LuanZihao

No content yet

LuanZihao

BTC trading view for the evening of September 7.

The recent drop in Bitcoin stabilized around 110,000, and the current price is

Starting to rise. From the market perspective, the bullish strength has strengthened again; the moving averages

Starting to turn upwards, trading volume is also increasing, and the momentum for short-term rise is quite strong.

sufficiently. Moreover, the Federal Reserve is almost certain to cut interest rates, and once the market opens

Once the "money is released", funds will flow to high-risk assets, and Bitcoin is certainly one of them.

Can benefit from it.

However,

The recent drop in Bitcoin stabilized around 110,000, and the current price is

Starting to rise. From the market perspective, the bullish strength has strengthened again; the moving averages

Starting to turn upwards, trading volume is also increasing, and the momentum for short-term rise is quite strong.

sufficiently. Moreover, the Federal Reserve is almost certain to cut interest rates, and once the market opens

Once the "money is released", funds will flow to high-risk assets, and Bitcoin is certainly one of them.

Can benefit from it.

However,

BTC0.69%

- Reward

- like

- Comment

- Repost

- Share

$ETH Evening Thoughts:

Look at the picture and talk: Erbing is still moving in a volatile consolidation within the box, but a small box has appeared inside the larger box. On the right side, if you chase the breakout above the small box's upper boundary, look upwards to the position indicated by the yellow arrow at 4372, and then look up step by step. If it reaches 4372, you should reduce your position or take all profits. Do not think that just because you opened a long position, you can make back all the previous losses. If you have this mindset, you will only end up losing more.

Low mul

Look at the picture and talk: Erbing is still moving in a volatile consolidation within the box, but a small box has appeared inside the larger box. On the right side, if you chase the breakout above the small box's upper boundary, look upwards to the position indicated by the yellow arrow at 4372, and then look up step by step. If it reaches 4372, you should reduce your position or take all profits. Do not think that just because you opened a long position, you can make back all the previous losses. If you have this mindset, you will only end up losing more.

Low mul

ETH0.1%

- Reward

- 2

- Comment

- Repost

- Share

9.7 midday $ETH ETH suggestion

Although it briefly fell back after reaching the peak with Bitcoin in the short term, the core support at 4205 has not been broken.

The early session has already shown a small rebound, indicating that the support at this level is relatively strong.

Suggestion:

4260, with a target looking at around 4370.

View OriginalAlthough it briefly fell back after reaching the peak with Bitcoin in the short term, the core support at 4205 has not been broken.

The early session has already shown a small rebound, indicating that the support at this level is relatively strong.

Suggestion:

4260, with a target looking at around 4370.

- Reward

- like

- Comment

- Repost

- Share

The price has reached a turning point, let's push a bit more. My target is 0.3, so let's be a bit stronger, okay? 😌

View Original

- Reward

- like

- Comment

- Repost

- Share

Review on September 6th

Lost one breakeven order, went short on ETH after it broke the trend line at 60, profits turned into losses, and hit the stop loss at 4300.

After SOL broke the trend line, I shorted it, but the market movement was too slow, and I shorted at 200.25. I thought that since the market was slow during the day, there should be a decent rebound or drop at midnight when it reached the trend line. As a result, it ran along the trend line all night, and I ended up breaking even; my body couldn't take it anymore. Even if it drops further later, I don't plan to short again,

View OriginalLost one breakeven order, went short on ETH after it broke the trend line at 60, profits turned into losses, and hit the stop loss at 4300.

After SOL broke the trend line, I shorted it, but the market movement was too slow, and I shorted at 200.25. I thought that since the market was slow during the day, there should be a decent rebound or drop at midnight when it reached the trend line. As a result, it ran along the trend line all night, and I ended up breaking even; my body couldn't take it anymore. Even if it drops further later, I don't plan to short again,

- Reward

- like

- Comment

- Repost

- Share

9.7 Bitcoin Strategy Analysis

The recent price of Bitcoin has been fluctuating narrowly around 110500, with a volatility range of only 300-500 points, and trading volume has correspondingly decreased, reaching a peak of market wait-and-see sentiment.

However, this "no volatility" state does not indicate a stagnation of trends, but rather resembles a buildup before a major directional choice. From the daily candlestick structure, the long upper shadow bearish candle formed after the price surged the previous day has released a clear bearish signal. Additionally, given the current market conditi

The recent price of Bitcoin has been fluctuating narrowly around 110500, with a volatility range of only 300-500 points, and trading volume has correspondingly decreased, reaching a peak of market wait-and-see sentiment.

