Post content & earn content mining yield

placeholder

CryptoGangNFT

GM crypto twitter me waking up realizing i have sold everything at $126K😌

- Reward

- like

- Comment

- Repost

- Share

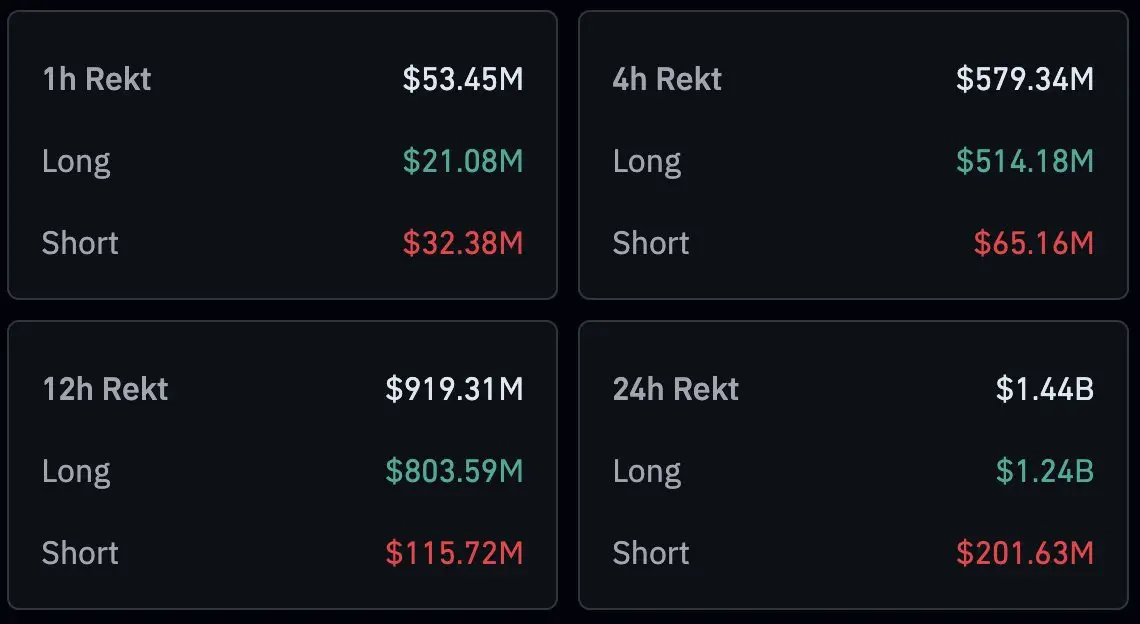

This is now one of the biggest liquidation events in crypto history.$1.2B — Covid crash panic$1.6B — FTX collapse chaos$1.44B — TodayBillions wiped out in hours. Leverage got punished. Weak hands got flushed.And every cycle, this is where the market resets before the next big move. 👀

