Gate Research: 2025 crypto employment market report

Abstract

- Despite the global economic slowdown and AI’s impact on traditional jobs, the crypto industry remained strong in 2024–2025, with a market cap exceeding USD 3 trillion. Talent inflow accelerated, especially in core tech, smart contracts, security, and AI + Web3.

- Technical roles now make up over 50% of crypto jobs, including blockchain development and security auditing. Meanwhile, product, operations, compliance, and marketing roles are rising, signaling a shift from “tech-driven” to “ecosystem + compliance.”

- Exchanges, public chain infrastructure, and DeFi absorb over 70% of positions. RWA (real-world assets on-chain) and AI + Crypto are rapidly emerging, driving demand for hybrid talents—especially engineers skilled in both machine learning and blockchain.

- Global crypto salaries rose 18% year-on-year, with North America highest and Asia growing fastest. Token incentives and remote work dominate, while DAO rewards and profit-sharing strengthen long-term engagement.

- Over 250 universities now offer blockchain and crypto courses, and online platforms like Gate Learn are shaping an “academic + ecosystem” education model.

- The crypto job structure is evolving from “tech-only” to “tech + compliance + operations.” AI × Crypto, RWA, and security auditing are top-paying areas. Remote and decentralized work are becoming mainstream, with global, cross-disciplinary skills defining competitiveness.

Introduction

1.1 Research Background

Over the past decade, the explosive growth of the digital asset market has profoundly reshaped the structure of the global economic system. Since the birth of Bitcoin, blockchain technology has undergone a complete evolution—from proof of concept to large-scale industrial implementation. The crypto industry has gradually shifted from an early “speculative economy” toward an “application-driven economy.” Meanwhile, the rise of artificial intelligence and data as production factors has accelerated the digital transformation of global industrial chains, forming a global competitive landscape centered on technological innovation. Against this broader backdrop, the crypto industry has become one of the most representative “technology-driven new economies,” attracting massive capital inflows and highly skilled professionals.

The employment ecosystem of the crypto industry exhibits clear structural characteristics. High salaries, borderless work models, open innovation environments, and token-based incentive mechanisms have endowed the industry with exceptional talent appeal. An increasing number of software engineers, product designers, and financial professionals are migrating from traditional Internet and financial systems to the Web3 ecosystem. According to research conducted by Gate Research Institute, since 2023, the number of professionals entering the global crypto industry has increased by 42% year-on-year, with 70% of them coming from traditional Internet and fintech companies.

This report aims to present a systematic analysis of the crypto industry’s job market in 2025, offering an accurate picture of its current employment landscape and development trends. It seeks to help job seekers better understand job structures and career paths, while also providing enterprises with insights and references for recruitment strategies and talent planning.

1.2 Research Methodology and Data Sources

This report adopts a mixed-method approach that combines quantitative analysis with qualitative interviews. Based on data samples collected from the fourth quarter of 2024 to the second quarter of 2025, it integrates publicly available datasets from Web3 Career, DefiLlama, CoinGecko, ILOSTAT, TradingView, and CoinMarketCap. The research team conducted structural analyses on more than 400 crypto companies, exchanges, and project teams, while also referencing macro-level employment data from the World Economic Forum (WEF) and the International Labour Organization (ILO) to ensure both the credibility and timeliness of the findings.

The report conducts a horizontal comparison of job structures and salary ranges across different sectors—such as public blockchains, DeFi, RWA (Real-World Assets), and AI + Crypto—while also incorporating regional variations to analyze employment trends in the world’s major crypto job markets, including North America, Europe, Asia, and Latin America.

