- Trending TopicsView More

1.7K Popularity

4.7M Popularity

119.5K Popularity

77.5K Popularity

162.8K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Hyperhidrosis solutions: Effective ways to reduce hand sweating.

###Pay attention to ETH! Tonight, $4500 is the "line between life and death": $1.395 billion in short positions is at risk, who will give in first in the battle between longs and shorts?

The market continues to have a gripping development ETH. If the line of 4500 Dollars is突破, there is a possibility that 1.395 billion Dollars worth of short positions will be liquidated. If the market changes rapidly, funds could double in minutes or the account balance could drop to zero. Let’s explain this tense situation in an easy-to-understand manner. ETH Price Analysis: The Importance of the 4500 Dollar Line and Liquidation Risks

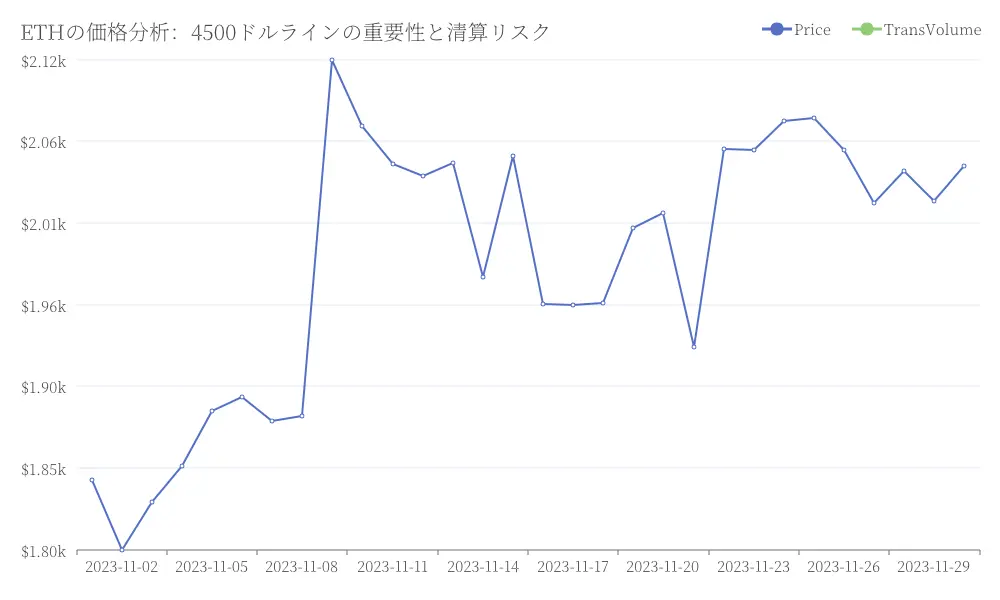

ETH Price Analysis: The Importance of the 4500 Dollar Line and Liquidation Risks

###1.395 billion Dollar short positions liquidation is a nightmare of "5-10 Dollar drop per second"

Don't be fooled by the figure of 1.395 billion Dollars. These short positions are concentrated around the 4480-4500 Dollar range, with 80% being from short-term traders using 5-10x leverage.

Last November, when ETH approached 2200 Dollar, it surged by 300 points due to the liquidation of 850 million Dollar short positions. This time, the scale is 60% larger. If it breaks through 4500 Dollar, there is a possibility that the price could rise by 5-10 Dollar per second. Analysis of ETH price fluctuations and the impact of cleared positions