However, this "no volatility" state does not indicate a stagnation of trends, but rather resembles a buildup before a major directional choice. From the daily candlestick structure, the long upper shadow bearish candle formed after the price surged the previous day has released a clear bearish signal. Additionally, given the current market conditi

BTC0.69%

- Reward

- like

- Comment

- Repost

- Share

We made it ashore, brothers! Things are getting better! 1000 RMB turned into 60,000 in historical profit and loss, returning to profitability in just half a month! Earning money is as simple as breathing; the road to trading is long and arduous. If I can achieve a hundred of these in the next two years, it won't be considered wasted time. I also wish for my brothers to make big profits and all make it ashore!

View Original

- Reward

- like

- Comment

- Repost

- Share

Morning Analysis on 9.6

The big pie can revolve around 111300, 112000.

↓Look 110300-109700

The two cakes can revolve around 4360, 4420.

↓Look at 4250-4180

Looking back at the night, after the non-farm payroll data was released, Bitcoin first experienced a sharp "spike", then it quickly declined to the 110,000 line, followed by a slight rebound.

From the hourly Bollinger Bands perspective, the upper and middle bands are continuing to flatten, reflecting that the market is caught in a stalemate. The lower band, however, is clearly turning downwards, suggesting that the support strength below

The big pie can revolve around 111300, 112000.

↓Look 110300-109700

The two cakes can revolve around 4360, 4420.

↓Look at 4250-4180

Looking back at the night, after the non-farm payroll data was released, Bitcoin first experienced a sharp "spike", then it quickly declined to the 110,000 line, followed by a slight rebound.

From the hourly Bollinger Bands perspective, the upper and middle bands are continuing to flatten, reflecting that the market is caught in a stalemate. The lower band, however, is clearly turning downwards, suggesting that the support strength below

BTC0.69%

- Reward

- like

- Comment

- Repost

- Share

BTC has higher trade volumes in long positions for one hour, and the four-hour KDJ has a cross upwards divergence, with long positions being dominant.

You can directly go long at the current price for short-term trades, looking at 112500!

Subsequently pay attention to the pressure situation at 112500 #BTC#

You can directly go long at the current price for short-term trades, looking at 112500!