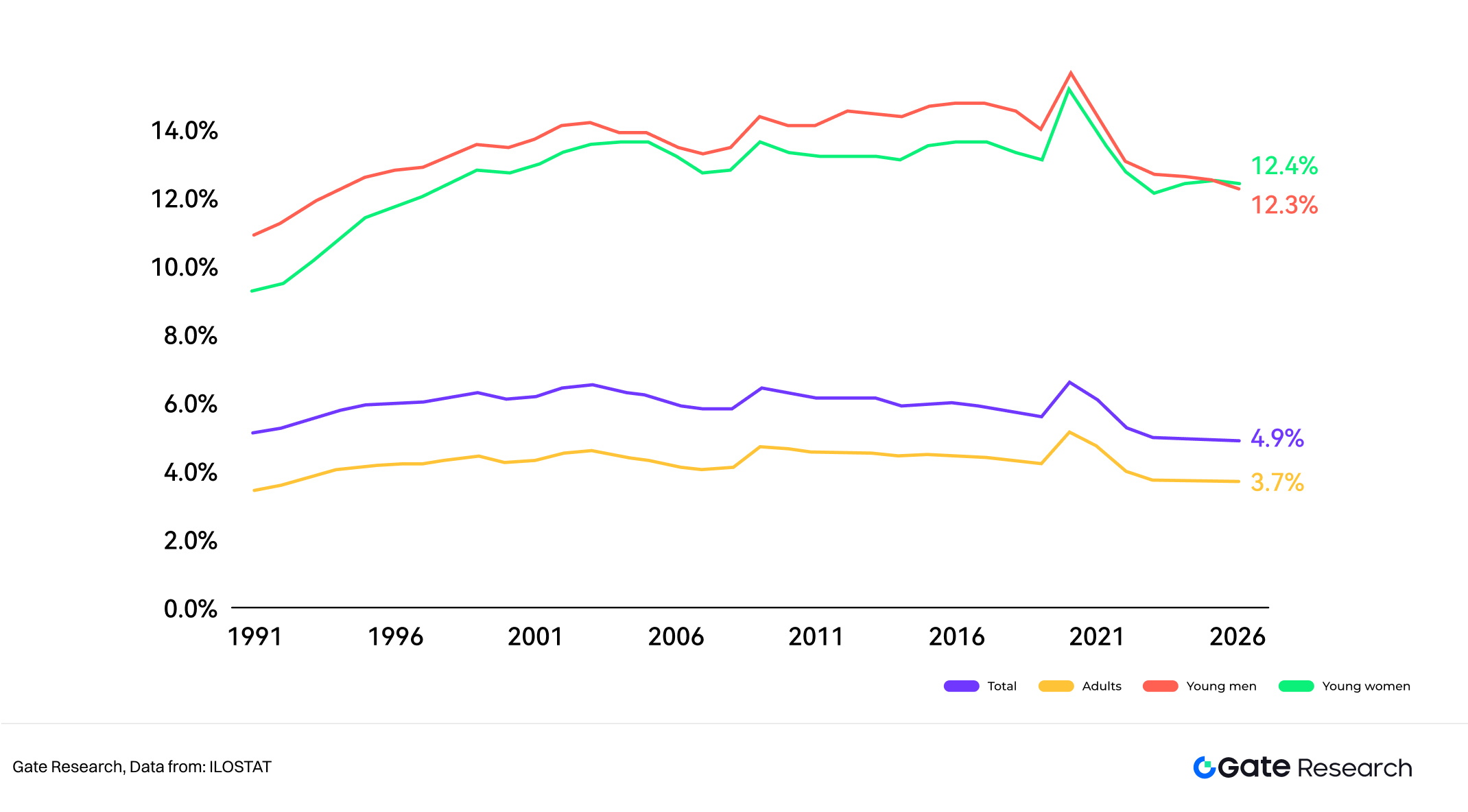

1.3 Overview of the Global Employment Environment

According to the International Labour Organization (ILOSTAT) Report 2025, the global unemployment rate stands at approximately 5%, showing a slight improvement compared with 2023. However, the overall employment growth rate has declined to 1.5%. The widespread adoption of artificial intelligence has intensified structural differentiation within the labor market: middle- and low-skilled positions are increasingly replaced by automation, while demand for high-skilled roles continues to rise—but the supply of such talent grows at a much slower pace, further widening the “skills gap.” Against this backdrop, the crypto industry—with its high technological intensity and cross-border nature—has emerged as an important “buffer zone” within the global employment system.

Unlike traditional technology enterprises, the labor organization within the crypto industry is far more flexible. The widespread adoption of DAOs (Decentralized Autonomous Organizations) and remote collaboration tools enables teams to operate across time zones and transcend national boundaries. This model not only enhances organizational efficiency but also increases diversity in talent participation. By 2025, more than 58% of crypto companies worldwide have adopted hybrid or fully remote work models, with employees distributed across over 120 countries and regions.

This form of “global collaborative employment” represents a new stage of digital labor. Individuals participate in projects using on-chain identities, with payments and settlements executed through smart contracts, and their work outcomes permanently recorded on the blockchain. The transparency of labor value and the immediacy of incentive mechanisms have become powerful supplements to traditional employment systems. Gate Research Institute believes that the employment system within the crypto industry may signal the evolutionary direction of future labor relations: more decentralized, more fluid, and increasingly dependent on technological trust.

Current State of the Crypto Industry

2.1 Counter-Cyclical Growth of the Industry

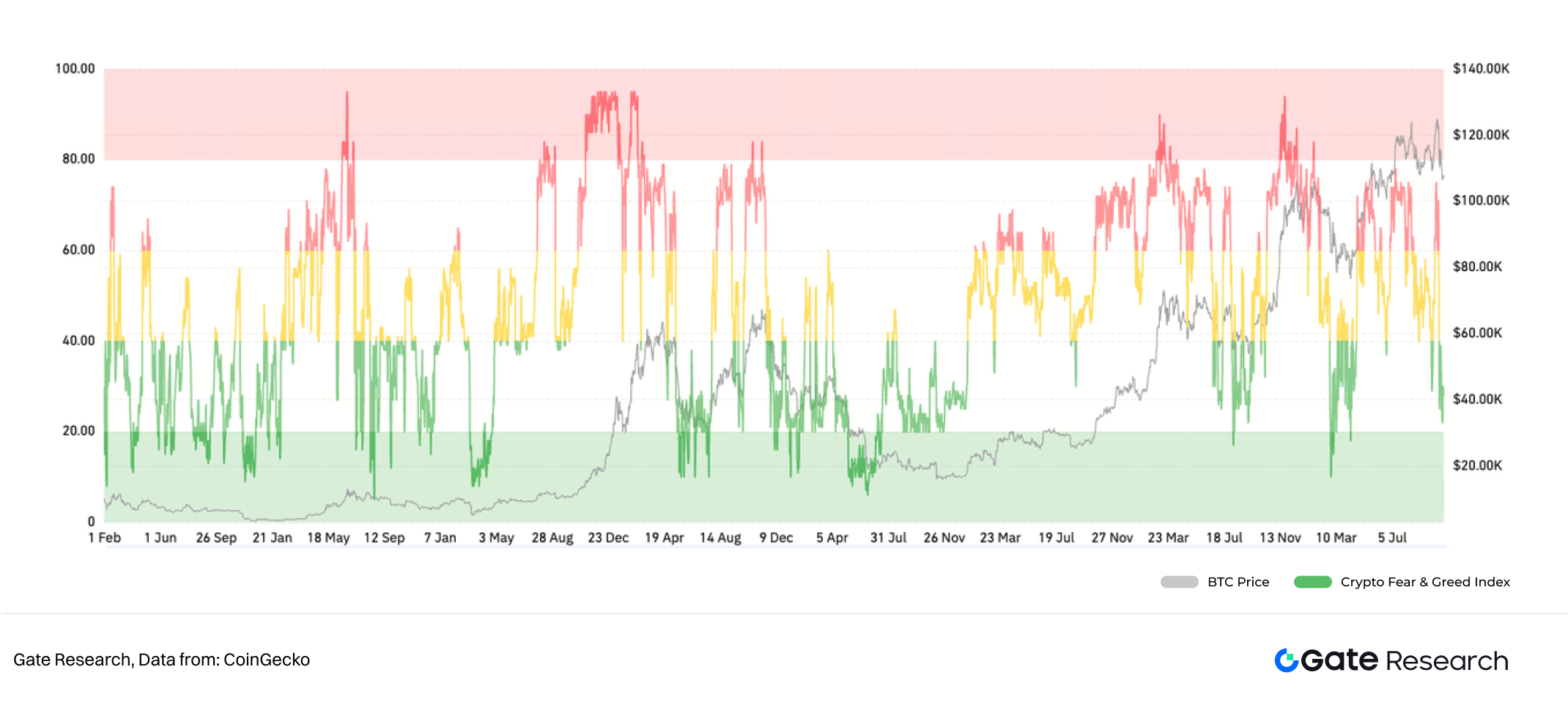

Despite mounting pressure on the global economy, the crypto industry has continued to demonstrate strong growth momentum. Since 2013, the industry’s total market capitalization has surged from USD 7 billion to nearly USD 3 trillion by 2025—an increase of more than 400 times. This remarkable expansion not only reflects the cumulative progress of technological innovation but also highlights the market’s sustained confidence in crypto assets. According to data from CoinGecko, the total market capitalization of crypto assets surpassed USD 2.8 trillion in the fourth quarter of 2024 and continued its steady upward trajectory through the second quarter of 2025, underscoring the stability of a maturing market structure.

