MingDao

Senate Banking Committee Democratic Leader Senator Warren has written to Treasury Secretary Yellen, urging her to swiftly implement the Stablecoin Innovation Act (GENIUS Act) and address its regulatory gaps. Warren emphasized that the U.S. Stablecoin Innovation Act (GENIUS Act) provides a "lightweight regulatory framework" for encryption banks, and the Treasury must take action to implement and enforce the law to minimize the significant risks it poses to U.S. financial stability, consumers, taxpayers, and national security. The Stablecoin Innovation Act was signed into law by President Donald

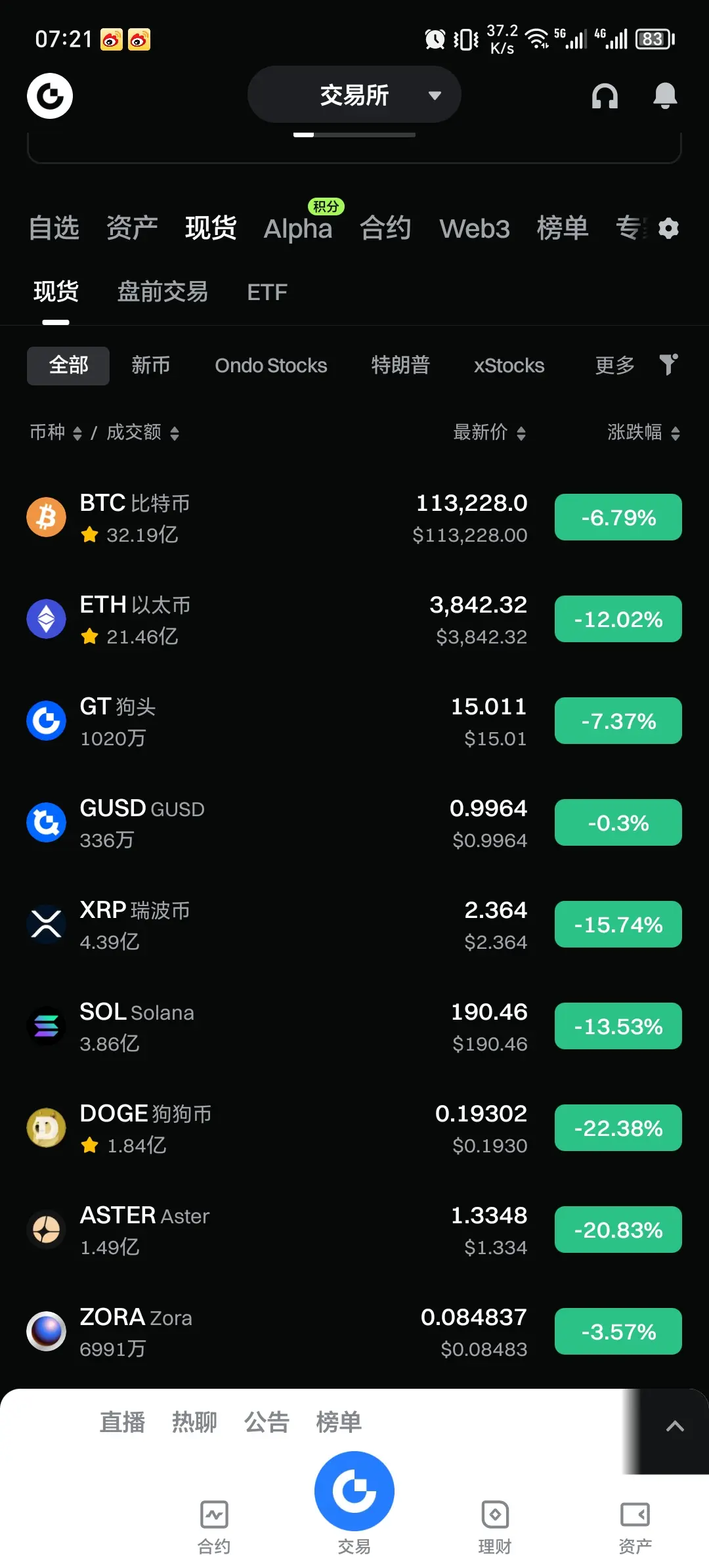

PYUSD-0.11%