Post content & earn content mining yield

placeholder

GateUser-b16e4a51

Gate Annual Report is out! Let's take a look at my yearly performance.

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VLQVVGGLBG&ref_type=126&shareUid=VVNCXFlaAQsO0O0O.

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VLQVVGGLBG&ref_type=126&shareUid=VVNCXFlaAQsO0O0O.

- Reward

- like

- Comment

- Repost

- Share

Frictionless is the new standard. 🕊️River abstracts the chaos of multi-chain liquidity into a seamless experience on @SuiNetwork.Why stay knotted when you can flow? 🌊#RiverOnSui @RiverdotInc @SuiNetwork

- Reward

- like

- Comment

- Repost

- Share

CRYPTO ANALYSIS 712!!!

- Reward

- like

- Comment

- Repost

- Share

芝麻开门

芝麻开门

Created By@AYuA

Subscription Progress

0.00%

MC:

$0

Create My Token

#FedRateDecisionApproaches

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

BOND-4,54%

- Reward

- 2

- 3

- Repost

- Share

EagleEye :

:

thanks for sharing thisn informationView More

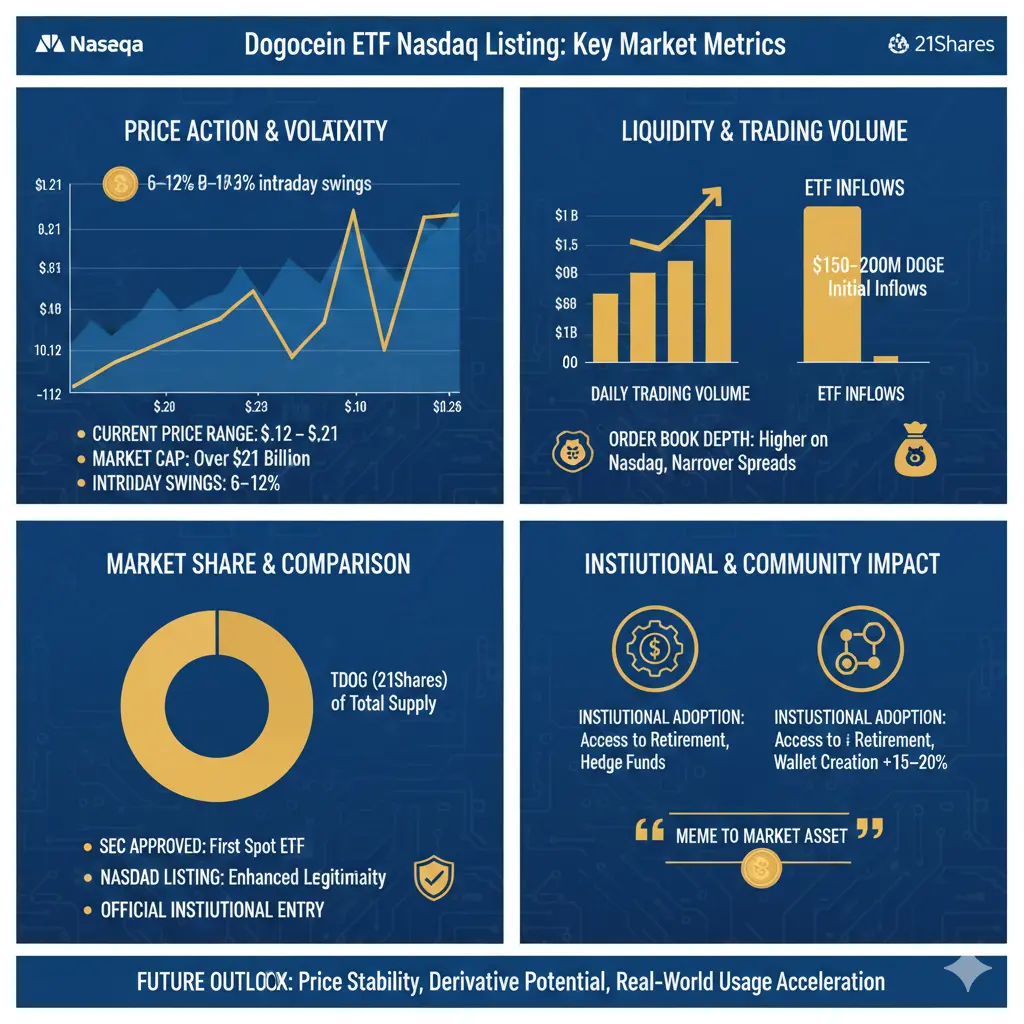

#DOGEETFListsonNasdaq

The Nasdaq listing of the 21Shares Dogecoin ETF (TDOG) marks a watershed moment for Dogecoin (DOGE), transitioning it from a community-driven meme coin into an institutional-grade asset. This development not only highlights Dogecoin’s mainstream adoption but also offers detailed insights into market behavior, liquidity, and trading dynamics post-launch.

TDOG Launch Overview

ETF Type: Spot ETF holding DOGE 1:1 (no derivatives)

Ticker: TDOG

Exchange: Nasdaq

Management Fee: 0.50% daily accrual, payable in DOGE weekly

SEC Status: First fully approved spot Dogecoin ETF, not c

The Nasdaq listing of the 21Shares Dogecoin ETF (TDOG) marks a watershed moment for Dogecoin (DOGE), transitioning it from a community-driven meme coin into an institutional-grade asset. This development not only highlights Dogecoin’s mainstream adoption but also offers detailed insights into market behavior, liquidity, and trading dynamics post-launch.

TDOG Launch Overview

ETF Type: Spot ETF holding DOGE 1:1 (no derivatives)

Ticker: TDOG

Exchange: Nasdaq

Management Fee: 0.50% daily accrual, payable in DOGE weekly

SEC Status: First fully approved spot Dogecoin ETF, not c

DOGE3,34%

- Reward

- 2

- Comment

- Repost

- Share

You have to stay long to make it for that day

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