- Reward

- like

- Comment

- Repost

- Share

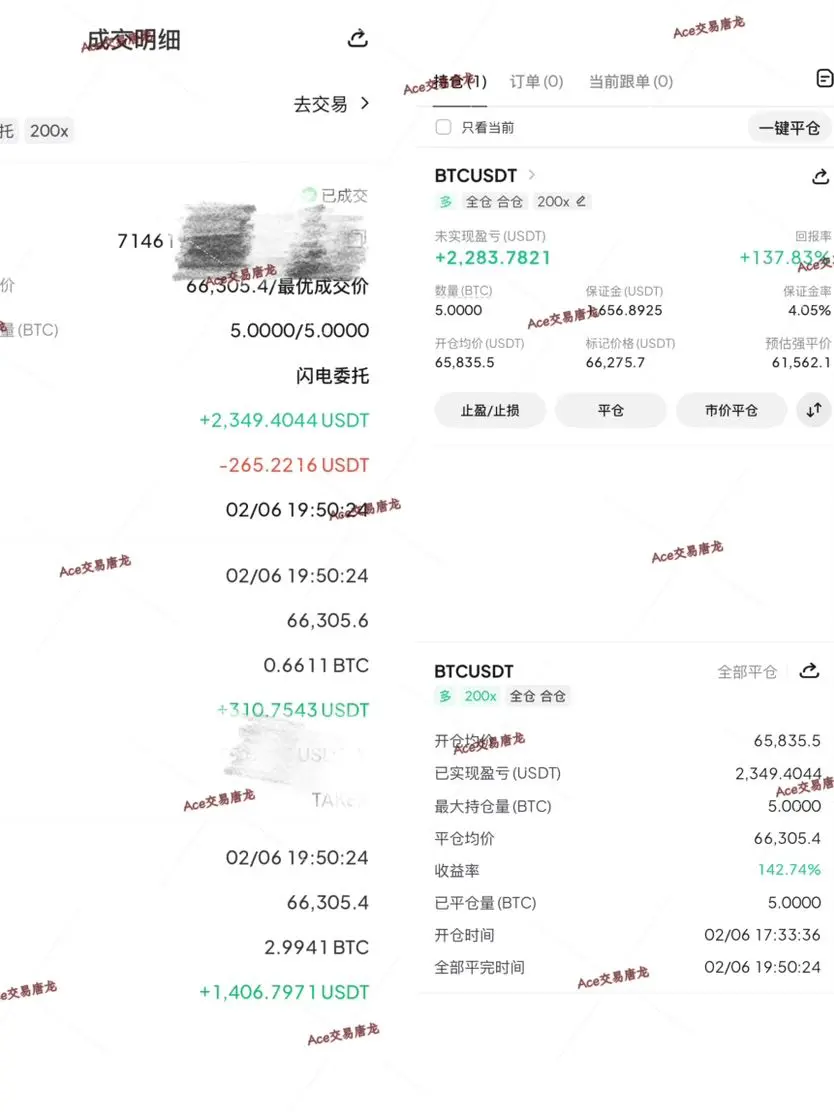

📈 See the experts’ profits in action!

Top traders’ performance on February 5:

🥇 Happy Little Moss: +34,845 USDT

🥈 Lernon: +20,506 USDT

🥉 Ten Thousand Times Journey 2026: +9,437 USDT

Why wander blindly when you can copy proven success?

With one-click copy trading, let the pros trade while your profits run automatically.

🔗 Follow now: https://www.gate.com/copytrading

Top traders’ performance on February 5:

🥇 Happy Little Moss: +34,845 USDT

🥈 Lernon: +20,506 USDT

🥉 Ten Thousand Times Journey 2026: +9,437 USDT

Why wander blindly when you can copy proven success?

With one-click copy trading, let the pros trade while your profits run automatically.

🔗 Follow now: https://www.gate.com/copytrading

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$14.82K

Create My Token

🔹 Global markets plunge in unison: Bitcoin drops to the $60,000 level, silver plunges 9 percentage intraday. Has market sentiment hit freezing point?

