- Trending TopicsView More

692 Popularity

4.7M Popularity

119K Popularity

77.4K Popularity

164.6K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

[Forex] Possibility of the U.S. Administration Inducing a Second Act of Yen Appreciation | Yoshida Tsune's Forex Daily | Moneyクリ MoneyX Securities' Investment Information and Money-Useful Media

###The yen appreciation that occurred after the Bessent-Ueda talks in early February

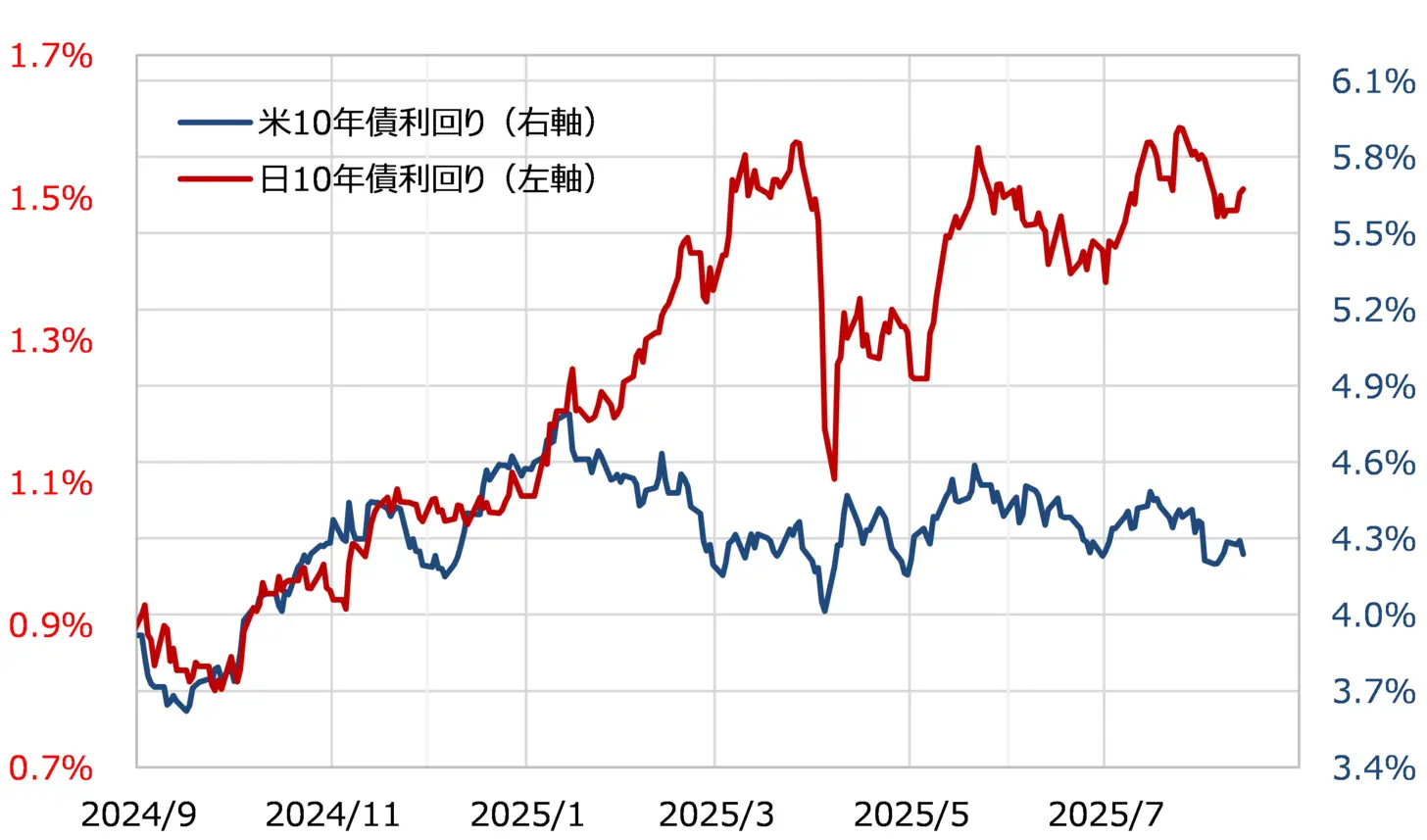

U.S. Treasury Secretary Yellen revealed in an interview on August 13 that she recently spoke with Bank of Japan Governor Ueda. This is the second time that discussions with Governor Ueda have come to light since Yellen took office as Treasury Secretary. The previous discussion took place in early February, but since then, there has been an "unnatural rise in Japanese interest rates" that has deviated significantly from U.S. interest rates (see Chart 1).