BTC, ETH SOL, Alt coin LIVE Analysis – Smart Trade Setup

- Reward

- like

- Comment

- Repost

- Share

#VanEckLaunchesAVAXSpotETF

The launch of VanEck’s AVAX Spot ETF represents a major milestone for the Avalanche ecosystem and the broader crypto market. This development signals growing institutional confidence in Layer-1 blockchain assets and highlights the increasing convergence between traditional finance and digital assets.

Below is a detailed, point-by-point breakdown of why this launch matters and its potential market impact.

1️⃣ Institutional Recognition for Avalanche

A spot ETF from a major asset manager like VanEck reflects institutional validation of Avalanche. It confirms that AVAX

The launch of VanEck’s AVAX Spot ETF represents a major milestone for the Avalanche ecosystem and the broader crypto market. This development signals growing institutional confidence in Layer-1 blockchain assets and highlights the increasing convergence between traditional finance and digital assets.

Below is a detailed, point-by-point breakdown of why this launch matters and its potential market impact.

1️⃣ Institutional Recognition for Avalanche

A spot ETF from a major asset manager like VanEck reflects institutional validation of Avalanche. It confirms that AVAX

- Reward

- 1

- 1

- Repost

- Share

EagleEye :

:

thanks for sharing thisn information#金价突破5200美元

The Golden Renaissance: Why $5,200 is Just the Beginning of a New Monetary Era

The global financial landscape is undergoing a profound transformation. As of January 28, 2026, gold has defied conventional market expectations by surging to an unprecedented $5,266 per ounce. This isn't merely a bull run; it is the manifestation of a fundamental realignment in how the world perceives value and security.

A Paradigm Shift in Currency Trust

The primary engine behind this rally is the eroding dominance of the U.S. Dollar. Recent policy signals from the Trump administration, prioritizing a

The Golden Renaissance: Why $5,200 is Just the Beginning of a New Monetary Era

The global financial landscape is undergoing a profound transformation. As of January 28, 2026, gold has defied conventional market expectations by surging to an unprecedented $5,266 per ounce. This isn't merely a bull run; it is the manifestation of a fundamental realignment in how the world perceives value and security.