Subsequently pay attention to the pressure situation at 112500 #BTC#

BTC0.69%

- Reward

- like

- Comment

- Repost

- Share

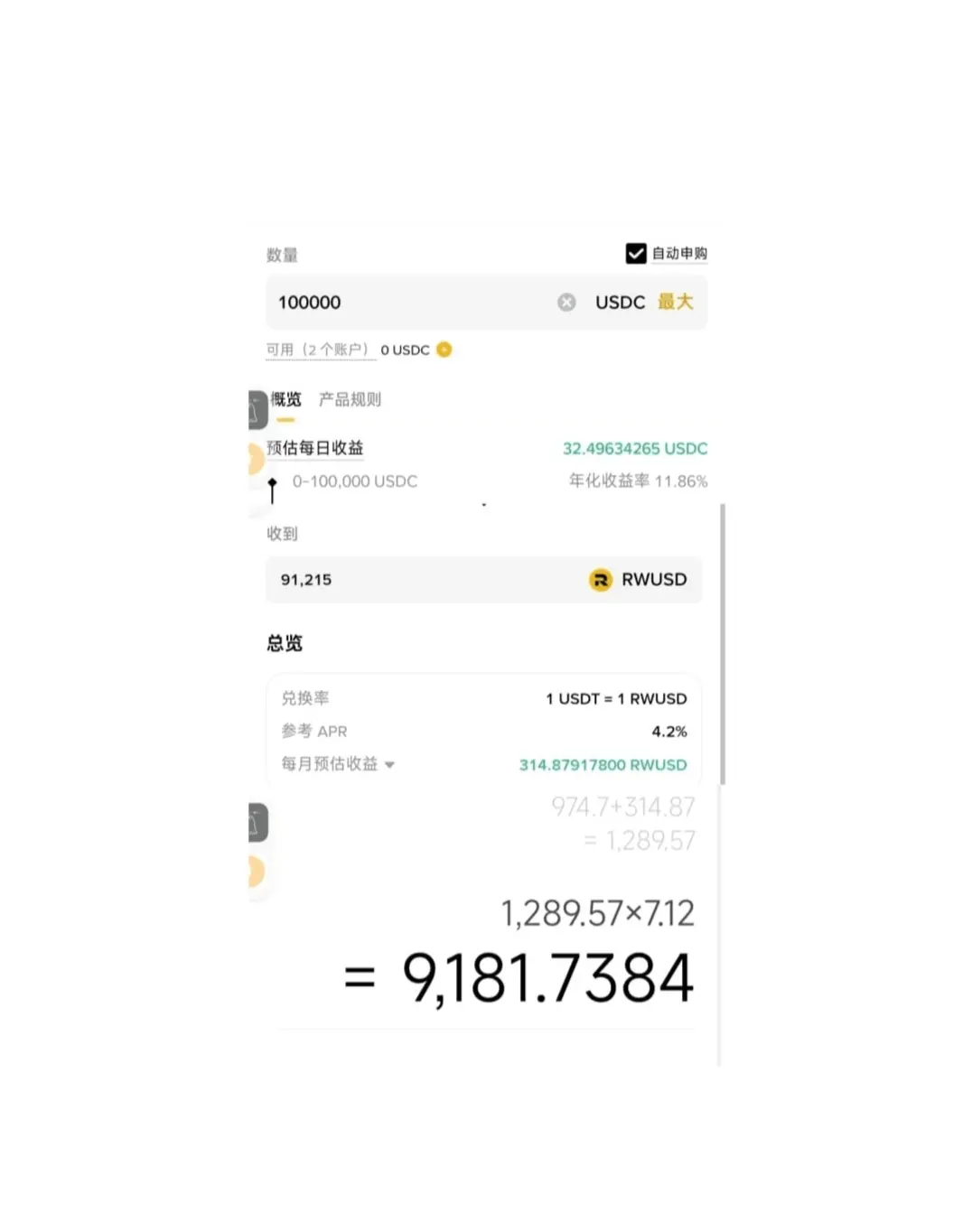

How to turn 200U into 2k U in 24 hours

1. Operational Insights

Recently, the market has been very volatile. I didn't have much USDT in my spot account, so I borrowed 200 USDT from leverage to trade ultra-short contracts. The core strategy is to rely on high-frequency small orders for compound interest to roll the snowball. At the beginning, I earned 3 to 8 USDT per order, and as the funds grew, the profit margin also increased. Gradually, I could earn 10 to 30 USDT per order, and occasionally, when catching a fluctuation, I could make over a hundred USDT on a single trade.

Don't think

View Original1. Operational Insights

Recently, the market has been very volatile. I didn't have much USDT in my spot account, so I borrowed 200 USDT from leverage to trade ultra-short contracts. The core strategy is to rely on high-frequency small orders for compound interest to roll the snowball. At the beginning, I earned 3 to 8 USDT per order, and as the funds grew, the profit margin also increased. Gradually, I could earn 10 to 30 USDT per order, and occasionally, when catching a fluctuation, I could make over a hundred USDT on a single trade.

Don't think

- Reward

- like

- Comment

- Repost

- Share

The dumbest way to make money in Cryptocurrency Trading: don’t do three things and six must-kills, the market maker is most afraid of you learning this!

The secrets to getting rich in the coin world are actually hidden in the simplest methods.

Today's "silly method" is ridiculously simple, but whoever learns it will make money.

Three "Absolutely Must Not Do" Pitfalls

1. FOMO and FUD

90% of the retail investors die here. When the price soars, they shout "this time is different," only to get trapped at the peak, feeling the cold wind. The real tough guys only enter the market when blood flow

View OriginalThe secrets to getting rich in the coin world are actually hidden in the simplest methods.

Today's "silly method" is ridiculously simple, but whoever learns it will make money.

Three "Absolutely Must Not Do" Pitfalls

1. FOMO and FUD

90% of the retail investors die here. When the price soars, they shout "this time is different," only to get trapped at the peak, feeling the cold wind. The real tough guys only enter the market when blood flow

- Reward

- like

- Comment

- Repost

- Share

From the 4-hour chart, BTC encountered resistance and fell back after hitting the resistance level of 112500 following consecutive bullish candles. Due to pressure on the upper band of the Bollinger Bands, it dropped to 111500 where it found support, and is currently in a state of consolidation. The support strength at this level of 111500 is sufficient, so the pullback can be considered a technical correction. The morning outlook remains unchanged, continuing the thoughts from earlier, with a pullback expected.