The core drivers behind this growth include the continued inflow of institutional capital, the improvement of infrastructure, and the expansion of application scenarios. The maturation of Layer2 technologies has significantly reduced transaction costs; the rise of RWA (Real-World Assets) has enabled traditional financial assets to be issued and circulated on-chain; and the integration of AI and Crypto has further extended the boundaries of data markets and computational power networks. At the same time, the gradual clarification of regulatory policies has strengthened long-term confidence in the industry. In 2024, multiple countries successively introduced regulatory frameworks for crypto assets, creating institutional foundations for capital inflows and enterprise participation.

2.2 Global Growth and Structure of Crypto Users

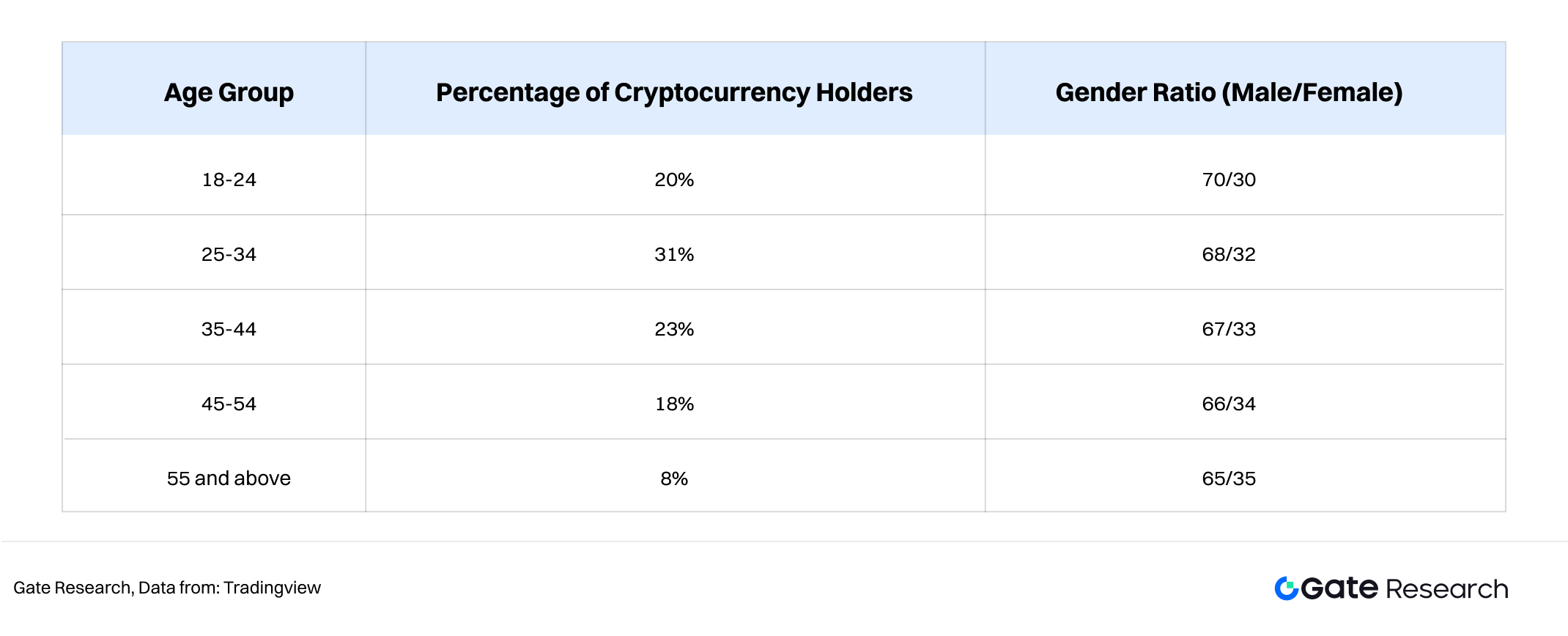

As of October 2025, the total number of global cryptocurrency users has reached 950 million, accounting for approximately 9.9% of the world’s population. In terms of user demographics, individuals aged 25–34 make up as much as 31%, revealing a clear generational concentration. This cohort not only demonstrates a high level of technological adaptability but also embraces more open attitudes toward wealth and globalization. They tend to seek passive income through digital assets and actively participate in decentralized finance (DeFi), NFT ecosystems, and GameFi projects.

The age distribution of crypto users shows a distinct trend toward younger generations, reflecting a strong alignment between the new economic model and digital-native culture. This group generally possesses higher digital literacy and stronger awareness of asset allocation, making them the core driving force behind Web3 adoption. Notably, the proportion of female users has risen from 12% in 2022 to 19%, indicating that the industry’s inclusiveness and public perception are gradually improving.

Regionally, the Asia-Pacific (APAC) region has experienced the fastest growth, with an annual increase rate of 69%, followed closely by Latin America at 63%. According to data from TradingView, growth in North America and Europe has stabilized; however, both regions continue to lead globally in active trading volume and average holdings per user. The geographic distribution of the crypto industry shows a clear trend of “southward expansion and decentralization.”

While user growth in North America and Europe has slowed, these regions remain dominant in terms of asset scale and institutional participation. In contrast, the APAC and Latin American markets have become the primary drivers of application innovation and employment growth. In particular, countries such as Nigeria, Argentina, and Brazil have seen widespread use of cryptocurrencies for cross-border remittances and inflation-hedging savings, forming a distinctive model of “utility-based adoption.”

2.3 Transformation of Industry Development Stages

After experiencing the speculative boom of 2021 and the deleveraging adjustments of 2022, the crypto industry entered a “rational growth phase” between 2024 and 2025. The current momentum of market expansion is primarily driven by three key factors:

First, the deep integration of AI technology and blockchain has fostered a decentralized economic system for data, computing power, and model incentives. Second, the RWA (Real-World Assets) model has introduced traditional financial assets onto the blockchain, extending the crypto industry from a purely virtual economy into the realm of real-world assetization. Third, the maturation of global regulatory frameworks has encouraged sustained inflows of compliant capital and institutional participants.

This stage is characterized by “quality growth” replacing “quantitative expansion.” Project teams are placing greater emphasis on product implementation and the sustainability of business models, while the user base is gradually shifting from speculation-driven participants to utility-oriented users. As of the second quarter of 2025, more than 58% of industry professionals believe that the sector has entered a phase of steady, long-term development. This structural maturation has provided the job market with more stable demand and clearer career pathways.