A Paradigm Shift in Currency Trust

The primary engine behind this rally is the eroding dominance of the U.S. Dollar. Recent policy signals from the Trump administration, prioritizing a

- Reward

- 5

- 9

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

As of January 28, 2026, spot gold is trading in the range of $5,200 to $5,311 per ounce, marking fresh all-time highs. The surge reflects a mix of currency instability and growing geopolitical uncertainty, both of which are driving investors toward safe-haven assets.

What’s Driving the Rally?

Several powerful forces are pushing gold higher:

1. The Dollar Problem

The US dollar has slipped to its weakest level in nearly four years. A key reason is a shift in White House policy that appears comfortable with a weaker dollar to support US exports. Since gold is priced in dollars, a falling greenbac

What’s Driving the Rally?

Several powerful forces are pushing gold higher:

1. The Dollar Problem

The US dollar has slipped to its weakest level in nearly four years. A key reason is a shift in White House policy that appears comfortable with a weaker dollar to support US exports. Since gold is priced in dollars, a falling greenbac

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 TODAY: FOMC decision at 2:00 PM ET, followed by Powell's press conference at 2:30 PM ET.

Will the crypto market pump or dump?

Will the crypto market pump or dump?

- Reward

- like

- Comment

- Repost

- Share

金龙马

JLM

Created By@RichList

Listing Progress

0.00%

MC:

