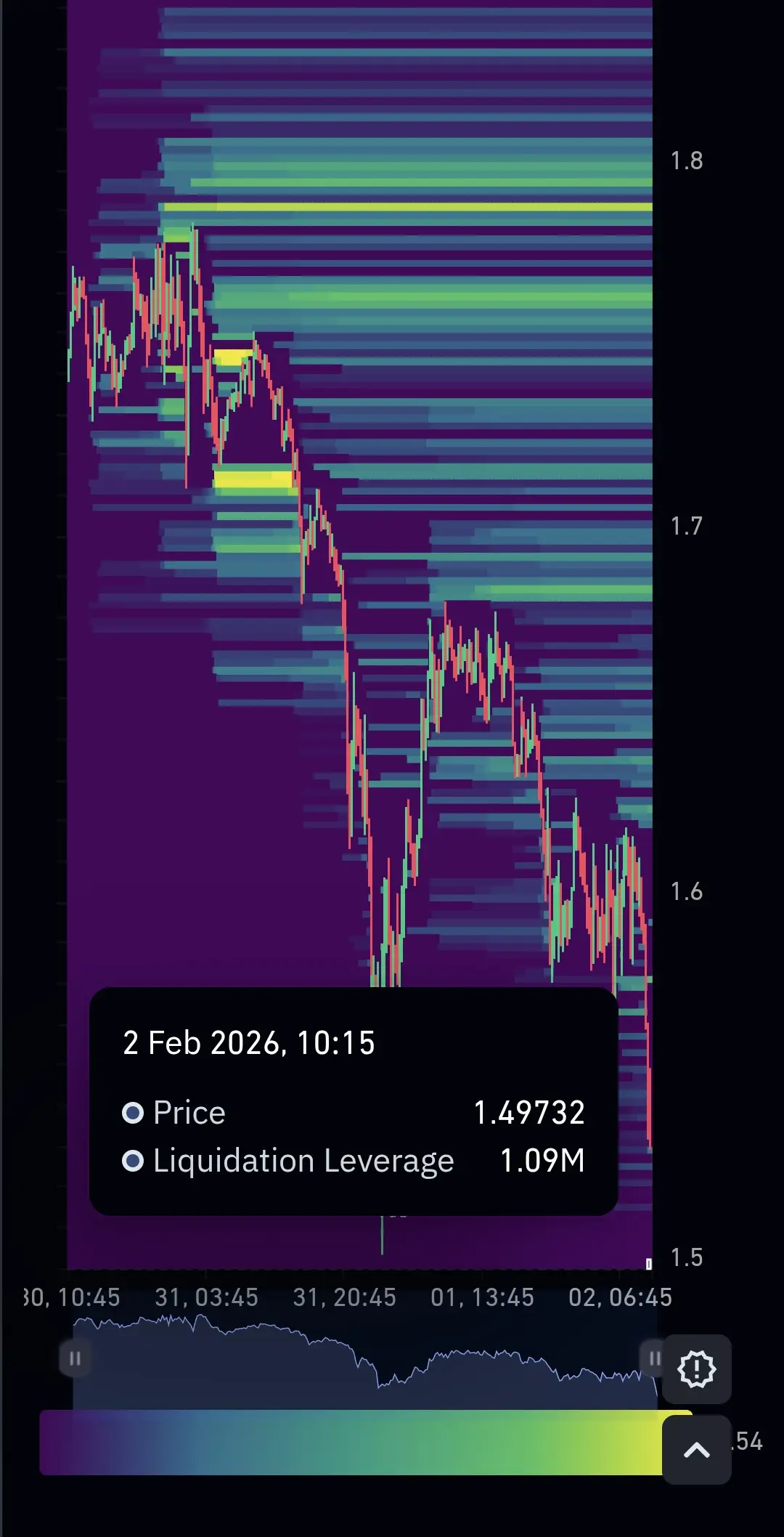

Last month, Bitcoin dipped below the 75,500 level, and over the weekend, the rebound was weak, repeatedly testing this level. The bearish pattern has become clear. The MACD green bars continue to expand, and the RSI is weakening simultaneously. The bearish momentum is not exhausted, and the trend remains highly persistent. The short- and medium-term trend is dominated by bears, and the overall bearish tone remains unchanged.

Core view: Before the key resistance is effectively broken, any rebound is a correction by the bears rather than a reversal, making it an excellent opportunity to follow

View OriginalCore view: Before the key resistance is effectively broken, any rebound is a correction by the bears rather than a reversal, making it an excellent opportunity to follow

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#Web3FebruaryFocus February Web3 Spotlight

February is shaping up to be a pivotal month for Web3, as the ecosystem witnesses a surge of activity across multiple sectors. Developers, investors, and users alike are paying attention to the latest Layer 2 scaling solutions, DeFi innovations, NFT drops, and infrastructure upgrades. Market participants are evaluating how each segment will contribute to adoption, liquidity, and long-term utility in a rapidly evolving digital landscape.