- Reward

- 1

- Comment

- Repost

- Share

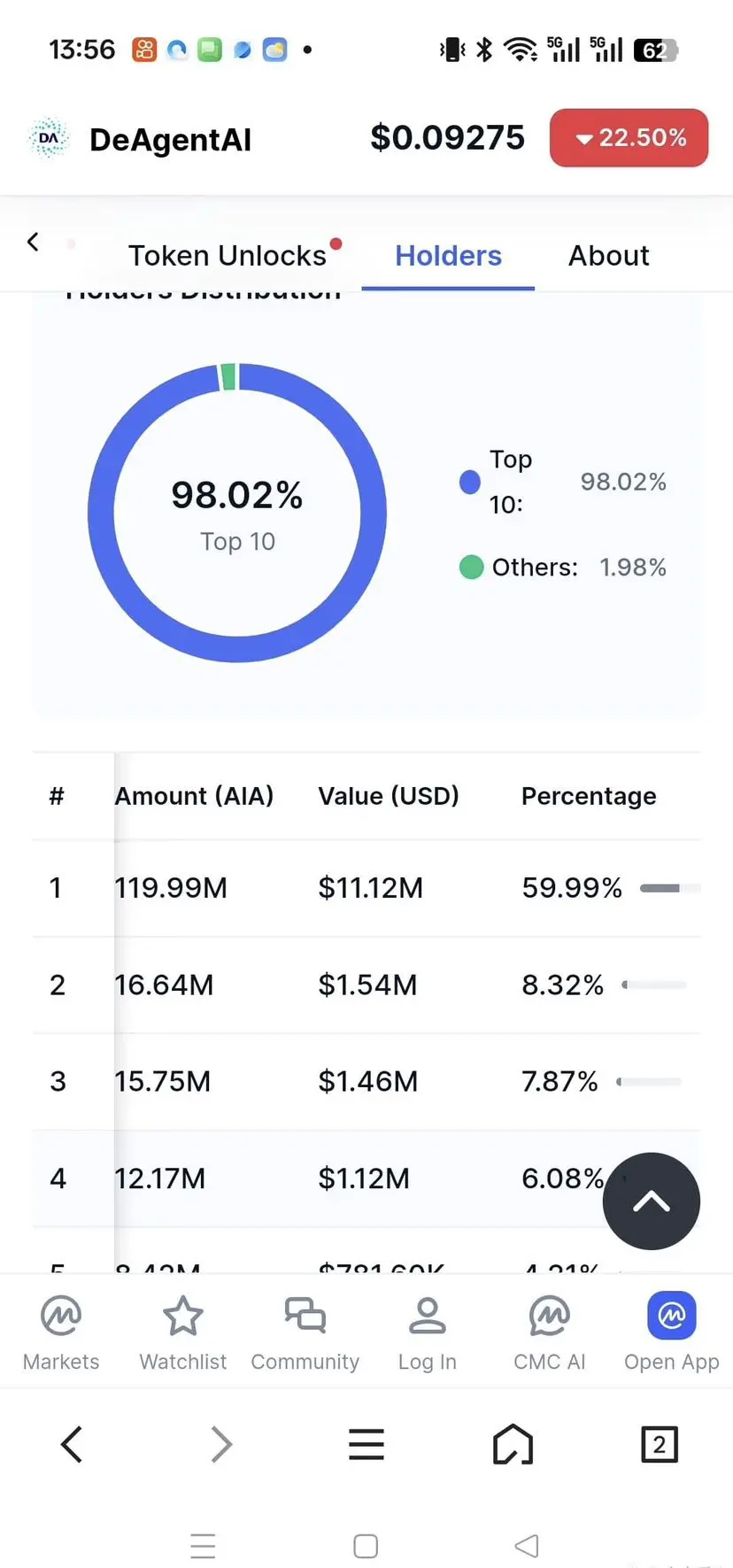

$AIA Accumulation finally reaches 98%, but based on the current market conditions, it needs to reach 99% to trigger a rally. The contract needs to see at least 0.06 to fully absorb this wave of chips. With the chips in place and no token release, a price surge is just around the corner. In the long term, expect to see above 1, but in the short term, it remains mainly bearish. Remember not to use high leverage, as market manipulators love to manipulate the price. #当前行情抄底还是观望?

AIA-13.24%

- Reward

- like

- Comment

- Repost

- Share

Trend research sells 8,000 ETH

- Reward

- like

- Comment

- Repost

- Share

Trading Ideas & Market Insights

I personally have not been aggressive in making purchases. From a structural perspective, BTC still has the potential to continue correcting toward the 64,000 area. This zone represents a strong demand zone in the previous structure and could become a medium-term buyer reaction point after liquidity has been swept.

• BTC Execution Strategy

The main approach is to wait for confirmation, not to guess the bottom.

Avoid buying during breakdowns.

Gradual accumulation is only considered if there is a clear price reaction and buying volume in the 64,000–66,000 area.

