- Trending TopicsView More

1.9K Popularity

4.7M Popularity

119.6K Popularity

78.6K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Innovative Crypto Platform for Seamless Transactions

###Technical Patterns Signal Ethereum's Potential Surge

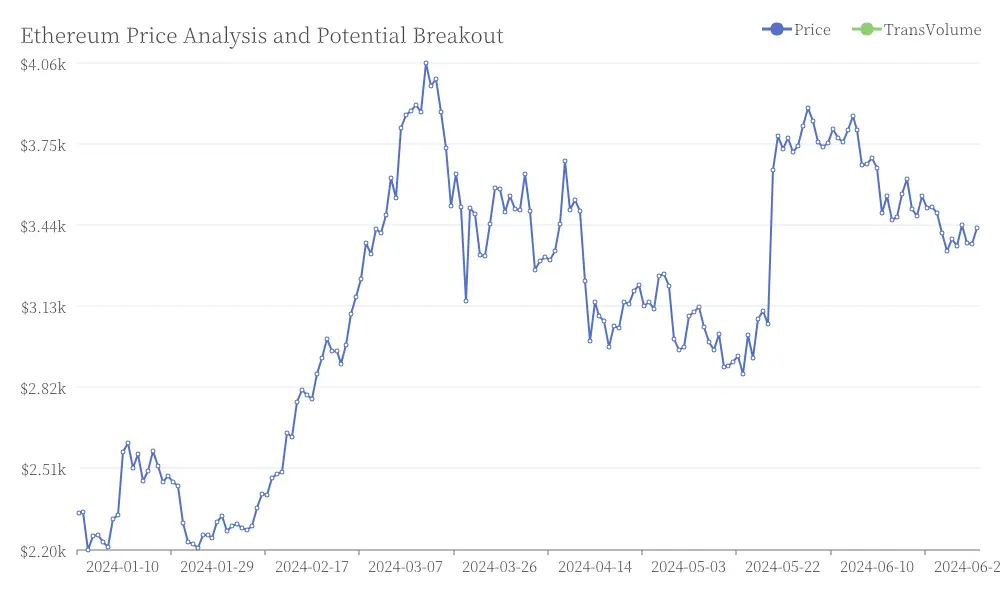

Ethereum (ETH) appears poised for a significant breakout, according to various technical analyses. A multi-year consolidation pattern, resembling a bullish flag, suggests a potential upward movement towards the $8,000 range. Additionally, a descending channel breakout scenario indicates a possible resurgence of upward momentum, with targets around $2,700. Ethereum Price Analysis and Potential Breakout

Ethereum Price Analysis and Potential Breakout

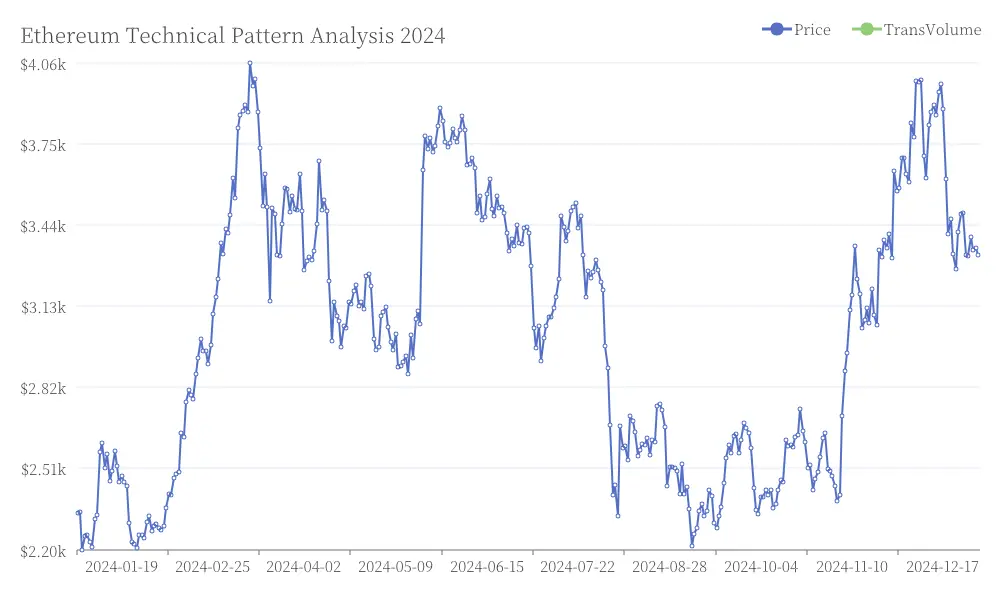

The current market structure bears a striking resemblance to the pattern that preceded ETH's rally above $4,000 in 2024. Furthermore, a cup and handle formation on the monthly chart presents a classic technical setup, hinting at a potential surge towards $6,675. Ethereum Technical Pattern Analysis 2024

