SKX Token Analysis: Understanding the Potential and Risks of SKX from Scratch

SKX Project Overview: Real-World Payment Meets Web3 Integration

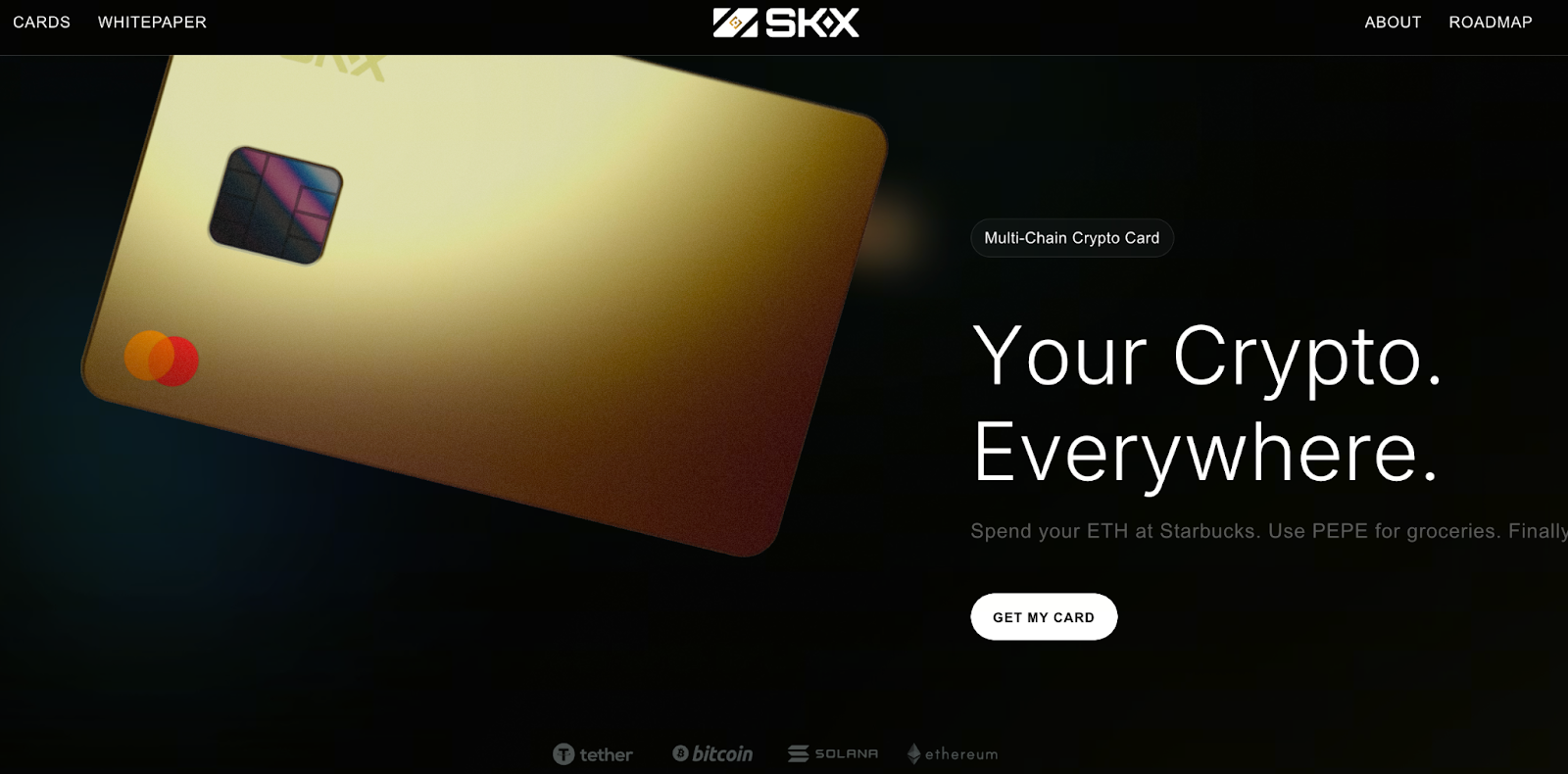

Image: https://skxpanax.net/

SKX (Skpanax) merges blockchain technology with practical payment solutions. It allows users to spend both online and offline through its digital wallet and payment card solutions. Gate and MEXC currently list SKX, with a total supply of 100 million tokens. The project emphasizes real-world payment applications for crypto assets.

Recent Price Volatility: Drop from Highs, Followed by a Rebound

Image: https://www.gate.com/trade/SKX_USDT

SKX has experienced heightened price volatility over the past two weeks.

- At the end of October, SKX briefly climbed above 0.68 USDT;

- Just three days later, it plunged to 0.29 USDT, dropping more than 55%;

- It rebounded quickly to 0.41 USDT in early November;

- As of the morning of November 5 (UTC), the price was fluctuating between 0.36 and 0.39 USDT.

While intraday swings of over 20% are common in crypto, SKX—a small and mid-cap token—exhibits dramatic volatility. This signals extremely unstable market sentiment.

Three Main Drivers of Volatility

- Thin liquidity and concentrated holdings: Trading volume is limited to a few platforms, so a handful of large holders can easily move the price.

- Project hype cycles: At the end of October, SKX attracted short-term investment through aggressive community marketing. However, enthusiasm quickly faded.

- Overall market correction: BTC’s drop from recent highs triggered widespread selling pressure on small and mid-cap tokens.

Technical Analysis: Key Support and Resistance Levels

From a technical standpoint:

- Support: 0.32 USDT (recent three-day low and high trading volume zone);

- Resistance: 0.42 USDT (previous high and upper Bollinger Band intersection);

- If the price holds above 0.40, it could rebound toward 0.50. A break below 0.30 may lead to further downside to 0.25.

KDJ and RSI technical indicators suggest a short-term bounce after overselling. However, momentum remains weak.

Investor Strategies and Risk Management

- Short-term traders can capitalize on volatility with range-bound trades, but must set stop-loss orders.

- Mid- and long-term investors should wait for market stabilization and clear project milestones before entering positions.

- Position sizing: Beginners should limit position size to 5–10% of total capital.

Conclusion: SKX—Speculation or Long-Term Opportunity?

SKX’s extreme price swings reveal its classic “high risk, high reward” profile. If the project fulfills its promise of real-world payment adoption, it could offer long-term potential; however, it currently functions primarily as a sentiment-driven speculative asset. Investors should exercise rational judgment and caution, avoiding impulsive reactions to price spikes.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article