Th

View OriginalI personally have not been aggressive in making purchases. From a structural perspective, BTC still has the potential to continue correcting toward the 64,000 area. This zone represents a strong demand zone in the previous structure and could become a medium-term buyer reaction point after liquidity has been swept.

• BTC Execution Strategy

The main approach is to wait for confirmation, not to guess the bottom.

Avoid buying during breakdowns.

Gradual accumulation is only considered if there is a clear price reaction and buying volume in the 64,000–66,000 area.

Th

- Reward

- 1

- Comment

- Repost

- Share

GM 🖤 I will forever support my supporters

- Reward

- like

- Comment

- Repost

- Share

The Gate Learn Incentive Campaign for Earn is already active. Keep learning and keep earning. Join now and discover a new experience while earning.

View Original- Reward

- like

- Comment

- Repost

- Share

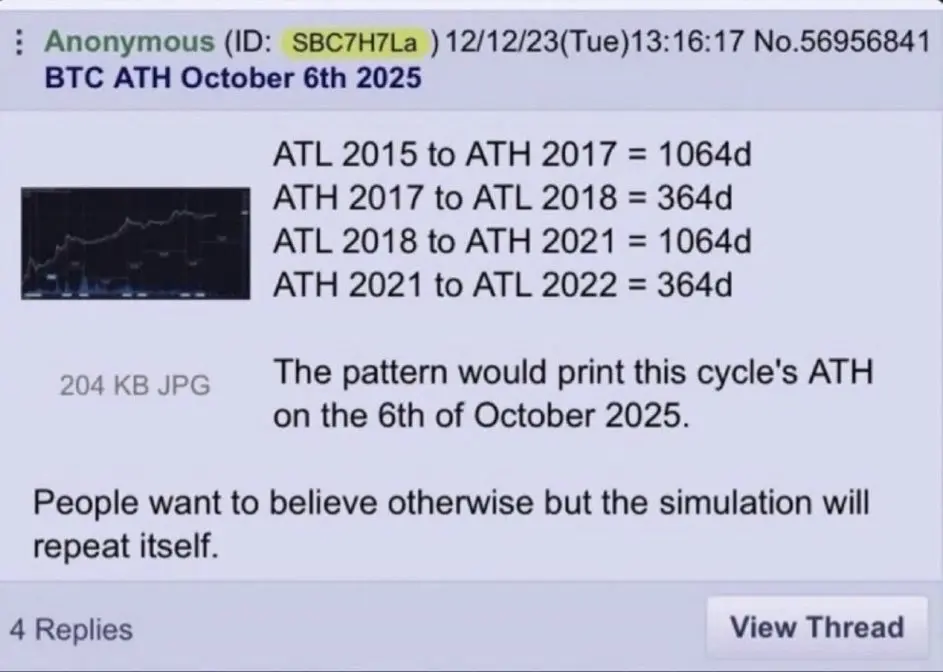

🚨 4CHAN NOSTRADAMUS WAS RIGHT!Why is the world calling this a simulation? Look at this chart:√ In Dec 2023, an anonymous user mapped the $BTC cycle on a 1064-day pattern and predicted the ATH on Oct 6, 2025.√ On Oct 6, 2025, Bitcoin actually hit a record high of $126,272! Neither early, nor late.What\'s Next? That same predictor is now giving a target of $250,000 for 2026.

BTC-3.72%

- Reward

- like

- Comment

- Repost

- Share

🦝 Junk Fun #12. Weekly Summary✨From clearing half a billion bot points to launching Season 10, here’s a summary of everything that happened. 👇👇👇 Still Not Joined?: Numbers👉 53.4K+ Total Burned Tokens and NFTs👉 61K+ Total Loot Boxes Opened👉 468 $SOL💰 Total Rewards Distributed 5,762 Total Winners🎬 Season 9 Summary: Ending with new updates aimed at protecting genuine users.🎥 Season 10 Part 2 Highlights are live!🎆 Featured #3 @junkfun_ x @cfldotfun All Gacha winners have been whitelisted to receive x2 points.✨️ The 4th Featured @junkfun_ x @mattlefun campaign is live with x2 Junk Fun

SOL-7.69%

- Reward

- 1

- Comment

- Repost

- Share

#CMEGroupPlansCMEToken

CME Group’s reported plans to explore a potential CME Token mark another pivotal moment in the convergence of traditional finance and blockchain technology.