[Figure 1] Japan-U.S. 10-Year Bond Yields (From September 2024) Source: Created by Monex Securities from Refinitiv data

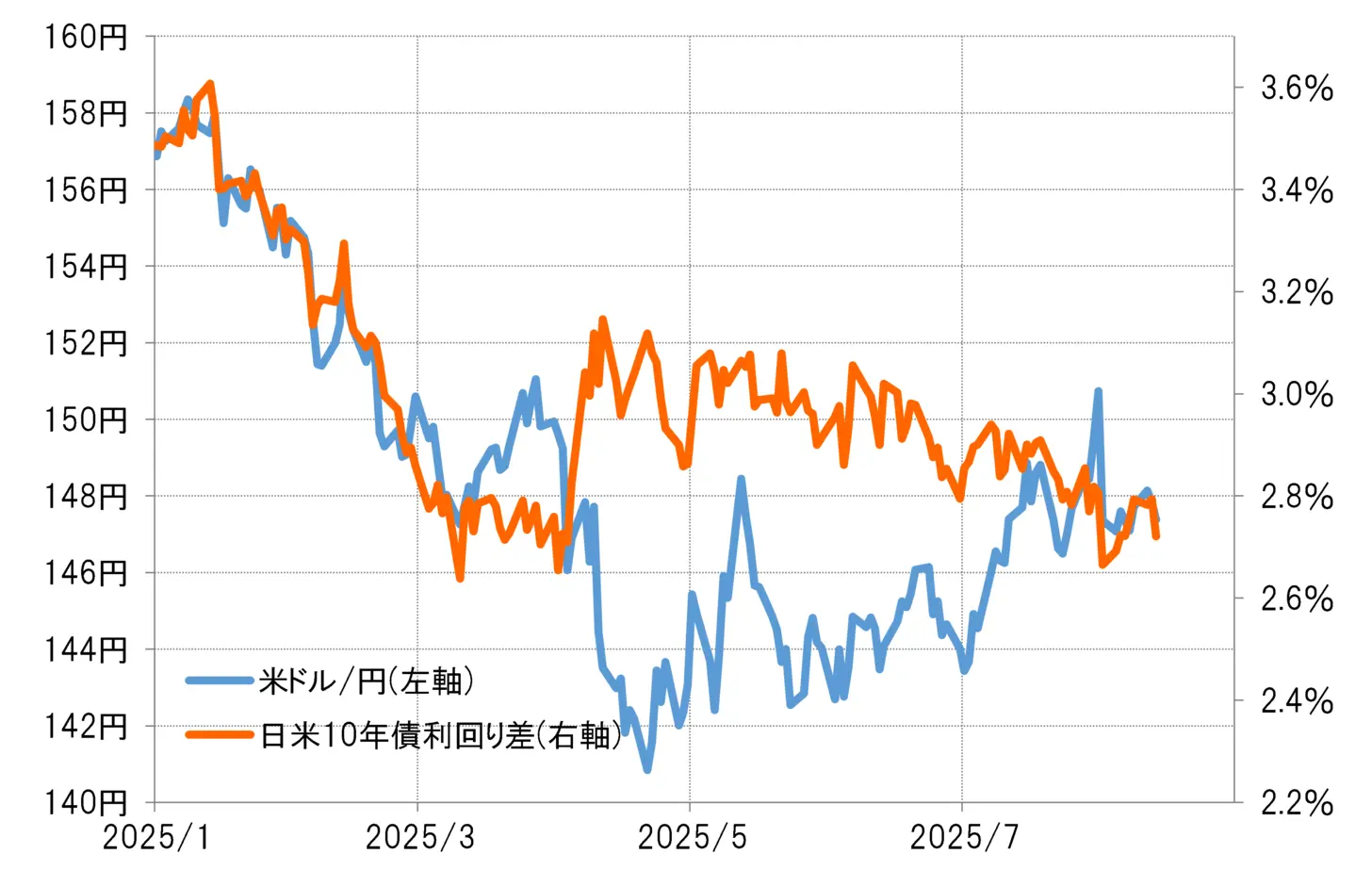

In response to the "unnatural rise in Japanese interest rates," the interest rate differential between Japan and the United States has narrowed, and accordingly, the USD/JPY fell below 150 yen by March, leading to a significant decline in the value of the US dollar against the yen (see Chart 2).