Ethereum Technical Pattern Analysis 2024

###Market Dynamics Fuel Optimism

The cryptocurrency market has witnessed a significant uptick in activity and demand for Ethereum. Futures open interest for ETH has doubled since June, surpassing levels seen when ETH traded near $4,000. This surge highlights increased speculative interest in the asset. Ethereum Futures Open Interest Growth

Ethereum Futures Open Interest Growth

Large-scale accumulation by significant players has also been observed, with reports indicating substantial buying activity. One particularly noteworthy metric is the addition of 256,000 new Ethereum addresses in a single day, mirroring patterns observed before major price surges in 2017 and 2021.

###Institutional Interest and Market Sentiment

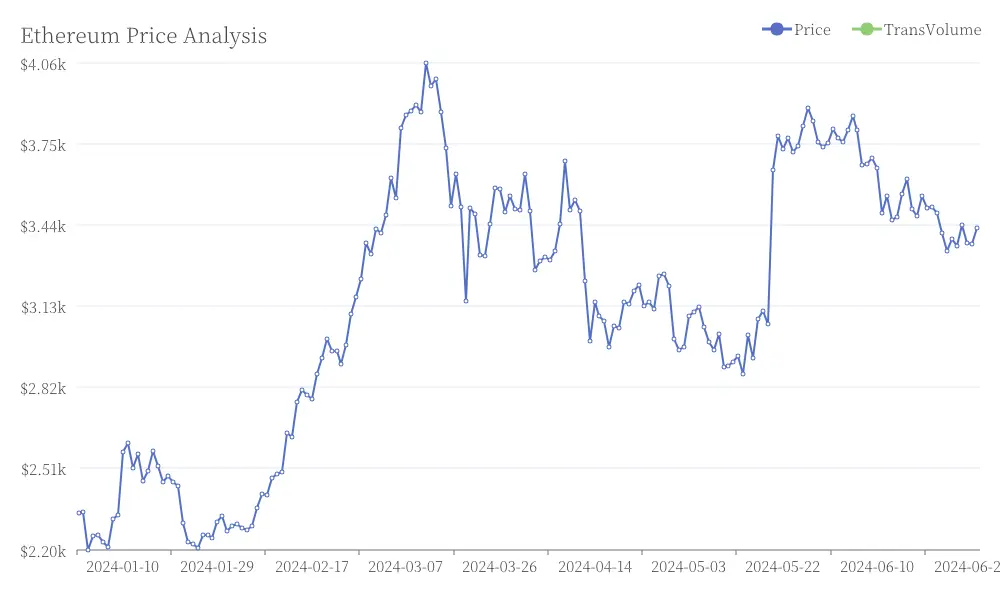

Ethereum recently reclaimed the $3,800 level, using it as a foundation for mounting upward pressure. Breaking the $4,000 mark is widely viewed as a critical near-term catalyst that could propel ETH towards new all-time highs. Ethereum Price Analysis

Ethereum Price Analysis

Institutional involvement in Ethereum has been on the rise. A prominent financial firm added over $5.26 billion in ETH to its holdings, underscoring growing confidence in the asset. Moreover, Ethereum now captures approximately 51% of the stablecoin market, highlighting its deep integration into cryptocurrency infrastructure.

###Factors Supporting Ethereum's Potential Explosion

Several key factors are converging to support Ethereum's potential price explosion. On the technical side, bullish flag formations, descending channel breakouts, and cup and handle patterns all suggest significant upward momentum. Market dynamics show surging futures interest, substantial whale accumulation, and explosive growth in new addresses. Meanwhile, institutional support continues to strengthen through increased holdings, growing stablecoin market share, and deeper integration into mainstream financial products. This powerful combination of technical indicators, market activity, and institutional backing creates a compelling case for ETH's imminent surge.