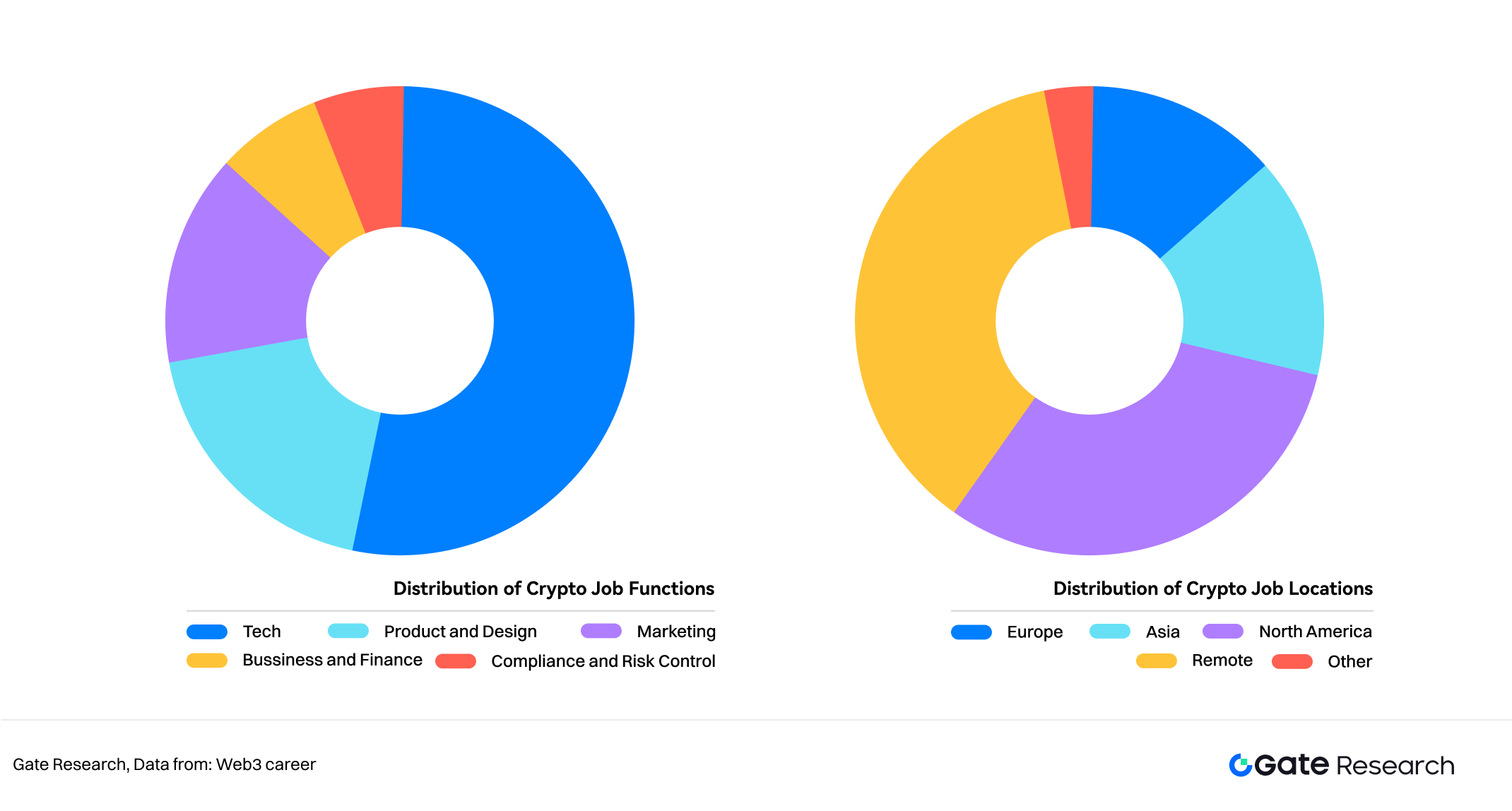

Structure of the Crypto Employment Market

According to statistics from Web3Career, the total number of crypto-related job positions worldwide in 2025 increased by 47% compared with the previous year, reaching approximately 66,000 new openings. Technical positions continue to dominate, accounting for more than 50% of the total, covering areas such as blockchain infrastructure development, smart contract engineering, security auditing, and system architecture.

At the same time, non-technical roles have grown significantly, with steady increases in positions related to product design, marketing and operations, as well as compliance and risk management. This trend indicates that the crypto industry is evolving from an early technology-intensive sector toward a model of “technology + governance + ecosystem collaboration.”

The increase in product and design positions reflects the industry’s growing emphasis on user experience and interface accessibility. Early Web3 products were largely technology-centered, whereas contemporary product teams now focus more on usability and interactive design. The expansion of operations and marketing roles stems from the rise of the community-driven economy, as projects need to maintain engagement and brand influence through content creation, events, and incentive mechanisms.

The growth of compliance and risk control positions has been particularly significant. Influenced by increasingly stringent global regulatory policies, such roles have grown by more than 35% over the past year. This indicates that the crypto industry is gradually moving toward greater institutionalization and long-term development.

