Ethereum Developers Bringing Their Talents to Private Ventures

On the evening of the 19th UTC, Bankless co-founder David Hoffman posted on X to acknowledge the departure of Dankrad Feist, the longest-serving research fellow at the Ethereum Foundation, who is leaving Ethereum to join Layer 1 project Tempo.

David Hoffman emphasized that profit-driven companies absorbing top talent cultivated by the Ethereum open-source community poses a significant challenge. He argued these companies do not actually bring greater benefits to Ethereum, contrary to their claims. Hoffman stated that in his view, Tempo’s purpose is to intercept the trillions of dollars in stablecoins expected to flow in over the next decade and move them to their private blockchain. While this increases the overall pie, Tempo still intends to claim as much of it as possible. He noted that Tempo will always be constrained by compliance issues, and issuing tokens won’t resolve this. Although both Tempo and Ethereum may drive global change, only Ethereum is suited to be the credibly neutral global settlement layer—without shareholders and free from legal constraints.

Discontent with Ethereum’s performance began when its price started to lag Bitcoin during this cycle. Over time, it has become clear that the exodus of elite talent from the Ethereum community is turning into an irreversible trend. When ideals and financial interests conflict, many ultimately choose the latter—a concern that has long troubled the industry.

Dankrad Feist Is Not the First, Nor Will He Be the Last

On the 17th of this month, Dankrad Feist announced on X his move to Tempo, while continuing as a research advisor for three strategic protocol cluster projects at the Ethereum Foundation (Scaling L1, Scaling Blob, and Improving User Experience). Feist commented, “Ethereum has powerful values and technical choices that make it unique. Tempo will be a valuable complement, built on similar technology and values while pushing boundaries in scale and speed. I believe this will greatly benefit Ethereum. Tempo’s open-source technology can be easily reintegrated into Ethereum, enhancing the ecosystem as a whole.”

According to LinkedIn, Dankrad Feist officially joined as an Ethereum researcher in 2019, focusing on sharding technology for scaling Ethereum’s mainnet. Danksharding—the central component of Ethereum’s scaling roadmap—is named after him. Danksharding is widely recognized as the key path for Ethereum to achieve high throughput and low-cost transactions, and is considered the most important upgrade following “Ethereum 2.0.”

Feist spearheaded the precursor to Danksharding, Proto-Danksharding (EIP-4844), which introduced Blob Transactions, providing a cheaper, more efficient data availability layer for Rollups and significantly reducing their data publication costs.

He also publicly debated Geth lead developer Péter Szilágyi on MEV issues, a dispute that ultimately prompted Vitalik to intervene and led to greater community focus on MEV mitigation mechanisms such as PBS (Proposer-Builder Separation).

Tempo researcher Mallesh Pai introduced new team members in September, including former OP Labs CEO and ETHGlobal co-founder Liam Horne.

Prior to Feist, the industry was surprised by Danny Ryan, co-founder of Etherealize (which raised $40 million). Formerly known as the “Ethereum 2.0 chief engineer” and a core Ethereum Foundation member, Ryan announced an indefinite departure in September 2024 but joined Etherealize only six months later. Given Etherealize’s similarities to ConsenSys—founded by Ethereum co-founder Joseph Lubin after disputes over commercialization eleven years ago—the community largely understood Ryan’s decision.

What truly concerns David Hoffman are companies like Tempo and Paradigm. Prominent Ethereum developer Federico Carrone shared similar views, reposting Hoffman’s comments on Feist’s move and noting that for two years he has warned that Paradigm’s growing influence within Ethereum could become a systemic risk for the entire ecosystem.

Federico Carrone wrote that the sole objective of a venture fund is to maximize LP returns, and Ethereum must avoid deep technical dependencies on a VC deploying highly strategic maneuvers. After the FTX collapse, Paradigm nearly scrubbed all crypto branding and pivoted to AI—a move Carrone believes validates his point.