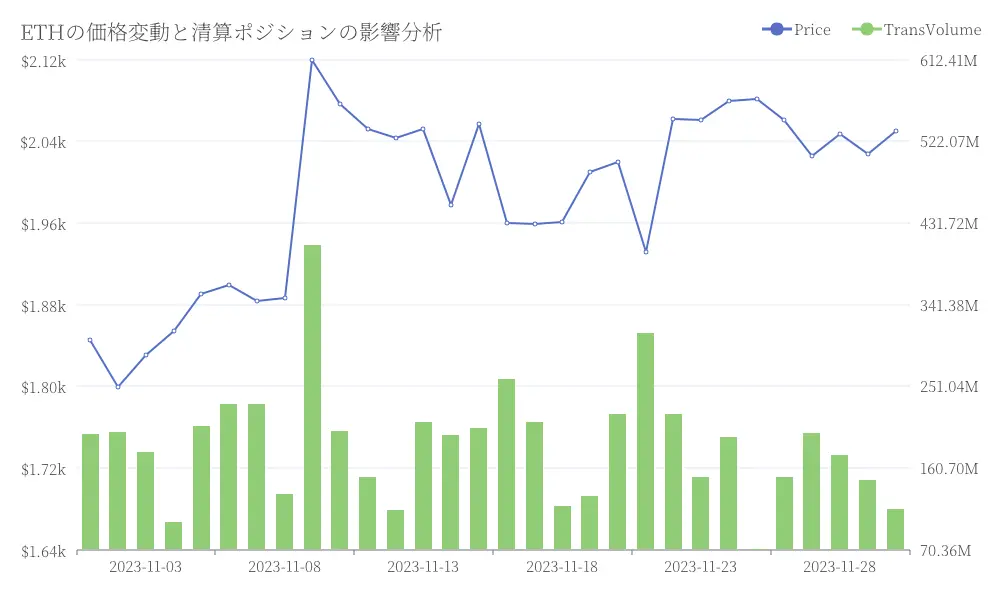

Analysis of ETH price fluctuations and the impact of cleared positions

| Time | Price | |------|------| | 1 second ago | 4500 Dollar | | Current | 4520 Dollar | | 1 second later | 4540 Dollar |

The funds of investors who are taking a short position with 10x leverage will rapidly decrease as if they are being sucked away.

###7.12 billion Dollar longs below 4300: "I thought it was support but it was a trap" A gathering of scattered investors

Furthermore, the troublesome part is that there are 712 million dollars in long positions buried below 4300 dollars. These are from individual investors aiming for the "bottom price".

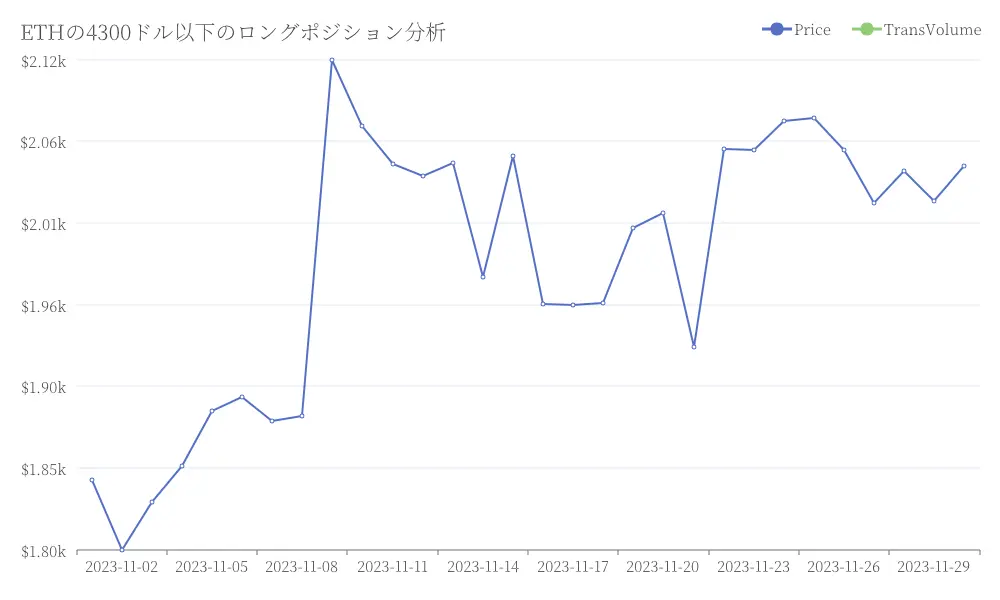

The issue with these longs positions is that they are concentrated around 4320-4350 Dollar, with the stop-loss line set below 4300 Dollar. If it falls below 4300 Dollar, it may lead to a chain liquidation like a domino effect. Analysis of longs positions below 4300 Dollar for ETH

Analysis of longs positions below 4300 Dollar for ETH

###The "Cipher that Determines Life and Death" Hidden in the Liquidation Chart: The $4500 Wave is Twice as Powerful as the $4300