$3.45K

Create My Token

- Reward

- like

- Comment

- Repost

- Share

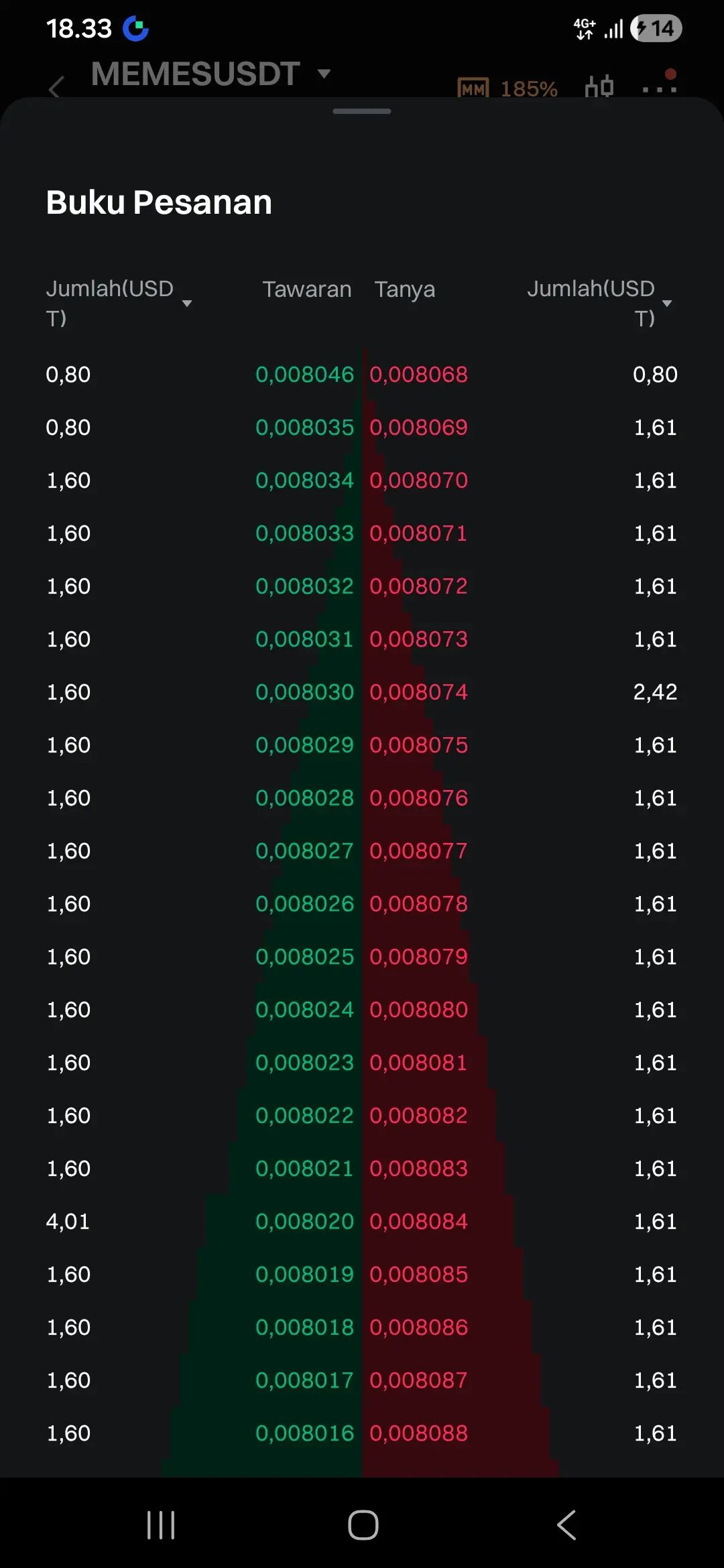

Trading often involves dealing with trapped orders, which is a common challenge. Market fluctuations are rapid, and only by adopting the correct methods can you maintain control. Here are the core strategies for handling trapped orders:

1. Take different measures based on the loss magnitude

· Shallow trap (small loss): Exit promptly during rebounds, or reduce positions at high points to control risk.

· Deep trap (large loss): Close positions in batches, preserve capital, and avoid emotional over-leverage.

2. Choose the appropriate unwinding method based on price levels

· Trapped at high levels

View Original1. Take different measures based on the loss magnitude

· Shallow trap (small loss): Exit promptly during rebounds, or reduce positions at high points to control risk.

· Deep trap (large loss): Close positions in batches, preserve capital, and avoid emotional over-leverage.

2. Choose the appropriate unwinding method based on price levels

· Trapped at high levels

- Reward

- like

- Comment

- Repost

- Share

#GoldBreaksAbove$5,200 🏆✨

Gold Rewrites History as Safe-Haven Demand Explodes

Gold has officially shattered all expectations by surging above $5,200 per ounce, marking a historic milestone in global financial markets. This breakout is not just another price rally it represents a deep shift in investor psychology, macroeconomic realities, and the future of money itself. As uncertainty grips the global economy, gold has once again proven why it remains the ultimate store of value.

The primary driver behind this explosive move is growing global instability. Persistent geopolitical tensions, expa

Gold Rewrites History as Safe-Haven Demand Explodes

Gold has officially shattered all expectations by surging above $5,200 per ounce, marking a historic milestone in global financial markets. This breakout is not just another price rally it represents a deep shift in investor psychology, macroeconomic realities, and the future of money itself. As uncertainty grips the global economy, gold has once again proven why it remains the ultimate store of value.

The primary driver behind this explosive move is growing global instability. Persistent geopolitical tensions, expa

- Reward

- 5

- 8

- Repost

- Share

MissCrypto :

:

DYOR 🤓View More

Bridgewater founder Ray Dalio reveals that currency devaluation makes all assets appear to be rising. During times of currency instability, the best asset class is "gold." Tether CEO, the leading stablecoin, stated that in the post-dollar era, we will become the "gold central bank," and confirmed that the company is currently purchasing 1 to 2 tons of gold weekly, with a total holding of 140 tons. Tether is also acquiring Canadian precious metals and mining rights companies. Why doesn't Tether buy $BTC?