Buy BTC near 111200—111500, with targets at 113500 and 115300, and a long-term tar

Buy BTC near 111200—111500, with targets at 113500 and 115300, and a long-term tar

BTC0.69%

- Reward

- like

- Comment

- Repost

- Share

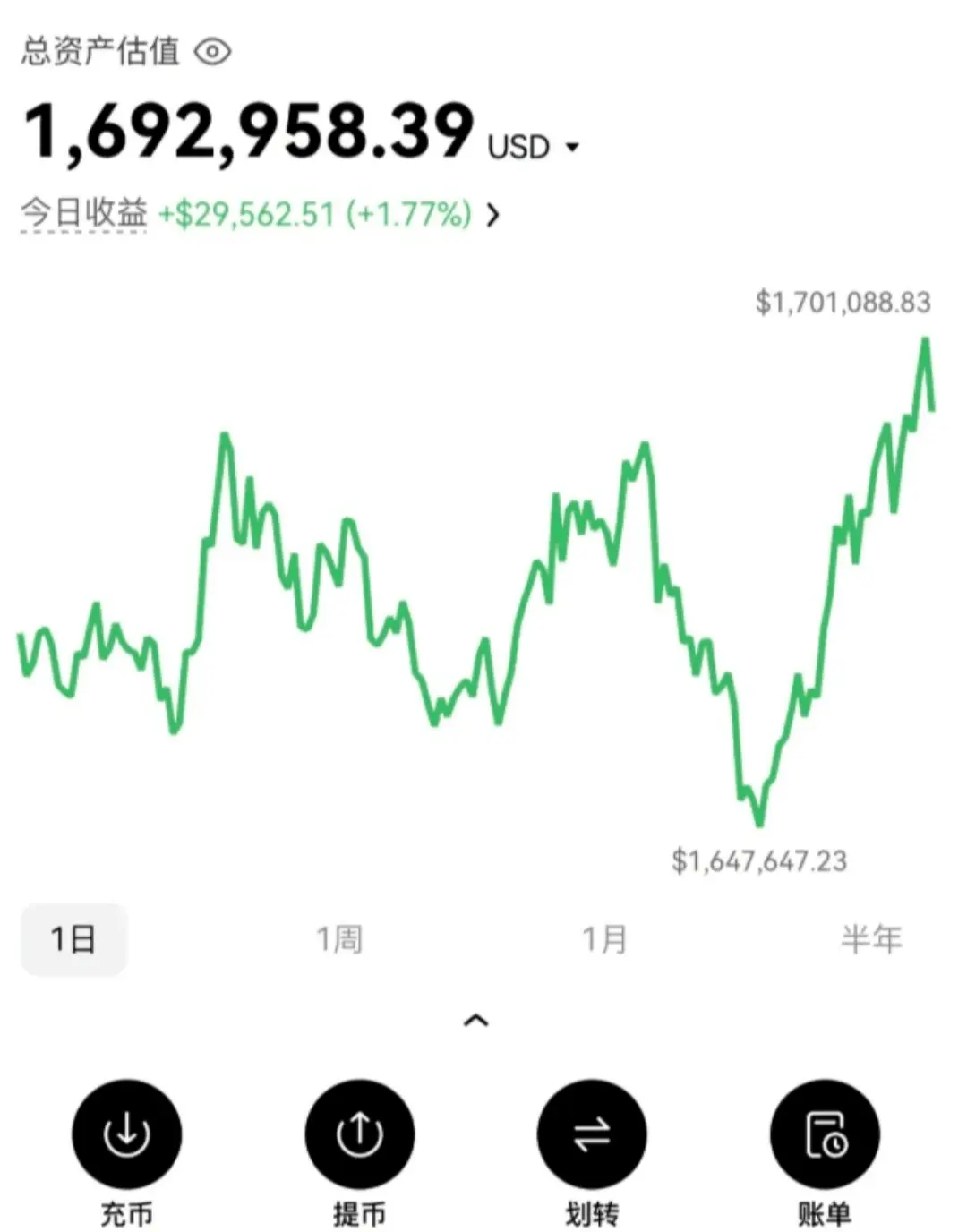

The crypto world has grown from 50,000 to 3,580,000, you just need to remember these few sentences!

1. Short-term

1. Focus only on the top 5 mainstream coins every day, based on current market hotspots, news, daily MACD golden cross, BOLL contraction and expansion, combined with market trends, and comprehensively consider and select the highly volatile varieties for trading.

2. Control your position size:

50,000 divided into 20% means 5 parts, each time taking one part to build a position.

3. Never go all in, at most 50%, always keep 50% in reserve waiting for opportunities.

4. Do not make mor

View Original1. Short-term

1. Focus only on the top 5 mainstream coins every day, based on current market hotspots, news, daily MACD golden cross, BOLL contraction and expansion, combined with market trends, and comprehensively consider and select the highly volatile varieties for trading.

2. Control your position size:

50,000 divided into 20% means 5 parts, each time taking one part to build a position.

3. Never go all in, at most 50%, always keep 50% in reserve waiting for opportunities.

4. Do not make mor

- Reward

- like

- Comment

- Repost

- Share

From getting liquidated 200,000 to account turnaround: 4 stages I took my fren out of the trading death loop.