Layer 2 Solutions — Scaling Ethereum and Beyond

Ethereum rollups and Layer 2 networks are taking center stage this m

February is shaping up to be a pivotal month for Web3, as the ecosystem witnesses a surge of activity across multiple sectors. Developers, investors, and users alike are paying attention to the latest Layer 2 scaling solutions, DeFi innovations, NFT drops, and infrastructure upgrades. Market participants are evaluating how each segment will contribute to adoption, liquidity, and long-term utility in a rapidly evolving digital landscape.

Layer 2 Solutions — Scaling Ethereum and Beyond

Ethereum rollups and Layer 2 networks are taking center stage this m

- Reward

- 1

- 3

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

MLGBZ

马了个巴子

Created By@GeniusYoungTrader

Listing Progress

0.00%

MC:

$0.1

Create My Token

Leverage imbalance:Short positions dominate derivatives positioning

- Reward

- like

- Comment

- Repost

- Share

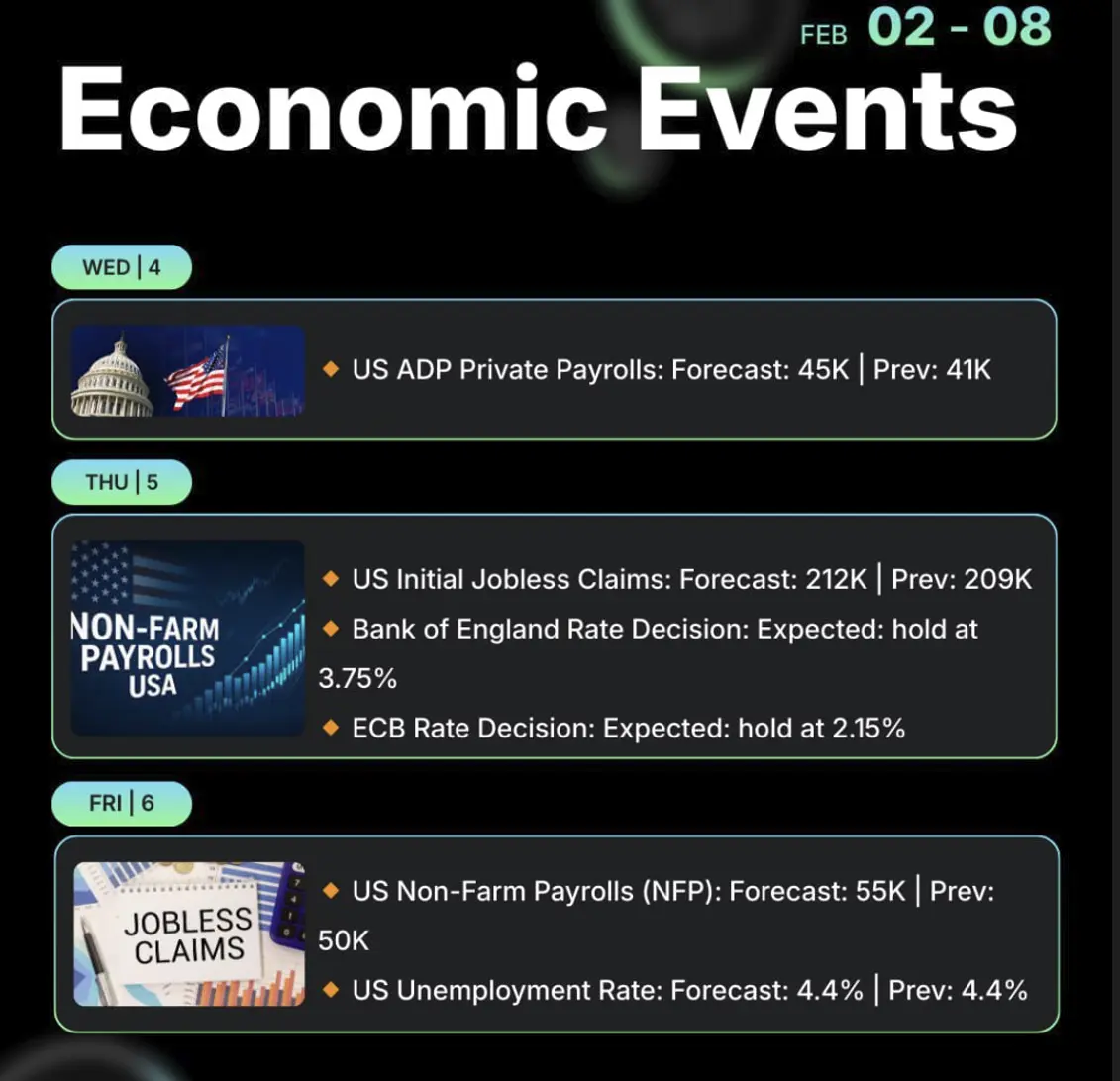

📅 ECONOMIC CALENDAR | WEEK AHEAD (US TIME)

Markets turn their focus to US labor data, alongside ECB & BoE rate decisions, while awaiting a potential US Supreme Court ruling on tariffs.