Source: Created by Monex Securities from Refinitiv data

In response to the "unnatural rise in Japanese interest rates," the interest rate differential between Japan and the United States has narrowed, and accordingly, the USD/JPY fell below 150 yen by March, leading to a significant decline in the value of the US dollar against the yen (see Chart 2).

[Figure 2] USD/JPY and the US-Japan 10-Year Bond Yield Spread (From January 2025) Source: Created by Monex Securities from Refinitiv data.

From the above, it can be considered that at the Bessent-Ueda meeting held in early February, Secretary Bessent requested Governor Ueda to review the low interest rates, and that the "true purpose" may have been to correct the depreciation of the yen through the narrowing of the interest rate differential between Japan and the United States. Now, as far as is currently known, could this second Bessent-Ueda meeting once again aim to correct the depreciation of the yen and induce yen appreciation?

Source: Created by Monex Securities from Refinitiv data.

From the above, it can be considered that at the Bessent-Ueda meeting held in early February, Secretary Bessent requested Governor Ueda to review the low interest rates, and that the "true purpose" may have been to correct the depreciation of the yen through the narrowing of the interest rate differential between Japan and the United States. Now, as far as is currently known, could this second Bessent-Ueda meeting once again aim to correct the depreciation of the yen and induce yen appreciation?

###Reference to the Unprecedented Bank of Japan Policy and the Underlying Discontent with Yen Depreciation

It is unusual for the U.S. Treasury Secretary to have a direct "meeting" with the Governor of the Bank of Japan and refer to Japan's monetary policy. If this were to occur exceptionally, it would likely be because the U.S. has concerns regarding the impact of Japan's monetary policy. A prime example of this is dissatisfaction with exchange rates due to interest rate differentials. If that is the case, it is understandable for the Treasury Secretary, who is responsible for currency policy, to comment on Japan's monetary policy.

Looking at the first Bessent-Ueda talks held in early February, and the subsequent movements of the US-Japan interest rate differential and exchange rates, it can be considered that the "true purpose" of the talks was to induce a stronger yen. However, after entering April, following President Trump's announcement of reciprocal tariffs, a global stock market crash known as the "tariff shock" occurred, leading to concerns about "selling off the US" spreading at one point. In such a situation, forcibly inducing a stronger yen could rather lead to a crisis for the US dollar, which might have resulted in it being temporarily "sealed off."

However, in recent times, both Japan and the United States have seen a rapid recovery in stock prices. The risk of a "U.S. dollar crisis" associated with "selling the U.S. dollar" seems to have receded. Given this background, it appears that Secretary Bessent has begun to move towards resuming the guidance for a stronger yen.

###Will the significant interest rate differential that caused the prolonged depreciation of the yen finally come to an end?

In a recent interview, Secretary Bessent expressed the view that "as Japan's interest rates rise through the Bank of Japan's monetary policy, the yen's depreciation will naturally be corrected." In other words, the fundamental idea of Secretary Bessent seems to be that the prolonged depreciation of the yen is primarily due to the significant interest rate differential.