BTC2,26%

- Reward

- like

- Comment

- Repost

- Share

#FedRateDecisionApproaches

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

- Reward

- 1

- Comment

- Repost

- Share

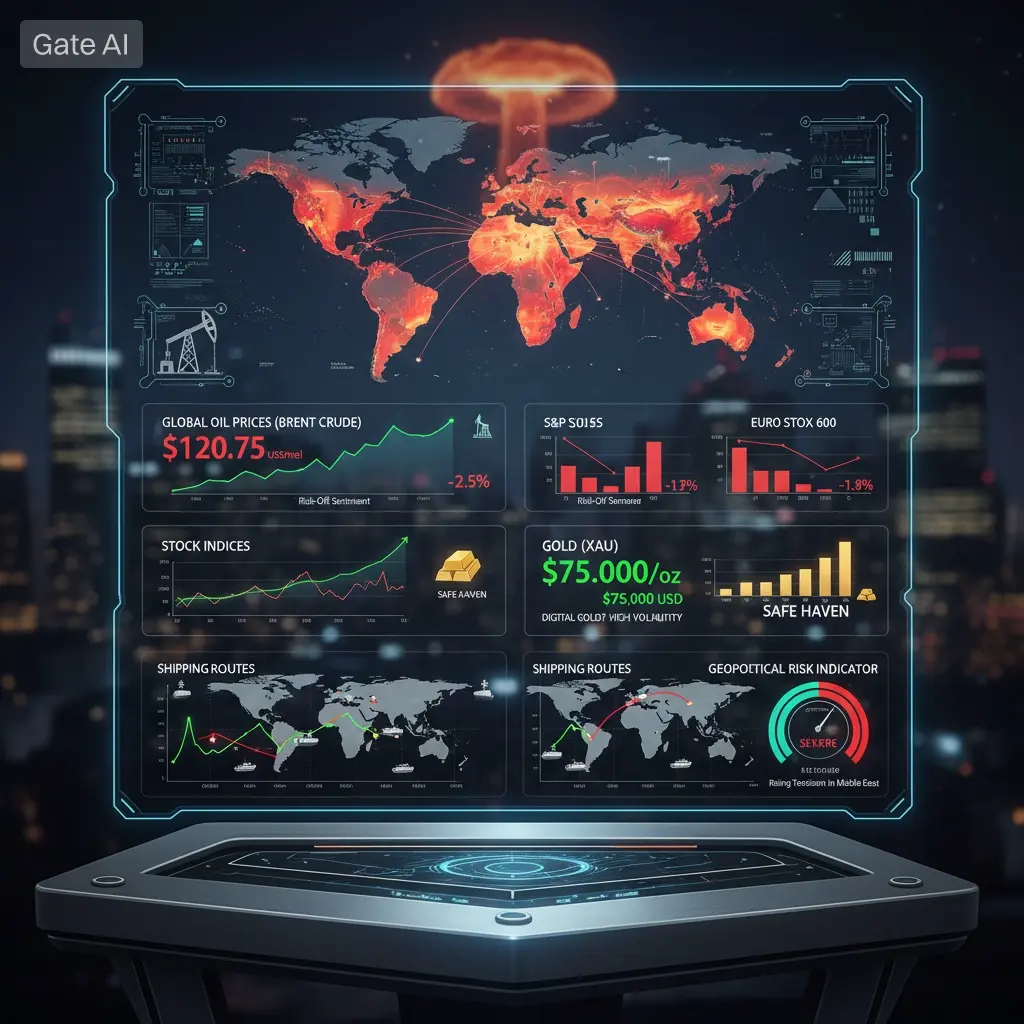

#MiddleEastTensionsEscalate

Rising tensions in the Middle East are once again reshaping global market dynamics. As geopolitical risks intensify, investors across traditional and digital markets are reassessing exposure, risk appetite, and safe-haven strategies. The region’s strategic importance to energy supply, trade routes, and global stability makes these developments highly significant.

Below is a detailed, point-by-point breakdown of the market implications.

1️⃣ Geopolitical Risk Premium Is Rising

Escalating tensions increase uncertainty across global markets. Investors tend to price in

Rising tensions in the Middle East are once again reshaping global market dynamics. As geopolitical risks intensify, investors across traditional and digital markets are reassessing exposure, risk appetite, and safe-haven strategies. The region’s strategic importance to energy supply, trade routes, and global stability makes these developments highly significant.