Major Recruitment Sectors

4.1 Industry Segmentation Landscape

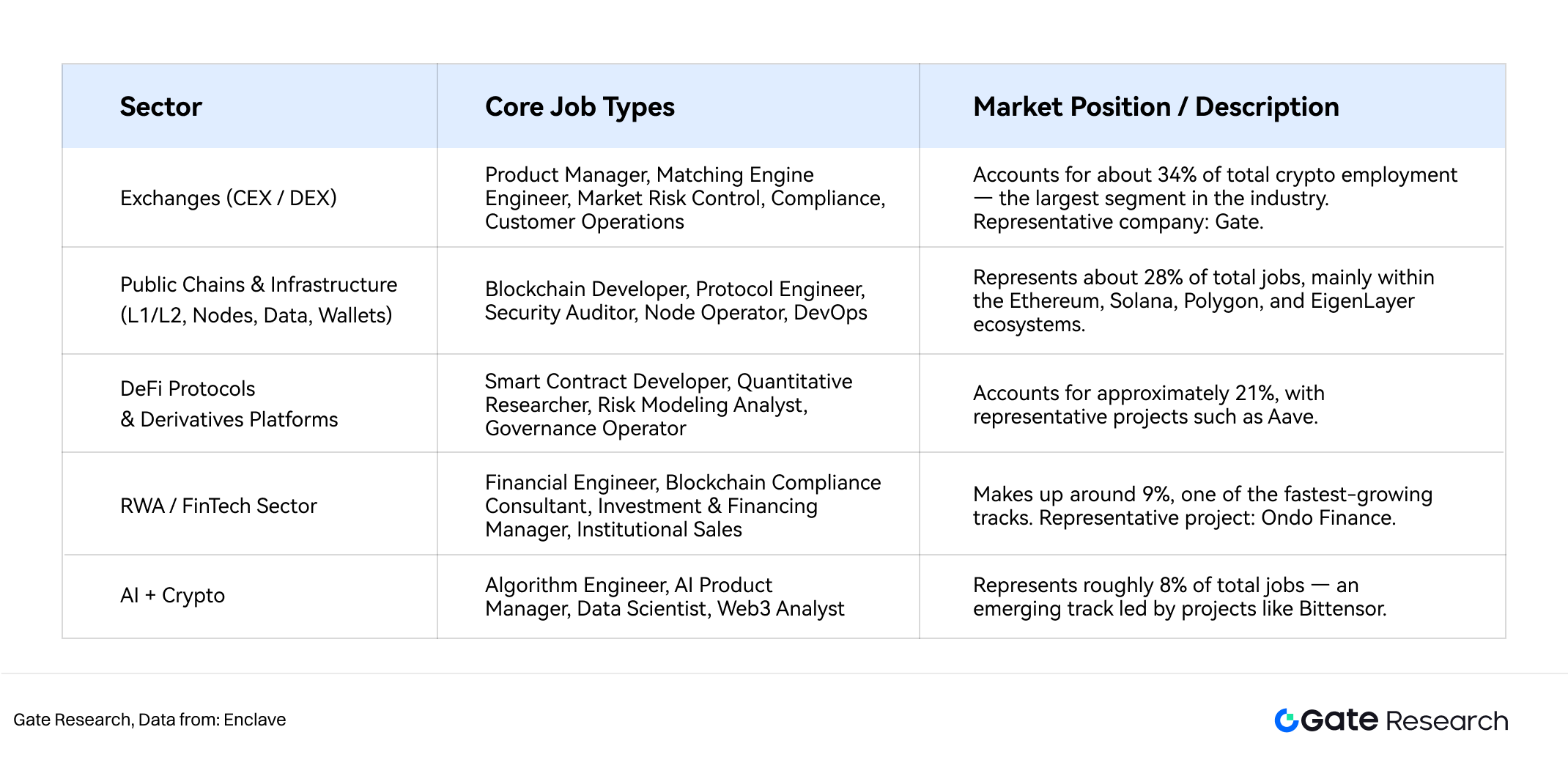

The crypto job market in 2025 exhibits a clear pattern of segmentation across different industry tracks. Cryptocurrency exchanges, public blockchain infrastructure, and DeFi protocols form the three core employment pillars of the sector, together absorbing approximately 70% of the total workforce.

According to data from Gate Research Institute (see Figure 5), exchange-related positions account for about 34%, public chains and underlying infrastructure for 28%, and DeFi protocols and derivative platforms for 21%. In addition, emerging sectors such as RWA (Real-World Asset tokenization) and AI + Crypto collectively represent around 17% of total positions, yet they are expanding at the fastest pace, demonstrating strong upward momentum.

This structure reflects the crypto industry’s transition from a “technology-centric” model to an “ecosystem-collaborative” one. In the early stages, the industry primarily focused on blockchain base-layer protocols and trading-matching systems. Today, however, the ecosystem has gradually expanded to include data infrastructure, application-layer products, and cross-chain services.

As a result, job demand has shifted from purely technical roles to cross-functional and hybrid positions. Companies are increasingly seeking multidisciplinary professionals who not only possess technical expertise but also understand finance and market dynamics—particularly in emerging sectors that combine RWA and AI.

4.2 Exchange Sector

Exchanges represent the fundamental infrastructure and liquidity core of the entire crypto industry. Centralized exchanges (CEX) such as Binance, Gate, OKX, and Coinbase, together with decentralized exchanges (DEX) such as Uniswap and dYdX, collectively form a global network for asset circulation.

The job structure within exchanges is characterized by a wide functional coverage, encompassing system development, matching engine engineering, cybersecurity, compliance operations, brand marketing, and customer support—forming highly specialized organizational teams.

According to data from Web3Career, within exchange-related positions, technical R&D roles account for approximately 42%, product and design 13%, marketing and operations 14%, business and finance 10%, compliance and risk control 12%, and customer support around 9%. This structure highlights the composite nature of exchanges as “crypto-financial institutions,” functioning not only as technology companies but also as financial service platforms.

In 2025, Southeast Asia and the Middle East have emerged as key regions for exchange expansion, with the strongest growth observed in demand for multilingual, localized operations and compliance positions.

4.3 Public Chains and Infrastructure Sector

Public chains and infrastructure form the foundational backbone of Web3 and represent the areas with the highest research and development intensity. Projects such as Ethereum, Solana, BNB Chain, Polygon, and EigenLayer focus primarily on scalability, security, and modular architecture. Job roles in this sector are mainly concentrated in protocol development, cryptographic algorithms, ZKP (Zero-Knowledge Proof) engineering, consensus mechanisms, and node operations.

According to data from Gate Research Institute, more than 55% of public chain positions belong to core R&D roles, while research and algorithm-related positions account for about 8%. The remaining positions are distributed among developer relations, ecosystem operations, and technical support.

The trend toward ecosystemization within public chains has driven the rise of developer relations (DevRel) and community ecosystem roles. With the growing maturity of Layer 2 networks and cross-chain protocols, ecosystem development has become a key competitive factor among public chains. Major blockchain ecosystems attract engineers through developer grants, hackathons, and technical education programs, leading to a surge in roles related to documentation writing, SDK support, and community technical engagement.

In addition, zero-knowledge technologies and modular blockchain design have emerged as among the highest-paying domains, with related engineers typically earning annual salaries exceeding USD 180,000.

4.4 DeFi Protocols and Derivatives

Decentralized finance (DeFi) remains the most innovative and complex area within blockchain applications. According to data from DefiLlama, as of Q2 2025, the total value locked (TVL) in global DeFi has exceeded USD 210 billion, representing a 24% year-over-year increase. Protocols such as Aave, Lido, Curve, Uniswap, and MakerDAO continue to drive innovation in liquidity and yield-generating products. Corresponding job demand is concentrated in four key areas: smart contract development, economic model design, protocol security, and market operations.

The characteristics of DeFi roles are highly interdisciplinary. Engineers are required not only to master Solidity programming and smart contract auditing, but also to understand financial risk modeling, liquidity design, and yield distribution mechanisms. Security auditing and compliance-related positions have seen particularly strong growth, with a growth rate of more than 50% from 2024 to 2025. As global regulations tighten, compliance specialists, risk-control consultants, and on-chain data analysts have become indispensable to DeFi projects. This trend reflects how DeFi is shifting from early-stage “experimental finance” toward more structured and institutionalized finance.