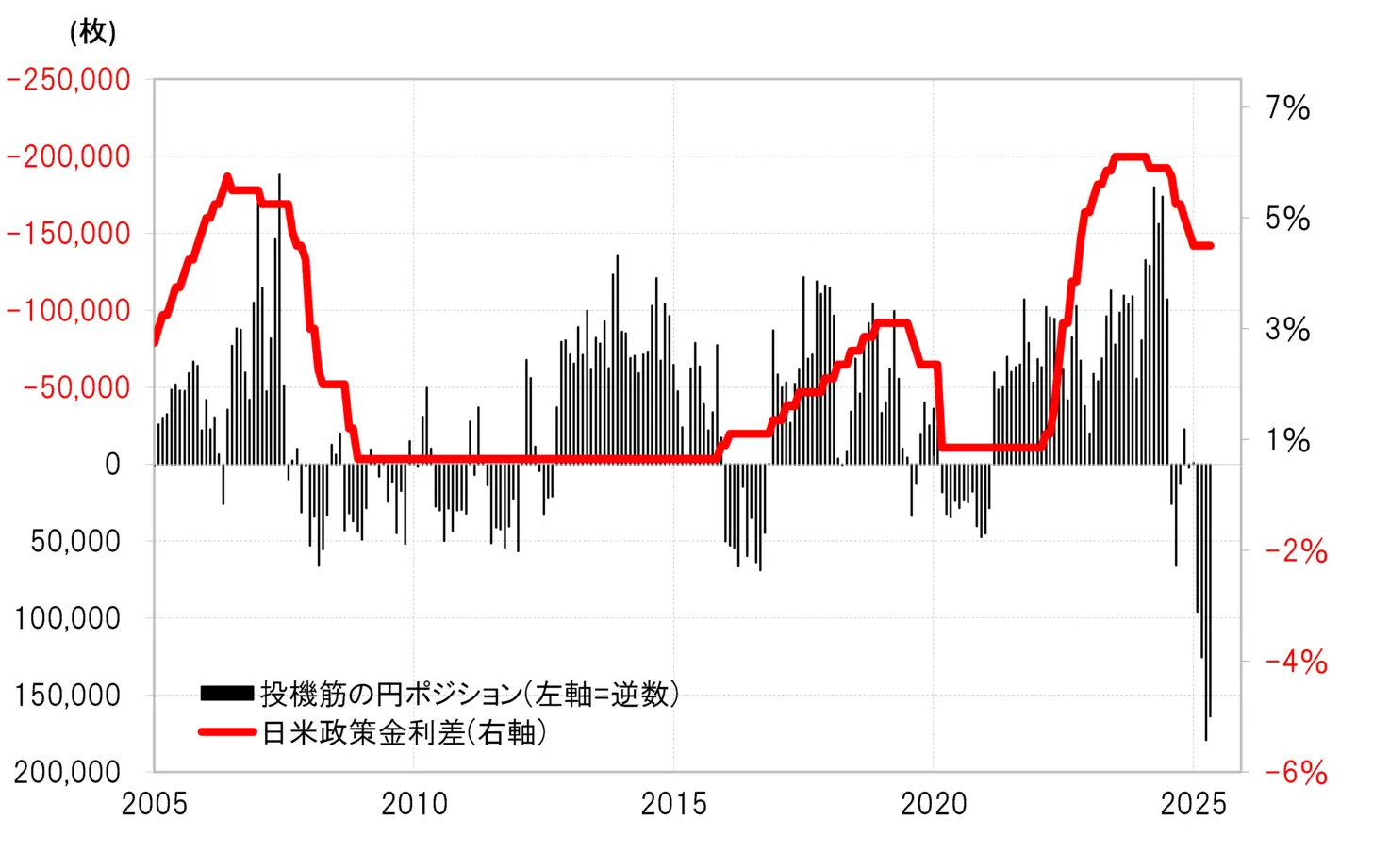

The interest rate differential disadvantage of the yen is expected to significantly narrow in the future. Secretary Bessent has indicated that the U.S. policy interest rate, the FF rate, is projected to decline from the current 4.5% (upper limit of the target) to below 3%. On the other hand, if Japan's policy interest rate rises to 1%, the interest rate differential between Japan and the U.S. is expected to narrow to below 2%, which was the level before the FRB (Federal Reserve Board) began to raise rates in earnest in 2022 as part of its inflation measures (see Chart 3).

[Figure 3] CFTC statistics on speculative positions in yen and the interest rate differential between Japan and the United States (2005 onwards) Source: Created by Monex Securities from Refinitiv data.

The significant interest rate differential has overwhelmingly favored yen selling. The structure that has continued since 2022 is finally expected to change. This is directly related to the theme of correcting the excessive depreciation of the yen, which promotes the trade imbalance of the United States and is connected to the assessment of the Secretary of the Treasury during the Trump administration.

Source: Created by Monex Securities from Refinitiv data.

The significant interest rate differential has overwhelmingly favored yen selling. The structure that has continued since 2022 is finally expected to change. This is directly related to the theme of correcting the excessive depreciation of the yen, which promotes the trade imbalance of the United States and is connected to the assessment of the Secretary of the Treasury during the Trump administration.