As the world’s largest derivatives marketplace, CME Group has long played a central role in shaping global financial infrastructure. Any move toward tokenization by such an institution signals not just innovation, but a broader shift in how regulated markets may operate in the digital era.

CME Group is no stranger to crypto-related products. From Bitcoin and Ethereum futures to options and reference rates, the compa

CME Group’s reported plans to explore a potential CME Token mark another pivotal moment in the convergence of traditional finance and blockchain technology.

As the world’s largest derivatives marketplace, CME Group has long played a central role in shaping global financial infrastructure. Any move toward tokenization by such an institution signals not just innovation, but a broader shift in how regulated markets may operate in the digital era.

CME Group is no stranger to crypto-related products. From Bitcoin and Ethereum futures to options and reference rates, the compa

- Reward

- 1

- Comment

- Repost

- Share

K11

K11

Created By@It_sGone

Listing Progress

0.00%

MC:

$2.32K

Create My Token

A wave of pullback and consolidation, eating through Bitcoin at 470 points

Luodai 2283 tour$BTC $ETH

#当前行情抄底还是观望?

View OriginalLuodai 2283 tour$BTC $ETH

#当前行情抄底还是观望?

- Reward

- like

- Comment

- Repost

- Share

The market is dropping rapidly. Whether you suffered trading losses or not, don't worry, Gate has launched the new round of 5,000,000 USDT Subsidy Care Program open to all users across the network. Simply meet the following requirements to receive up to 100 USDT in subsidies. If you are a newly registered user or making your first futures trade during the event, you will also receive an extra 50 USDT care bonus. Gate will always stand with you, powering your wealth growth journey. https://www.gate.com/campaigns/3978?ref=VVBDU19YCQ&ref_type=132

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎💥🇺🇸BLACKROCK CEO LARRY FINK: "WE’RE NOT SPENDING ENOUGH TIME TALKING ABOUT HOW QUICKLY WE’RE GOING TO TOKENIZE EVERY FINANCIAL ASSET."

- Reward

- like

- Comment

- Repost

- Share

2013: Bitcoin Bubble Burst

260 → 70

2014: Mt. Gox Collapse

1,000 → 400

2018: Crypto Winter

19,800 → 3,200

2020: COVID-19 Market Crash

9,100 → 4,000

2021: China Mining And Regulatory Crackdown

58,000 → 30,000

2022: Luna And FTX Collapse

69,000 → 15,000

2025: Trade Tensions And Sharp Market Correction

126,000 → 84,000

2026: Global Risk-Off And Broad Sell-Off

88,000 → 60,000

Bitcoin Has Repeatedly Faced Severe Drawdowns Across Cycles.

Each Phase Created Fear, Volatility, And Strong Emotional Reactions.

Yet Every Decline Became A Reference Point In Market Histor

260 → 70

2014: Mt. Gox Collapse

1,000 → 400

2018: Crypto Winter

19,800 → 3,200

2020: COVID-19 Market Crash

9,100 → 4,000

2021: China Mining And Regulatory Crackdown

58,000 → 30,000

2022: Luna And FTX Collapse

69,000 → 15,000

2025: Trade Tensions And Sharp Market Correction

126,000 → 84,000

2026: Global Risk-Off And Broad Sell-Off

88,000 → 60,000

Bitcoin Has Repeatedly Faced Severe Drawdowns Across Cycles.

Each Phase Created Fear, Volatility, And Strong Emotional Reactions.