With Trump’s return to the White House, Paradigm shifted back to Web3, aggressively recruiting top researchers, funding key Ethereum open-source libraries, and supporting Stripe’s launch of Tempo. Carrone observed that while Paradigm claims its efforts benefit Ethereum—more capital, tools, testing grounds, and new ideas with potential feedback into Ethereum—when a corporation holds excessive visibility and influence over an open-source project, priorities shift from the community’s long-term vision to corporate interests.

Ethereum’s Technical Debt Is Mounting

Losing open-source community talent alone may not raise widespread alarm, but pairing this loss with mounting technical debt raises a red flag.

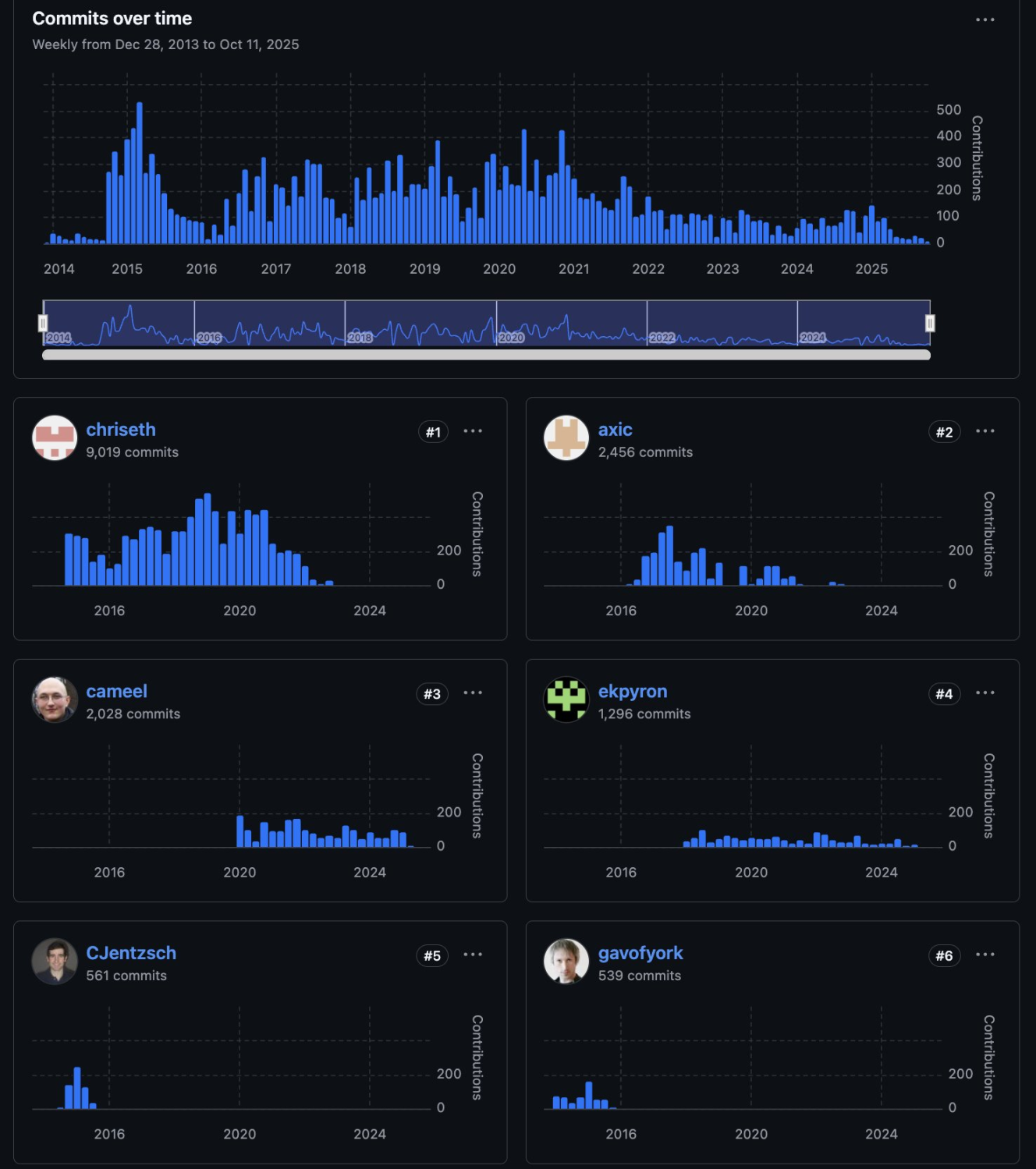

One week ago, a community member posted a screenshot on X, noting that top contributors to the Solidity language have nearly stopped development. Only Cameel continues to raise new issues and push technical progress, but mostly in maintenance mode. The view is that the community must invest more resources to support the language.

Some commenters questioned the allocation of resources to upgrade Solidity instead of maintaining its stability and security. The original poster explained that even if the Solidity compiler changes, it won’t affect deployed contracts, but improvements can enhance security, developer experience, or support new contract features. The chart shows that development activity has plummeted since the last major bull run.

Federico Carrone added that his greatest concern is the long-term maintenance of core Solidity tools and libraries, noting that even the latest Solidity compiler is maintained by very few developers. Companies working on L2 and ZK technologies are also downsizing, meaning that future technical iterations may depend on only a handful of firms. As the gas limit rises, many execution clients haven’t significantly improved performance, and their development teams seem to be falling behind based on repository activity.

Carrone stated, “Ethereum’s technical debt keeps piling up—not just because the protocol must keep evolving, but because many supporting libraries and repositories have stagnated. The ecosystem continues to expand, safeguarding tens of billions of dollars in assets, while parts of its foundation are quietly eroding.”

Open-Source Communities Can’t Survive on ‘Passion’ Alone