4.5 Real-World Assets Sector

RWA has emerged as one of the most promising growth sectors in 2025. Its core objective is to tokenize traditional assets—such as bonds, real estate, commodities, or fund shares—so that they can be issued and circulated on blockchain networks. According to joint data from Gate Research Institute and DefiLlama, the global market capitalization of RWA exceeded USD 6 billion in the first half of 2025, representing a 180% increase compared with the same period in the previous year. Major representative projects include Ondo Finance, Backed Finance, Chainlink, and Maple Finance.

The structural feature of RWA-related roles lies in the deep integration of finance and technology. Professionals with traditional finance backgrounds are entering this sector at an accelerated pace, particularly those with experience in structured products, asset management, and regulatory compliance. Technical positions are mainly focused on asset tokenization, smart contract design, and cross-chain verification, while non-technical positions emphasize financial analysis, legal compliance, and business development.

As regulatory frameworks become clearer and institutional participants continue to enter, the professionalization and standardization of the RWA sector are increasing significantly, making it a key gateway for traditional finance professionals transitioning into the crypto industry.

4.6 AI + Crypto Sector

The integration of AI and blockchain has given rise to an entirely new employment ecosystem. Projects such as Bittensor, Ritual, Fetch.ai, and 0G are driving the development of decentralized computing networks and model incentive mechanisms. According to data from Web3Career (see Figure 9), within this sector, AI/ML R&D roles account for 30%, blockchain protocol engineering for 25%, data and security engineering for 15%, product and ecosystem growth for 20%, and compliance and operations support for 10%.

The core trends in this field can be summarized as the “commoditization of computing power,” “assetization of data,” and “economization of intelligent agents.” The roles of AI engineers and blockchain developers are gradually converging, giving rise to a new professional category known as the “AI-on-chain engineer.” As decentralized allocation of large-model training resources and token-based incentive systems continue to mature, the demand for talent in this sector is expected to double within the next three years.

Salary Levels and Employee Incentives

5.1 Global Salary Overview

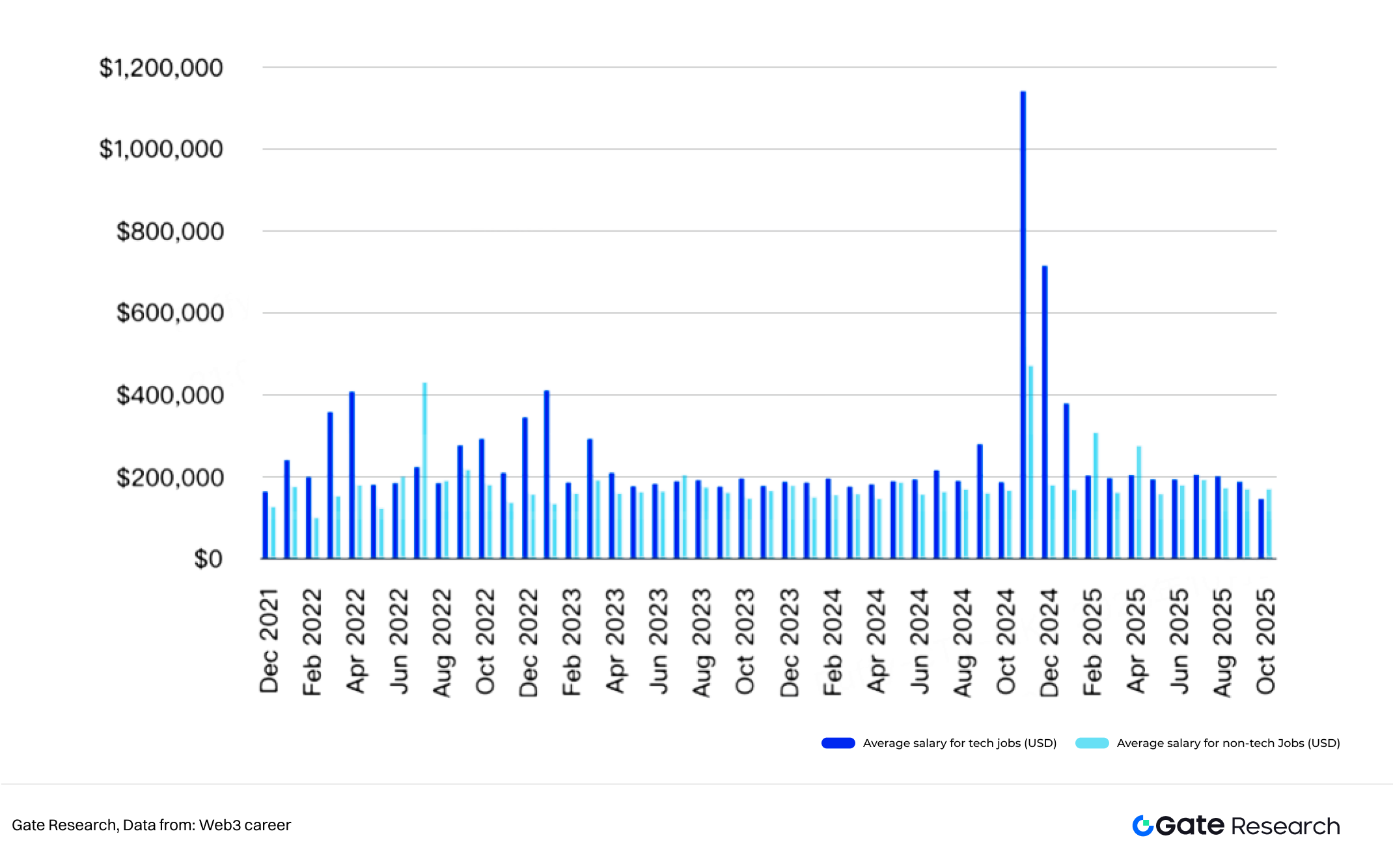

In 2025, overall salary levels in the crypto industry increased by approximately 18% compared with the previous year. Blockchain development, security auditing, and protocol engineering positions remain the core high-paying roles, with top-tier engineers now earning annual salaries exceeding USD 200,000.

According to the Gate Research Institute’s Compensation Index, the most significant salary growth was observed among engineers and compliance consultants, while marketing and operations roles maintained steady increases. The average salary for compliance and legal positions rose by 23% year-on-year, making them the highest-paying category among non-technical roles.