Yet Every Decline Became A Reference Point In Market Histor

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Stay strong and HODL💎Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4025?ref=VLIWBLOKUW&ref_type=132&utm_cmp=fbFT2Eqd

- Reward

- 4

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

pick a number 1-99, winner gets $5000

- Reward

- like

- Comment

- Repost

- Share

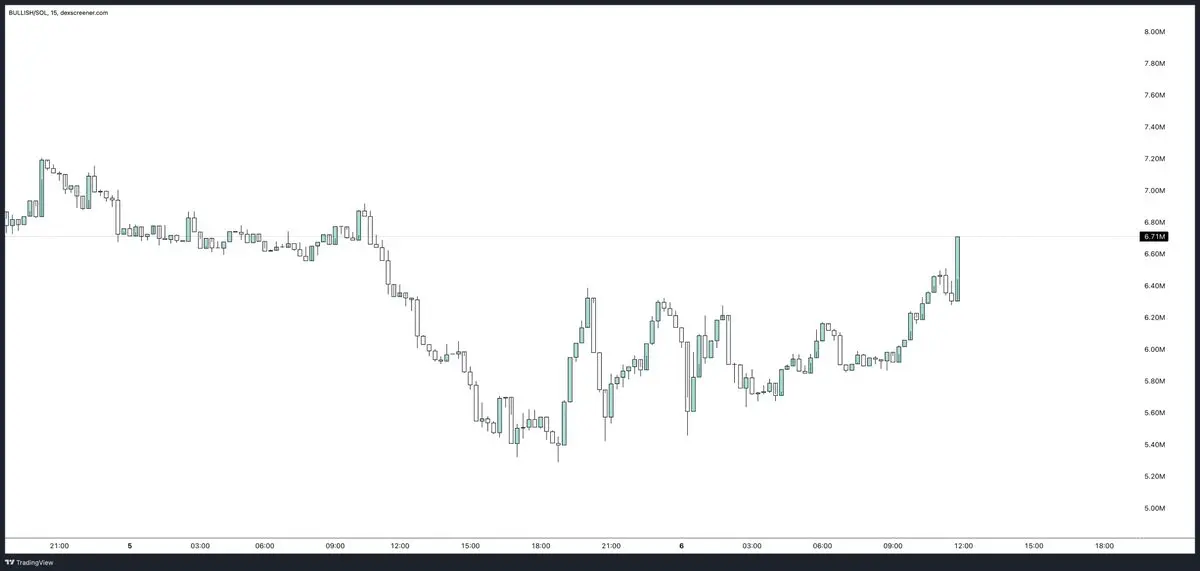

Popular 4Chan Guy\'s favorite meme coin $BULLISH is gaining some traction.