Below is a detailed, point-by-point breakdown of the market implications.

1️⃣ Geopolitical Risk Premium Is Rising

Escalating tensions increase uncertainty across global markets. Investors tend to price in

- Reward

- 1

- Comment

- Repost

- Share

Crypto and US stock market opening traders, those who have been consistently losing can get in touch. Priority is given to major players trading US stocks.

View Original

- Reward

- like

- Comment

- Repost

- Share

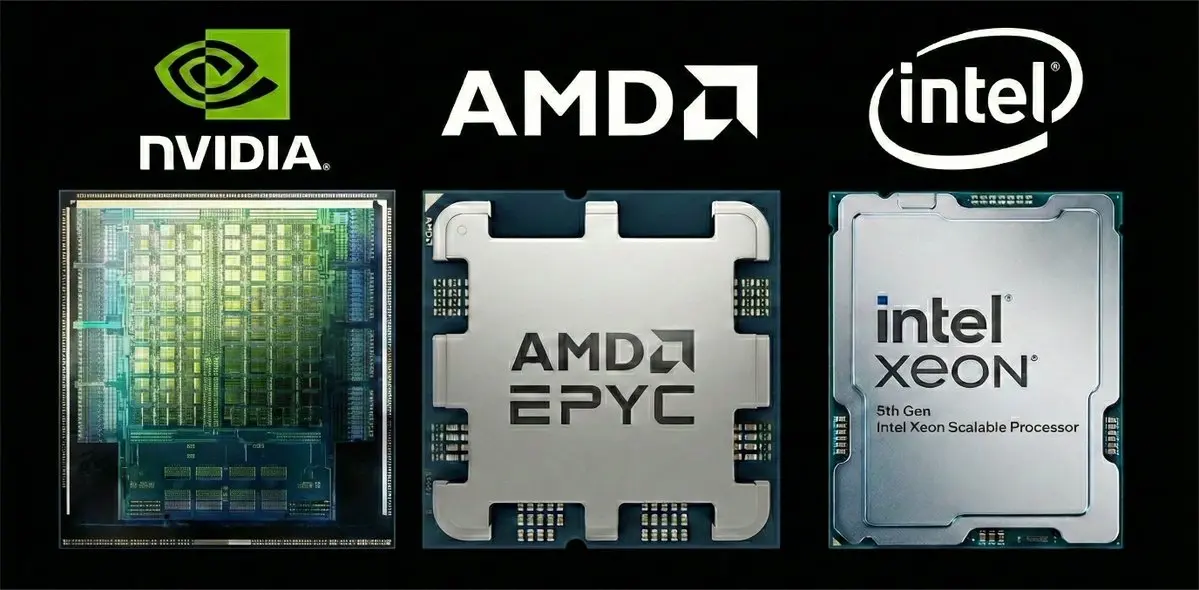

$NVDA is competing with $AMD and $INTC directly on CPUs for the first time$NVDA will offer Vera CPUs as a standalone product, marking its first entry as a direct competitor to Intel Xeon and AMD EPYC server-grade CPUs

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More9.1K Popularity

71.46K Popularity

27.9K Popularity

9.63K Popularity

9.63K Popularity

Hot Gate Fun

View More- MC:$3.45KHolders:10.00%

- MC:$3.45KHolders:10.00%

- MC:$3.45KHolders:10.00%

- MC:$3.46KHolders:10.00%

- MC:$3.46KHolders:10.00%

News

View MoreData: 1250 XAUt transferred from Tether to Abraxas Capital Mgmt, worth approximately $6.58 million

1 m

Gate Perps launches "Precious Metals Trading Season", on-chain trading sharing a 20,000 USDT prize pool

5 m

Public company SRx Health Solutions has invested $18 million in purchasing BTC and ETH

13 m

WisdomTree expands its tokenized funds to the Solana blockchain

20 m

Data: 1,563,700 TON transferred from an anonymous address, worth approximately $2.39 million

23 m

Pin