5.2 Regional Salary Differences

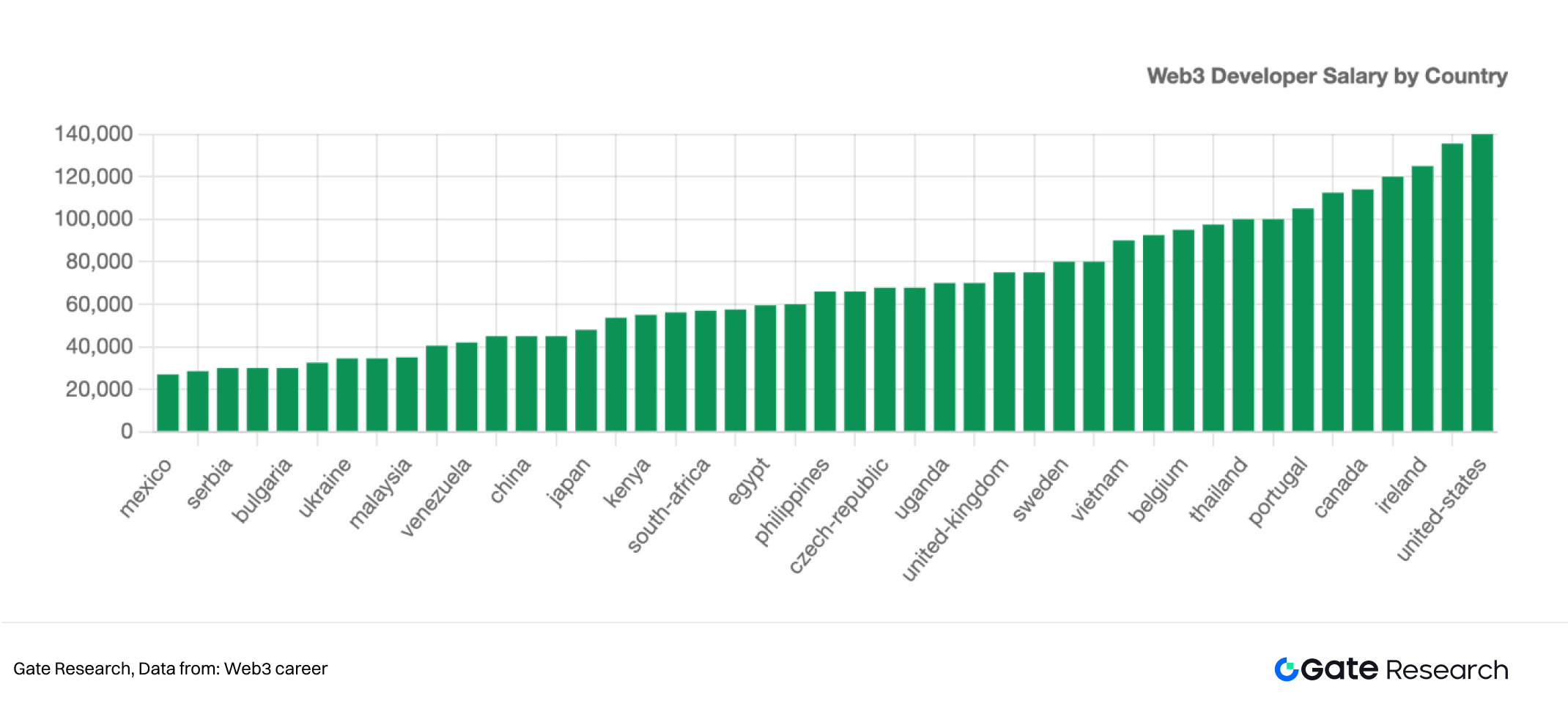

From a regional perspective, North America remains the highest-paying market globally, with average annual salaries ranging between USD 120,000 and 250,000. In Europe, research and compliance positions are highly valued, though average pay levels are approximately 15% lower than those in North America.

Asia is experiencing the fastest salary growth, with compensation levels in Singapore and Hong Kong now approaching those of Europe, while Vietnam, India, and South Korea show the most significant increase in job opportunities. Although overall salaries in Eastern Europe and Latin America are comparatively lower, these regions have recorded the highest growth rates in remote job opportunities worldwide. Overall, the crypto industry is evolving toward a multipolar global salary network.

5.3 Incentive and Organizational Mechanisms

The compensation structure of the crypto industry is characterized by a distinct “hybrid incentive” model. In addition to base salaries, token incentives have become standard in more than 70% of projects, allowing employees to gain long-term returns through project tokens. Furthermore, DAO ecosystems commonly adopt contribution-based reward mechanisms, while remote and flexible working arrangements serve as additional sources of attraction. For senior management and core developers, performance bonuses and project profit-sharing have become increasingly common, making overall incentive structures more flexible and diversified.

Compared with the traditional internet and financial sectors, salary volatility in the crypto industry is higher; however, the potential upper limit of the total compensation package is 30–50% greater. Crypto companies typically feature flat organizational hierarchies, fast decision-making processes, and strong emphasis on individual output and community contribution. Although short-term fluctuations remain pronounced, the combination of flexible remote work culture, cross-border team collaboration, and token-based incentives gives the industry a distinct advantage in attracting young, highly skilled professionals. In essence, crypto employment is redefining the value of work in the digital era through a combination of high risk, high reward, and high flexibility.