🇺🇸 Wed (Feb 4)

🔸 US ADP Private Payrolls: Forecast: 45K | Prev: 41K

🇺🇸 Thu (Feb 5)

🔸 US Initial Jobless Claims: Forecast: 212K | Prev: 209K

🔸 Bank of England Rate Decision: Expected: hold at 3.75%

🔸 ECB Rate Decision: Expected: hold at 2.15%

🇺🇸 Fri (Feb 6)

🔸 US Non-Farm Payrolls (NFP): Forecast: 55K | Prev: 50K

🔸 US Unemployment Rate: Forecast: 4.4% | Prev: 4.4%

Markets turn their focus to US labor data, alongside ECB & BoE rate decisions, while awaiting a potential US Supreme Court ruling on tariffs.

🇺🇸 Wed (Feb 4)

🔸 US ADP Private Payrolls: Forecast: 45K | Prev: 41K

🇺🇸 Thu (Feb 5)

🔸 US Initial Jobless Claims: Forecast: 212K | Prev: 209K

🔸 Bank of England Rate Decision: Expected: hold at 3.75%

🔸 ECB Rate Decision: Expected: hold at 2.15%

🇺🇸 Fri (Feb 6)

🔸 US Non-Farm Payrolls (NFP): Forecast: 55K | Prev: 50K

🔸 US Unemployment Rate: Forecast: 4.4% | Prev: 4.4%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