- Reward

- like

- Comment

- Repost

- Share

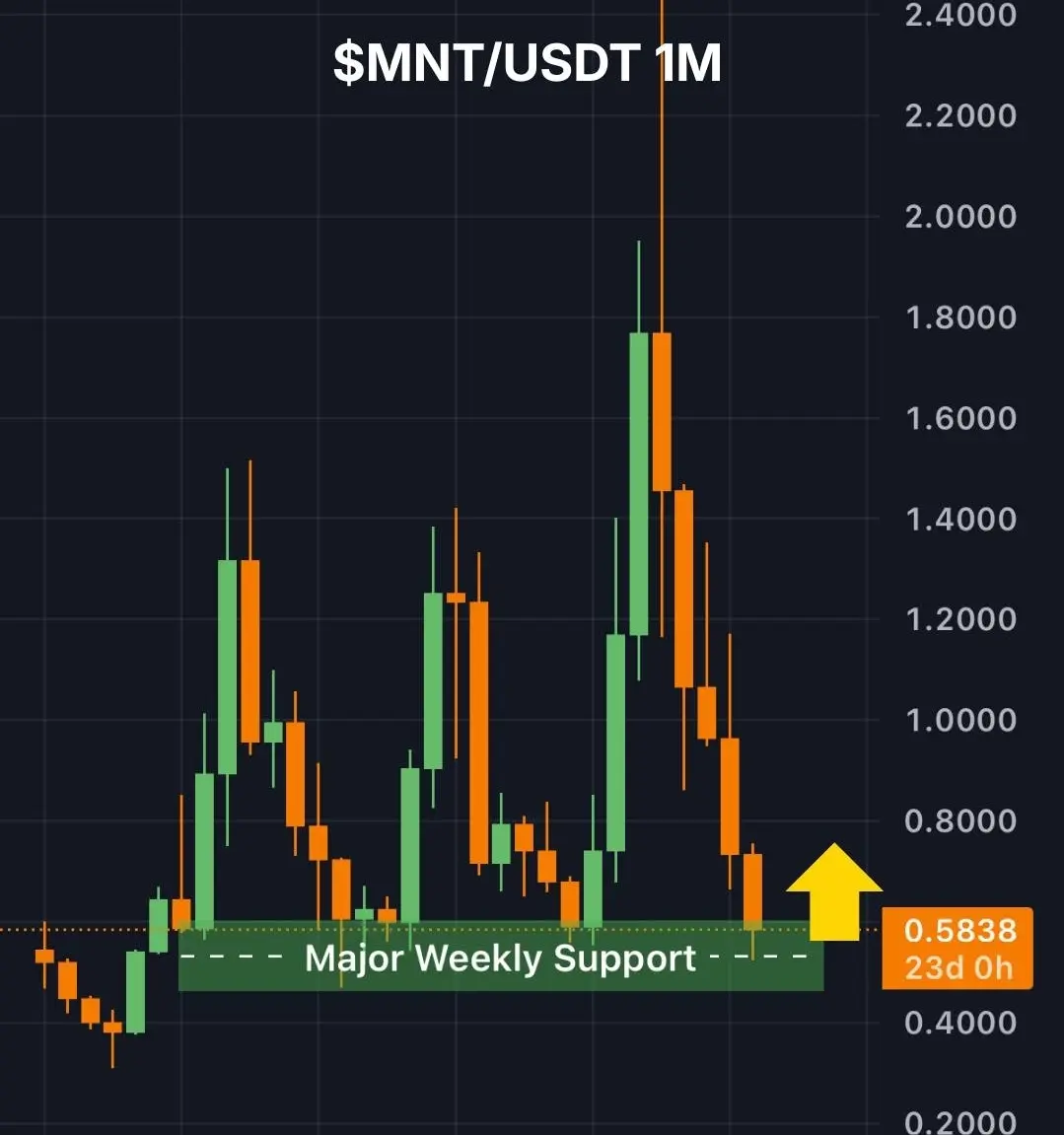

The #MNTUSDT coin is stabilizing at a major monthly support level 👀

The price is currently testing a long-term major support zone around $0.50, a level that has historically represented a strong demand area.

If buyers enter and maintain this level, a short-term rebound toward $0.8 - $1 could follow.

Join us for more technical analyses, important news, key market events, discussions, and much more – click follow on our profile page.

#BuyTheDipOrWaitNow?

#MNT

$MNT

The price is currently testing a long-term major support zone around $0.50, a level that has historically represented a strong demand area.

If buyers enter and maintain this level, a short-term rebound toward $0.8 - $1 could follow.

Join us for more technical analyses, important news, key market events, discussions, and much more – click follow on our profile page.

#BuyTheDipOrWaitNow?

#MNT

$MNT

MNT-6.45%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

If buyers enter and maintain this level, a short-term rebound towards $0.8 - $1 could follow.Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More104.91K Popularity

17.68K Popularity

387.19K Popularity

5.85K Popularity

3.13K Popularity

Hot Gate Fun

View More- MC:$2.32KHolders:10.00%

- MC:$2.32KHolders:10.00%

- MC:$2.31KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreInstitutional funds buy the dip, driving Bitcoin to rebound 11% from the low point and climb back above $65,000

2 m

ETH Breaks Through 1950 USDT

5 m

NFT market capitalization has fallen back to pre-2021 boom levels, approaching $1.5 billion.

9 m

The CSRC releases "Regulatory Guidelines on the Offshore Issuance of Asset-Backed Securities Tokens for Domestic Assets"

9 m

Data: BTC Breaks Through $67,000

9 m