Market Supply and Talent Development

6.1 Talent Supply-Demand Imbalance

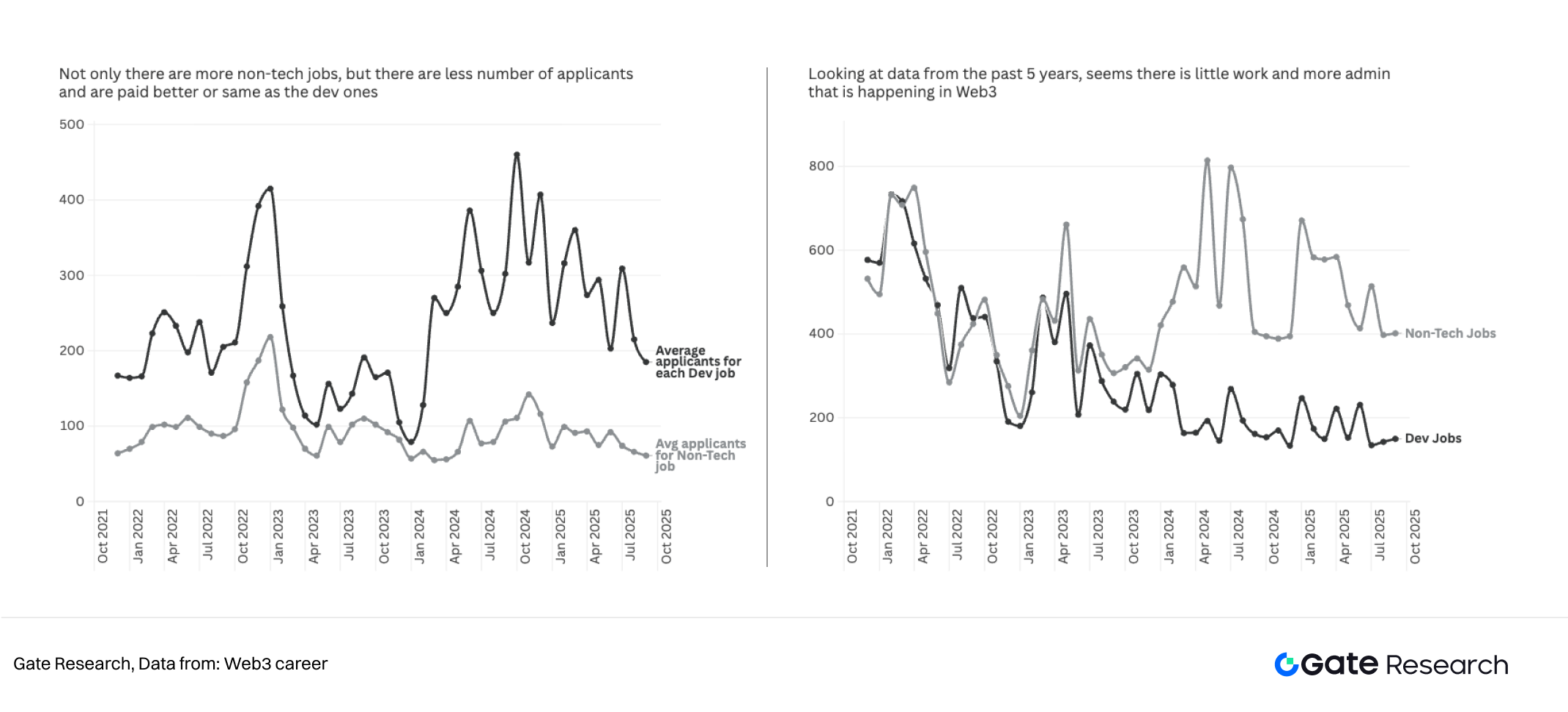

Although the number of job openings in the crypto industry has been growing rapidly, the shortage of high-level technical talent remains pronounced. According to data from Coinhub Research Institute, over the past two years, the number of non-technical positions has continued to rise, at one point in mid-2024 exceeding twice the number of development roles.

However, each non-technical position receives on average only about 80–120 applicants, far fewer than the 200–400 applicants per development role. This indicates that despite the significant increase in non-technical openings—such as marketing, product management, and community operations—high-end technical professionals remain a scarce resource, with competition among them becoming increasingly intense.

6.2 Regional Talent Distribution

North America remains the region with the highest concentration of crypto professionals, accounting for 38% of the global total. Asia has shown the fastest growth, rising from 19% in 2021 to 32% in 2025, becoming a global hub for crypto education and entrepreneurship. Europe continues to lead in research and compliance, while Latin America and Africa participate in the global market primarily through remote collaboration and DAO-based organizational models.

In particular, Latin America has witnessed a 64% year-on-year increase in the number of Web3 startups, establishing itself as one of the most important regions for remote developer talent worldwide.

6.3 Education and Training Systems

The global blockchain education system is gradually becoming more mature. By 2025, more than 250 universities have launched courses on blockchain and crypto economics, including top institutions such as the Massachusetts Institute of Technology (MIT), the University of Oxford, and Cornell University. Online learning platforms such as Gate Learn, Binance Academy, and Coursera have attracted over 4 million registered learners, contributing to the democratization of educational resources.

At the same time, major blockchain ecosystems have introduced developer scholarship and bootcamp programs—such as those from Polygon, Optimism, and LayerZero—providing ecosystem-funded initiatives to foster developer growth. This “academic + ecosystem co-education” model continues to inject fresh talent into the industry.

Future Outlook

From 2025 to 2030, the crypto employment market will shift from rapid expansion to structural transformation. The deep integration of AI and blockchain will generate new talent demands, with the AI × Crypto field emerging as a new growth driver. Hybrid engineers who are proficient in both machine learning and tokenomics will be among the most sought-after professionals. Meanwhile, the tokenization of real-world assets (RWA) is driving financialization across the industry, creating substantial demand for roles in financial engineering, compliance, and legal services. Regions such as Singapore, Hong Kong, and Switzerland will continue to serve as global hubs for compliance and institutionalization.

In the public chain and infrastructure sectors, competition will increasingly focus on security and usability. Positions related to security auditing, zero-knowledge (ZK) engineering, platform development, and DevRel will continue to expand. Exchanges and brokerage services are trending toward compliance and localization, fueling higher demand for regional compliance and risk management talent. Overall, the employment structure will evolve from a “technology-centered” model to a multi-pillar framework of “technology + compliance + operations,” with remote and decentralized organizations becoming mainstream work formats.

In terms of compensation, while market volatility will gradually ease, total compensation packages will remain highly competitive, with a growing share of long-term value coming from tokens and performance-based incentives. On-chain credentials and verifiable work histories are expected to gradually replace traditional résumés, shifting talent evaluation toward measurable, on-chain contributions.

North America will continue to lead in high salaries, Asia will maintain strong growth momentum, Europe will advance steadily in compliance and research, while Latin America and Eastern Europe will continue expanding through their strength in remote engineering.

Overall, the crypto industry is entering a new cycle characterized by rational growth, interdisciplinary capability, and global collaboration. The evolution of talent structures will become the most decisive variable shaping this new phase of the industry.

Refrence

- Coingecko, https://www.coingecko.com/charts

- Weforum, https://www.weforum.org/publications/the-future-of-jobs-report-2025/digest/

- Tradingview, https://www.tradingview.com/news/coinpedia:f8b90af45094b:0-global-crypto-adoption-report-2025/

- Demandsage, https://www.demandsage.com/crypto-adoption-statistics/

- Weforum, https://reports.weforum.org/docs/WEF_Future_of_Jobs_Report_2025.pdf

- Coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

- Coingecko, https://www.coingecko.com/en/categories/real-world-assets-rwa

- Web3career, https://web3.career/web3-companies/aave

- Defillama, https://defillama.com/

- Web3career, https://web3.career/web3-salaries

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review