For an open-source community like Ethereum, which anchors vast real-world value, balancing “passion” with economic incentives is uncharted territory. This should be a major concern for the Ethereum Foundation, but it appears to have been overlooked.

Péter Szilágyi, who joined the Ethereum Foundation in 2015 and led Geth development, highlighted three main disappointments in a letter to the Foundation’s leadership a year and a half ago: being externally portrayed as a leader but marginalized internally; income grossly disproportionate to Ethereum’s market cap; and excessive influence wielded by Vitalik and his inner circle over the ecosystem.

By late 2024, Szilágyi discovered the Foundation was secretly incubating an independent Geth fork team. After disputes, he was dismissed and repeatedly rejected re-employment offers. Szilágyi declined the Foundation’s $5 million offer for Geth’s full independence. Szilágyi now maintains the Geth codebase as an independent contributor.

Persistent rumors of corruption within the Ethereum Foundation should have been anticipated from its inception. As the saying goes, “where people gather, there’s inevitable rivalry.” Greed cannot be eliminated, but unchecked commercialization cannot be permitted to erode Ethereum’s core values.

Ethereum’s hundreds of billions in market cap and trillions in on-chain value transfer rest on professional technical teams building its infrastructure, the permissionless open-source ethos, and commercial contributions from various companies. Maintaining such a massive system requires substantial ongoing effort, yet as discussed, many responsible contributors are leaving out of disappointment or pursuing other economic opportunities.

This year, the Ethereum Foundation undertook major reforms, but so far, there have been no breakthrough results. Ethereum remains the “world’s computer,” with strong commercial potential being continually explored by elite teams. Yet for all this progress, Ethereum must not continue to discourage those who remain committed to its ideals.

Statement:

- This article was originally published by Foresight News. Copyright remains with the original author [Eric, Foresight News]. If you have concerns about republication, please contact the Gate Learn team for assistance.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or reproduce this translated article without proper attribution to Gate.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

Our Across Thesis

What is Neiro? All You Need to Know About NEIROETH in 2025

An Introduction to ERC-20 Tokens