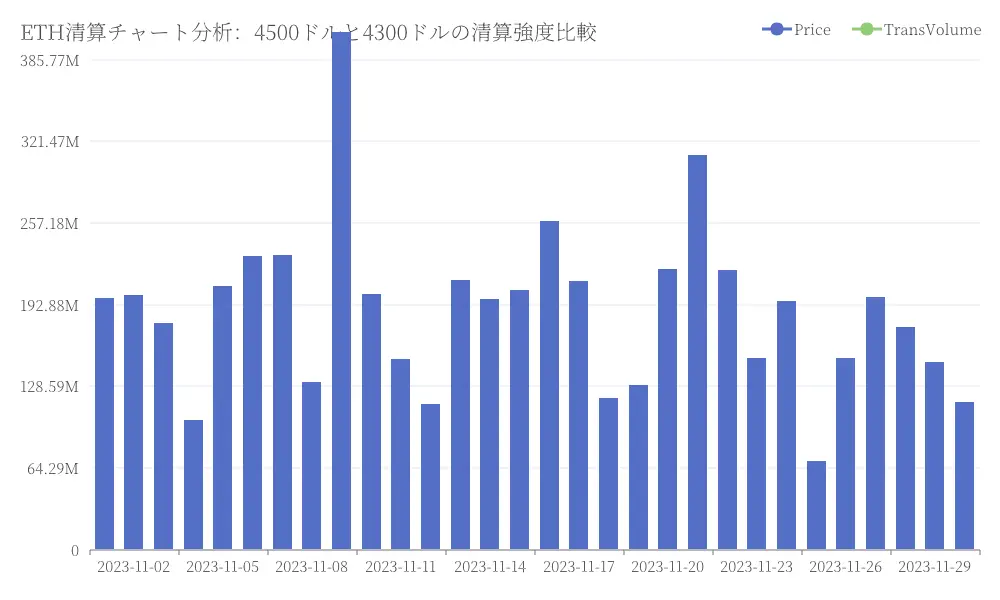

When looking at the liquidation chart, it is important to pay attention to the "liquidation intensity." Currently, the pillar of liquidation at 4500 Dollars is about twice the height of that at 4300 Dollars. This suggests that the price fluctuation upon breaking through 4500 Dollars could be twice that of breaking through 4300 Dollars. ETH liquidation chart analysis: comparison of liquidation intensity at 4500 Dollar and 4300 Dollar

ETH liquidation chart analysis: comparison of liquidation intensity at 4500 Dollar and 4300 Dollar

| Price Range | Expected Price Fluctuation | |--------|------------| | When surpassing 4500 Dollar | 50-80 Dollar/min | | When surpassing 4300 Dollar | 30-50 Dollar/min |

###Institutional investors are already on the move! Buying $87 million at $4,350 and waiting for a breakthrough at $4,500.

There is information that a large institutional investor purchased 20,000 ETH (approximately 87 million Dollars) at 4,350 Dollars yesterday. These large funds are not aiming for a sideways market, but are waiting for the "moment of ignition" to break through 4,500 Dollars.

Looking at the current market, ETH is fluctuating between 4380-4420 Dollar, and the MACD histogram is gradually expanding. The CVD (Cumulative Volume Delta) for spot trading also shows a positive sign, indicating that the influx of real demand capital continues.

###Survival Strategy for Individual Investors: Establish Accurate "Order Position" and Avoid Reckless Bets

In tonight's market, it is important to "act at calculated positions" rather than "betting on highs and lows." The most practical strategy is to avoid chasing long positions above 4450 Dollar and wait for a correction to 4400-4420 Dollar. Set the stop-loss line at 4380 Dollar, and withdraw immediately if it falls below that. The first profit target is 4480 Dollar, and if it breaks through 4500 Dollar, let's aim for 4550-4600 Dollar.

On the other hand, when taking a short position, it is wise to take a small position after confirming three failed breakthroughs in the range of 4480-4500 Dollars. It is important to set the stop-loss line at 4510 Dollars and not to concede even a slight difference of 10 Dollars. The first target for profit taking should be 4420 Dollars, and after breaking through 4400 Dollars, let's aim for 4350 Dollars.

The most important thing is to avoid full positions and not to use high leverage. The market tonight is just a few days away from the non-farm payroll report, and the price fluctuations of ETH may be nearly twice as much as usual. Using leverage of more than 5 times could lead to either doubling your funds or losing it all.