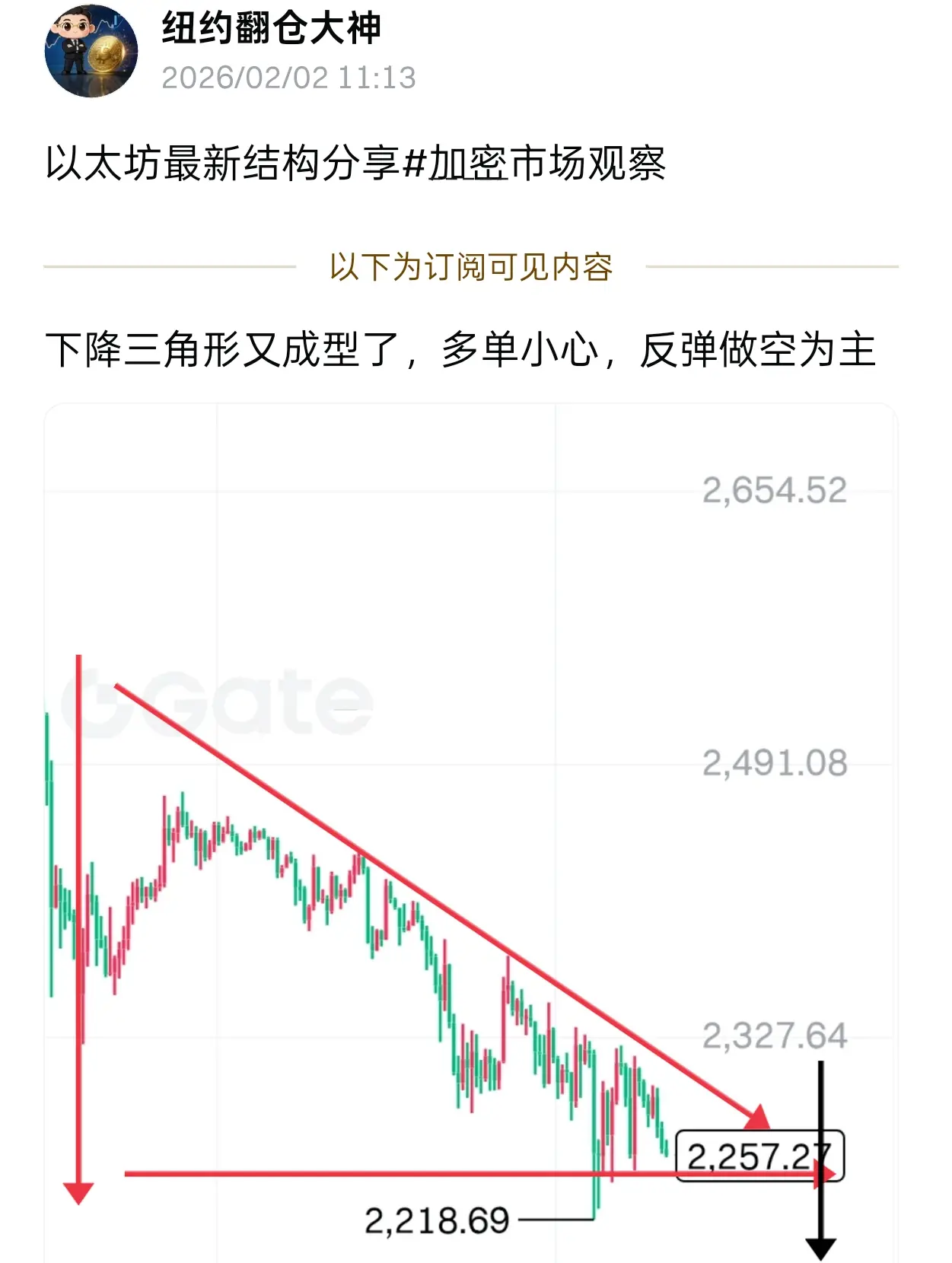

Cover song master predicts structure success again!

The air force is eating big gains! Ethereum is experiencing a direct waterfall.

Still dare to buy the dip? I've already told you, just block those who are bullish. They will only affect your progress in flipping your position. If it doesn't drop to make them doubt life, this bear market won't end!#加密市场观察

The air force is eating big gains! Ethereum is experiencing a direct waterfall.

Still dare to buy the dip? I've already told you, just block those who are bullish. They will only affect your progress in flipping your position. If it doesn't drop to make them doubt life, this bear market won't end!#加密市场观察

ETH-7.56%

- Reward

- 2

- 14

- Repost

- Share

IDon'tHaveMuchWithHim. :

:

Now it's rebounding. Is shorting after the peak correct😀View More

#Web3FebruaryFocus

February is shaping up as a pivotal month for the Web3 ecosystem, with multiple milestones, product launches, protocol upgrades, and community events poised to drive both activity and sentiment across the sector. Investors and traders should pay close attention to developments in Layer-1 and Layer-2 networks, NFT marketplaces, decentralized finance (DeFi), tokenized assets, and Web3 infrastructure projects, as each presents distinct opportunities and risk profiles. Layer-1 blockchains like Ethereum, Solana, and SUI are focusing on scalability, staking, and developer adoptio

February is shaping up as a pivotal month for the Web3 ecosystem, with multiple milestones, product launches, protocol upgrades, and community events poised to drive both activity and sentiment across the sector. Investors and traders should pay close attention to developments in Layer-1 and Layer-2 networks, NFT marketplaces, decentralized finance (DeFi), tokenized assets, and Web3 infrastructure projects, as each presents distinct opportunities and risk profiles. Layer-1 blockchains like Ethereum, Solana, and SUI are focusing on scalability, staking, and developer adoptio

- Reward

- like

- Comment

- Repost

- Share

$OKB showing resilience after pullback and holding above higher timeframe demand.

Sell-side liquidity taken and structure stabilizing as price finds balance.

EP

$86.80 – $87.60

TP

TP1 $89.00

TP2 $91.20

TP3 $94.00

SL

$85.70

Price dipped into sell-side liquidity near the recent lows and began to stabilize, signaling absorption rather than continuation. Current structure shows compression with sellers losing momentum after the sweep. As long as price holds this zone, upside liquidity toward prior highs remains in focus.

Let’s go $OKB

Sell-side liquidity taken and structure stabilizing as price finds balance.

EP

$86.80 – $87.60

TP

TP1 $89.00

TP2 $91.20

TP3 $94.00

SL

$85.70

Price dipped into sell-side liquidity near the recent lows and began to stabilize, signaling absorption rather than continuation. Current structure shows compression with sellers losing momentum after the sweep. As long as price holds this zone, upside liquidity toward prior highs remains in focus.

Let’s go $OKB

OKB-5.72%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More373.4K Popularity

1.07K Popularity

766 Popularity

745 Popularity

197 Popularity

Hot Gate Fun

View More- MC:$2.72KHolders:10.00%

- MC:$2.85KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.85KHolders:10.00%

News

View MoreData: The current Crypto Fear & Greed Index is 13, indicating extreme fear.

3 m

JustLend DAO launches the WBTC market supply mining activity

8 m

JustLend DAO launches USDD 2.0 supply mining phase fourteen

8 m

Data: 8.739 million ASTER tokens transferred out from Wintermute, valued at approximately $4.69 million.

10 m

ETH Breaks Through 2250 USDT

10 m

Pin