People often ask me, "Bro, my account only has a few thousand U left, can it be saved?" I have heard this question too many times. And I have a vivid example around me - a fren once lost 200,000, falling into a dead cycle of "the more anxious you are to leverage to recover, the more you lose completely," even starting to doubt life.

Later he found me, and I told him: "Trading recovery never relies on miracles, only on methods." After guiding him through four stages, in half a year,

View OriginalPeople often ask me, "Bro, my account only has a few thousand U left, can it be saved?" I have heard this question too many times. And I have a vivid example around me - a fren once lost 200,000, falling into a dead cycle of "the more anxious you are to leverage to recover, the more you lose completely," even starting to doubt life.

Later he found me, and I told him: "Trading recovery never relies on miracles, only on methods." After guiding him through four stages, in half a year,

- Reward

- like

- Comment

- Repost

- Share

The price has continued to rise from midnight to early morning, peaking at the line of 111487; Ether quickly stabilized after a slight pullback, and long positions also aggressively increased, with a one-sided upward movement exceeding 100 points, reaching a high of 4333 from midnight to early morning, with the overall increase appearing slightly inferior compared to BTC.

On the four-hour chart, as the downward channel has been further broken, the indicators are about to enter the overbought range. In the short term, there is a certain demand for a pullback after the price reaches a high, but

View OriginalOn the four-hour chart, as the downward channel has been further broken, the indicators are about to enter the overbought range. In the short term, there is a certain demand for a pullback after the price reaches a high, but

- Reward

- like

- Comment

- Repost

- Share

Why does playing contracts always get liquidated?

Why do you always get liquidated when trading contracts? It's not bad luck; it's that you fundamentally don't understand the essence of trading! This article, which condenses ten years of trading experience into low-risk principles, will completely overturn your understanding of contract trading — getting liquidated has never been the market's fault, but a time bomb you planted yourself.

Three Major Truths That Disrupt Perception

Leverage ≠ Risk: Position is the Lifeline

Using 1% position with 100x leverage, the actual risk is o

Why do you always get liquidated when trading contracts? It's not bad luck; it's that you fundamentally don't understand the essence of trading! This article, which condenses ten years of trading experience into low-risk principles, will completely overturn your understanding of contract trading — getting liquidated has never been the market's fault, but a time bomb you planted yourself.

Three Major Truths That Disrupt Perception

Leverage ≠ Risk: Position is the Lifeline

Using 1% position with 100x leverage, the actual risk is o

ETH0.1%

- Reward

- like

- Comment

- Repost

- Share

Recently, my phone's memory was full, so I flipped through the album and saw some old screenshots. I realized long ago that people will never understand gratitude. Even if you achieve some success in certain areas, you will always feel amazing. Thinking back to the Ethereum I made my ex-girlfriend buy for 100 bucks is just funny.

ETH0.1%

- Reward

- like

- Comment

- Repost

- Share

In the early morning hours, the Ethereum trend showed an "irrational" V-shaped reversal, with the decline phase being particularly rapid, not a gradual descent, but a typical cliff-like big dump.

This downward trend has lasted for a relatively long time, with the price dropping from a high point of around 4350 to approximately 4200, with a maximum fall of about 150 points within this range.

Currently, the market has entered a repair phase, and it is expected that this repair process will be relatively lengthy. In terms of operations, it is recommended to continuously follow the trends of m

This downward trend has lasted for a relatively long time, with the price dropping from a high point of around 4350 to approximately 4200, with a maximum fall of about 150 points within this range.

Currently, the market has entered a repair phase, and it is expected that this repair process will be relatively lengthy. In terms of operations, it is recommended to continuously follow the trends of m

ETH0.1%

- Reward

- like

- Comment

- Repost

- Share

From the current market data perspective, a brief bearish divergence has appeared in the hourly MACD, and there is a trend toward forming a golden cross pattern; if the four-hour market data does not break below the lower band, there should not be a significant pullback.

Today the US stock market is closed, and fluctuations are expected to be small, mainly oscillating within the range, oscillating between 1070 and 1085, with resistance near 1086 above.

The big coin can be lightly entered around 1072 in the afternoon, with a target of 1086. If it breaks through, continue to look up around 1094,

Today the US stock market is closed, and fluctuations are expected to be small, mainly oscillating within the range, oscillating between 1070 and 1085, with resistance near 1086 above.

The big coin can be lightly entered around 1072 in the afternoon, with a target of 1086. If it breaks through, continue to look up around 1094,

BTC0.69%

- Reward

- like

- Comment

- Repost

- Share